Artificial Disc Replacement Market Size, Share & Trends Analysis Report By Material Type (Metal + Plastic), By Indication (Cervical, Lumbar), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-482-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Artificial Disc Replacement Market Trends

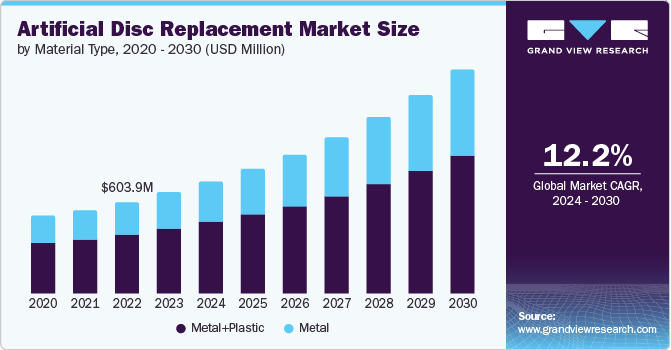

The global artificial disc replacement market size was estimated at USD 603.9 million in 2023 and is projected to grow at a CAGR of 12.2% from 2024 to 2030. The increasing number of trauma-related sports injuries and orthopedic surgeries is expected to boost the market growth. According to the NFL Physicians Society, approximately 1.2 million football-related injuries are sustained annually. The market is also anticipated to grow owing to increasing technological advancements and the rising geriatric population globally. For instance, in December 2023, it was found that between 65% and 85% of elderly individuals experienced musculoskeletal pain, with 36% to 70% reporting back pain.

The increasing demand for this minimally invasive surgical procedure drives the market growth. The growing prevalence of degenerative disc disease (DDD), a condition that affects intervertebral discs, causing pain, stiffness, and limited mobility, is a key driver. As the population ages, the incidence of DDD is expected to rise, further fueling market growth. Furthermore, the increasing awareness of the benefits of artificial disc replacement (ADR) over traditional spinal fusion surgery is driving adoption. ADR offers advantages such as preserving motion, reducing pain, and improving quality of life.

Rising technological advancements in artificial disc design and materials are another significant growth driver. Modern artificial discs are more biocompatible & durable and offer better biomechanical performance, improving clinical outcomes. The development of minimally invasive surgical techniques contributes to the market’s growth and allows for faster recovery times and reduced complications. The increasing availability of reimbursement for ADR procedures is a key factor driving market expansion. As healthcare systems recognize the long-term cost-effectiveness of this procedure, more patients can access this treatment option.

ADR surgeries are performed on patients suffering from back pain due to degenerated discs. According to the American Chiropractic Association, 80% of the population experiences back pain at least once in their lifetimes. It also stated that low back pain costs around USD 50 billion in healthcare costs every year to Americans. The rising geriatric or target population, which is highly prone to back pain, will also support the market growth. According to the Population Reference Bureau, the number of Americans aged 65 years and more is projected to nearly double from 58 million in 2022 to 82 million by 2050.

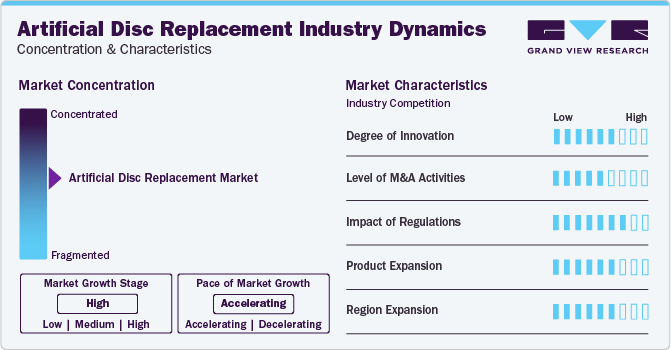

Market Concentration & Characteristics

The degree of innovation in the ADR market is high, with numerous companies investing in R&D to create more advanced and efficient products. One example of this is the development of 3D-printed artificial discs, which are a more precise fit and can potentially lead to faster recovery times for patients. In addition, companies explore the use of new materials, such as synthetic biomaterials, which can better enact the natural properties of human tissue

Several companies participate in mergers and acquisitions to improve their market position. These activities boost their market expertise, diversify their product offerings, and enhance their skills. In October 2023, Silony Medical acquired Centinel Spine’s Global Fusion Business, adding cervical and lumbar fusion products, including STALIF technology, to its portfolio. This extends Silony's offerings, merging them with its Verticale, Roccia, and Favo systems for improved spinal fusion solutions

The impact of regulations on the ADR market is high. To bring a new artificial disc replacement product to market, companies must comply with a wide range of regulatory requirements, including clinical trials and obtaining approval from regulatory bodies such as the FDA. These regulations can be time-consuming and expensive, which can limit the number of new products that are brought to market. Additionally, regulations can also vary by region, which can create challenges for companies looking to expand their operations globally.

The presence of product substitutes in the market is low. Currently, there are few alternatives to ADR surgery for patients with degenerative disc disease or other spinal conditions. While traditional spinal fusion surgery is an option, it has a longer recovery time and can lead to decreased mobility compared to ADR surgery. As a result, patients and doctors may be more likely to choose ADR surgery over other options.

The level of regional expansion in the market is medium. While there are already several established players, there are still opportunities for growth and expansion in certain regions. For instance, companies expand their operations in emerging markets such as Asia and South America where there is a growing demand for medical devices and treatments. Additionally, some companies expand their operations through strategic partnerships or collaborations with local healthcare providers or distributors.

Material Type Insights

The metal + plastic segment dominated the market and accounted for a share of 64.2% in 2023. The majority of cervical total disc replacement implants, which are FDA-approved incorporate iterations of metal alloy-based inferior and superior prosthetic endplates, which articulate with a central medical-grade plastic core. Also, the overall success rate of metal + plastic ADR procedures is high, which fuels market growth. In February 2024, Synergy Spine Solutions secured a USD 30 million Series A equity financing led by Amzak Health for artificial cervical disc replacement development. This funding aims to finalize its US IDE 2-level clinical trial enrollment, maintain ongoing trials, seek FDA Pre-Market Approvals, and enhance international commercial efforts. The company completed its 1-level IDE trial enrollment in June 2023.

The metal segment is projected to grow at the fastest CAGR over the forecast period. This growth is credited to the rising number of research activities in this segment due to the high potential of metals to remove long-term wear compared to metal + plastic materials. Despite immense opportunities in this segment, it holds the second-largest market share due to product recalls. In May 2023, Dymicron aims to transform the spinal disc market by offering more durable, flexible joint replacements using diamond technology, seeking investors for the initiative. Dymicron's innovation addresses a critical balance between durability and mobility within this specialized market, beginning its focus on spinal disc replacement. According to Dymicron, their technology enhances the durability of spinal discs by a factor of 1,000.

Indication Insights

The cervical disc replacement segment held the largest share of 51.3% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Key factors contributing to this share include a rising number of disc degeneration cases in the cervical discs compared to lumbar discs. Furthermore, the high number of products available for artificial cervical disc replacement is expected to boost the segment growth. For instance, in October 2022, Centinel Spine emerged as the only company offering a range of solutions tailored to fit the anatomical needs of patients, with four cervical total disc replacement devices approved by the FDA for single-level use.

The lumbar disc replacement segment is anticipated to grow significantly during the forecast period. Lumbar disc replacement procedures do not require bone fusion, leading to shorter recovery time than the other spinal procedures, which is expected to impact market growth positively. Growing technological advancements and research activities are also anticipated to boost the segment growth. In February 2024, Centinel Spine's prodisc L, the only approved lumbar TDR system for one- and two-level procedures in the U.S., received coverage from Tennessee's largest commercial payer, serving 2.3 million people. Lumbar TDR covers nearly 94% of U.S. individuals with commercial insurance, and two-level coverage extends to over 30%.

End-use Insights

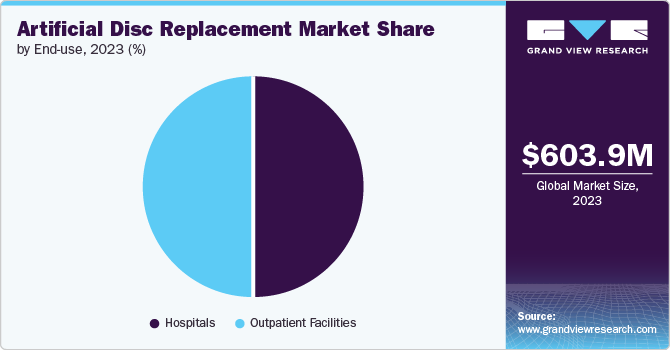

The hospitals segment held the largest share of 50.1% in 2023 due to the rising demand for treatments for degenerative disc diseases and spinal disorders. The push for adopting advanced technologies and procedures, coupled with improvements in surgical techniques and implant materials, has made ADR more popular. This led to an increase in patient volumes at hospitals offering this innovative procedure, highlighting a positive market trend.

The outpatient facilities segment is anticipated to grow significantly over the forecast period. The market is influenced by the growing trend of outpatient orthopedic surgeries, including disc replacements, due to advancements in minimally invasive techniques. These advancements enable quicker recovery times, reducing the need for prolonged hospital stays. Outpatient facilities offer cost-effective and convenient options for these procedures, catering to the demand for more affordable and accessible healthcare. The increase in outpatient facilities providing ADRs highlights the market's adaptation to changing patient preferences and needs. In November 2023, DISC Surgery Center at Newport Beach engaged in a clinical trial on ADR, inviting patients who meet certain criteria, including those between 18 and 75, and needing cervical surgery at two adjacent levels.

Regional Insights

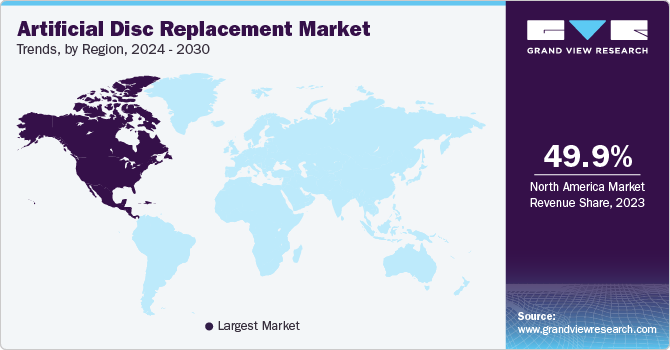

The artificial disc replacement market in North America accounted for a share of 49.97% in 2023. In recent years, North America has witnessed a significant surge in the adoption of ADR procedures due to the increasing prevalence of degenerative disc diseases and spinal disorders. The growing awareness of minimally invasive spine surgeries and the availability of advanced healthcare infrastructure are expected to drive market growth. Moreover, rising demand for improved patient outcomes and reduced post-operative complications have encouraged medical device manufacturers to invest in R&D activities to introduce innovative ADR systems.

U.S. Artificial Disc Replacement Market Trends

The U.S. artificial disc replacement market held the largest share in the North America regional market in 2023 and is expected to grow rapidly over the forecast period. The U.S. market has experienced significant growth in recent years, driven by technological advancements and a growing preference for minimally invasive procedures. One notable trend is the increasing use of MRI-compatible discs, which allow for more accurate post-operative monitoring and reduce the need for additional surgeries. Additionally, the development of 3D-printed artificial discs has gained traction, offering enhanced customization and improved patient outcomes. For instance, in 2021, Spineology Inc. announced the FDA clearance of their 3D-printed OptiMesh expandable cage, further solidifying this trend.

Europe Artificial Disc Replacement Market Trends

The artificial disc replacement market in Europe is a lucrative regional market. The market is experiencing an upward trajectory owing to the rising geriatric population, sedentary lifestyles, and increasing incidence of spinal disorders. Countries like Germany, France, and the UK are at the forefront of ADR adoption, driven by technological advancements and supportive reimbursement policies. Furthermore, the increasing preference for outpatient spine procedures is anticipated to fuel market growth.

The UK ADR market is witnessing steady growth due to the growing demand for minimally invasive spine surgeries and improved patient outcomes. The National Health Service (NHS) has included ADR as a treatment option for specific spinal conditions, which has led to increased adoption rates. However, concerns regarding high costs and limited reimbursement coverage may hinder market growth.

The artificial disc replacement market in France is expected to grow rapidly during the forecast period. France is experiencing a considerable rise in ADR adoption due to its aging population and high prevalence of spinal disorders. The French government’s commitment to improving healthcare services and increasing accessibility to advanced medical technologies has contributed to market growth. In addition, prominent medical device manufacturers in France support the development of innovative ADR systems.

The Germany artificial disc replacement market is expected to grow substantially due to its robust healthcare infrastructure, high adoption rate of advanced medical technologies, and favorable reimbursement policies. The increasing demand for minimally invasive spine surgeries and improved patient outcomes drive the market growth. Furthermore, the presence of prominent medical device manufacturers in Germany fosters innovation and technology advancements in ADR systems.

Asia Pacific Artificial Disc Replacement Market Trends

The artificial disc replacement market in Asia Pacific is anticipated to witness the fastest growth over the forecast period. The market is witnessing a significant trend towards technological advancements and innovation in medical devices. Countries like South Korea and Singapore are investing heavily in research and development to enhance the quality of ADRs. In addition, there is a growing trend towards medical tourism in countries like Thailand and India, where patients from Western countries seek affordable ADR surgeries combined with high-quality healthcare services. The political stability and favorable regulatory environment in countries like Australia and Japan are also contributing to market growth.

The China artificial disc replacement market is experiencing rapid growth due to increasing healthcare expenditure, rising awareness about spinal disorders, and advancements in medical infrastructure. Moreover, the government’s initiatives to improve healthcare access for its large population fuel the demand for ADRs. Furthermore, collaborations between Chinese hospitals and international medical device companies bring cutting-edge technologies to the Chinese market. Recent statistics show that China accounts for a substantial global market share, reflecting its growing importance in this sector.

The artificial disc replacement market in Japan is expected to grow owing to the increasing geriatric population and high prevalence of degenerative disc diseases. The government’s focus on promoting advanced healthcare technologies is driving the adoption of ADRs in this country. Moreover, cultural factors, such as a preference for minimally invasive procedures, are shaping the market trends in Japan. Recent data shows that Japan has one of the highest rates of spinal surgeries globally, indicating a significant demand for ADRs.

Latin America Artificial Disc Replacement Market Trends

The Latin America artificial disc replacement market is expected to grow rapidly over the forecast period. In Latin America, there is a noticeable trend towards expanding access to advanced healthcare treatments like ADRs. Countries like Colombia and Argentina are investing in upgrading their healthcare systems to cater to a growing number of patients with spinal disorders. Increasing disposable income levels among the middle class drive demand for premium medical services, including ADRs. Cultural acceptance of modern medical interventions also contributes to this market's growth in Latin America.

The artificial disc replacement market in Brazil is expected to grow over the forecast period due to the country’s improving economic conditions have led to higher healthcare spending among its population, resulting in increased demand for advanced medical procedures like ADRs. Moreover, recent regulatory changes aimed at streamlining approval processes for medical devices have facilitated market entry for innovative products in Brazil. With a large patient pool suffering from spinal ailments, Brazil presents significant opportunities for companies operating in the ADR sector.

MEA Artificial Disc Replacement Market Trends

The MEA artificial disc replacement market was identified as a lucrative region in this industry. The MEA region is experiencing a growing demand for ADR procedures due to population growth, sedentary lifestyles, and an increasing prevalence of spinal disorders. Countries like Saudi Arabia invest heavily in healthcare modernization and infrastructure development, which drives market growth. However, limited access to advanced medical technologies, low insurance penetration, and a lack of skilled professionals may hinder market expansion.

The artificial disc replacement market in Saudi Arabia is expanding due to increased healthcare spending and a growing emphasis on medical tourism. The country’s Vision 2030 initiative aims to increase the number of medical tourists to 1.5 million by 2025, fostering an environment conducive to advanced spinal treatments. Moreover, the Saudi Arabian government has been implementing measures to combat chronic diseases such as back pain, which is a leading cause of disability. Consequently, ADR procedures are becoming more commonplace.

Key Artificial Disc Replacement Company Insights

The market is highly competitive. Companies implement strategic initiatives, such as product development & launches, expansion of distribution network, and global footprint through subsidiaries and partnerships. Key companies are also involved in portfolio diversification and mergers & acquisitions. For instance, in April 2021, NuVasive, Inc. received U.S. FDA approval for its Simplify Cervical Artificial Disc for 2-level cervical total disc replacement. In September 2020, Orthhofix Medical, Inc. partnered with Neo Medical SA, a privately held Switzerland-based medical device company to develop novel spinal surgery-related products.

Key Artificial Disc Replacement Companies:

The following are the leading companies in the artificial disc replacement market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Orthofix Medical Inc.

- Globus Medical

- Aesculap, Inc.

- NuVasive, Inc.

- AxioMed LLC

- Zimmer Biomet

- SpineArt SA

- Synergy Spine Solutions Inc.

- Centinel Spine

- Johnson & Johnson

- B Braun Melsungen

- Evospine

- Stryker Corporation

Recent Developments

-

In February 2024, NGMedical GmbH announced the sales launch and completion of the first surgery using their MOVE-C cervical artificial disc replacement in the UAE. This followed the approval of the MOVE-C device in Mexico, marking a significant step in NGMedical's global commercialization efforts. The first MOVE-C disc was implanted in Abu Dhabi

-

In August 2023, the FDA approved a new, smaller-height version of the ZimVie Inc. Mobi-C Cervical Disc in seven sizes to better meet the anatomical needs of the U.S. population. The Mobi-C device, used for cervical disc replacement, has been available in France since 2004 and in the U.S. since 2013 when it was first approved for use at one or two contiguous levels

-

In April 2024, Centinel Spine, LLC announced surpassing 5,000 surgeries in the U.S. with its cervical TDR systems, prodisc C Vivo and prodisc C SK. Part of their Match-the-Disc System, launched in 2022, this achievement demonstrates rapid adoption by over 600 surgeons, showcasing the system's ability to customize implants intraoperatively and significantly increase its market usage

-

In November 2023, Orthofix Medical Inc. announced five-year results from a study in Spine Journal, showing the M6-C artificial cervical disc outperformed anterior cervical discectomy and fusion (ACDF) in clinical success after 60 months. Patients with the M6-C disc experienced better neck and arm pain relief, improved function, and enhanced quality of life, maintaining motion in key areas. This report comes as over 100,000 M6-C and M6-L artificial disc implantations have been achieved globally since their introduction in 2006

Artificial Disc Replacement Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 669.5 million |

|

Revenue forecast in 2030 |

USD 1.34 billion |

|

Growth rate |

CAGR of 12.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

July 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material type, Indication, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Thailand; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Medtronic; Orthofix Medical, Inc.; Globus Medical; Aesculap, Inc.; NuVasive, Inc.; AxioMed LLC; Zimmer Biomet; SpineArt SA; Synergy Spine Solutions, Inc.; Centinel Spine; Johnson & Johnson; B Braun Melsungen; Evospine; Stryker Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Disc Replacement Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial disc replacement market report based on material type, indication, end-use, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Metal+Plastic

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cervical Disc Replacement

-

Lumbar Disc Replacement

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global artificial disc replacement market size was estimated at USD 603.9 million in 2023 and is expected to reach USD 669.5 million in 2024.

b. The global artificial disc replacement market is expected to grow at a compound annual growth rate of 12.2% from 2024 to 2030 to reach USD 1.3 billion by 2030.

b. North America dominated the artificial disc replacement market with a share of 49.9% in 2023. This is attributable to the presence of key players and technologically equipped hospitals in the U.S. and Canada.

b. Some key players operating in the artificial disc replacement market include Medtronic, Orthofix Medical Inc., Globus Medical, Aesculap, Inc., NuVasive, Inc., AxioMed LLC, Zimmer Biomet, SpineArt SA, Synergy Spine Solutions Inc., and Centinel Spine, among others.

b. Key factors that are driving the artificial disc replacement market growth include an increasing number of trauma-related & sports injuries, a rising number of orthopedic surgeries, increasing technological advancements, and a rising geriatric population globally.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."