Aroma Chemicals Market Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Chemicals, By Application (Flavors, Fragrances), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-111-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Aroma Chemicals Market Size & Trends

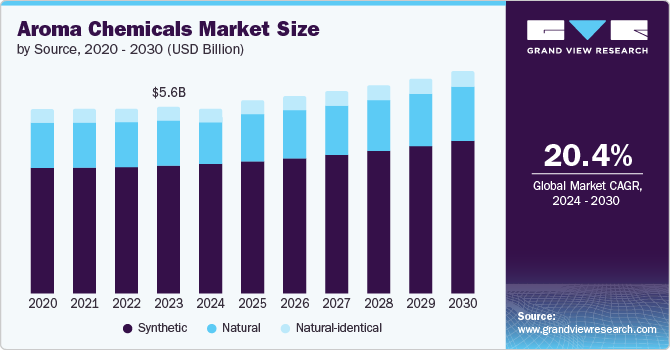

The global aroma chemicals market size was valued at USD 5.65 billion in 2023 and is expected to expand at a CAGR of 4.8% from 2024 to 2030. The increasing consumption of flavors & fragrance products in cosmetics & toiletries, soaps & detergents, and food & beverages and the development of these industries are major drivers for the market growth. In addition, the rising applications of aroma chemicals in industries such as dairy, personal care, fine fragrances, convenience foods, bakery foods, and confectionery industries are further expected to drive demand for aroma chemicals.

According to the Food and Agriculture Organization, approximately 6billion people across the world consume milk and milk products. The rising consumption of these products signifies the increasing need for product variation and demand for flavors and fragrances, which is expected to drive the market for aroma chemicals over the forecast period.

In addition, as flavors are a prominent factor for taste in edible products, aroma chemicals are used to enahnce the taste in food and beverage products. The rising trend of preventive healthcare and, therefore, the increase in the demand for healthier food products has stirred product innovation, which is likely to drive market growth.

In addition, increasing regulations in the food and beverage industry to ensure food safety and the ban on the use of some synthetic flavors are also driving the demand for natural aroma chemicals. The health benefits and product innovation offered by the natural flavors are key factors driving the market growth.

The increased awareness and demand for hygiene products during the COVID-10 pandemic further added to the growth of the aroma chemicals market. For instance, in India, the hygiene products category experienced an increase of 25% and 60% in demand for floor cleaners and hand washes, respectively, in March 2020. This resulted in the increasing demand for aroma chemicals in the personal care and hygiene industry, fostering market growth.

Source Insights

The synthetic source segment dominated the market in 2023. This is attributed to the rising utilization of synthetic products in cosmetics, personal care, and food & beverages. The India Brand Equity Foundation estimated that the Indian food processing industry is expected to reach USD 1,274 billion in 2027 from USD 866 billion in 2022. The development of such industries with applications of aroma chemicals is likely to add to the segmental growth. In addition, synthetic aromas are also considered essential in producing custom and fine fragrances and are widely used in the cosmetics industry. The easy availability and low production cost of these sources is likely to drive the demand for synthetic products.

Natural-identical aromas are expected to grow at a significant CAGR over the forecast period. Natural-identical aromas are obtained by isolation or chemical synthesis using various chemical reactions such as acetylation and esterification. Raw materials required to produce natural-identical aromas are chemically identical to natural substances derived from animal or plant sources.

The increasing environmental consciousness among people and the resultant demand for natural and more environmentally friendly products are likely to drive the demand for naturally extracted aromatic substances. This is expected further to drive the market growth over the forecast period. However, factors such as availability and cost can affect the consumption of these goods. For instance, the limited availability of the purest form of vanilla obtained from bourbon vanilla and its high cost can result in the preference for its synthetic and natural-identical alternatives.

Chemicals Insights

The terpenes & terpenoids segment dominated the aroma chemicals market in 2023. The increasing applications of these chemicals in products such as resin in paints & printing inks, rubber adhesives, and pressure-sensitive tapes, and their wide availability are driving the segmental growth in the market.

The musk chemicals segment is expected to grow substantially over the forecast period due to the rising applications of musk chemicals in industries such as soaps & detergents, cosmetics & personal care products, food, and others. In addition, natural musk is extracted from the rump gland of musk deer, civet cats, and muskrats, and plant roots and seeds, which further increases its value and leads to the market demand.

The increasing working-class population and rising disposable incomes across the countries have resulted in the rising demand for branded products, especially in the developed economies, which are driving the demand for musk chemicals. According to the Bureau of Economic Analysis, personal disposable income in the U.S. increased by USD 37.7 billion in June 2024. This has further increased demand for grooming and personal care products, which is expected to further drive market growth.

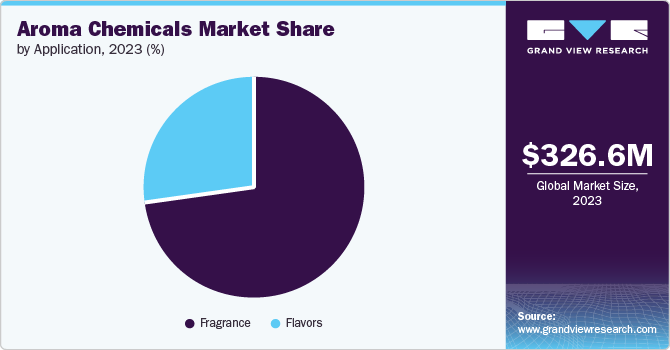

Application Insights

The fragrance application segment held the largest revenue share in 2023. The increasing demand for aroma chemicals in personal care industry, the rising popularity of exotic flavors, and increasing demand for several food applications including convenience foods, confectionery, dairy, and bakery are major factors driving the demand for aroma chemicals.

Perfumers blend aroma chemicals to create fine fragrances such as cinnamyl alcohol (lilac) and dihydrocinnamyl alcohol (hyacinth), using raw materials such as Cinnamaldehyde. In addition, Allyl hexanoate is also utilized in fine fragrances to imbue wisteria, apple blossom, and peach blossom fragrances. The presence and availability of several ingredients for the development of fragrances is expected to drive the demand for aroma chemicals and drive segment growth.

The flavors segment is expected to grow at a significant CAGR over the forecast period owing to their wide applications in the non-alcoholic beverages such as juices, shakes & smoothies, health drinks, coffee, and protein shakes. The population coupled with the increasing demand for varied coffee beverages and unique flavors across the globe is expected to drive market growth of aroma chemicals.

The increasing demand for convenience food owing to the busy lifestyles and an aging population has added to the demand for aroma chemicals. These chemicals are used to enhance the flavor of several convenience products such as snacks, chips, soups, soft drinks, and others. The increasing demand for convenience food and the growing need for product innovation and variation to gain a competitive edge is further expected to increase the demand for various aroma chemicals among competitors. In addition, the formulation of convenience foods is difficult without aroma chemicals owing to their capabilities to act as processing agents, nutritional additives, sensory agents, and preservatives, which have significantly contributed to the product demand.

Regional Insights

The North America aroma chemicals market is expected to grow significantly owing to the changing lifestyle and food habits of people; the increasing consumption of dairy and low-fat products and the increasing use of flavors and fragrances are major factors driving the market growth in the region. For instance, according to the information published by the International Dairy Foods Association in September 2022, the USDA data showed an increase in dairy consumption in the U.S. to 12.4 pounds per person.

U.S. Aroma Chemicals Market Trends

The U.S. accounted for a significant market share in the North American aroma chemicals market owing to the rising demand for aroma chemicals in the cosmetics & personal care industry. In addition, the increasing demand for low-fat food & beverage products, which require the use of extra flavors to augment the taste of the final product, has also resulted in the increased demand for aroma chemicals in the food and beverage industry. According to the National Institute of Health, approximately one in three adults in the U.S. is overweight, and over two in five have obesity. This high prevalence of obesity in the country is further expected to drive the demand for low-calorie food and boost the demand in the aroma chemicals market.

Europe Aroma Chemicals Market Trends

The Europe aroma chemical market is expected to grow significantly due to the development of industries such as food and beverage, dairy, personal care, and others that require flavors and fragrances. According to Cosmetics Europe - The Personal Care Association, the cosmetics and personal care industry adds approximately USD 31 billion in added value to the European economy. The development of such industries is expected to drive the market growth in the region further.

Germany accounted for a significant share of the Europe aroma chemicals market and is anticipated to dominate the region over the forecast period owing to increasing applications of aroma chemicals in personal care & cosmetic products. The rising popularity of social media has resulted in the globalization of local businesses in the country.

Some cosmetic brands, including BELLAMI Hair, Revlon, and others, became popular on social media and have been acquired by established market players in Europe. In addition, key players in Germany are creating exotic flavors owing to the strong demand for dairy and meat products and the growing importance of ready-to-eat meals, which is expected to trigger the demand for aroma chemicals.

Asia Pacific Aroma Chemicals Market Trends

Asia Pacific dominated with a revenue share of 32.1% in 2023 and is expected to grow at the fastest CAGR of 6.7% over the forecast period. The growth can be attributed to the presence of developing countries such as India and China and the increasing demand for fragrances and flavors in these countries. In addition, the increasing popularity of Asian flavors and fragrances in major regions, including North America and Europe, are further expected to add to the market growth.

The India aroma chemicals industry is expected to grow significantly over the forecast period owing to the development of industries such as flavor & fragrance and dairy, which have higher demands for aroma chemicals. As per the information published by the Ministry Of Micro, Small, And Medium Enterprises in India, the Indian fragrance & flavor industry contributes approximately USD 500 million to the global industry, worth USD 24.10 Billion. This development of the fragrance & flavor industry in the country is further expected to contribute the market growth.

Key Aroma Chemicals Company Insights

Some of the companies in the aroma chemicals market include BASF SE, Privi Organics India Limited, Takasago International Corporation, and Givaudan. In 2023, the overall group sales of Givaudan accounted for USD 8,019.26. The companies are engaged in strategies such as mergers and acquisitions and, introducing new products, and establishing strong and highly integrated value chains to get a higher share of the market.

-

BASF SE, headquartered in Ludwigshafen, Germany, is a global chemical producer. The company also engages in producing aroma ingredients that can be used in a variety of products such as shampoo, perfumes, fine fragrances, air care, and others.

-

Privi Organics India Limited is an India-based company that manufactures, supplies, and exports aroma and fragrance chemicals. the company's product range includes amber fleur, acetates, dihydromyrcenol, Ionones, nitriles, and others.

Key Aroma Chemicals Companies:

The following are the leading companies in the aroma chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Privi Organics India Limited

- Takasago International Corporation

- Kao Corporation

- Bell Flowers & Fragrances

- Givaudan

- S H Kelkar and Company

- Symrise

Recent Developments

-

In June 2024, the CSIR-Indian Institute of Integrative Medicine (CSIR-IIIM) and Aromatic & Allied Chemicals entered into a MOA to collaborate on the development of innovative aromatic products.

-

In May 2024, LANXESS will exhibited its portfolio of aroma chemicals at SIMPPAR, which is an international exhibition of raw materials for perfumery.

Aroma Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.84 billion |

|

Revenue forecast in 2030 |

USD 7.72 billion |

|

Growth Rate |

CAGR of 4.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, chemicals, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Privi Organics India Limited; BASF SE; Kao Corporation; Takasgo International Corporation; Givaudan; Bell Flowers & Fragrances; Symrise; S H Kelkar and Company. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

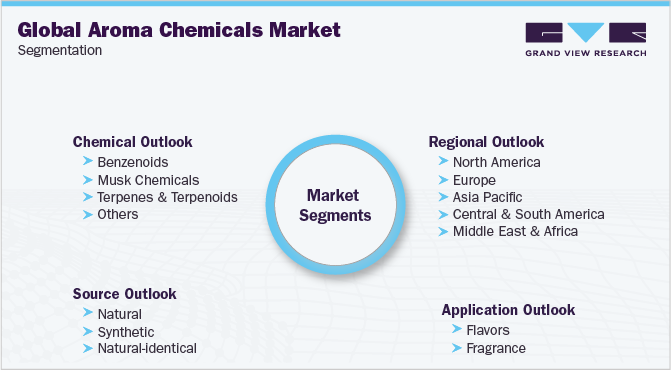

Global Aroma Chemical Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aroma chemicals market report based on source, chemical, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

Natural-identical

-

-

Chemicals Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Benzenoids

-

Musk Chemicals

-

Terpenes & Terpenoids

-

Others (Ketones, Esters, Aldehydes)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flavors

-

Confectionery

-

Convenience Food

-

Bakery Food

-

Dairy Products

-

Beverages

-

Others

-

-

Fragrance

-

Fine Fragrance

-

Cosmetics and Toiletries

-

Soaps and Detergents

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aroma chemicals market size was estimated at USD 5.65 billion in 2023 and is expected to reach USD 5.84 billion in 2023.

b. The global aroma chemicals market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 7.72 billion by 2030.

b. The Asia Pacific dominated the aroma chemicals market with a share of 32.1% in 2023. This is attributable to the rising demand for flavors and fragrances from developing countries such as China, India, and Japan are triggering the demand for aroma chemicals in the region.

b. Some key players operating in the aroma chemicals market include Symrise, Givaudan, Kao Corporation, MANE, Robertet, Firmenich, and BASF SE among others.

b. Key factors that are driving the aroma chemicals market growth include the rapid expansion of food & beverage industries and increasing consumer disposable incomes.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."