Architectural Lighting Market Size, Share, & Trends Analysis Report By Component (Lamp Holders, Ballasts), By Source (Light Emitting Diode, High Intensity Discharge), By Application (Indoor, Outdoor), By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-445-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Architectural Lighting Market Size & Trends

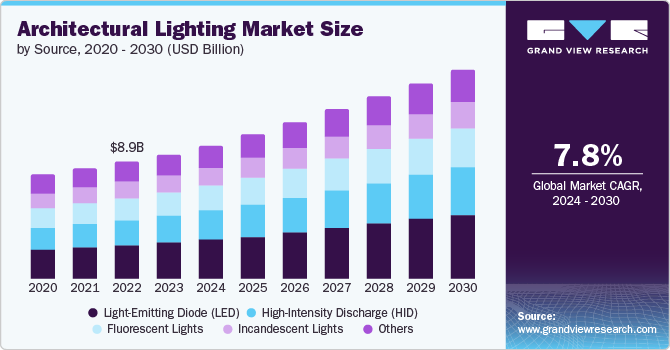

The global architectural lighting market size was estimated at USD 10.20 billion in 2024 and is anticipated to grow at a CAGR of 7.7% from 2025 to 2030. The architectural lighting market is a dynamic and rapidly evolving sector focused on enhancing the functionality, aesthetics, and sustainability of lighting solutions in various architectural applications. Rapid urbanization and expanding infrastructure development are pivotal growth drivers in the architectural lighting market, especially in emerging economies.

As cities grow and modernize, the need for well-lit public spaces, commercial buildings, and residential areas increases significantly. Governments globally are prioritizing the development of smart cities, which aim to integrate advanced technologies for enhanced efficiency and sustainability. Architectural lighting plays a critical role in these initiatives by providing energy-efficient solutions that reduce power consumption while meeting the aesthetic and functional needs of modern infrastructure. LEDs and smart lighting systems, with their ability to be automated and customized, are increasingly favored for urban projects such as parks, bridges, and cultural landmarks. These systems not only enhance safety and visual appeal but also align with global sustainability goals. This surge in urbanization and smart city initiatives positions architectural lighting as a key component of future urban development strategies.

The adoption of LED technology has significantly driven growth in the architectural lighting market due to its superior energy efficiency, longevity, and cost savings. LEDs consume less power, reducing energy costs and carbon footprints, aligning with global sustainability goals. Their longer lifespan minimizes maintenance costs, making them ideal for large-scale and long-term applications. Additionally, advancements in LED technology offer greater design flexibility, enabling creative lighting solutions for diverse architectural needs, from residential spaces to commercial and public infrastructure projects.

The future of the architectural lighting market looks promising, driven by technological advancements and increasing demand for sustainable solutions. The integration of AI, IoT, and advanced control systems will lead to the proliferation of smart lighting in both residential and commercial spaces. Human-centric lighting will become a standard, promoting health and productivity in workplaces and homes. The expansion of smart cities and infrastructure projects globally will create substantial opportunities. Emerging markets in Asia, Africa, and Latin America will witness accelerated growth due to urbanization and increasing investments in infrastructure.

Smart and human-centric lighting solutions, while offering long-term energy and operational savings, require substantial upfront expenses for equipment, installation, and integration. These costs deter small-scale users and businesses with limited budgets. Additionally, retrofitting older structures with modern lighting systems is complex, often involving technical challenges like upgrading outdated wiring and infrastructure. Logistics, including compatibility with existing building designs and regulations, further complicate retrofitting. These factors collectively slow the penetration of advanced architectural lighting solutions, especially in regions lacking financial and technical resources.

Component Insights

The ballasts segment dominated the market and accounted for a revenue share of over 18.0% in 2024. The rising adoption of LED lighting has significantly increased the demand for LED-compatible ballasts, which enhance performance, reliability, and energy efficiency in lighting systems. These ballasts are crucial for optimizing the functionality of LEDs, ensuring consistent and efficient operation across various applications. Simultaneously, the growing retrofit market is a major growth driver for the ballasts segment.

As older buildings replace traditional lighting systems with modern, energy-efficient alternatives, upgrading or installing new ballasts becomes essential to support advanced technologies like LEDs. This trend is particularly pronounced in urban areas and commercial spaces, where retrofitting projects aim to align with energy efficiency goals and regulatory compliance standards.

The lamps segment is anticipated to grow at a significant CAGR of 10.0% during the forecast period. The increasing adoption of LED lamps is driving growth in the architectural lighting market, as they offer superior energy efficiency, extended lifespan, and lower operational costs. Their versatility makes them suitable for applications ranging from decorative accent lighting to large-scale architectural projects. Additionally, heightened awareness of environmental sustainability and stricter energy efficiency regulations are boosting demand for eco-friendly lamp solutions. This trend is particularly prominent in developed markets, where sustainable lighting solutions align with global goals for energy conservation and reduced carbon footprints.

Source Insights

The light-emitting diode (LED) segment accounted for the largest revenue share in 2024. LEDs are gaining significant traction in the architectural lighting market due to their exceptional energy efficiency and cost-saving potential. By consuming much less energy than traditional lighting technologies like incandescent and fluorescent bulbs, LEDs help lower electricity bills, making them a sustainable and economical choice for both residential and commercial applications. In addition, LEDs are integral to the rise of smart lighting systems, which offer advanced features such as compatibility with IoT, remote control, and automation. These smart capabilities enable better energy management, customization, and integration into broader smart cities and building initiatives. As urbanization and the demand for energy-efficient, intelligent infrastructure grow, the adoption of LED-based smart lighting solutions becomes increasingly essential.

The high-intensity discharge (HID) segment is expected to grow at a considerable rate during the forecast period. High-intensity discharge (HID) lamps are valued for their high luminous output, making them ideal for large-scale applications like street lighting, stadiums, and industrial spaces, where bright, expansive illumination is essential. Their ability to efficiently light vast areas drives demand in these sectors. In addition, modern HID technologies, such as metal halide and high-pressure sodium lamps, offer notable improvements in energy efficiency compared to older lighting technologies. This makes them an appealing option for energy-conscious users seeking cost-effective and powerful lighting solutions for both outdoor and industrial environments.

Application Insights

The indoor segment accounted for the largest revenue share of over 76% in 2024. Awareness of how lighting affects mood, productivity, and overall health is driving the demand for human-centric lighting solutions. These systems, which adjust color temperature and brightness to mimic natural daylight patterns, align with circadian rhythms, benefiting indoor environments like workplaces and healthcare facilities. In addition, indoor lighting plays a vital role in enhancing both the aesthetics and functionality of spaces. As interior design trends evolve, there is a rising demand for customized, decorative lighting solutions that complement modern architectural styles. This is especially evident in residential, commercial, and hospitality settings, where ambiance and lighting quality are integral to creating inviting and functional environments.

The outdoor segment is expected to register significant growth during the forecast period. Rapid urbanization and infrastructure development are significantly driving the demand for outdoor lighting solutions, as they enhance safety, visibility, and aesthetics in growing urban environments. The expansion of public spaces, streets, and highways requires efficient lighting systems to support these needs. Additionally, the rise of smart city initiatives is fueling the adoption of IoT-enabled outdoor lighting systems. These systems provide benefits such as automated control, energy management, and real-time monitoring, enhancing security, operational efficiency, and sustainability in urban settings.

End Use Insights

The commercial segment accounted for the largest revenue share of over 51% in 2024. The demand for energy-efficient lighting solutions is driving growth in the commercial segment of the architectural lighting market. As commercial buildings such as offices, retail stores, and hotels prioritize sustainability, the adoption of energy-saving lighting technologies like LEDs has surged. These solutions not only help reduce operating costs but also align with broader environmental goals by decreasing energy consumption. In addition, businesses are increasingly focusing on sustainability to meet green building certification standards, such as LEED. As a result, eco-friendly and energy-efficient lighting solutions have become a core component of modern commercial building designs, enhancing both operational efficiency and a company’s environmental footprint. This trend is transforming the commercial lighting landscape.

The residential segment is anticipated to grow at the highest CAGR from 2025 to 2030. Homeowners are increasingly prioritizing aesthetics and interior design, leading to a growing demand for architectural lighting that complements and enhances the visual appeal of living spaces. Lighting is now seen as a critical element of interior design, used to highlight architectural features, create focal points, and set the mood within different rooms. From accent lighting that emphasizes art and furniture to ambient lighting that creates a warm and inviting atmosphere, the role of lighting in residential design has expanded significantly. This focus on home aesthetics drives the adoption of customizable and design-forward lighting solutions in the residential market.

Regional Insights

North America architectural lighting industry held the revenue share of over 19% of the architectural lighting industry in 2024. The growth of the North American architectural lighting market can be attributed to vast developments in LED technology over the years, which have resulted in increased efficiency, greater lifespans, and lower costs for LEDs. As a result, LED lighting has become an increasingly popular option for new building and retrofit projects. North America's stringent energy efficiency requirements and standards have pushed the use of energy-efficient lighting systems across applications, including architectural lighting.

U.S. Architectural Lighting Industry Trends

The architectural lighting industry in the U.S. is expected to grow significantly from 2025 to 2030. The expansion of commercial infrastructure, including retail spaces, office buildings, and hospitality sectors, is driving the demand for architectural lighting. Businesses are increasingly using lighting to enhance aesthetics, create ambiance, and improve energy efficiency, thus promoting market growth.

Europe Architectural Lighting Industry Trends

The Europe architectural lighting market is expected to register a CAGR of 6.6% from 2025 to 2030. Europe's stringent regulatory framework and energy-efficiency policies and standards significantly impact the region's architectural lighting sector. These laws require energy-efficient lighting technology and establish performance requirements for lighting systems. For instance, the EU Eco-Design Directive regulates energy efficiency requirements for lighting products, stimulating innovation and utilization of efficient lighting solutions.

The architectural lighting industry in the UK is expected to grow rapidly in the coming years. As the UK focuses on reducing its carbon footprint and meeting environmental targets, energy-efficient lighting systems are integral to achieving green building certifications like BREEAM and LEED. These certifications are driving demand for advanced, eco-friendly lighting solutions in commercial buildings, public infrastructure, and residential projects.

Germany architectural lighting market held a substantial market share in 2024. Germany emphasizes sustainable urban planning and architectural illumination as fundamental to developing environment-friendly urban spaces. The country aims to incorporate energy-efficient street lighting, pedestrian-friendly lighting designs, and green infrastructure. Such initiatives drive the growth of the market.

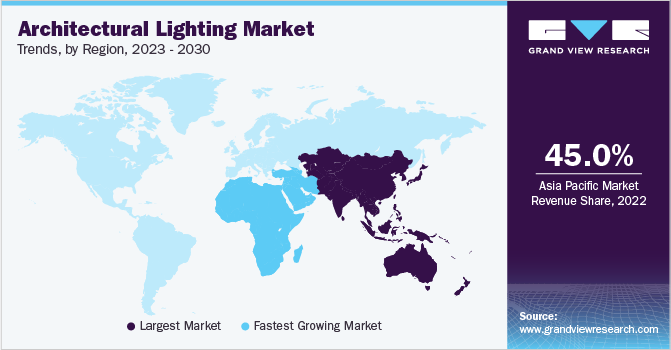

Asia Pacific Architectural Lighting Industry Trends

The architectural lighting market in the Asia Pacific is growing significantly at a CAGR of over 8.0% from 2025 to 2030, due to rapid urbanization, with several cities undergoing immense growth and expansion. Architectural lighting is essential for upgrading urban landscapes, improving cityscapes, and creating attractive environments. Many APAC countries are concerned with energy savings and environmental sustainability, increasing the adoption of energy-efficient and innovative lighting solutions. As urban areas continue to expand and evolve, the demand for advanced architectural lighting is expected to grow, driven by the need for modern, sustainable, and visually impactful lighting solutions.

China architectural lighting industry held a substantial revenue share in 2024. China’s push to develop smart cities is driving demand for integrated lighting systems that are compatible with IoT and building management systems (BMS). These systems offer energy management, automation, and enhanced functionality, supporting China’s ambitions to modernize urban infrastructure.

The architectural lighting industry in Japan held a substantial revenue share in 2024. Japan is known for its focus on technological innovation, which is reflected in the architectural lighting market. The country is a leader in the development and adoption of advanced lighting technologies, such as OLEDs, LEDs, and smart lighting systems. These innovations offer energy efficiency, enhanced performance, and customization, driving market growth.

In India, the architectural lighting industry is growing rapidly due to India’s booming hospitality and retail industries, which are contributing to the demand for innovative architectural lighting solutions. Lighting plays a crucial role in enhancing the ambiance and customer experience in hotels, restaurants, malls, and other commercial establishments.

Key Architectural Lighting Market Company Insights

The key market players in the global architectural lighting industry are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Architectural Lighting Companies:

The following are the leading companies in the architectural lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Acuity Brands, Inc.

- Cree Lighting

- Delta Light

- Current Lighting

- GVA Lighting, Inc.

- Hubbell

- OSRAM SYLVANIA Inc.

- Panasonic Corporation

- Signify Holding

- Siteco GmbH

- Technical Consumer Products, Inc.

- Zumtobel Group AG

- Feilo Sylvania

- Seoul Semiconductor Co., Ltd.

View a comprehensive list of companies in the Architectural Lighting Market

Recent Developments

-

In December 2024, Zumtobel Group AG announced the acquisition of a UK-based LED lighting company, AC/DC. This strategic move enhances Zumtobel's position in the architectural lighting market by expanding its portfolio with advanced LED lighting solutions. AC/DC specializes in high-quality, energy-efficient LED products, which aligns with Zumtobel’s focus on sustainable and innovative lighting technologies. The acquisition aims to leverage AC/DC's expertise to offer more diverse and energy-efficient lighting options to meet the growing demand in both residential and commercial sectors.

-

In February 2024, Panasonic expanded its lighting business by inaugurating a new facility in Daman, India. This strategic move is aimed at strengthening its presence in the lighting market, focusing on energy-efficient solutions. The facility will enhance Panasonic's manufacturing capacity, enabling the company to meet the growing demand for innovative and sustainable lighting products. The expansion aligns with the company's commitment to environmental sustainability and serves as a step forward in advancing its lighting technologies in the Indian market.

-

In August 2023, Acuity Brand, Inc. expanded its lighting product range by introducing new FMLR Round and FMLSQ Square Flush Mounts. These flush mounts provide flexible and attractive lighting options for various locations. They are available in circular and square shapes to suit different design preferences and uses, offering practicality and improved aesthetic appeal.

Architectural Lighting Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 11.05 billion |

|

Market Size forecast in 2030 |

USD 15.98 billion |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Market size forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, source, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Acuity Brands, Inc.; Cree Lighting; Delta Light; Current Lighting; GVA Lighting, Inc.; Hubbell; OSRAM SYLVANIA Inc.; Panasonic Corporation; Signify Holding; Siteco GmbH; Technical Consumer Products, Inc.; Zumtobel Group AG; Feilo Sylvania Seoul Semiconductor Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Architectural Lighting Market Report Segmentation

This report forecasts market Size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global architectural lighting market report based on component, source, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Lamp Holders

-

Ballasts

-

Lamps

-

Lenses/Shades

-

Trims

-

Wiring

-

Reflectors

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Incandescent Lights

-

Fluorescent Lights

-

Light-Emitting Diode (LED)

-

High-Intensity Discharge (HID)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growth of the architectural lighting market can be attributed to rapid urbanization and the expansion of infrastructure development. Architectural lighting is becoming increasingly important in various settings, including independent bungalows, condominiums, community houses, skyscrapers, residential buildings, shopping malls, office spaces, hotels, public offices, and industrial lofts, among others.

b. The global architectural lighting market size was estimated at USD 10.20 billion in 2024 and is expected to reach USD 11.05 billion in 2025.

b. The global architectural lighting market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 15.98 billion by 2030.

b. Asia Pacific dominated the architectural lighting market with a share of 42.3% in 2024. This is attributable to infrastructure development, such as commercial buildings, public spaces, and high-end residential complexes in developing Asian nations.

b. Some key players operating in the architectural lighting market include Acuity Brands, Inc., Cree Lighting, Delta Light, Current Lighting, GVA Lighting, Inc., Hubbell, OSRAM SYLVANIA Inc., Panasonic Corporation, Signify Holding, Siteco GmbH, Technical Consumer Products, Inc., Zumtobel Group AG, Feilo Sylvania Seoul Semiconductor Co., Ltd.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."