- Home

- »

- Personal Care & Cosmetics

- »

-

Aromatherapy Market Size & Share, Industry Report, 2030GVR Report cover

![Aromatherapy Market Size, Share & Trends Report]()

Aromatherapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Equipment), By Mode of Delivery (Topical Application, Aerial Diffusion, Direct Inhalation), By End-use, By Sales Channel, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-573-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aromatherapy Market Summary

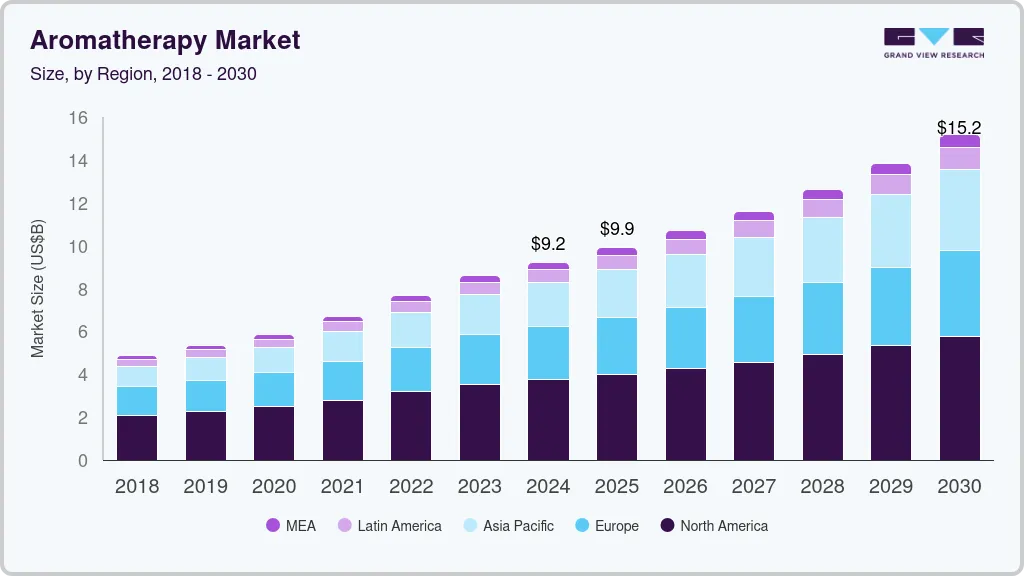

The global aromatherapy market size was estimated at USD 9,211.7 million in 2024 and is projected to reach USD 15,172.4 million by 2030, growing at a CAGR of 8.9% from 2025 to 2030.The market is driven by an increasing recognition of the therapeutic applications of essential oils and a rising inclination toward natural products.

Key Market Trends & Insights

- North America aromatherapy market dominated the global market with the largest revenue share of 40.64% in 2024.

- The aromatherapy market in the U.S. accounted for the largest market share of 76.5% in North America in 2024.

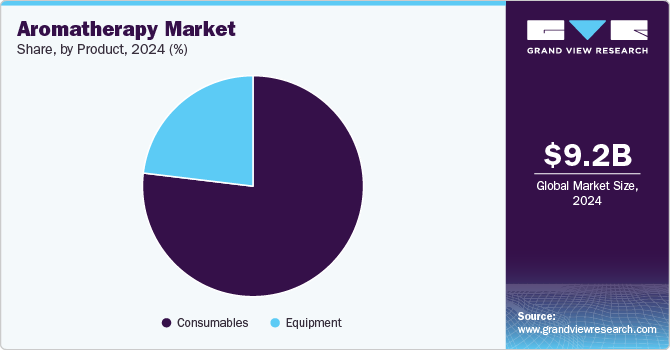

- Based on product, the consumable segment led the market with the largest revenue share of 76.9% in 2024.

- Based on mode of delivery, the topical application segment led the market with the largest revenue share of 42.7% in 2024.

- Based on end-use, the spa & wellness centers segment led the market with the largest revenue share of 54.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9,211.7 Million

- 2030 Projected Market Size: USD 15,172.4 Million

- CAGR (2025-2030): 8.9%

- North America: Largest Market in 2024

Aromatherapy, serving as an alternative medicinal approach, aids in addressing diverse health issues such as pain, cardiovascular disorders, respiratory problems, skin ailments, colds, digestive issues, immune system imbalances, insomnia, anxiety, and wound healing. Particularly, women showing a heightened concern for acne scars and individuals dealing with acne-related concerns frequently opt for therapeutic-grade essential oils. These aforementioned factors are expected to increase the market demand over the forecast period. According to the National Institute of Mental Health, anxiety disorder affects nearly 40 million adults in the U.S. Essential oils are highly effective in treating people with anxiety and stress. For instance, Basil Essential Oil manufactured by DoTERRA helps in treating anxiety and stress. These oils are also very useful for skin- and hair-related problems. Patients with second or third-degree burns are often recommended to massage with essential oils to reduce pain. These aforementioned factors are expected to foster industry growth over the coming years.

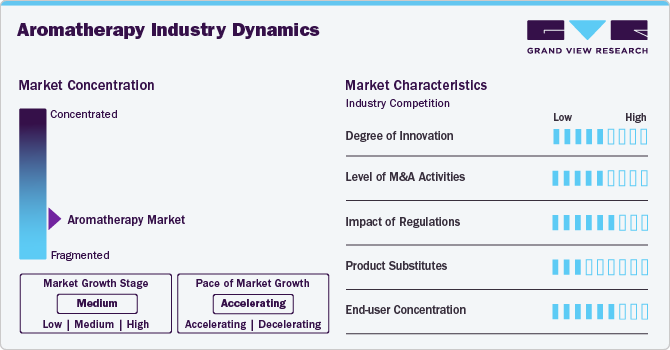

Market Concentration & Characteristics

The market exhibits several key characteristics that shape its dynamics and growth trajectory. Moreover, the increasing awareness of the therapeutic benefits of essential oils and a growing preference for natural and holistic wellness solutions are pivotal factors driving market expansion. Consumers are increasingly seeking alternatives to conventional medical treatments, contributing to the rise in popularity of aromatherapy as a complementary approach to health and well-being.

The versatility of aromatherapy applications contributes to its widespread adoption. Aromatherapy is not confined to a specific demographic or health condition; instead, it caters to a broad spectrum of consumers seeking relaxation, stress relief, skincare benefits, and overall mental and emotional well-being. This versatility allows the market to address a diverse range of consumer needs, fostering sustained demand.

The integration of aromatherapy into various consumer products, including candles, diffusers, massage oils, and skincare items, enhances its accessibility. The market has witnessed the development of innovative and convenient delivery methods, making aromatherapy products easy to incorporate into daily routines. This adaptability contributes to the seamless integration of aromatherapy into diverse lifestyles. Moreover, the market is influenced by the increasing incorporation of aromatherapy in mainstream healthcare practices. Healthcare professionals recognize the potential therapeutic value of essential oils in managing certain health conditions, leading to the integration of aromatherapy into treatments such as massage therapy and mental health interventions.

The rise of e-commerce and direct-to-consumer channels has transformed the distribution landscape of aromatherapy products. Consumers can now easily access a wide range of aromatherapy offerings online, leading to increased market reach and customer engagement. This shift in distribution channels also allows for personalized experiences, as brands can provide tailored recommendations based on individual preferences. Moreover, the aromatherapy industry benefits from a consumer base that is increasingly conscious of product quality, authenticity, and sustainability.

Drivers, Opportunities & Restraints

The growth of the aromatherapy industry is largely driven by increasing consumer awareness of the benefits of natural wellness products and the rising demand for alternative treatments. As people seek stress relief, better sleep, and improved mental well-being, essential oils and aromatherapy products are becoming more popular in both personal care and healthcare sectors. In addition, the growing trend of holistic health and self-care is fueling market expansion.

One of the main restraints in the aromatherapy industry is the lack of standardization and regulation in the industry, leading to concerns over the purity and quality of essential oils. In addition, high-quality essential oils can be expensive, limiting their accessibility to a broader consumer base and potentially hindering market growth.

There is a significant opportunity in the growing popularity of aromatherapy in spas, wellness centers, and hotels as part of luxury treatments. In addition, the rising demand for organic and eco-friendly products, coupled with advancements in essential oil extraction techniques, is opening up new avenues for innovation and product differentiation in the aromatherapy industry.

Product Insights

The consumable segment led the market with the largest revenue share of 76.9% in 2024. The increasing awareness of the therapeutic properties of essential oils derived from botanical sources has contributed significantly to the rising demand for consumable aromatherapy products. Consumers are seeking alternatives to synthetic and chemical-laden products, opting for natural remedies that align with a wellness-oriented lifestyle.

The global demand for equipment-based aromatherapy is experiencing a notable upswing, driven by a convergence of factors that underscore a growing appreciation for the therapeutic benefits of aromatherapy in diverse settings. As individuals worldwide place an increasing emphasis on mental well-being and stress reduction, the use of aromatherapy equipment, such as diffusers, nebulizers, and humidifiers, has become integral to creating immersive and personalized aromatic environments. The versatility of these devices, accommodating various essential oils and catering to different preferences, has contributed to their popularity in homes, offices, and commercial spaces.

Mode of Delivery Insights

Based on mode of delivery, the topical application segment led the market with the largest revenue share of 42.7% in 2024. Topical application in aromatherapy as a mode of delivery has gained prominence due to its targeted and direct approach to harnessing the therapeutic benefits of essential oils.

The direct inhalation sub-segment is expected to grow at the fastest CAGR during the forecast period, as more consumers seek quick, effective relief from stress, anxiety, and respiratory issues through personal, portable aromatherapy solutions like inhalers. The increasing focus on mental wellness and the convenience of direct inhalation methods are contributing to the growing demand for these products.

End-use Insights

Based on end use, the spa & wellness centers segment led the market with the largest revenue share of 54.1% in 2024. Aromatherapy is used in spas and wellness centers for massage therapies. Essential oils are often diluted with carrier oils and applied to the skin, allowing both physical and mental benefits. Aromatherapy is also extensively incorporated in spas and wellness centers owing to its ability to enhance relaxation and reduce stress.

The aromatherapy holds significant potential for enhancing the ambiance and experience within yoga and meditation facilities. Diffusing essential oils during yoga and meditation sessions creates an atmosphere conducive to relaxation, focus, and mental clarity. Certain oils, such as lavender or bergamot, have calming properties that can help reduce stress and promote a sense of peace and tranquility. This creates a supportive environment for practitioners to deepen their practice and cultivate mindfulness.

Application Insights

Based on application, the relaxation segment led the market with the largest revenue share of 25.4% in 2024. Stress management is also a huge concern for people. The inclination toward natural and herbal treatment has led people to opt for such products in order to get relief from stress. All the modes of aromatherapy treatment, like topical, aerial, and inhalation, help people reduce anxiety and stress, thereby facilitating relaxation. Some of the essential oils commonly used for stress and stress relief include lavender, orange, patchouli, tangerine, geranium, ylang-ylang, and clary sage.

The integration of aromatherapy into skin and hair care routines has become a prevalent trend, driven by several key factors that align with evolving consumer preferences and a heightened focus on natural and holistic well-being. The rising awareness of the mind-body connection contributes to the popularity of aromatherapy in skin and hair care. Aromas can have a profound impact on mood and emotions, influencing the overall experience of self-care routines. Products infused with calming scents, such as lavender or chamomile, provide a sensory element that enhances relaxation and stress relief during skincare and hair care rituals.

Sales Channel Insights

Based on sales channel, the offline segment led the market with the largest revenue share of 59.4% in 2024. Aromatherapy products are distributed through offline sales channels, primarily through brick-and-mortar retail stores, holistic health centers, spas, and specialty shops. These physical retail outlets provide customers with the opportunity to experience aromatherapy products firsthand, interact with knowledgeable staff, and receive personalized recommendations based on their needs and preferences.

The e-commerce websites often provide detailed product descriptions, usage tips, and customer reviews to help consumers make informed purchasing decisions. In addition, many aromatherapy brands utilize social media platforms and email marketing campaigns to promote their products and drive traffic to their e-commerce websites, further expanding their reach and attracting new customers.

Regional Insights

North America aromatherapy market dominated the global market with the largest revenue share of 40.64% in 2024. The increasing awareness of the therapeutic benefits of essential oils, coupled with a growing emphasis on holistic well-being, has propelled the demand for aromatherapy products. High awareness about the benefits of alternative therapies also aids in the market growth of this region.

U.S. Aromatherapy Market Trends

The aromatherapy market in the U.S. accounted for the largest market share of 76.5% in North America in 2024. The U.S. has a diverse and strong manufacturing base across various industries, including aerospace, automotive, healthcare, and consumer goods. The demand for customized, lightweight, and complex components within these industries fuels the adoption of SLS equipment for rapid prototyping and low-volume production, contributing to market expansion.

Europe Aromatherapy Market Trends

The aromatherapy market in Europe is anticipated to witness at a significant CAGR from 2024 to 2030. Healthy living and wellness have been on the rise across Europe. With fast-paced and hectic life schedules, many individuals have realized the need for stress relief and investing to take care of their physical and mental well-being. This has led to an increased awareness and adoption of various health practices, such as meditation, yoga, and aromatherapy

The UK aromatherapy market is expected to grow at a significant CAGR of 9.6% over the forecast period, owing to the rising end use industries. The UK possesses a strong and diverse manufacturing sector, with significant contributions from industries such as aerospace, automotive, healthcare, and consumer goods. The demand for advanced manufacturing technologies like SLS is driven by the need for rapid prototyping, customization, and production of complex components within these industries.

The aromatherapy market in Germany held over significant share of the European market, accounting for 20.9% market share in 2024. In recent years, aromatherapy has gained popularity in the German healthcare industry as a natural and non-invasive way to reduce anxiety, stress, and pain. Hospitals use it to reduce pain and anxiety levels in patients undergoing medical procedures or recovering from surgery

Asia Pacific Aromatherapy Market Trends

The aromatherapy market in Asia Pacific has been witnessing a surge in lifestyle-related health issues such as anxiety, depression, insomnia, chronic stress, and mental & behavioral disorders. The World Health Organization, in its June 2023 report, reported that approximately 260 million people living in the Southeast Asia region have mental health conditions. Inadequate investment in mental health services and the health workforce has resulted in treatment gaps, further contributing to the rising number of individuals with mental disorders.

The India aromatherapy market is estimated to grow at a significant CAGR of 11.9% over the forecast period. As the government of India has been investing heavily to promote the construction of new hospitals, the demand for aromatherapy will increase. In addition, the rise in lifestyle-related health issues, such as depression, trauma, insomnia, and chronic stress, has led to a greater demand for aromatherapy that can help to reduce these psychological imbalances without any side effects.

The aromatherapy market in the China held a substantial market share of 32.0% in Asia Pacific in 2024. The government of China has launched initiatives like the Healthy China 2030 program to enhance public health. This significant initiative, announced by the Chinese authorities, encourages the entire society to embrace the principle of "Health for All, and All for Health", promoting widespread participation in health promotion activities.

Middle East & Africa Aromatherapy Market Trends

The aromatherapy market in the Middle East & Africa is experiencing rapid development. In the Middle East & Africa, the prevalence of mental disorders in young individuals is high. According to a report by UNICEF on the health and well-being of young people in the Middle East and North Africa (MENA) in 2023, almost a quarter of the total disease burden in the region is due to mental disorders. Due to the prevalence of mental disorders in the young population in MENA, the demand for supplementary treatment methodologies to relieve stress and anxiety among young individuals is high in the region. This demand is anticipated to grow in the coming years as well.

Latin America Aromatherapy Market Trends

The aromatherapy market in Latin America is estimated to grow at a rapid CAGR over the forecast period. Aromatherapy can be practiced through various methods, including diffusers, inhalers, carrier oils, and candles. This natural way of reducing stress levels can be a safe, effective, and cost-effective alternative to modern medicines. Hence, with the prevalence of young individuals with a high number of mental health disorders in the region, the demand for aromatherapy is expected to increase in the coming years.

Key Aromatherapy Company Insights

Some of the key players operating in the market include dōTERRA and Young Living Essential Oils, among others.

-

dōTERRA is engaged in providing wellness, health, and fitness products. Furthermore, it functions by manufacturing and selling a diversified array of products through more than 2 million wellness advocates/distributors spread across the globe. The company’s offices are located in Australia, China, Japan, Mexico, Singapore, South Korea, and Taiwan. The major product segments include essential oils, personal care, kits & collections, supplements, and diffusers. In addition, the company offers a wide range of accessories, such as roller bottles, sprayer bottles, bottle pumps, and orifice removers.

-

Young Living Essential Oils, LC. has offices across various countries, including Australia, New Zealand, Japan, Singapore, Ecuador, Canada, Hong Kong, Indonesia, Malaysia, Mexico, the Philippines, Taiwan, the U.S., and the UK. The company’s product portfolio comprises a wide array of products such as essential oils, diffusers, massage oils, hair care, oral care, skin care, pet care, household cleaners, antioxidants, essential oil supplements, target solutions, cleansing products, primary nutrition, multivitamins, meal replacement, and probiotics. The company offers its products under several trademarks, including Savvy Minerals, Thieves, Slique, NingXia, KidScent, Seedlings, Animal Scents, Shutran, Einkorn, ART, Young Living Gear, and Mirah. In addition, it offers products to customers across the globe by improving & expanding their farms and engaging in global partnerships.

Key Aromatherapy Companies:

The following are the leading companies in the aromatherapy market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Ryohin Keikaku Co., Ltd.

- dōTERRA

- Young Living Essential Oils, LC.

- Mountain Rose Herbs

- Edens Garden

- Aurora

- Rocky Mountain Oils, LLC

- Plant Therapy

- FLORIHANA

- Biolandes

- Falcon

- Stadler Form

- Pilgrim

- sparoom

- EO Products

- NOW Foods

Recent Development

-

In January 2024, Febreze, a brand of Procter & Gamble introduced Romance & Desire, designed to set an intimate ambiance throughout any space.

-

In June 2023, the dōTERRA officially opened Terra Roza, a distillery dedicated to rose products in Shipka, Bulgaria. This production site, staffed by a highly skilled and committed team, marks a significant milestone in dōTERRA's ongoing development.

Aromatherapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,907.2 million

Revenue forecast in 2030

USD 15,172.4 million

Growth rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, mode of delivery, application, sales channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Poland; China; India; Japan; Australia; South Korea; Singapore; Philippines; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; and UAE

Key companies profiled

Procter & Gamble; Reckitt Benckiser Group PLC; Ryohin Keikaku Co., Ltd.; dōTERRA; Young Living Essential Oils, LC.; Mountain Rose Herbs; Edens Garden; Aurora; Rocky Mountain Oils, LLC; Plant Therapy; FLORIHANA; Biolandes; Falcon; Stadler Form; Pilgrim; sparoom; EO Products; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aromatherapy Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aromatherapy market report based on product, mode of delivery, application, sales channel, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Essential Oil

-

Carrier Oil

-

Soaps & Bath Salts

-

Creams & Lotions

-

Candles

-

Others

-

-

Equipment

-

Ultrasonic Diffuser

-

Nebulizing Diffuser

-

Evaporative Diffuser

-

Heat Diffuser

-

Facial Steamers

-

Spray

-

Hot & Cold Compress

-

Inhalers

-

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Application

-

Aerial Diffusion

-

Direct Inhalation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Use

-

Spa & Wellness Centers

-

Hospitals & Clinics

-

Yoga & Meditation Centers

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Offline Stores

-

Drug Stores

-

Grocery Stores

-

Specialty Stores

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Relaxation

-

Skin & Hair Care

-

Pain Management

-

Cold & Cough

-

Insomnia

-

Scar Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Philippines

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aromatherapy market size was estimated at USD 9,221.7 million in 2024 and is expected to reach USD 9,907.2 million in 2025.

b. The global aromatherapy market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2030 to reach USD 15,172.4 million by 2030.

b. North America region dominated the market and accounted for 40.6% share in 2024. The increasing awareness of the therapeutic benefits of essential oils, coupled with a growing emphasis on holistic well-being, has propelled the demand for aromatherapy products.

b. Some of the key players operating in the aromatherapy market include dōTERRA, Young Living Essential Oils, Mountain Rose Herbs, Edens Garden, Rocky Mountain Oils, LLC, Plant Therapy Essential Oils, FLORIHANA, Biolandes, Falcon, Stadler Form Aktiengesellschaft, Hubmar International, SpaRoom, EO Products, NOW Foods, and Ryohin Keikaku Co., Ltd.

b. The market is driven by an increasing recognition of essential oils' therapeutic applications and a rising inclination towards natural products. Aromatherapy, serving as an alternative medicinal approach, aids in addressing diverse health issues such as pain, cardiovascular disorders, respiratory problems, skin ailments, colds, digestive issues, immune system imbalances, insomnia, anxiety, and wound healing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.