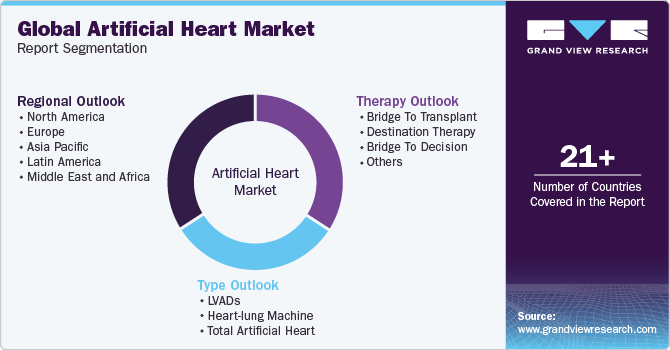

Artificial Heart Market Size, Share & Trends Analysis Report By Type (Heart-lung Machine, Total Artificial Heart), By Therapy (Destination Therapy, Bridge To Transplant, Bridge To Decision), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-275-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Artificial Heart Market Size & Trends

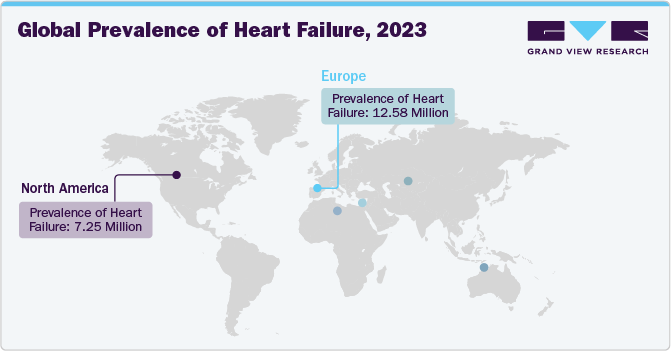

The global artificial heart market size was estimated at USD 2.84 billion in 2023 and is anticipated to grow at a CAGR of 11.3% from 2024 to 2030. Some of the key factors driving the market are the rising prevalence of heart failure and other cardiac disorders, the shortage of donor organs for heart transplantation, and recent developments in medicine. According to an article published by the British Heart Foundation in 2022, nearly 7.6 million people were suffering from heart or circulatory disease in UK, and more than a million people are living with heart failure. With the global population aging, there is a growing need for cardiac care and devices such as artificial hearts.

Increased knowledge among patients and healthcare professionals about the benefits of artificial heart in extending and enhancing quality of life is driving market acceptance. Furthermore, availability of advanced artificial heart implants in certain regions at reduced costs compared to traditional transplantation is another key factor driving medical tourism for cardiac treatment. For instance, according to an article published by the India Cardiac Surgery Site, the average cost of a ventricular assist device or artificial heart transplant in India was estimated at around USD 54,000 to USD 98,000.

Technological breakthroughs in materials science, robotics, and biotechnology have led to the creation of more advanced heart devices, driving market expansion. The development of fully implantable artificial heart, such as the SynCardia Total Artificial Heart, designed to provide circulatory support for patients with end-stage biventricular heart failure, represents a significant innovation in the industry. These devices offer patients a longer-term solution than temporary assist devices, showcasing the ongoing advancement in artificial heart technology. Collaboration between research centers, medical device manufacturers, and academic institutions is leading to the development of more innovative artificial heart technologies.

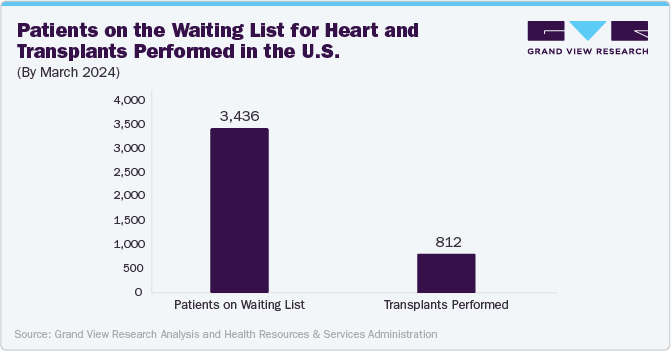

The ongoing shortage of donor organs for heart transplantation has created an unmet need for patients with end-stage heart failure, making artificial heart a practical alternative. According to Oxford University Press, over 64 million people worldwide suffer from heart failure, with only 6,000 receiving a donor heart. This scarcity necessitates developing and using artificial heart to sustain patients while they wait for a suitable donor organ. According to the Human Resources & Services Administration and the Organ Procurement and Transplantation Network in the U.S., around 3,436 patients are waiting for heart transplantations.

Market Concentration & Characteristics

The growth stage in the market is high, and pace of the market growth is accelerating. In recent years, there has been significant innovation in this field, with developments such as biocompatible materials, miniaturization of components, and advanced control systems enhancing the performance and reliability of artificial heart. For instance, the incorporation of advanced sensors and algorithms in artificial heart, like the HeartMate 3 by Abbott, has improved device reliability and patient outcomes by enabling better synchronization with the patient's natural heart rhythms.

The artificial heart industry is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. For instance, in May 2023, SynCardia Systems' parent company, Picard Medical, a manufacturer and provider of mechanical heart replacement technology, entered into a definitive business combination agreement. This deal is anticipated to help SynCardia pursue FDA clearance for long-term indications, accelerate its worldwide expansion, and enhance its next-generation product R&D.

Regulations are crucial in shaping the market, ensuring high-quality, safe products. In the U.S., the FDA approval process, like the Humanitarian Device Exemption pathway, ensures these devices meet safety standards. However, excessive regulations hinder innovation. The impact of regulations varies by region, with some markets having more stringent requirements. For example, the European Medicines Agency's Medical Device Regulation in 2020 led to stricter CE marking requirements, affecting how artificial heart manufacturers demonstrate compliance and safety for market entry in Europe.

Product expansion in the market involves introducing new variations of artificial heart that cater to different patient needs or offer improved features. Product expansion strategies often focus on addressing unmet needs or improving upon existing technologies to stay competitive. For instance, CARMAT, a company developing artificial heart, focuses on developing a bioprosthetic artificial heart with potential long-term benefits, targeting patients with end-stage heart failure, reflecting a strategic move towards expanding product offerings beyond mechanical devices.

The global market is witnessing significant regional expansion as companies seek to capitalize on the growing demand for alternate heart technologies. Key companies in the artificial heart industry are also focusing on market expansion. For instance, in November 2022, Medtronic, a key med-tech player, announced its expansionary plans in Costa Rica by allocating USD 65 million to launch a new manufacturing unit, completion of which is expected to finish by 2024.

Type Insights

The left ventricular assist device (LVAD) segment held the largest market share of 77.40% in 2023. The rising prevalence of heart failure globally has contributed significantly to the growth of the LVAD market. As heart failure cases increase, there is a growing demand for advanced cardiac support devices like LVADs to improve patient outcomes and quality of life. For instance, Abbott's introduction of the HeartMate 3 LVAD, which incorporates magnetically levitated rotor technology, has significantly reduced the risk of pump thrombosis and improved patient outcomes compared to earlier generations of LVADs.

Ongoing technological advancements in LVADs, such as miniaturization, improved durability, and enhanced control algorithms, have made these devices effective, safer, and suitable for a broader range of patients. Clinical studies, such as the MOMENTUM 3 trial comparing the HeartMate 3 LVAD to the HeartMate II, have demonstrated superior outcomes with newer LVAD technologies, leading to increased adoption and market share. The significant improvement in patient outcomes, including survival rates, quality of life, and functional capacity, with LVAD therapy has fueled its demand among heart failure patients and healthcare providers. The significant improvement in patient outcomes, including survival rates, quality of life, and functional capacity, with LVAD therapy has fueled its demand among heart failure patients and healthcare providers.

The Total Artificial Heart (TAH) segment is anticipated to witness the fastest CAGR of 14.6% during the forecast period owing to the increasing prevalence of advanced heart failure, driven by factors such as aging populations, rising incidence of cardiovascular diseases, and improved survival rates of patients with chronic heart conditions, has created a larger patient pool for TAH therapy. Continuous advancements in TAH technology, including improved biocompatibility, miniaturization, enhanced durability, and sophisticated control algorithms, have made these devices more reliable, safer, and suitable for a broader range of patients.

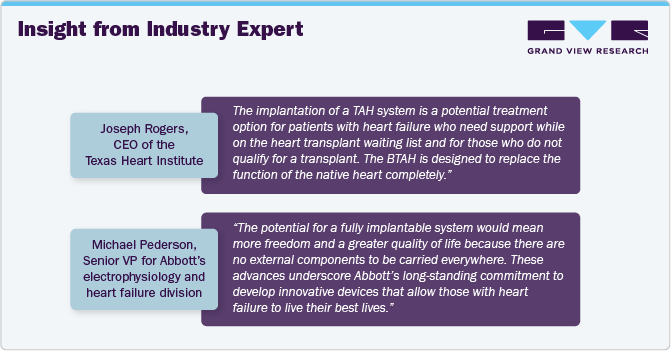

According to Daniel Timms, Founder and Chief Technology Officer of BiVACOR Inc.,

“There is a huge gap between available treatment options and the number of patients with severe heart failure. Initiating human clinical work for the BiVacor TAH is the first step to address critical patient needs from this noncurative disease.”

BiVACOR focuses on developing total artificial heart (TAH) to perform complete functions related to patient’s failing heart.

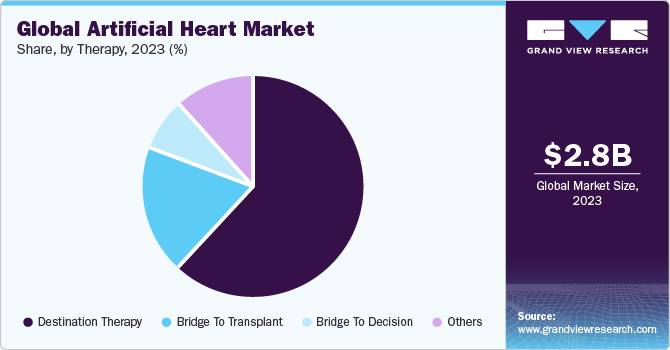

Therapy Insights

The destination therapy segment accounted for largest revenue share in 2023 and is expected to witness the fastest CAGR during the forecast period. This is due to the increasing prevalence of advanced heart failure patients who are ineligible for heart transplantation or other therapies. This patient population represents a significant unmet medical need, driving demand for long-term mechanical circulatory support provided by artificial heart. Companies are focused on developing next-generation artificial heart with enhanced features, such as remote monitoring capabilities, improved battery life, and reduced device-related complications. These advancements aim to improve patient outcomes and expand the reach of destination therapy (DT) to a wider patient population.

Expanded clinical indications and regulatory approvals have further fueled the growth of the DT segment. Regulatory agencies like the FDA have granted approvals for artificial heart, including LVADs and Total Artificial Heart, specifically for destination therapy use. Clinical evidence supporting destination therapy devices' efficacy and positive outcomes has bolstered confidence among healthcare professionals and patients. Long-term studies and real-world data have demonstrated significant improvements in survival rates, reduced hospitalization rates, and enhanced patient well-being with DT interventions.

Regional Insights

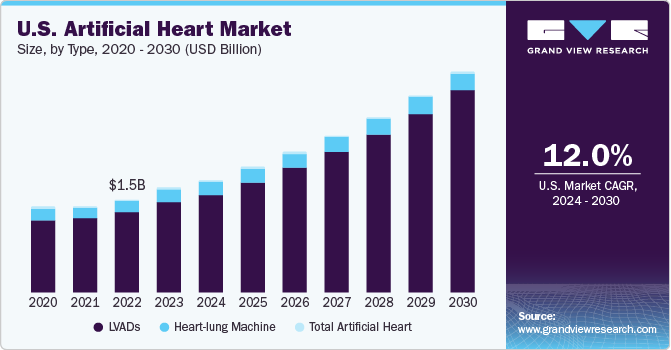

North America dominated the market with a revenue share of 64.1% in 2023 and is expected to witness the fastest CAGR of 11.9% during the forecast period. Advanced healthcare infrastructure, increasing prevalence of cardiovascular diseases, favorable reimbursement policies, and technological advancements in the region drives the market growth for artificial heart. The U.S. dominates the artificial heart market in North America, with major players like Abbott, BiVacor and SynCardia leading innovations in LVADs and Total Artificial Heart.

U.S. Artificial Heart Market Trends

The artificial heart market in the U.S. held the largest share of nearly 89.8% in 2023, in the North American region, owing to the high prevalence of cardiac diseases and demand for artificial heart technologies. According to the Centers for Disease Control and Prevention, heart failure in the U.S. causes 6.2 million cases yearly, resulting in approximately 380,000 deaths and USD 30.7 billion in medical costs. However, due to a limited donor heart supply, only 3% of these patients receive a transplant, highlighting the need for a reliable mechanical heart replacement solution such as artificial heart transplantation.

Europe Artificial Heart Market Trends

The artificial heart market in Europe is expected to witness lucrative growth over the forecast period, owing to growing aging population, increasing prevalence of heart failure, supportive healthcare policies, and technological advancements. The European Heart Health Charter, initiated by the European Society of Cardiology and the European Heart Network, aims to enhance cardiovascular health by preventing and ensuring treatment for those in need. It recommends a collaborative framework to reduce premature and preventable cardiovascular disease events in the European Union and WHO European Region countries. Moreover, the Heart failure policy and practice in Europe aims to support advocates with a clear outline of policy issues and best practices in heart failure across 11 European countries.

UK artificial heart market is expected to show lucrative growth owing to the increasing prevalence of cardiovascular disorders in the country’s population. As cardiovascular diseases remain a significant health concern in the country, the need for advanced treatment options like artificial heart continues to grow. According to the British Heart Foundation, approximately 4 million men and 3.6 million women in the country suffer from heart and circulatory diseases.

The artificial heart market in France is anticipated to witness significant growth attributing to the increased emphasis on medical technology adoption. France has a strong focus on adopting cutting-edge medical technologies to enhance patient care and outcomes. This emphasis on innovation has led to increased acceptance of artificial heart devices as viable treatment options for patients with severe cardiac conditions. There are notable advancements in LVAD technologies, with companies like CARMAT in the region focusing on developing bioprosthetic artificial heart. Regulatory support from agencies like ANSM (Agence Nationale de Sécurité du Médicament) facilitates market access for innovative devices.

Asia Pacific Artificial Heart Market Trends

The Asia-Pacific region is experiencing a rise in cardiovascular diseases due to changing lifestyles, dietary habits, and aging populations. This increase in cardiac disorders creates a significant demand for advanced cardiac care solutions, including artificial heart. There is a growing awareness about cardiovascular health in the region, leading to increased early detection and treatment of heart conditions. This heightened awareness drives the demand for advanced cardiac therapies, including artificial heart.

Australia artificial heart market expected to show lucrative growth owing to the high incidence of cardiovascular disorders among the population, especially in older age groups, which drives the demand for artificial heart devices. According to the Minister's Department of Health and Aged Care, the Australian Government is investing USD 50 million in developing and commercializing the world's most advanced artificial heart, which could potentially reduce global heart failure deaths and contribute USD 1.8 billion to Australia.

The artificial heart market in India is expected to show lucrative growth owing to the improving healthcare access, rising disposable income, and advancements in medical technology. India has a large population with a growing burden of cardiovascular diseases, making it one of the key drivers for artificial heart adoption. The increasing prevalence of risk factors such as hypertension, diabetes, and obesity contribute to a higher incidence of heart-related conditions, creating a demand for advanced cardiac therapies like artificial heart. According to the World Health Organization, cardiovascular disease, including ischemic heart disease and stroke, is the primary cause of 17.7 million deaths globally. India is responsible for one-fifth of these fatalities, especially in younger populations.

Latin America Artificial Heart Market Trends

Latin America is experiencing a rise in cardiovascular diseases, including coronary artery disease and heart failure. This prevalence of cardiac conditions is driving the demand for artificial heart devices in the region. Similar to global trends, this region is also witnessing an aging population leading to cardiovascular issues and other heart-related illnesses.

Mexico artificial heart market is expected to grow significantly owing to the prevalence of cardiovascular diseases. The Mexican government verified that around 226,000 fatalities in 2021 were attributable to cardiovascular disorders. Moreover, Mexico’s rapidly advancing healthcare infrastructure and technological capabilities provide opportunities for the growth of the artificial heart market.

MEA Artificial Heart Market Trends

The MEA region is witnessing rapid development in its healthcare sector, with governments investing in modernizing healthcare facilities and services. This progress creates opportunities for the adoption of advanced medical technologies like artificial heart. According to the Saudi Health Council, the Middle East experiences 309 deaths per 100,000 individuals from ischemic heart disease and hypertensive heart disease, compared to 204 per 100,000 in North America and 187 per 100,000 in Western Europe.

Saudi Arabia artificial heart market is anticipated to witness significant growth attributing to the rising heart diseases due to aging and lifestyle factors. The government in Saudi Arabia focuses on healthcare infrastructure development and investment in research and development further to support the growth of the artificial heart market. Initiatives aimed at improving cardiac care and reducing mortality rates from cardiovascular diseases are expected to propel the adoption of artificial heart in the country. In 2022, the Saudi government allocated a one-time payment of $3,000 per patient over five years to reduce cardiovascular disease (CVD) mortality and morbidity, with the goal of screening most of the population for CV risk factors.

Key Artificial Heart Company Insights

The artificial heart market is a dynamic and competitive industry with several key players vying for market share. The companys in this market are focusing on research and development, along with strategic partnerships and product launches. The commitment to advancing cardiac care through technological innovations has contributed to a substantial market share in the artificial heart sector.

Key Artificial Heart Companies:

The following are the leading companies in the artificial heart market. These companies collectively hold the largest market share and dictate industry trends.

- SynCardia Systems, LLC

- CARMAT

- BiVACOR Inc.

- RealHeart

- Abbott

- ABIOMED (Johnson & Johnson Services Inc)

- Jarvik Heart, Inc.

- LivaNova PLC

- Getinge

- Terumo Corporation

Recent Developments

-

In February 2024, BiVacor, an Australian medical device company, received a USD 13 million grant from the Australian Government's Medical Research Future Fund to support its Total Artificial Heart program, a long-term therapy for severe biventricular heart failure patients.

-

In December 2023, CARMAT, a developer and designer of the advanced total artificial heart, announced the first implant of its artificial heart, Aeson, for a patient suffering from a cardiac tumor. The heart, designed by the company, is a therapeutic alternative for patients with advanced biventricular heart failure. The implant was performed in France.

-

In November 2023, BiVACOR was granted an investigational device exemption (IDE) by the U.S. FDA, allowing it to start a first-in-human study on its total artificial heart (BTAH). The study aims to evaluate the safety and feasibility of the BTAH device, which is used to bridge the time to a heart transplant for patients with heart failure who can wait nearly three years.

Artificial Heart Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.13 billion |

|

Revenue forecast in 2030 |

USD 5.94 billion |

|

Growth Rate |

CAGR of 11.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, therapy, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

SynCardia Systems, LLC ; CARMAT; BiVacor; RealHeart; Abbott; Abiomed (Johnson & Johnson Services Inc); Jarvik Heart, Inc.; LivaNova PLC; Getinge AB; Terumo Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Heart Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial heart market report based on type, therapy and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

LVADs

-

Heart-lung Machine

-

Total Artificial Heart

-

-

Therapy Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bridge To Transplant

-

Destination Therapy

-

Bridge To Decision

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial heart market size was estimated at USD 2.84 billion in 2023 and is expected to reach USD 3.13 billion in 2024.

b. The global artificial heart market is expected to grow at a compound annual growth rate of 11.3% from 2024 to 2030 to reach USD 5.94 billion by 2030.

b. North America dominated the artificial heart market with a share of 64.1% in 2023. This is attributable to expanding the base of the geriatric populace, rising occurrences of interminable disorders, and developing interest in remote and wireless devices combined with streamlined coverage policies.

b. Some key players operating in the artificial heart market include SynCardia Systems, LLC, CARMAT, BiVacor, Abbott, Medtronic, Jarvik Heart, Berlin Heart, LivaNova PLC, and Getinge AB.

b. Key factors that are driving the artificial heart market growth include increasing product innovation, rising number of healthcare settings, and increasing prevalence of heart failure disorders.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."