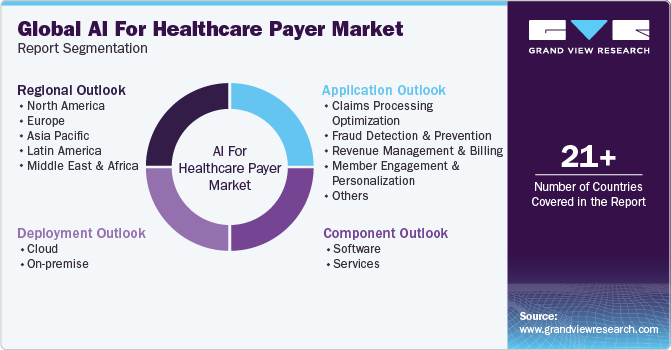

AI For Healthcare Payer Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-315-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

AI For Healthcare Payer Market Trends

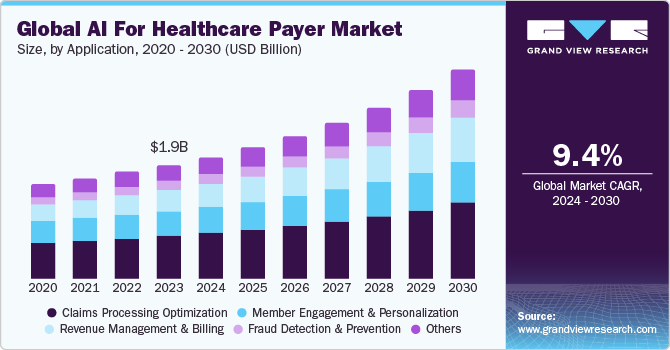

The global AI for healthcare payer market size was estimated at USD 1.95 billion in 2023 and is projected to grow at a CAGR of 9.40% from 2024 to 2030. The rising demand for efficient and cost-effective healthcare solutions has accelerated the adoption of Artificial intelligence (AI) technologies in the healthcare payers market. Artificial intelligence helps in automating administrative tasks, reducing operational costs, and enhancing the accuracy of claims processing, thereby improving overall efficiency.

In addition, the growing volume of healthcare data necessitates advanced analytics, which AI can provide, offering deeper insights into patient care and outcomes. Moreover, regulatory changes and the increasing focus on value-based care models push payers to adopt AI to improve patient engagement and satisfaction while managing risks more effectively.

Advancements in machine learning (ML) and natural language processing enable artificial intelligence systems to understand better and analyze complex medical data, leading to more informed decision-making. The continuous innovation in artificial intelligence technologies, along with the strategic partnerships between AI companies and healthcare payers, also plays a crucial role in market expansion. For instance, in April 2024, Pager Health announced the development of three new applications utilizing Google Cloud's advanced generative AI (GenAI) capabilities. These GenAI applications aim to support the fourfold aim of care by alleviating the administrative burden on multidisciplinary care teams and fostering a more personalized and conversational experience for members. This enhanced interaction aids members in navigating, coordinating, and taking the next best steps in their healthcare journey.

Furthermore, fraudulent activities in healthcare claims are a significant concern for payers, leading to substantial financial losses. Artificial intelligence and machine learning algorithms excel in detecting anomalous patterns indicative of fraud. These technologies analyze historical claims data to identify suspicious activities in real-time, allowing for prompt investigation and mitigation. By reducing fraud, healthcare payers can safeguard their financial resources and ensure that funds are appropriately allocated to genuine claims, thereby maintaining the integrity of the healthcare system.

The shift from fee-for-service to value-based care models places a greater emphasis on patient outcomes and cost efficiency. Artificial intelligence plays a pivotal role in this transition by enabling healthcare payers to analyze patient data and measure the effectiveness of care interventions. Predictive analytics help identify patients who would benefit most from preventive care and early interventions, thereby reducing hospital readmissions and improving long-term health outcomes. By supporting value-based care initiatives, artificial intelligence helps payers align with industry trends and deliver better value to members. These factors collectively contribute to the rapid growth of artificial intelligence in the healthcare payer market, promising improved efficiency, reduced costs, and enhanced patient care.

The COVID-19 pandemic had a positive impact on the healthcare payer market, acting as a catalyst for accelerated artificial intelligence adoption. The pandemic highlighted the need for rapid, scalable solutions to manage the surge in healthcare demand and adapt to changing circumstances. AI technologies proved invaluable in several key areas during the pandemic. The surge in healthcare claims during COVID 19 added to the surge in the AI technology adoption solutions such as the AI-powered claims processing systems expedited the handling of these claims, reducing administrative delays and providing financial relief to providers and members.

Case Study:

According to Definitive Healthcare's December 2023 case study, large payors are actively exploring the potential of AI in their processes. However, this exploration brings challenges, requiring a balance to ensure ethical use. For instance, UnitedHealthcare faces a potential class-action lawsuit for allegedly using an AI tool to wrongfully deny Medicare Advantage claims. Similarly, Cigna has been sued for its use of an algorithm to reject claims.

Fight Against Healthcare Fraud:

Based on insights from the Definitive Healthcare blog post, payors are leveraging AI to combat healthcare fraud more effectively. Identifying fraudulent schemes can be difficult, but AI expedites the detection of suspicious claims, streamlining processes that were traditionally resource-intensive and time-consuming. For instance, Blue Cross Blue Shield of Massachusetts employs an algorithm to scrutinize claims for suspicious activity before payment. Moreover, Highmark's report underscores significant savings of USD 245 million, with AI software playing a pivotal role in detecting errors and unusual patterns indicative of fraud.

Advancements In Cost And Quality-Controlled Prior Authorizations

AI technology is transforming the prior authorization (PA) process, significantly improving efficiency. According to CMS, the current PA process takes an average of 10 days. However, AI integration promises transformative enhancements.

For example, the Health Care Service Corporation (HCSC) uses artificial and augmented intelligence to process PA requests approximately 1,400 times faster than traditional methods. Their proprietary AI tool can almost instantly approve care for member treatments by referencing historical authorizations. In addition, Blue Shield of California’s collaboration with Google Cloud highlights AI’s potential to significantly reduce the administrative burden on healthcare providers.

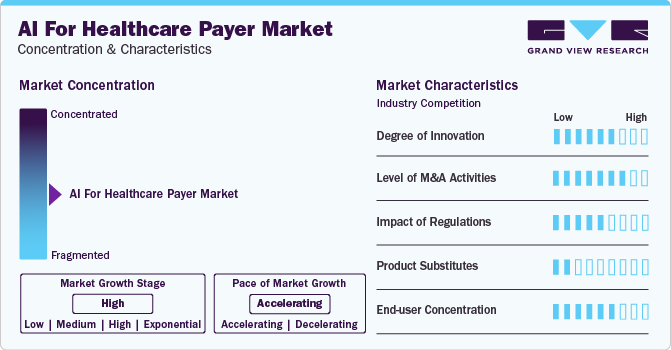

Market Concentration & Characteristics

The Artificial intelligence for healthcare payer market is experiencing rapid growth, driven by the increasing adoption of advanced technology solutions within the healthcare sector. Companies such as Cognizant, Microsoft, Optum, and Change Healthcare are at the forefront, focusing on AI solutions that improve claims management, fraud detection, and personalized member engagement. This surge in demand is accelerating market expansion.

Degree of innovation in the AI for healthcare payer market is substantial and evolving rapidly, fueled by technological advancements and the growing demand for efficiency and personalization in healthcare services.

Players are implementing strategic initiatives, such as collaborations, acquisitions, and partnerships, to strengthen their market presence. For instance, in February 2024, Veradigm LLC acquired ScienceIO. This acquisition allows Veradigm to leverage ScienceIO’s advanced healthcare artificial intelligence platform alongside its extensive, high-quality data set to develop proprietary language models for healthcare. The acquisition is expected to expedite platform enhancements across the Veradigm network, benefiting the provider, payer, and life sciences sectors.

The regulatory landscape concerning the market has increased, with a specific emphasis on data privacy, security, and ethical standards. Emerging trends encompass heightened compliance standards, increased transparency in AI decision-making processes, and bolstered guidelines aimed at safeguarding patient welfare and promoting equitable access. These developments are fostering the adoption of more robust and reliable AI solutions within the healthcare sector.

The threat of substitutes in the market is expected to remain low. AI technologies are revolutionizing diverse processes such as claims processing, fraud detection, member engagement, and risk assessment, offering superior efficacy compared to conventional methodologies.

With the healthcare industry transitioning towards a value-based care model, the integration of data into claims adjudication processes assumes paramount importance within this ecosystem. Leveraging AI-driven data analytics and emergent technologies, healthcare payers can mitigate errors, address operational complexities, and ultimately augment operational efficiency. This facilitates the alignment of incentives with patient outcomes, promotes enhanced care coordination, and fosters a patient-centric healthcare paradigm.

Component Insights

Based on the component, the market is segmented into software and services. The software segment held the largest market share of over 58.0% in 2023. This can be attributed to the increasing demand for advanced analytics capabilities to harness the vast amount of healthcare data that drives the adoption of AI-powered software solutions. These solutions offer predictive analytics, machine learning algorithms, and natural language processing capabilities, enabling payers to extract actionable insights and improve decision-making processes. Moreover, the need for automation and efficiency in administrative tasks, such as claims processing and member enrollment, fuels the demand for AI-driven software solutions.

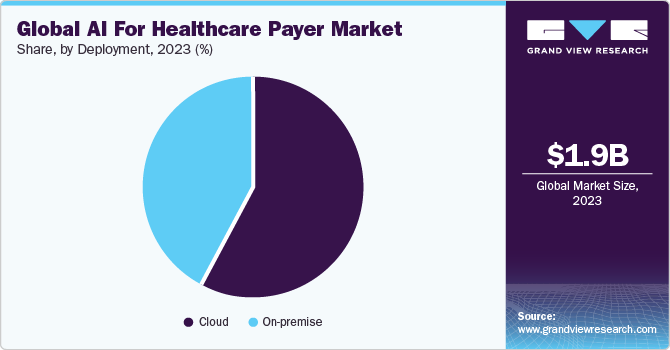

Deployment Insights

Based on deployment, the market is categorized into cloud and on-premise segments. The cloud segment held the largest market share of over 57.0% in 2023. The scalability and flexibility of cloud infrastructure enable healthcare payers to efficiently deploy and manage artificial intelligence applications, accommodating fluctuating workloads and expanding data volumes.

Cloud platforms offer advanced AI services, such as machine learning algorithms and natural language processing tools, allowing payers to harness powerful capabilities without significant upfront investments in hardware or software development. Moreover, enhanced data security and compliance measures provided by reputable cloud providers address concerns regarding patient privacy and regulatory requirements, further driving the adoption of cloud-based solutions.

Application Insights

Based on application, the claims processing optimization segment held the largest market share in 2023. Efficient claim processing is vital for ensuring timely reimbursement, cost reduction, fraud prevention, and fostering positive provider relationships. The volume of insurance claims is also rising with a growing population of insured individuals and increasing demand for healthcare services. Therefore, optimizing claim processing becomes imperative to meet these demands effectively while maintaining accuracy and efficiency. Moreover, regulatory requirements and compliance standards compel payers to invest in AI-powered solutions for claims processing to ensure adherence to industry regulations and standards.

According to an article published by Mastek in March 2024, an analysis of health insurance claims administered by a mid-sized payer with 1.5 million members highlighted that 70% of claims were identified as anomalous, necessitating manual review. Using machine learning with past claim data allows for a flexible response system, surpassing static rules that may not fully assess each case.

The revenue management and billing segment is expected to grow at the fastest CAGR of 11.5% over the forecast period. The increasing complexity of healthcare billing regulations and payer-provider contracts necessitates sophisticated solutions to ensure compliance and streamline revenue workflows. Artificial intelligence applications in revenue management and billing address these challenges by automating coding, documentation, and claims submission processes, reducing administrative burdens, and enhancing overall operational efficiency. AI technologies offer advanced analytics capabilities that enable more accurate and efficient revenue cycle management. Such factors would likely fuel the segment's growth.

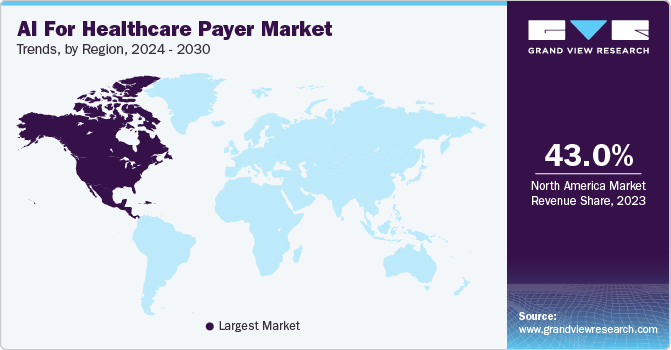

Regional Insights

North America AI for healthcare payer market dominated globally with a revenue share of 43.0% in 2023. The regional growth of the market is propelled by factors such as the increasing adoption of AI technologies to automate claims processing, detect fraud and abuse, and optimize network management. Moreover, adopting AI-powered virtual assistants and chatbots enhances customer service and engagement, providing members with personalized support and guidance. As the demand for efficient and cost-effective healthcare solutions continues to rise, artificial intelligence is poised to play an increasingly vital role in shaping the future of the healthcare payer market in North America.

U.S. AI For Healthcare Payer Market Trends

The U.S. AI for healthcare payer market held a large revenue share in the North America region in 2023. This can be attributed to the increasing convergence of technological advancements, regulatory support, and the imperative for improved healthcare outcomes, which fuel the growth of AI within the U.S. healthcare payer market.

The AI for healthcare payer market in Canada is anticipated to grow at a significant rate over the forecast period. This growth is due to the payers recognizing the value of artificial intelligence in improving operational efficiency, decision making, and delivering better healthcare outcomes for their members.

Asia Pacific AI For Healthcare Payer Market Trends

AI for healthcare payer market in Asia Pacific is anticipated to witness significant growth over the forecast years. The increasing cost of healthcare services in the region has led payers to seek innovative solutions to manage expenses while maintaining quality. Artificial intelligence offers avenues for cost reduction through predictive analytics, fraud detection, and claims processing automation.

China AI for healthcare payer market held the largest market share in the Asia Pacific region in 2023. Healthcare payers in China are pressured to improve operational efficiency and provide better services to their members. AI-driven solutions such as claims processing automation, virtual assistants for customer support, and predictive analytics for risk assessment are increasingly being adopted to meet these demands. Moreover, the China government has been actively promoting the adoption of artificial intelligence in healthcare to improve efficiency, reduce costs, and enhance patient care. Initiatives like the "Healthy China 2030" plan emphasize the importance of technology, including AI, in transforming the healthcare sector.

Latin America AI For Healthcare Payer Market Trends

AI for healthcare payer market in Latin America is expected to grow significantly over the forecast period. Latin American countries have steadily increased their healthcare expenditures to improve healthcare services and infrastructure, which has paved the way for the adoption of advanced technologies like AI in healthcare.

MEA AI For Healthcare Payer Market Trends

AI for healthcare payer market in MEA is expected to grow significantly over the coming years. There is a growing awareness and acceptance of artificial intelligence technologies within the healthcare industry in the MEA region. Payers are recognizing the potential benefits of artificial intelligence in terms of cost savings, operational efficiency, and improved patient outcomes, driving investment in AI solutions.

Key AI For Healthcare Payer Company Insights

Notable players are adopting strategies such as product development, partnerships, funding, and investments to drive market growth. Healthcare payers' willingness to adopt AI technologies is increasing competition among AI solution providers, impacting market shares.

Technology companies that collaborate early with healthcare payers gain competitive advantages. Startups also contribute significantly to the innovation ecosystem, with companies like Lyric.ai, Softheon, and ZS providing niche AI solutions to optimize operational efficiencies and improve patient care pathways.

Key AI For Healthcare Payer Companies:

The following are the leading companies in the AI For Healthcare Payer market. These companies collectively hold the largest market share and dictate industry trends.

- Nuance Communications (Microsoft)

- AiRo Digital Labs

- Accenture

- Cognizant

- CareCloud, Inc.

- MST Solutions, L.L.C.

- Hexaware Technologies Limited

- Innovaccer, Inc.

- Oracle

- Codoxo

- Amelia US LLC

- R1 RCM Inc

- Optum

- Quantiphi

- Softheon

Recent Developments

-

In March 2024, Microsoft and Cognizant entered into a collaboration agreement to integrate generative AI into healthcare. The goal behind the strategy is to enhance productivity and efficiency for healthcare providers and payers while prioritizing timely responses and elevating patient care. Through the utilization of Azure OpenAI Service and Semantic Kernel, the TriZetto Assistant on Facets will incorporate generative AI directly into the TriZetto user interface, facilitating seamless access to advanced AI capabilities.

-

In July 2023, Codoxo launched its latest solution ClaimPilot for healthcare payers. This cutting-edge generative AI offering is designed to enhance the efficiency of healthcare cost containment and payment integrity programs significantly.

"Generative AI has the potential to inject USD 1 trillion into the U.S. economy over the next decade through new revenue streams, operational efficiency, and innovation in products, services, and ways of working."

- said Surya Gummadi, EVP and President, Cognizant Americas.

AI For Healthcare Payer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.09 billion |

|

Revenue forecast in 2030 |

USD 3.58 billion |

|

Growth rate |

CAGR of 9.40% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Actual data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; UAE; South Africa; Saudi Arabia; Kuwait |

|

Key companies profiled |

Nuance Communications (Microsoft); AiRo Digital Labs; Accenture; Cognizant; CareCloud, Inc.; MST Solutions, L.L.C.; Hexaware Technologies Limited; Innovaccer, Inc.; Oracle; Amelia US LLC; R1 RCM Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI For Healthcare Payer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI for healthcare payer market report based on component, deployment, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Claims Processing Optimization

-

Fraud Detection And Prevention

-

Revenue Management And Billing

-

Member Engagement And Personalization

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global AI for healthcare payer market size was estimated at USD 1.95 billion in 2023 and is expected to reach USD 2.09 billion in 2024

b. The global AI for healthcare payer market is expected to grow at a compound annual growth rate of 9.40% from 2024 to 2030 to reach USD 3.58 billion by 2030.

b. North America dominated the AI for healthcare payer market with a share of 38.5% in 2023. The regional growth of the AI for healthcare payer market is propelled by factors such as increasing adoption of AI technologies in to automate claims processing, detect fraud and abuse, and optimize network management. Moreover, adopting AI-powered virtual assistants and chatbots enhances customer service and engagement, providing members with personalized support and guidance.

b. Some key players operating in the AI for healthcare payer market include Nuance Communications (Microsoft), AiRo Digital Labs, Accenture, Cognizant, CareCloud, Inc., MST Solutions, L.L.C., Hexaware Technologies Limited, Innovaccer, Inc., Oracle, Amelia US LLC, and R1 RCM Inc.

b. Key factors that are driving the market growth include rising demand for efficient and cost-effective healthcare solutions, a growing volume of healthcare data that necessitates advanced analytics, and an increasing focus on value-based care models that push payers to adopt AI to improve patient engagement and satisfaction.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."