Architectural Flat Glass Market Size, Share & Trends Analysis Report By Product (Tempered, Laminated, Insulated), By Application (Residential, Non-residential, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-256-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Architectural Flat Glass Market Size & Trends

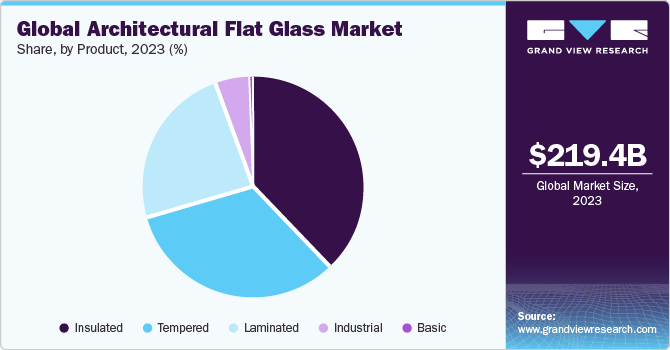

The global architectural flat glass market size was estimated at USD 219.41 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. Growing efforts towards reviving economic growth by making investments in construction and infrastructure is propelling the demand for glass worldwide. Moreover, its characteristic of being eco-friendly is further aiding its penetration, especially in commercial buildings.

Glass has numerous applications for architectural purposes, such as façade, doors, windows, railings, patio covers, partitions, and sunrooms, to name a few. It is largely preferred in the exterior construction of commercial spaces due to features such as recyclability and aesthetics. For instance, Tower Two of the Manhattan West Development in New York was completed in January 2024. High-performance glass clads both towers One, and Two, highlighting elegant simplicity reflected.

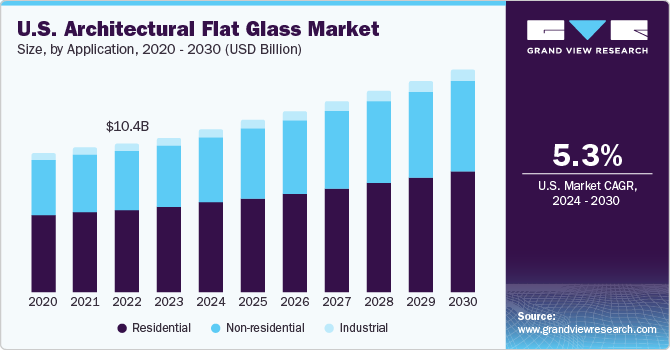

The U.S. is one of the largest consumers of architectural flat glass.The product is widely used in the country for various residential & commercial architectural purposes such as façade, doors, windows, railings, patio covers, partitions, and sunrooms. The construction investment is expected to increase the demand for products in the forecast period.

For instance, in 2023, construction spending was around USD 1,978.7 billion, which is 7.0% higher than the previous year. The expenditure in 2022 was USD 1,848.7 billion. Where, residential construction sector had an estimated worth of USD 911.7 billion in December 2023, which is 1.4% higher than the revised November 2023 estimate of USD 898.8 billion. The private construction sector's spending in 2023 was around USD 1,541.0 billion, which is 4.7% higher than the expenditure in 2022, which was USD 1,472.4 billion.

Also, increasing construction of high-rise office and residential buildings is expected to propel the consumption of the product in the forecast period. For instance, in January 2024, AO and Matteson Capital proposed a new project named the Boardwalk at Bricktown, which involves constructing a 1,907-foot skyscraper in downtown Oklahoma City. If approved, this project will become the sixth tallest building in the world and be situated at the heart of the city's downtown area.

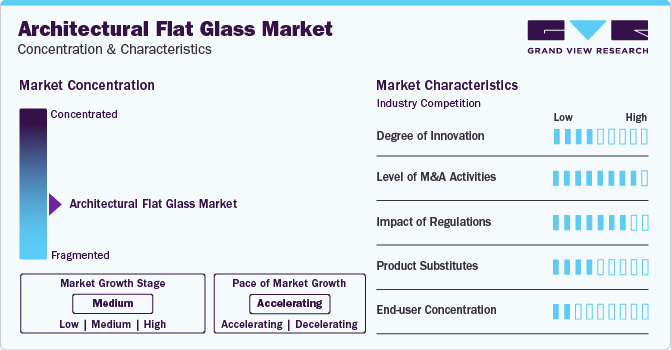

Market Concentration & Characteristics

The market growth stage is moderate, and pace of market growth is accelerating. The use of architectural flat glass, including base, toughened, and glass, is on the rise for both residential and commercial buildings due to improving living standards and modernization among the population. The architectural glass market is fragmented in nature.

Several emerging players in the market are forming partnerships and collaborations to achieve common objectives. These collaborations help them leverage each other's strengths, resources, and expertise for their mutual benefit. This is primarily due to the competitive, fragmented, and growing market. These companies are taking this approach to maintain their market share and stay relevant in the industry.

Architectural flat glass manufacturing is subject to government regulations, which can impact its operations. For example, the Occupational Safety and Health Administration (OSHA) has established standards for safety in glass manufacturing. In addition, building codes may be in place at the local or national level to regulate the use of glass in construction, with specific requirements for the thickness, strength, and type of glass used for safety reasons.

Architectural flat glass cannot be directly replaced by any other material as it possesses distinct and exceptional features like durability, transparency, and eco-friendliness. However, in some cases, alternative materials like polycarbonate sheets, acrylic sheets, and ETFE (ethylene tetrafluoroethylene) film are used as substitutes for architectural glass as they possess similar properties. These materials are comparatively less costly than glass but may not necessarily provide the same level of performance or aesthetic appeal in every application.

Product Insights

The insulated glass segment held the market with the largest revenue share of 38.22% in 2023. Insulated glass has the ability to improve energy efficiency in buildings by minimizing heat transfer, which in turn reduces the amount of electrical power required for heating or cooling of the space. Thus, building codes and regulations to increase energy efficiency are expected to drive product demand.

The tempered glass segment is anticipated to grow at a CAGR of 3.8% during the forecast period. This type of glass is about 2.5 times stronger than standard glass of the same thickness when it comes to physical or thermal shock. Tempered glass is commonly employed in structural glass applications where there is a risk of wind, snow, thermal, or seismic loads.

Application Insights

Based on application, the residential segment led the market with the largest revenue share of 54.81% in 2023. The product is used in residential buildings for various purposes, such as windows, doors, railings, patio covers, sunrooms, and partitions. It is preferred in the exterior construction of residential spaces due to its eco-friendliness, durability, and aesthetics. In addition, architectural flat glass provides natural light and enhances the overall look of the building. Thus, rising investment in building construction and renovation is expected to augment the demand for the product in the forecast period.

The non-residential segment is anticipated to grow at the fastest CAGR during the forecast period. Glass plays a crucial role in modern architectural design, enabling the creation of unique and customized designs for commercial buildings. Moreover, using energy-efficient glass can reduce the environmental footprint and make commercial spaces more sustainable.

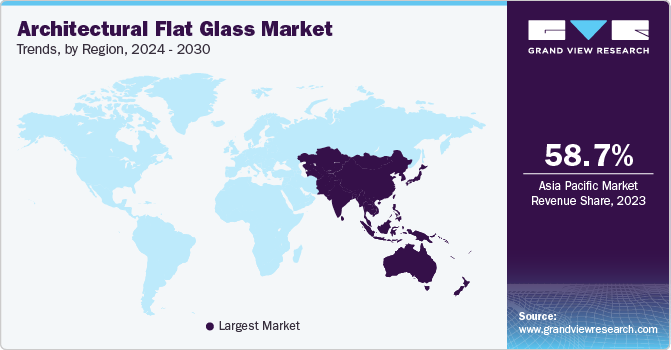

Regional Insights

North America dominated the architectural flat glass market with a revenue share of more than 16.32% in 2023. Rising investment in residential & commercial buildings is expected to propel the demand for the product in the forecast period.

U.S. Architectural Flat Glass Market Trends

The architectural flat glass market in U.S. accounted with a revenue share of approximately 30.0% in North America in 2023. The market's growth can be attributed to the rising demand for glass in both commercial and residential buildings.

Europe Architectural Flat Glass Market Trends

The architectural flat glass market in Europe accounted with a revenue share of 12.88% in 2023. The market growth is attributed to the increasing demand for energy-efficient buildings in the region.

The Germany architectural flat glass market accounted with the revenue share of 15.0% in Europe in 2023.The increasing demand for sustainable and energy-efficient buildings is driving the market growth.

The architectural flat glass market in UK is expected to grow at the fastest CAGR during the forecast period. The government is investing in affordable housing to address the country's housing crisis, which is expected to increase demand for architectural glass.

Asia Pacific Architectural Flat Glass Market Trends

The architectural flat glass market in Asia Pacific held a revenue share of 58.71% in 2023. The demand for architectural flat glass is increasing in Asia due to rapid urbanization and construction activities, stemming from population growth and economic development, which necessitate modern infrastructure and buildings.

The China architectural flat glass market held a revenue share of approximately 60.96% in Asia Pacific in 2023. Rising investment in the construction of high-rise office and commercial buildings is propelling the demand for the product.

The architectural flat glass market in India is the fastest-growing market in the Asia Pacific. The demand for the product is being driven by the government's initiative to develop smart cities and improve public infrastructure, such as schools, offices, and tourism.

Central & South America Architectural Flat Glass Market Trends

The architectural flat glass market in Central & South America held a revenue share of 4.77% in 2023. The demand for architectural flat glass is increasing due to significant growth in the construction industry in the region.

The Brazil architectural flat glass market held a revenue share of approximately 40.0% in Central & South America region in 2023. Rising investment in tourism and infrastructure development is expected to propel the demand for architectural flat glass in the country.

Middle East & Africa Architectural Flat Glass Market Trends

The architectural flat glass market in Middle East & Africa region held a revenue share of over 7.32% in 2023. The rising investment in industrial and office construction is expected to propel the demand for architectural glass in the region.

The Saudi Arabia architectural flat glass market held a revenue share of approximately 22.0% in Middle East & Africa region in 2023. The country is developing and is experiencing a construction boom, with several large-scale projects underway, such as the Neom project, Red Sea Project, and Qiddiya Entertainment City, which is positively influencing the market growth.

Key Architectural Flat Glass Company Insights

Some of the key players operating in the market include Guardian Industries, and Saint-Gobain

-

Saint-Gobain operates in 75 countries and employs over 166,000 people, providing construction and industrial materials and services.The company offers various types of flat glass, including laminated glass, silvered glass, patterned glass, and coated glass

-

Guardian Glass is present in more than 160 countries on 5 continents of the world. The company’s product portfolio includes advanced architectural glass (SunGuard), interior glass (InGlass), residential glass (ClimaGuard), and automotive & transportation glass, as well as glass for solar energy systems (EcoGuard), and technical glass for lighting, electronics, and commercial refrigeration

Xinyi Glass Holdings Limited, and Paragon Tempered Glass, LLC are some of the emerging market participants.

-

Xinyi Glass Holdings Limited, established in 1988 and based in Hong Kong, China, is dedicated to producing superior quality float glass, automotive glass, and energy-efficient architectural glass. The company has a sales network spanning over 140 countries and regions worldwide

Key Architectural Flat Glass Companies:

The following are the leading companies in the architectural flat glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Guardian Industrie

- Saint-Gobain

- Şişecam

- Vitro Architectural Glass

- CARDINAL GLASS INDUSTRIES, INC

- Schott AG,

- Paragon Tempered Glass, LLC

- Xinyi Glass Holdings Limited.

- Vitrum Glass Group.

Recent Developments

-

In March 2023, Keda Industrial Group announced plans to invest USD 86.8 million in building an architectural glass plant in Tanzania. The construction of the new plant is aimed at expanding the range of building materials in the African market and growing Keda Industrial's market share. The company plans to establish a local subsidiary or partner with a local entity to construct the plant, which is expected to have an annual production capacity of 600 tons of architectural glass

-

In September 2023, Press Glass announced a USD 155.2 million investment to expand its glass manufacturing site located in Ridgeway, Virginia. The company plans to create 335 new jobs by building a 360,000-square-foot addition to its existing facility. The new facility will focus on producing architectural glass designed for the commercial construction industry

Architectural Flat Glass Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 227.70 billion |

|

Revenue forecast in 2030 |

USD 285.31 billion |

|

Growth rate |

CAGR of 3.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Germany; UK; France; Spain; China; Japan; India; Brazil; Saudi Arabia |

|

Key companies profiled |

AGC Inc.; Guardian Industries; Saint-Gobain, Şişecam; Vitro Architectural Glass; CARDINAL GLASS INDUSTRIES, INC; Schott AG; Paragon Tempered Glass; LLC; Xinyi Glass Holdings Limited.; Vitrum Glass Group |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Architectural Flat Glass Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global architectural flat glass market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Basic

-

Tempered

-

Laminated

-

Insulated

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global architectural flat glass market size was estimated at USD 219.41 billion in 2023 and is expected to reach USD 227.70 billion in 2024.

b. The global architectural flat glass market is expected to grow at a compound annual growth rate of 3.8%from 2024 to 2030 to reach USD 285.31 billion by 2030.

b. Residential application segment dominated the global market with a revenue share of over 54.0% in 2023. Rising demand for energy efficient buildings is driving the growth of the market

b. Some of the key players operating in the architectural flat glass market include AGC Inc., Guardian Industrie, Saint-Gobain, Şişecam, Vitro Architectural Glass, CARDINAL GLASS INDUSTRIES, INC, Schott AG, among others.

b. The consumption of architectural flat glass is on the rise due to increasing industrialization, urbanization, and modernization in emerging countries like China, India, and Vietnam.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."