ARM-Based Servers Market Size, Share, & Trends Analysis Report By Core Type (ARM Cortex-A Core, ARM Cortex-M Core), By OS, By Processor, By Application, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-460-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

ARM-Based Servers Market Size & Trends

The global ARM-based servers market size was estimated at USD 5.84 billion in 2023 and is anticipated to grow at a CAGR of 14.3% from 2024 to 2030. The rapid expansion of the Internet of Things (IoT) market and the growing need for edge computing devices fuel the demand for ARM-based servers. ARM processors are well-suited for IoT applications due to their scalability, flexibility, and energy efficiency. ARM processors are known for their energy efficiency and low power consumption, which is critical for servers. The growing demand for energy-efficient computing solutions, especially in data centers and cloud environments, is driving the adoption of ARM-based servers.

The rapid growth of cloud computing and the increasing adoption of hyperscale data centers are also key drivers of the ARM-based server market. Cloud service providers, such as Amazon Web Services (AWS) and Microsoft Azure, continually expand their infrastructure to meet the rising demand for on-demand computing resources. ARM-based servers offer a scalable and cost-effective solution for these providers, enabling them to manage vast amounts of data and support large-scale workloads efficiently.

Hyperscale data centers, designed to support major cloud providers' needs, benefit from ARM processors' modular architecture and scalability. ARM servers can handle parallel processing and distributed computing tasks efficiently, making them ideal for workloads like data analytics, AI, machine learning, and content delivery networks (CDNs). This trend is further accelerated by the growing use of containers and microservices, which ARM-based servers are well-suited to handle due to their energy-efficient, scalable design.

As businesses and governments prioritize sustainability, there is a growing focus on green computing and reducing the carbon footprint of data centers. With their energy-efficient architecture, ARM-based servers are well-positioned to support this trend. Data centers consume vast amounts of electricity, and with the global push toward reducing greenhouse gas emissions, there is significant interest in deploying eco-friendly computing solutions. ARM-based servers enable organizations to achieve their performance goals while consuming less energy, aligning with sustainability objectives, and reducing operational costs related to power and cooling.

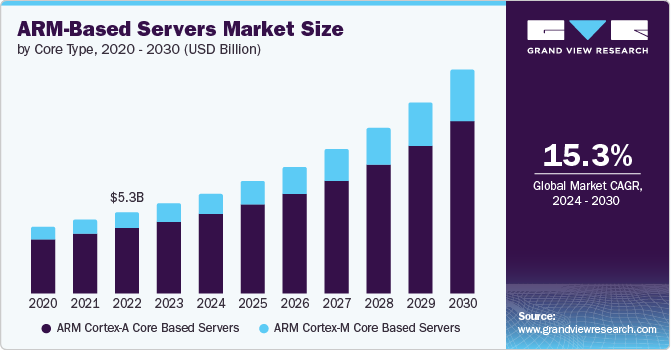

Core Type Insights

The ARM cortex-A core based servers segment accounted for the largest market share of 79.9% in 2023. The growing focus on open-source software and ARM's collaboration with companies like Microsoft and Amazon Web Services (AWS) to optimize software for ARM-based servers are helping accelerate adoption. This ecosystem development ensures that ARM Cortex-A core-based servers can efficiently run a broad range of applications, driving market growth.

The ARM cortex-M core based servers segment is anticipated to grow at the fastest CAGR over the forecast period. The ARM Cortex-M cores are designed with energy efficiency at their core, consuming far less power than traditional x86 or higher-end ARM Cortex-A processors. This makes them an attractive option for enterprises and data centers focused on reducing energy costs and minimizing carbon footprint. The demand for low-power server solutions is rising with growing concerns about energy consumption, especially in large-scale server environments.

OS Insights

The Android segment accounted for the largest market share of 52.4% in 2023, driven by the rise of mobile and edge computing environments where Android systems are becoming more prevalent. ARM's power-efficient architecture aligns well with Android's focus on mobile devices, and as Android continues to expand into more IoT and edge use cases, the demand for ARM-based servers to support these applications is rising.

The iOS segment is anticipated to grow at the fastest CAGR over the forecast period due to the rise of cloud computing and edge computing for scalable, efficient servers with ARM-based architectures. The growing interest in 5G technology and its associated infrastructure boosts the market, as ARM processors are well-suited for low-latency, high-speed networks.

Processor Insights

The 64-bit operating system ARM-Based servers segment accounted for the largest market share of 87.8% in 2023. The competitive landscape for ARM-based servers is evolving, with major players investing in developing advanced 64-bit architectures. Innovations such as the ARM Neoverse platform and specialized processors such as the Ampere Altra are enhancing the performance and scalability of ARM-based solutions. These advancements attract more enterprises to consider ARM architecture a viable alternative to traditional server solutions, particularly as the ecosystem matures and software compatibility improves.

The 32-bit operating system ARM-Based servers segment is anticipated to grow at the fastest CAGR over the forecast period. The proliferation of Internet of Things (IoT) devices contributes to the segment's growth. Many IoT applications require lightweight and efficient processing capabilities, which 32-bit ARM architecture provides. The Cortex-A32 processor, for instance, is designed specifically for embedded and IoT applications, offering high efficiency and the ability to run rich operating systems. This specialization allows organizations to deploy 32-bit ARM servers in resource-constrained environments, where power efficiency and compact form factors are critical.

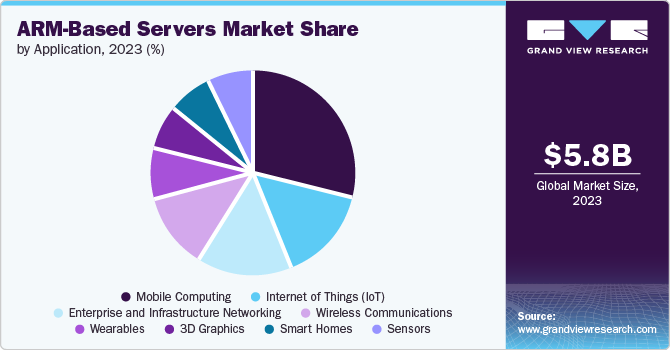

Application Insights

The mobile computing segment accounted for the largest market share of 28.8% in 2023. The ongoing advancements in 5G networks have accelerated the segment's growth. With 5G enabling faster data transmission and improved connectivity, mobile applications are becoming more sophisticated, requiring robust server infrastructures to support real-time processing, low latency, and high throughput. ARM-based servers, known for their scalability and efficiency, are crucial in meeting the demands of 5G-enabled mobile applications, from streaming services to augmented and virtual reality.

The sensors segment is anticipated to grow at the fastest CAGR over the forecast period due to the rising demand for energy-efficient solutions in data centers. With data centers consuming significant amounts of power, there is a growing focus on reducing energy costs and improving operational efficiency. ARM-based servers, equipped with sensors, provide real-time data on various operational parameters such as temperature, humidity, and power consumption. This data allows for proactive management of cooling systems and energy usage, ultimately reducing operational costs and enhancing sustainability.

Vertical Insights

The telecommunications segment accounted for the largest market share of 20.3% in 2023 due to the increasing adoption of edge computing within the telecommunications industry. Edge computing requires smaller, decentralized data centers closer to the source of data generation. ARM-based servers are well-suited for edge computing environments due to their compact design, low power consumption, and ability to handle real-time data processing at the network's edge. This trend is expected to accelerate as more telecom companies adopt edge solutions to support low-latency applications, such as autonomous vehicles, augmented reality, and smart cities.

The bioscience segment is anticipated to grow at the fastest CAGR over the forecast period, driven by the unique computational needs of modern biosciences, including genomics, proteomics, bioinformatics, and pharmaceutical development. Bioscience research often involves processing massive datasets, requiring efficient and scalable computing architectures to handle complex simulations, data analysis, and real-time processing. ARM-based servers, known for their energy efficiency and performance per watt, align well with these needs, offering high computational power with lower operational costs. This particularly appeals to labs and research institutions working with limited budgets but large computational demands.

Regional Insights

The ARM-based servers market in North America held a share of 36.3% in 2023. The growth can be attributed to the growing adoption of emerging technologies such asartificial intelligence (AI), machine learning (ML), and high-performance computing (HPC). ARM-based servers are increasingly being adopted to support these emerging technologies due to their ability to handle parallel processing and specialized workloads efficiently. As businesses and research institutions continue to invest in AI and ML, the demand for ARM-based servers capable of supporting these technologies is growing.

U.S. ARM-Based Servers Market Trends

The ARM-based servers market in theU.S. is expected to grow significantly from 2024 to 2030. Many U.S. companies are adopting ARM-based servers as part of their broader sustainability initiatives. By leveraging ARM’s low power consumption and reduced heat generation, organizations can meet their environmental goals while also achieving significant operational cost savings.

Europe ARM-Based Servers Market Trends

The ARM-based servers market in Europe is growing significantly at a CAGR of 14.1% from 2024 to 2030. Data sovereignty and compliance with European data protection regulations, such as the General Data Protection Regulation (GDPR), are key considerations for European organizations. There is a growing interest in localizing IT infrastructure and leveraging data centers within Europe to ensure compliance with data privacy laws.

Asia Pacific ARM-Based Servers Market Trends

The ARM-based servers market in Asia Pacific is growing significantly at a CAGR of 16.1% from 2024 to 2030. The APAC region is witnessing rapid expansion in cloud computing and data center infrastructure. Major cloud providers such as Alibaba Cloud, Tencent Cloud, and Google Cloud are investing heavily in building and upgrading data centers across the region. These cloud providers are increasingly incorporating ARM-based servers into their infrastructure to offer cost-effective and energy-efficient solutions. For instance, in March 2023, Amazon Web Services (AWS) announced a USD 6 billion investment in Malaysia to develop cloud data centers. AWS's total investment in Southeast Asian countries, including Indonesia, Singapore, and Thailand, amounts to USD 22.5 billion. Major cloud providers such as Alibaba Cloud, Microsoft, and Tencent have collectively invested USD 6 billion in Malaysia for data center development.

Key ARM-based Servers Company Insights

Key players operating in the service analytics market include Ampere Computing LLC, Marvell, Advanced Micro Devices, Inc., ARM Limited, Huawei Technologies Co., Ltd., and Linaro Limited. The companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key ARM-based Servers Companies:

The following are the leading companies in the ARM-based servers market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc

- Ampere Computing LLC

- ARM Limited

- Cloud Software Group, Inc.

- Huawei Technologies Co., Ltd.

- Linaro Limited

- Marvell

- Red Hat, Inc.

- SUSE

- Texas Instruments Incorporated

Recent Developments

-

In July 2024, Marvell introduced the Marvell Structera product line, featuring Compute Express Link (CXL) devices created to enhance memory performance and scaling in general-purpose servers for cloud data centers. The CXL offers a solution by enabling new server architectures that allow for efficient memory expansion, thereby improving overall system performance and resource utilization.

-

In May 2024, Ampere Computing LLC partnered with Qualcomm Incorporated to develop an AI server based on ARM architecture, combining their expertise to enhance performance and efficiency in data centers. This collaboration aims to leverage Ampere's strength in high-performance processors and Qualcomm's advanced AI technologies, providing a scalable solution for AI workloads. The new server is designed to meet the increasing demand for energy-efficient, high-performance computing in cloud environments, particularly for AI applications and data-intensive tasks.

-

In April 2024, Google unveiled the Google Axion Processors, the company's first custom CPUs based on ARM architecture, specifically designed for data centers. These processors aim to optimize performance, efficiency, and scalability for cloud computing and data center operations, offering improved processing power tailored for Google's infrastructure. The introduction of Axion marks a significant step in enhancing the performance of cloud services while also meeting growing demands for energy-efficient and high-performance computing in modern data centers.

ARM-Based Servers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.51 billion |

|

Revenue forecast in 2030 |

USD 14.51 billion |

|

Growth rate |

CAGR of 14.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Core type,OS, processor, application, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Advanced Micro Devices, Inc.; Ampere Computing LLC; ARM Limited; Cloud Software Group, Inc.; Huawei Technologies Co., Ltd.; Linaro Limited; Marvell; Red Hat, Inc.; SUSE; Texas Instruments Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global ARM-Based Servers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the service analytics market report based on core type, OS, processor, application, vertical, and region.

-

Core Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

ARM Cortex-A Core Based Servers

-

ARM Cortex-M Core Based Servers

-

-

OS Outlook (Revenue, USD Billion, 2018 - 2030)

-

Android

-

iOS

-

Windows

-

-

Processor Outlook (Revenue, USD Billion, 2018 - 2030)

-

32-bit Operating System ARM-Based Servers

-

64-bit Operating System ARM-Based Servers

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mobile Computing

-

3D Graphics

-

Internet of Things (IoT)

-

Smart Homes

-

Wearables

-

Sensors

-

Enterprise and Infrastructure Networking

-

Wireless Communications

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Healthcare

-

Telecommunications

-

Oil & Gas Extraction

-

Bioscience

-

Industrial Automation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ARM-based servers market size was estimated at USD 5.84 billion in 2023 and is expected to reach USD 6.51 billion in 2024.

b. The global ARM-based servers market is expected to grow at a compound annual growth rate of 14.3% from 2024 to 2030 to reach USD 14.51 billion by 2030.

b. The ARM-based servers market in North America held a share of 36.3% in 2023. The growth can be attributed to the growing adoption on emerging technologies such as artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC).

b. Some key players operating in the ARM-based servers market include Advanced Micro Devices, Inc, Ampere Computing LLC, ARM Limited, Cloud Software Group, Inc., Huawei Technologies Co., Ltd., Linaro Limited, Marvell, Red Hat, Inc., SUSE, Texas Instruments Incorporated

b. The rapid expansion of the Internet of Things (IoT) market and the growing need for edge computing devices are fueling the demand for ARM-based servers. ARM processors are well-suited for IoT applications due to their scalability, flexibility, and energy efficiency. ARM processors are known for their energy efficiency and low power consumption, which is a critical factor for servers.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."