Articulated Robot Market Size, Share & Trends Analysis Report By Application (Handling, Wielding, Assembly, Picking, Processing), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-350-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Articulated Robot Market Size & Trends

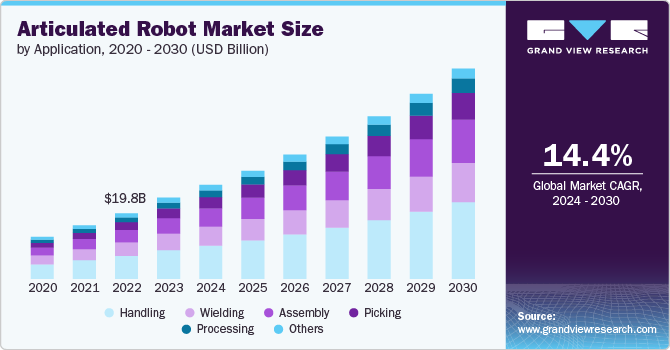

The global articulated robot market size was estimated at USD 24.48 billion in 2023 and is expected to grow at a CAGR of 14.4% from 2024 to 2030. The growing advancements in automation and robotics technology is driving the demand and the adoption of articulated robots across various industries, including automotive, electronics, and pharmaceuticals.These robots, with their multi-jointed arms, provide enhanced flexibility and efficiency, making them a preferred choice for complex manufacturing processes.

The rising demand for automation in manufacturing to improve productivity and reduce operational costs is a major driver of the articulated robots market. Articulated robots are increasingly being adopted in manufacturing processes to automate repetitive and labor-intensive tasks. These robots can be programmed to perform a wide range of functions, such as material handling, assembly, welding, and painting, with high precision and speed. As manufacturers seek to optimize their production processes, the adoption of articulated robots has grown significantly, as they can enhance efficiency, reduce errors, and lower labor costs.

Integrating the Internet of Things (IoT) and Industry 4.0 principles has revolutionized manufacturing processes by enabling enhanced connectivity, automation, and data exchange. This integration has significantly impacted the adoption of robots in manufacturing industries. The convergence of IoT with Industry 4.0 technologies allows for real-time monitoring, predictive maintenance, and optimization of production processes through interconnected devices and systems.

Furthermore, collaborative robots, or cobots, which are designed to work alongside human workers, are gaining popularity owing to their safety features and ease of use. The trend towards miniaturization is also notable, with smaller and more compact articulated robots being developed for applications in the electronics and healthcare industries. Moreover, the increasing focus on sustainable manufacturing practices is leading to the adoption of energy-efficient robots that help reduce the overall environmental impact, thereby accelerating the market expansion.

The expanding applications of articulated robots in new industries, such as agriculture and logistics, are likely to open up new opportunities for market players. In the agriculture industry, articulated robots are being utilized for various tasks such as harvesting crops, planting seeds, applying fertilizers and pesticides, and monitoring crop health. These robots can navigate through fields autonomously using sensors and GPS technology to perform tasks with high accuracy and efficiency. By automating labor-intensive processes, farmers can increase productivity, reduce labor costs, and optimize resource utilization. Additionally, the ongoing research and development efforts to enhance robot capabilities and reduce costs is expected to further drive the market growth.

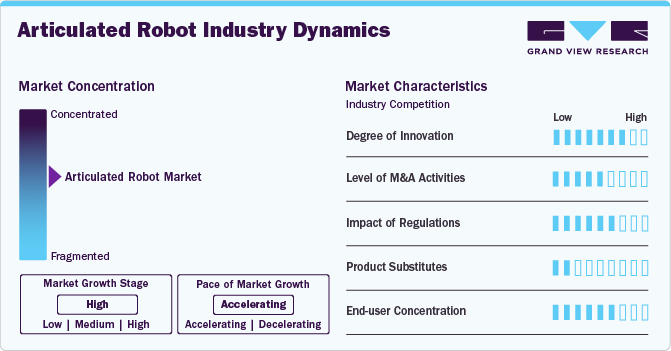

Industry Dynamics

The articulated robot market is characterized by a high degree of innovation. Companies in this industry investing heavily in research and development to improve the performance, capabilities, and efficiency of their robotic systems. Innovations such as advanced sensors, artificial intelligence integration, and enhanced programming capabilities are expected to drive competition and differentiation among market players.

The level of mergers & acquisition activities in the market is expected to be moderate. Companies operating in this sector are engaging in M&A activities to expand their product offerings, acquire new technologies access new markets, or consolidate their market positions. Larger companies are acquiring smaller innovative firms to enhance their technological capabilities or increase their market share.

The impact of regulations on the market is expected to be moderate to high. Compliance with safety standards, data privacy regulations, and industry-specific guidelines can influence product development, manufacturing processes, and market entry barriers. Regulatory changes may affect industry concentration by favoring companies with resources to adapt quickly or comply with evolving requirements.

The end user concentration in the market is expected to be moderate to high. Industries such as automotive manufacturing, electronics assembly, and logistics are major consumers of articulated robots. The preferences, purchasing power, and technological requirements of these end users can shape demand patterns and impact the competitive landscape among robot manufacturers.

Application Insights

The handling segment registered largest market shareof 35.3% in 2023. The growing trend of automation in manufacturing has driven the adoption of articulated robots for handling applications. Articulated robots can perform repetitive handling tasks with high speed, precision, and consistency, improving productivity and efficiency. Furthermore, articulated robots can take over physically demanding or dangerous handling tasks, reducing the risk of worker injuries and improving overall workplace safety. This is a key factor driving their adoption in the handling application.

The picking segment is expected to grow at the fastest CAGR of 15.6% from 2024 to 2030. This rapid expansion is driven by the rising demand for automation across various industries, such as manufacturing, e-commerce, and logistics. Continuous advancements in robotics technology have significantly enhanced the capabilities of articulated robots in performing complex picking tasks. Innovations in sensors, artificial intelligence, machine learning, and computer vision have enabled robots to handle a wider range of products with greater speed and precision, thereby driving the segmental growth.

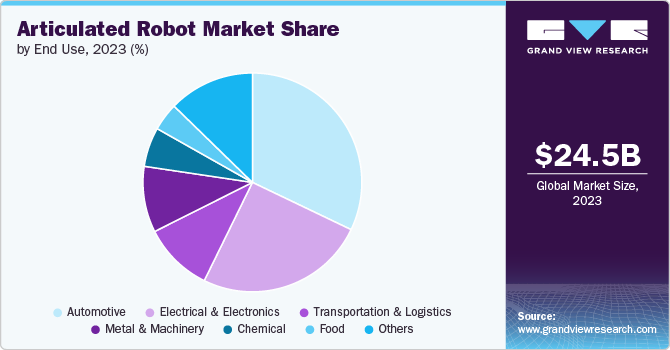

End Use Insights

The automotive segment registered the largest market sharein 2023. The growth is attributable to their flexibility, precision, and efficiency in performing various tasks such as welding, painting, assembly, and material handling. The automotive industry has been at the forefront of adopting automation technologies, including articulated robots, to improve efficiency, productivity, and quality in manufacturing processes such as welding, painting, and material handling. Additionally, the rising demand for electric vehicles worldwide is driving the adoption of articulated robots with higher payload capacities (16-60 kg) to handle the increased weight and size of EV Applications.

The chemical segment is expected to register the fastest CAGR from 2024 to 2030. Articulated robots are capable of performing tasks that are dangerous for human workers, such as handling toxic substances, working in extreme temperatures, and operating in environments with high levels of radiation or contamination. By automating these tasks, companies can significantly reduce the risk of workplace accidents and improve overall safety standards.Technological advancements are further accelerating the adoption of articulated robots in the chemical segment. Innovations in robotic technology, including enhanced AI algorithms, advanced sensors, and improved control systems, are enabling robots to perform more complex tasks with greater reliability.

Regional Insights

The North America region accounted for the highest revenue share of 37.6% in 2023. This growth can be attributed to several factors such as technological advancements, high adoption rates of automation solutions, strong manufacturing base, and robust investment in research and development.Advancements in technology, such as artificial intelligence and computer vision, are enhancing the intelligence and efficiency of articulated robots. This is further driving the growth of the articulated robot market in North America.

U.S. Articulated Robot Market Trends

The articulated robot market in U.S. is projected to grow at a CAGR of 12.5% from 2024 to 2030. The market is experiencing significant growth due to the increasing adoption of automation in various industries such as automotive, electronics, and healthcare.

Europe Articulated Robot Market Trends

The articulated robot market in Europe is anticipated to grow at a CAGR of 13.1% from 2024 to 2030. This growth is driven by the government’s initiatives to promote automation and robotics in various industries such as aerospace, food and beverage, and pharmaceuticals.

The UK articulated robot market is anticipated to grow at a significant CAGR during the forecast period. In the U.K., there is a growing trend towards the integration of collaborative robots (cobots) in manufacturing facilities to work alongside human workers, which is further driving the market expansion in the country.

The articulated robot market in Germany is expected to grow at a CAGR from 2024 to 2030. The focus on Industry 4.0 and smart factory initiatives is leading to increased adoption of articulated robots in German industries to improve productivity and competitiveness.

The France articulated robot market is projected to grow at a CAGR from 2024 to 2030. The French government’s support for innovation and automation is fostering growth opportunities for articulated robot manufacturers in the country.

Asia-Pacific Articulated Robot Market Trends

The articulated robot market in the Asia-Pacific region is expected to account for the fastest growth of 18.3% from 2024 to 2030. Governments across the Asia-Pacific region are actively promoting the adoption of advanced technologies such as robotics to drive economic growth and competitiveness. Through initiatives such as incentives for automation adoption and investments in research and development, governments are creating a conducive environment for the growth of the articulated robot market.

The China articulated robot market is projected to grow at a significant CAGR from 2024 to 2030. The Chinese government’s focus on upgrading industrial capabilities through automation is propelling the demand for advanced robotic solutions, including articulated robots in China.

The articulated robot market in Japan is expected to grow at a CAGR from 2024 to 2030. Continued investments in research and development are expected to lead to further enhancements in the precision and performance of articulated robots within Japan.

India articulated robot market is expected to grow at a CAGR from 2024 to 2030. India’s evolving manufacturing landscape is creating opportunities for articulated robot vendors as industries seek to improve production efficiency and quality standards, which is driving the adoption of articulated robots in India.

Middle East And Africa Articulated Robot Market Trends

The articulated robot market in Middle East and Africa is expected to grow at a CAGR of 12.6% from 2024 to 2030. Government initiatives aimed at promoting industrial automation and Industry 4.0 practices are contributing to the growth of the in the MEA. These initiatives create a conducive environment for businesses to invest in advanced technologies like robotics.

Saudi Arabia articulated robot market is anticipated to grow at a CAGR from 2024 to 2030. Saudi Arabia’s industrial sector is witnessing a shift towards automation to enhance operational efficiency and reduce labor costs. In addition, the oil and gas industry in Saudi Arabia is one of the primary sectors adopting articulated robots for various applications such as inspection, maintenance, and material handling, which is further driving the market growth in the country.

Key Articulated Robot Company Insights

Some of the key players operating in the market include FANUC, KUKA, among others

-

FANUC Corporation is a Japanese multinational corporation that specializes in factory automation, robotics, and machine tools. The company offers a wide range of products and services, including industrial robots, CNC systems, robomachines, and other factory automation solutions. The company’s industrial robots are widely used in various industries such as automotive manufacturing, electronics, food and beverage, and more.

-

KUKA AG is a German manufacturer of industrial robots and automation solutions. The company offers a comprehensive portfolio of robotic products and services, including industrial robots, collaborative robots (cobots), mobile platforms, and software solutions for automation. KUKA’s robots are known for their high performance, flexibility, and reliability in industrial applications.

Yaskawa Electric, Omron Adept Technologies are some of the emerging market participants in the articulated robot market.

-

Yaskawa Electric Corporation is a Japanese manufacturer of servos, motion controllers, inverters, and industrial robots. The company offers a wide range of articulated robots that cater to different applications and industries. These robots are designed to perform tasks with high accuracy and efficiency, contributing to increased productivity and cost savings for businesses.

-

Omron Adept Technologies is a subsidiary of Omron Corporation, a Japanese electronics company that specializes in automation technology. Omron Adept Technologies focuses on developing robotics and automation solutions for various industries, including food processing, pharmaceuticals, and logistics.The company is known for designing and manufacturing high-performance articulated robots that excel in precision handling and complex assembly tasks. The company’s robots are equipped with advanced vision systems and software algorithms that enable them to adapt to changing environments and perform intricate operations with ease.

Key Articulated Robot Companies:

The following are the leading companies in the articulated robot market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Limited

- Comau

- FANUC

- Kawasaki Heavy Industries

- KUKA

- Mitsubishi Electric

- Omron Adept Technologies

- Seiko Epson Corporation

- Stäubli

- Yaskawa Electric

Recent Developments

-

In November 2023, FANUC Canada demonstrated robot and cobot solutions for picking, packing and palletizing at ATX PackEx Canada. The event showcased the latest innovations in automation technology, highlighting FANUC’s advanced robotics capabilities.

-

In June 2023, ABB expanded its large robot family by introducing four energy-saving models, totaling 22 variants. These new robots are designed to enhance efficiency and productivity in industrial settings. The introduction of these models aimed to provide customers with a wider range of options to meet their specific automation needs.

-

In May 2023, ABB showcased its next-generation robots, highlighting advancements in robotics technology at Automate 2023. The showcased robots featured cutting-edge technologies such as advanced sensors, improved motion control systems, and enhanced programming capabilities. These enhancements aimed to optimize performance, increase safety standards, and enable seamless integration with other automation systems.

Articulated Robot Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 28.30 billion |

|

Revenue forecast in 2030 |

USD 63.37 billion |

|

Growth rate |

CAGR of 14.4% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2030 |

|

Report Deployment |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE. |

|

Key companies profiled |

ABB Limited; Comau; FANUC; Kawasaki Heavy Industries; KUKA; Mitsubishi Electric; Omron Adept Technologies; Seiko Epson Corporation; Staubli; Yaskawa Electric |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Articulated Robot Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Articulated Robot market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handling

-

Wielding

-

Assembly

-

Picking

-

Processing

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Electrical and Electronics

-

Metal and Machinery

-

Transportation and Logistics

-

Chemical

-

Food

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. North America dominated the articulated robot market with a share of around 37% in 2023. This growth can be attributed to several factors such as technological advancements, high adoption rates of automation solutions, strong manufacturing base, and robust investment in research and development.

b. Some key players operating in the articulated robot market include ABB Limited, Comau, FANUC, Kawasaki Heavy Industries, KUKA, Mitsubishi Electric, Omron Adept Technologies, Seiko Epson Corporation, Staubli, Yaskawa Electric

b. Key factors that are driving the articulated robot market growth include growing advancements in automation and robotics technology, integration of Internet of Things (IoT), and expanding applications of articulated robots in new industries, such as agriculture and logistics.

b. The global articulated robot market size was estimated at USD 24.48 billion in 2023 and is expected to reach USD 28.30 billion in 2024.

b. The global articulated robot market is expected to grow at a compound annual growth rate of 14.4% from 2024 to 2030 to reach USD 63.37 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."