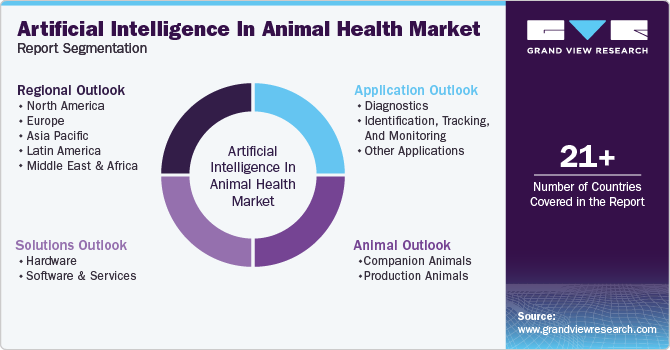

Artificial Intelligence In Animal Health Market Size, Share & Trends Analysis Report By Solutions (Hardware, Software & Services), By Application (Diagnostics, Identification, Tracking & Monitoring), By Animal, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-100-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

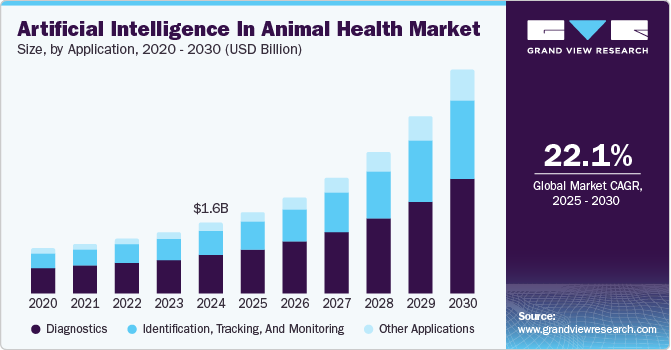

The global artificial intelligence in animal health market size was valued at USD 1.57 billion in 2024 and is estimated to grow at a CAGR of 22.1% from 2025 to 2030. Key market drivers include rapidly rising adoption & integration of AI into multiple sectors of the veterinary industry, increasing activities to spread awareness & education among veterinary professionals, continuously emerging novel applications of AI, and crucial benefits of AI utilization.

In recent years, AI has continuously transformed various aspects of the veterinary industry, including drug/ product discovery and development, diagnostics, animal tracking & identification, health monitoring, predictive analytics assistance, workflow process streamlining, and many more. For example, this technology is revolutionizing the daily workflows in veterinary practices by improving efficiency, accuracy, and client experiences. AI-powered tools assist in faster radiology results and digital pathology, provide real-time health monitoring, and leverage data for predictive analysis. Streamlined record-keeping is another benefit achieved through AI-driven tools. Chatbots and virtual assistants improve client communication while optimized marketing strategies enable personalized and targeted content creation. These advancements reshape how veterinary services are delivered and managed, marking a new era in veterinary medicine.

This increasing adoption and integration of this technology into the veterinary sector is set to revolutionize it. One such important vertical is veterinary pharmacology. Artificial Intelligence (AI) is revolutionizing the field by enhancing the drug development process. This technology is essential in streamlining drug discovery through potential drug candidate prediction and identifying therapeutic target sites. This ultimately assists drug manufacturers in reducing development time and associated costs.

Furthermore, it is also helpful in optimizing treatment regimes through personalized medicine, assisting the clinician in analyzing patient data to predict drug responses and minimize side effects. The technology can also revolutionize pharmacovigilance by helping detect adverse drug reactions and monitoring drug utilization. Furthermore, it facilitates drug repurposing by identifying novel applications for existing drugs and advances predictive modeling for drug efficacy and toxicity. Overall, this integration promises improved animal health outcomes and well-being.

Veterinary diagnostics is another sector of the veterinary industry that is starting to experience disruptive advancements due to this technology. AI integration is progressing rapidly in many sectors of the veterinary industry, but below are some of the leading avenues within veterinary diagnostics that are at the forefront of adopting it.

According to a January 2025 article written by experts from Mars Inc. (Antech Diagnostics), AI is revolutionizing veterinary diagnostics by enhancing the processing of acquired diagnostic processes. It aids veterinary radiologists by improving image orientation, analyzing the image, and increasing the accuracy of generated reports. The experts further highlighted that collaboration between domain experts, data scientists, extensive data, and user education is crucial for successful AI implementation. Antech Imaging Services has developed a solution, AIS RapidRead, which utilizes machine learning to analyze radiographs with over tested accuracy of 95%, speeding up the results during critical cases. However, the researchers highlighted that proper training & education on this tool's limitations are crucial for practical use to avoid dependence on the veterinary professional.

Furthermore, researchers worldwide are conducting projects to improve the availability and affordability of critical diagnostics like veterinary cancer. For instance, in March 2024, research scientists from Virginia-Maryland College of Veterinary Medicine initiated a project to implement AI into canine lymphoma diagnosis. Scientists plan to train an AI tool to analyze more than 10,000 cytological images of canine lymph node aspirates to differentiate between lymphoma-affected and healthy dogs. The second phase will focus on early disease detection through a modified AI model. Supported by various grants, the research aspires to enhance veterinary diagnostics and treatment options, ultimately improving the quality of life for pets with cancer. The project also aims to collaborate with computer science and engineering experts for broader diagnostic applications.

|

Opportunities and Risks Associated with the Use of Artificial Intelligence (AI) in Veterinary Practices |

|

|

Opportunities |

Risks |

|

Operational Efficiency |

Data Privacy & Security |

|

Diagnosis & Treatment Enhancement |

Reliability & Accuracy |

|

Remote Monitoring |

Ethical Concerns |

|

Personalized Treatment Plans |

Training & Education |

|

Predictive Analytics |

Cost & Accessibility |

Apart from the positives and disruptive integrations of AI, an essential factor that has the potential to hinder the growth of this market is the potential risks associated with AI-associated hallucinations. AI hallucinations are instances where these machine & deep learning models generate incorrect outputs. In this phenomenon, AI produces information or images that may look plausible but are not factually accurate or are entirely fabricated. One such recent example is of a pet owner from the U.S. According to an article from August 2024, an AI chatbot known as Vera (AskVet) misled a woman to euthanize her dog by providing inaccurate health information. Such incidents raise concerns about the reliability of AI in crucial animal health-related decisions and highlight the importance of human surveillance in veterinary consultations. It has sparked discussions on the ethical implications of using AI in healthcare.

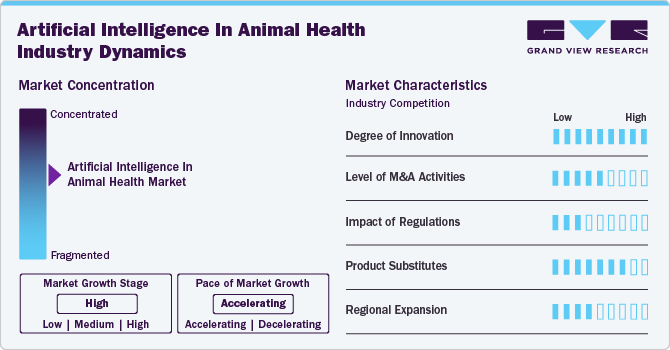

Market Concentration & Characteristics

The degree of innovation in this industry is very high. Owing to the rapid pace of AI development, innovation in the market is expected to be disruptive. The technology's dynamic nature is expected to penetrate every small vertical within the veterinary industry.

The industry is expected to experience a low-moderate impact of merger and acquisition (M&A) activities. Veterinary healthcare companies worldwide aim to integrate AI technology into their product/service portfolio by acquiring AI-based technology companies. For instance, in August 2024, Inspire Veterinary Partners Inc., a U.S.-based healthcare service provider, announced its intentions to acquire Vetsie.ai, a Canadian company that provides AI - AI-assisted access to vital information about veterinary conditions, treatments, and medications.

The regulatory impact on this market is low since regulations surrounding the use of AI are still in their very nascent stage. Organizations around the world are continuously updating and reforming the guidelines due to the highly dynamic and rapidly evolving nature of the technology. In the near future, however, these regulations are expected to take a concrete shape, pointing towards a well-controlled utilization of AI.

The impact of product substitutes in this industry is estimated to be high. Furthermore, this impact is expected to rise exponentially due to rapidly emerging companies with innovative AI solutions for various veterinary industry verticals.

Regional expansion can be anticipated to be moderate. The market is somewhat concentrated in North America and Europe, as most of the participants hail from these regions. These participants are rapidly attempting to spread throughout the globe to assert their dominance. However, a trend of emerging startups from countries in regions like Asia Pacific and MEA is taking a grip on the industry. This is expected to limit the regional expansion of larger players in the future.

Solutions Insights

Based on solutions, the hardware segment dominated the market with a share of about 62% in 2024, while the software & services segment is estimated to grow at the fastest rate of about 23%. Continuous advancements in hardware & software technologies, such as sensors, imaging devices, analyzing devices, computer vision, deep learning, and wearables, are fueling the growth of the segments. Improved performance, miniaturization, increased processing power, and cost reductions make these solutions more efficient and accessible to veterinary professionals and animal owners. Zoetis, for example, launched the latest version of its flagship product, Vetscan Imagyst, which is integrated with AI technology and designed to analyze potential neoplastic cells in lymph nodes and subcutaneous lesions. This new addition is aimed at enhancing treatment decisions and improving the efficiency of the professionals. The company plans to initiate the pre-orders in the second quarter of 2025.

The market's growth is also attributed to factors such as increasing partnerships & collaborations between software developers, technology companies, veterinary clinics, research institutions, and industry associations. These partnerships have led to innovative AI solutions tailored to animal health applications. In February 2025, Tuya Smart announced an alliance with DeepSeek to integrate their proprietary Artificial Intelligence of Things (AIoT) platform with advanced AI models like DeepSeek to create novel software to revolutionize its integration of smart devices. This integration will have features like real-time health monitoring and emotional analysis. The companies also have innovative concepts like brainwave translation collars and AI gene feeders in the pipeline.

Application Insights

The diagnostics segment dominated the market with a revenue share of 55% in 2024. Some factors contributing to this growth include the increasing integration of AI in veterinary diagnostics, the availability of AI-powered diagnostic solutions, and the need to improve diagnostic capabilities in animal health. IDEXX, Zoetis, SignalPET, and Vetology LLC are key market players in AI and veterinary diagnostics. SignalPET’s portfolio, for instance, includes SignalRAY- AI-based radiology test panels for common clinical findings; SignalRAY+, an AI tool that adds history to refine clinical answers, and SignalSMILE- AI-based dental radiology test panels for common pathologies.

The other segment is projected to grow at the highest CAGR of around 25% during the forecast period. It includes emerging applications of AI in animal health, such as drug discovery & development, precision medicine, etc. For instance, FidoCure- a One Health Company (OHC) sequences canine DNA, identifies mutations, creates a personalized DNA report, and helps veterinary practitioners prescribe targeted therapies based on AI-informed decision-making. ImpriMed, on the other hand, the Personalized Prediction Profile provides AI-based drug response predictions for canine leukemia or lymphoma using the patient’s live cancer cells, medical history, and breed. Furthermore, according to this November 2024 press release, Zoetis scientists are working on developing a generative AI model to aid in veterinary drug discovery and development.

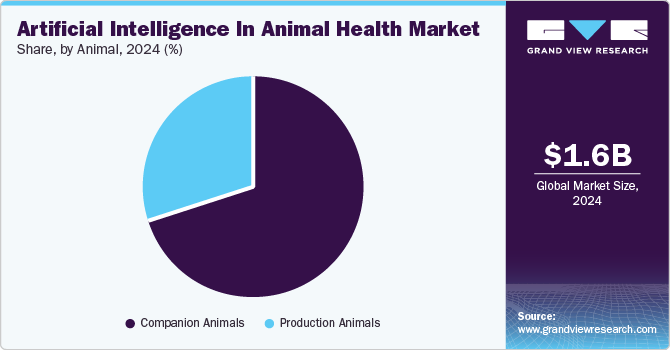

Animal Insights

Based on animal, the companion animal segment held the highest share in 2024. The increasing availability of AI-based pet health solutions, growing pet expenditure, and pet humanization are some key drivers contributing to the segment share. For instance, in January 2025, FidoCure launched Fetch, an AI-based platform that can access canine cancer databases to identify connections between genetic profiles and targeted cancer therapies. ImpriMed, Inc., on the other hand, provides an AI-driven drug response prediction profile for treating canine cancer.

The production animal segment is estimated to witness the fastest growth of nearly 24% in the near future. The global demand for animal protein, such as meat and dairy products, continues to rise due to population growth, urbanization, and changing dietary preferences. This drives the need for efficient and sustainable livestock production, thus fueling the awareness and uptake of precision livestock farming solutions. AI-enabled devices and wearables can track and monitor animals' vital signs, activity levels, and behavior remotely. This helps in the early detection of health changes, ensuring timely intervention and reducing the need for frequent veterinary visits. A recent January 2025 article published by the USDA Agricultural Research Service states that they, in collaboration with Iowa State University, are utilizing generative AI to accelerate the development of solutions for reducing methane emissions from cattle. The study is focused on identifying non-toxic compounds that can inhibit methane production in the cow's rumen. By combining AI with laboratory studies, the team aims to discover safe and effective methane inhibitors, enhancing strategies for sustainable animal agriculture and mitigating climate change.

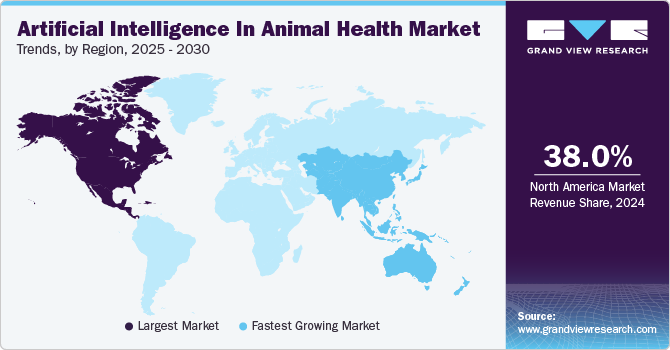

Regional Insights

North America artificial intelligence in animal health market held the largest share of more than 38% of the total market by region in 2024. AI algorithms can analyze radiographs, CT scans, and MRI images to assist veterinarians in diagnosing diseases and abnormalities. These algorithms can detect patterns and markers that may be difficult for humans to identify, leading to improved accuracy and faster diagnosis. The growing integration of AI in veterinary diagnostics and advanced veterinary healthcare infrastructure in the U.S. and Canada are key factors contributing to the regional share. For instance, in December 2024, Canadian veterinary company TelmyVet partnered with PetPace to develop an AI-powered pet health monitoring and analytics platform for pet parents in Canada.

U.S. Artificial Intelligence In Animal Health Market Trends

The artificial intelligence (AI) in animal health market in the U.S. takes the highest share globally due to growing efforts in the country to create awareness about fair use, benefits, and risks of AI among veterinary professionals and animal owners. For instance, in May 2024, Cornell University's College of Veterinary Medicine (CVM) conducted an inaugural conference on integrating AI into veterinary medicine. Many individuals, like researchers, AI scientists, industry pioneers, veterinary professionals, and many more, attended this event.

Europe Artificial Intelligence In Animal Health Market Trends

The artificial intelligence (AI) in animal health market in Europe held the second-largest share of the total market in 2024. This can be attributed to prestigious institutions around the region acknowledging the growing importance of AI and conducting knowledge-sharing events to explore its application in the veterinary field. For instance, in May 2024, the prestigious Royal College of Veterinary Surgeons, UK (RCVS) conducted a Roundtable Conference on AI. This event was conducted at the Institute of Engineering and Technology in London and aimed to discuss artificial intelligence (AI) regulation in veterinary medicine. Over 100 stakeholders, including veterinary professionals, educators, technology representatives, and public sector participants, attended this event to share insights and expertise.

The UK artificial intelligence (AI) in animal health market is expected to grow. Apart from the experts from the country actively seeking to regulate the use of AI in veterinary medicine, the industry is also driven by investments in AI - integration from various sectors related to animal health. For instance, in July 2024, UK's leading retailer, Sainsbury, partnered with Vet Vision AI, a startup from the University of Nottingham, to test innovative AI - technology that utilizes low-cost, portable cameras to monitor cow behavior, providing real-time data on their health and happiness, and offering farmers actionable insights to improve cow comfort and productivity.

The artificial intelligence (AI) in animal health market in Germany is driven by growing investments and advancements in veterinary radiology diagnostics and the rapid increase in ongoing research studies. For instance, in February 2024, researchers from Hannover University of Veterinary Medicine conducted a study to utilize AI in enhancing pain diagnosis in cats. This study found that the nose and mouth regions are more critical for AI systems to identify pain accurately than the ear region. It compared two AI-based systems for evaluating pain through facial expressions, achieving over 77% accuracy with manually annotated facial landmarks and over 65% with AI-annotated landmarks. This research aims to develop automated systems for objective pain assessment in cats, improving veterinary care.

Asia Pacific Artificial Intelligence In Animal Health Market Trends

The artificial intelligence (AI) in animal health market in Asia Pacific, on the other hand, is estimated to grow at the highest CAGR of more than 23% from 2025 to 2030. This is due to local market players' initiatives and the region's increasing veterinary care disparities. For instance, Alibaba Cloud’s ET Agricultural Brain extends the company's self-developed AI technology to agriculture. The technology uses voice recognition, visual recognition, and real-time environmental parameter tracking to monitor animal activity, pregnancy, growth indicators, and other health conditions. Many leading pig farming enterprises in China have already adopted ET Agricultural Brain.

Furthermore, AI is making significant strides in addressing veterinary care disparities in Asia by enhancing animal welfare and healthcare delivery. These technologies are being utilized to analyze complex behavioral data, enabling a better understanding of animal emotions and needs, which can lead to more effective welfare practices. Integrating AI in veterinary diagnostics, such as through advanced imaging and data analysis, also facilitates early disease detection and intervention. Overall, these advancements are helping to bridge gaps in veterinary care access and quality across the region.

Although relatively nascent in adopting this technology for veterinary use, the country is rapidly gaining traction in the industry. Veterinary professionals from South Korea are attempting to increase the utilization of AI in crucial verticals like disease diagnostics. Innovative AI-driven tools are being developed to analyze pet health data, enabling faster and more accurate diagnoses of various conditions. This technology enhances the efficiency of veterinary practices and improves the overall quality of care for pets. As a result, pet owners in South Korea benefit from more personalized and effective healthcare solutions for their animals, reflecting a growing trend toward integrating technology into veterinary medicine.

Latin America Artificial Intelligence In Animal Health Market Trends

The artificial intelligence (AI) in animal health market in Latin America is expected to show lucrative growth over the forecast period. The region heavily depends on livestock animals for its economic development, prompting industry experts to utilize advanced technologies to make livestock management efficient. For instance, according to an October 2024 article published by The International Society for Photogrammetry and Remote Sensing (ISPRS), SENASA, an Argentina government agency, collaborated with ISPRS to develop a Deep Learning algorithm for detection and counting of cattle using very high-resolution satellite images from the Argentine Space Agency. The study preprocessed and labeled approximately 320 satellite scenes, and around 8,000 labels of various animals were generated, primarily cows and sheep.

Brazil artificial intelligence (AI) in animal health market is primarily driven by various activities that participants undertake to enhance the animal feed supply chain. For instance, in February, Cargill and BinSentry entered into a partnership to develop AI-based sensor technology and platform to optimize and enhance the feed supply chain management of the pork & poultry producers from Brazil. The technology includes solar-powered sensors that monitor feed levels, allowing producers to manage inventory in real-time and reduce costs associated with feed management.

MEA Artificial Intelligence In Animal Health Market Trends

The driving factors of this region are the active involvement of regional economic development agencies in advancing the existing livestock management systems and sprouting startup culture in the area. In a July 2023 blog, the African Union Development Agency (AUDA) emphasized the significant economic impact of Foot and mouth disease (FMD) on the African cattle industry, calling for practical outbreak prediction tools. Machine learning (ML) is being explored to enhance the prediction of FMD outbreaks. These ML technologies are being recommended to improve biosecurity, vaccination, and early detection of FMD, with successful implementations already completed in countries like Kenya and Ethiopia. By leveraging data-driven approaches, the AUDA aims to mitigate the economic losses associated with diseases like FMD and support sustainable livestock farming in Africa.

The adoption of AI in the country's veterinary industry can be attributed to the growing participation of the government in pioneering the use of the technology. For instance, Saudi Arabia's Deputy Minister of Environment launched the Animal Intelligence Platform for Animal Health at the 2025 LEAP conference. This platform will enable the government to monitor the spread of animal diseases with the help of geographical and temporal data visualization and provide real-time forecasts.

Key Artificial Intelligence In Animal Health Company Insights

The market is very competitive owing to the presence of diverse players, established and emerging, and also due to growing startups. As the field advances, other companies are anticipated to enter the market and contribute to developing AI-driven solutions in veterinary medicine. Existing market participants continue to implement strategic initiatives ranging from partnerships and collaborations to mergers and acquisitions to product launches and upgrades to increase their market presence.

Key Artificial Intelligence In Animal Health Companies:

The following are the leading companies in the artificial intelligence in animal health market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis, Inc

- Idexx Laboratories

- Covetrus

- Merck & Co., Inc.

- Mars Inc.

- ImpriMed, Inc.

- Vetology Llc.

- Petriage

- AI Superior GmbH

- LifeLearn Inc

Recent Development:

-

In January 2025, LifeLearn Inc. launched two new AI-powered platforms, ClientEd and Sofie AI, to provide accurate pet health information to pet owners and veterinarians.

-

In December 2024, Zoetis launched its first AI-based screen-less POC hematology analyzer, Vetscan OptiCell, at the Veterinary Meeting & Expo (VMX) conference in Florida, U.S.

-

In May 2024, Modern Animal announced AI-assisted upgrades to its flagship medical platform, Claude. Veterinary settings use this platform to streamline their daily administrative tasks and reduce the burden on veterinarians.

Artificial Intelligence In Animal Health Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2025 |

USD 1.80 billion |

|

The revenue forecast in 2030 |

USD 4.89 billion |

|

Growth Rate |

CAGR of 22.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion & CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Solutions, application, animal, region |

|

Regions covered |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Norway; Sweden; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Zoetis, Inc.; Idexx Laboratories; Covetrus; Merck & Co., Inc.; Mars Inc.; ImpriMed, Inc.; Vetology Llc.; Petriage; AI Superior GmbH; LifeLearn Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Intelligence In Animal Health Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial intelligence in animal health market report on the basis of solutions, application, animal, and region:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Identification, Tracking, and Monitoring

-

Other Applications

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Production Animals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in animal health market size was estimated at USD 1.57 billion in 2024 and is expected to reach USD 1.80 billion in 2025.

b. The global artificial intelligence in animal health market is expected to grow at a compound annual growth rate of 22.1% from 2025 to 2030 to reach USD 4.89 billion by 2030.

b. By solutions, the hardware segment dominated with a market share of about 62% in 2024, while the software & services segment is estimated to grow at the fastest rate of about 23%. Continuous advancements in hardware & software technologies, such as sensors, imaging devices, analyzing devices, computer vision, deep learning, and wearables, are fueling the growth of the segments.

b. Some key players operating in the AI in animal health market include Zoetis, Inc.; Idexx Laboratories; Covetrus; Merck & Co., Inc.; Mars Inc.; ImpriMed, Inc.; Vetology Llc.; Petriage; AI Superior GmbH; LifeLearn Inc.

b. Some of the key drivers of the artificial intelligence in animal health market include rapidly rising adoption & integration of AI into multiple sectors of the veterinary industry, increasing activities to spread awareness & education among veterinary professionals, continuously emerging novel applications of AI, and crucial benefits of AI utilization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."