- Home

- »

- Advanced Interior Materials

- »

-

Argon Gas Market Size, Share, Trends Analysis Report, 2030GVR Report cover

![Argon Gas Market Size, Share & Trends Report]()

Argon Gas Market Size, Share & Trends Analysis Report By Form, By End-Use (Food & Beverages, Chemicals, Pharmaceuticals, Electronics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-113-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

The global argon gas market size was valued at USD 10.20 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Growing consumption of the product in automobiles, transportation equipment, stainless steel manufacturing plants, fabricated metalworking units, among others is likely to boost the market growth in the coming years. Moreover, due to its superior thermal insulation capabilities over air, it is one of the most often utilized gases to fill scuba divers' dry suits.

Argon is produced through fractional distillation of liquid air. It is frequently used as an alternative to nitrogen, thereby leading to its surged consumption in various applications across the globe. It is utilized to create an inert barrier between molten metals and slags and atmospheric oxygen, nitrogen, or carbon dioxide. In addition, the product’s resistance to heat cracking and other properties, such as its high thermal conductivity, allows for quick travel rates throughout the welding process, make it vital when welding stainless steel.

Additionally, the growing adoption of the internet of things (IoT) technologies to link machinery and smart devices in order to get real-time insights and find manufacturing process gaps is expected to further expand the growth of the overall market. For instance, smart systems provide data on the operation and performance of chemical reactors with embedded analytics capabilities to alert plant managers and operators of potential machine failures. Praxair-Linde and Air Products are two significant product manufacturers that have embraced IoT technology.

Rising prices may hamper the overall expansion or market growth. An increase in the production expenses as a result of the rising cost of raw materials reduced the funds available for new product development and research. Additionally, the rising freight prices for trucks, railroads, dry bulk, and air freight and the demand on businesses to safeguard margins while preserving the quality of their products increased as a result of the rise in operational costs.

Argon is also difficult to separate from oxygen due to its diffusive and adsorptive qualities. The sales of the product are being restricted by the development of nitrogen microwave inductively coupled atmospheric pressure plasma (MICAP), which is more affordable in comparison. In addition, manufacturers are switching from krypton since it is denser and gives greater thermal efficiency. Therefore, the presence of substitutes which offer better features is likely to create barriers in the industry growth.

Furthermore, excessive inhalation of the chemical can lead to dizziness, nausea, vomiting, loss of consciousness, and death. Very high levels can decrease the amount of oxygen in the air and cause suffocation with symptoms of headache, rapid breathing, and loss of coordination and judgment. Hence, various harmful effects of the product in humans will further create hurdles in the growth of the product.

Form Insights

The gas form segment dominated the argon gas market with a revenue share of 53.82 % in 2022. This is attributable to its ability to provide an oxygen and nitrogen free setting for any process that involves high temperature heat treatment. Cryogenic fractional distillation is used for the production of large quantities of purified argon in the health care industries. It is a noble gas component that has shown valuable narcotic and defensive capability in the medical sector.

In order to selectively kill small areas of diseased or unhealthy tissue, especially on the skin, the product is used to conduct accurate cryosurgery, which requires intense cold. Very cold argon is generated by controlled expansion of the product at the site and is driven using a cryoneedle to the treatment stage. This gives the device greater control than older liquid nitrogen techniques.

A similar technique, cryoablation, is used to treat heart arrhythmia by destroying cells which interfere with the normal distribution of electrical impulse. As an important technique in clinical laboratories, electrospray ionization mass spectrometry (ESI-MS) has arisen. With the increasing growth of the product in healthcare industries is expected to influence major trends in the industry globally over the forecast period.

Liquid argon is produced in large quantities at air separation plants. In most cases, it is used in laboratory applications for spark analysis and dark matter studies. It is also used for scientific purposes, transportation, and storage. Furthermore, it is the highest form of purity to supply argon and is more cost effective in storing the product. Such factors are likely to positively impact the industry growth in the coming years.

End-Use Insights

The manufacturing end-use segment dominated the market with a revenue share of 32.9 % in 2022. This is attributed to the rising demand for the product from the manufacturing and fabrication sector. It is the most desired gas for the metal industry because of its inert reactivity; it is utilized as an inert gas to protect metals from oxidation during welding as well as being used to join many nonferrous and ferrous alloys. In addition to this, it is also used as a filler gas in the dry suits of scuba diving, fire extinguishers, airbag inflation, incandescent lamps, and phosphorescent tubes.

Increasing demand from the electronics sector will augment the growth in the market over the forecast period as it is used as a carrier gas for semiconductor manufacturing processes. It prevents reactions and protects the silicon crystal that is formed on the wafer. Rising demand for smartphones, laptops, televisions, solar PV cells, and other electronic products will continue driving sales in the market.

Argon lasers are primarily used in the medical sector, as it is capable of targeting areas with high precision. They are used in the diabetic treatment of retinal detachment and retinal phototherapy. It is also used in surgeries to weld arteries and destroy tumors. Further, it has also been used to treat heart arrhythmias and to destroy or remove abnormal tissues.

In the food and beverage industry, the product is frequently employed for packaging. Argons can be utilized as a preservative for meat products because they are odorless and inert. Additionally, by inhibiting oxidation and other chemical reactions of oxygen-sensitive components contained in packaged foods like fruits and vegetables, argon aids in maintaining product quality. By regulating temperature and maintaining storage pressure, the product is used in the beverage industry for wine preservation, beer foam stability, and carbonation management.

Using argon gas for packaging food & beverages is an effective way to maximize their shelf life, maintain their freshness, and enhance their overall quality. The product is preferred in packaging applications as it displaces oxygen efficiently, thereby preventing oxidation. Consequently, the use of the product prolongs the lifespan of stored food products and beverages, ensuring that they remain fresh and of high quality for a long duration

Regional Insights

Asia Pacific region dominated market with a revenue share of 31% in 2022. This is attributable to the increasing demand for argon gas in the food & beverage and healthcare industries across the region. According to the India Brand Equity Foundation, the healthcare sector in India is considered as one of the largest sectors both in terms of revenue and employment.

According to the USDA Foreign Agricultural Service, the food, beverage, and grocery industries of Australia account for over one-third of the country's total. Thus, the rising growth of food & beverage and healthcare industries in various countries is therefore anticipated to increase the market growth over the forecast period.

Europe is among the largest region for the argon gas market, with the presence of key manufacturing countries especially Germany. Increasing demand for the product from the metal fabrication sector in the Germany is likely to drive the market demand in the coming years. In addition, ongoing expansion of the aviation and automobile sectors in the country is anticipated to boost the application of metal fabrication, thus, in turn, driving the industry demand in the coming years.

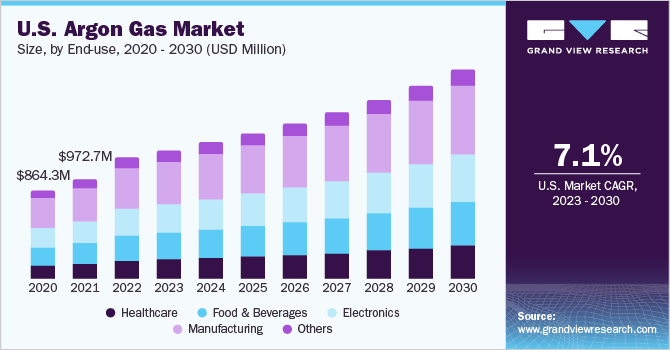

North America is expected to be the largest market, owing to the significant growth in automobile and energy markets. In addition, the Middle East and African countries are also expected to witness increasing industrialization which is expected to drive the market over the forecast period.

Key Companies & Market Share Insights

The market for argon gas is characterized by intense competition with major players expanding into different regions are engaged in diversifying their product portfolio and extending their global reach. These manufacturing companies are forming various strategic partnerships and distribution agreements to cater to the growing demand for their products in new geographical markets.

For instance, in 2022, Linde plc has entered into a new long-term agreement with a major space launch company located in Florida to supply bulk industrial gases. The air separation facility in Mims, Florida, will serve as the source for the delivery of liquid argon to the client. Linde plc plans to expand production capacity by up to 50% and expects the additional capacity to be operational in 2023.

Companies are adopting cost-effective, reliable, and operationally flexible solutions for the production of the product. Market players are also actively taking initiatives to explore new applications for the product, which is also expected to increase product demand over the forecast period. Argon production is tied to oxygen production in ASUs (Air Separation Units), thus players are emphasizing increasing oxygen production which in turn is expected to drive the market over the forecast period. Some of the prominent players in the argon gas market include:

-

Air Products & Chemicals Inc.

-

BASF SE

-

Linde Gas LLC

-

AMCS Corporation

-

Praxair

-

Messer Group GmbH

-

Air Liquide

-

KBR

-

National Industrial Gas Plants

Argon Gas Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.77 billion

Revenue forecast in 2030

USD 17.21 billion

Growth Rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-Uses, forms, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Switzerland; Italy; Spain Netherland; Russia; China; India; Japan; Malaysia; Vietnam; Indonesia; Australia; New Zealand; Brazil; Argentina; Chile; Columbia; Saudi Arabia; South Africa; UAE; Iran; Oman; UAE; Qatar; Kuwait; Nigeria; Angola

Key companies profiled

Air Products and Chemicals, Inc.; Gulf Cyro; Universal Industrial Gases, Inc.; nexAir; Southern Industrial Gas; Praxair; Taiyo Nippon Sanso; Axcel Gases; Linde Plc; Omega Air; Ellenbarrie Industrial Gases Ltd; Messer Group; Parker Hannifin Corp.; Dubai Industrial Gases; Yingde Gases Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Argon gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Argon gas market report on the basis of form, end-use and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gas

-

Liquid Argon Gas

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Food & Beverages

-

Electronics

-

Manufacturing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Switzerland

-

France

-

Italy

-

Spain

- The Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Vietnam

-

-

Oceania

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Nigeria

-

Angola

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."