- Home

- »

- Advanced Interior Materials

- »

-

Arc Flash Protection Market Size And Share Report, 2030GVR Report cover

![Arc Flash Protection Market Size, Share & Trends Report]()

Arc Flash Protection Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Arc Flash Detection & Control Systems, Personal Protective Equipment (PPE)), By End Use (Utilities, Oil & gas), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-336-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Arc Flash Protection Market Size & Trends

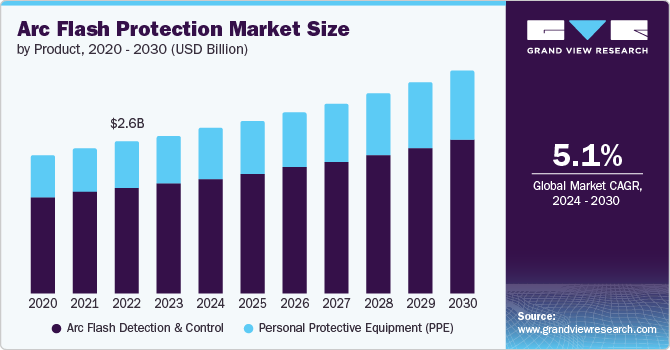

The global arc flash protection market size was estimated at USD 2.72 billion in 2023 and is anticipated to grow at a CAGR of 5.1% from 2024 to 2030. The demand for arc flash protection is driven by the increasing need for electrical safety in various industries such as utilities, oil & gas, manufacturing, and data centers. As these industries continue to grow, there is a greater requirement for reliable and effective arc flash protection systems to safeguard workers and equipment from electrical hazards.

With a growing emphasis on workplace safety and regulatory compliance, businesses are seeking arc flash protection solutions that offer optimal performance while minimizing risks. Additionally, the rise in renewable energy projects and the expansion of electrical infrastructure in developing regions have bolstered the demand for arc flash protection equipment. This trend is further fueled by technological advancements and the integration of smart monitoring systems in arc flash protection devices.

Arc flash protection plays a crucial role in maintaining safety standards across various applications. In industrial settings, arc flash protection systems are essential in electrical panels, switchgear, and control panels to prevent severe injuries caused by arc flash incidents. Additionally, in the utility sector, arc flash protection is utilized in substations and power distribution networks to enhance the safety of maintenance personnel and minimize downtime.

Drivers, Opportunities & Restraints

One of the primary drivers behind the growth of the arc flash protection market is the stringent safety regulations and standards imposed by governments and regulatory bodies worldwide. Organizations such as the Occupational Safety and Health Administration (OSHA) in the United States and the European Union's Directive on Electrical Safety mandate the adoption of safety practices and protective equipment to safeguard workers from electrical hazards. This has compelled industries to invest in arc flash protection solutions, fueling market growth.

Technological advancements play a crucial role in shaping the market. Modern solutions, including arc flash detection and control systems, personal protective equipment (PPE) like flame-resistant clothing, insulating blankets, and face shields, are becoming increasingly sophisticated. These advancements offer enhanced protection and improve the overall efficiency of safety practices in industrial settings. Furthermore, the incorporation of Internet of Things (IoT) technologies for real-time monitoring and predictive maintenance of electrical equipment is a trend that's gaining traction, offering new opportunities for market expansion.

One of the primary restraints facing the market is the significant investment required for the implementation of comprehensive arc flash protection systems. Upfront costs include the purchase of protective equipment and devices and the expenses related to training employees and implementing safety protocols. For small and medium-sized enterprises (SMEs) operating with tight budgets, these costs can be prohibitively high, making them hesitant to adopt advanced arc flash protection solutions.

Product Insights

“The demand for personal protective equipment segment is expected to grow at a CAGR of 5.5% from 2024 to 2030 in terms of revenue”

The arc flash detection & control systems segment led the market and accounted for over 69% of the global revenue share in 2023. Stringent safety regulations, advancements in technology leading to more affordable systems, and a growing focus on worker safety are all driving this segment's growth. These systems act as the first line of defense by quickly identifying an arc flash and triggering protective measures like tripping circuit breakers or shutting down equipment. This can significantly reduce the damage caused by an arc flash incident, protecting workers and equipment.

The personal protective equipment segment is projected to grow at a significant CAGR from 2024 to 2030. This segment includes arc-rated clothing, gloves, face shields, and helmets, which are essential for protecting workers from arc flash hazards. The growing emphasis on worker safety and compliance with safety standards is driving the demand for high-quality PPE.

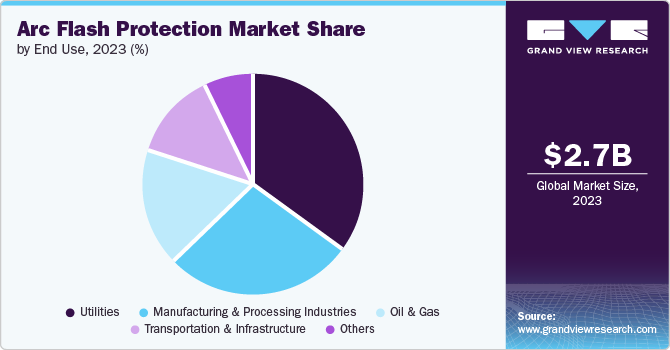

End Use Insights

“The manufacturing & processing industries end use segment is expected to grow at a significant CAGR of 5.7% from 2024 to 2030 in terms of revenue”

The utility end use segment led the market and accounted for 35.1% share of the global market revenue in 2023. This sector encompasses electricity generation, transmission, and distribution companies that operate in environments with inherently high electrical hazard risks. Given the critical nature of uninterrupted power supply and the high potential for arc flash incidents in these settings, utilities are under stringent regulatory scrutiny to adopt comprehensive arc flash protection measures. This includes the deployment of advanced detection systems, personal protective equipment (PPE), and safety protocols designed to safeguard employees against the severe outcomes of arc flash episodes.

The transportation & infrastructure segment presents a promising growth opportunity within the market. This segment encompasses various sectors like railways, airports, and data centers, all heavily reliant on electrical systems for safe and efficient operation. Growing awareness of arc flash hazards and the increasing complexity of electrical infrastructure in these sectors are driving the demand for advanced arc flash protection solutions.

Regional Insights

The North America region led the market and accounted for 32.7% revenue share in 2023. The market is driven by stringent regulatory frameworks, a strong focus on occupational safety, and the presence of numerous industries with significant electrical hazard risks. In the United States and Canada, organizations such as the Occupational Safety and Health Administration (OSHA) and the Canadian Standards Association (CSA) enforce regulations that necessitate the incorporation of arc flash protection measures in workplaces. These regulations, coupled with the growing awareness of workplace safety among businesses and the adoption of state-of-the-art electrical safety technologies, propel the demand for arc flash protection solutions across the region.

U.S. Arc Flash Protection Market Trends

In the U.S., the market is significantly advanced, underscored by comprehensive regulatory standards and a heightened emphasis on workplace safety. The Occupational Safety and Health Administration (OSHA) and the National Fire Protection Association (NFPA) play pivotal roles in shaping the nation's approach to electrical safety, with the NFPA 70E standard being particularly influential in setting guidelines for arc flash risk assessment and mitigation. This regulatory environment compels businesses across various sectors, including utilities, manufacturing, and energy, to adopt arc flash protection measures rigorously.

Europe Arc Flash Protection Market Trends

Europe is marked by a strong emphasis on safety regulations and sustainability. Major manufacturing and utility companies in countries like Germany, France, and the UK are expected to drive the demand for arc flash protection solutions in the region. The presence of leading safety equipment manufacturers and technological innovators in the region supports developing and adopting state-of-the-art arc flash protection gear, detection systems, and training programs.

Asia Pacific Arc Flash Protection Market Trends

The market in Asia Pacific is experiencing robust growth due to rapid industrialization, urbanization, and the expansion of electrical infrastructure. Countries like China, India, and Japan are investing heavily in power generation and distribution, which is expected to drive the demand for arc flash protection solutions in the region.

Key Arc Flash Protection Company Insights

Some of the key players operating in the market include ABB Group, Siemens, Eaton, Schneider Electric., among others.

-

ABB designs and manufactures switchgear that's mechanically robust to withstand the immense pressure and heat generated during an arc flash. These enclosures are engineered to channel the arc flash safely and minimize debris expulsion, protecting personnel and equipment in the surrounding area. ABB's portfolio includes the REA family of relays, known for their exceptional speed in detecting arc flash events.

-

Siemens manufactures switchgear designed to withstand the intense pressure and heat generated by an arc flash. These enclosures are meticulously engineered to safely contain the arc flash and minimize the expulsion of debris, protecting workers and nearby equipment. Siemens' offerings include the Sentrix series of arc flash detection relays, known for their superior speed and accuracy. Beyond hardware, Siemens provides arc-rated personal protective equipment (PPE) like flame-resistant clothing and arc flash gloves to ensure worker safety during maintenance or emergencies.

Honeywell International Inc., Hubbell Incorporated, DuPont, Arcteq Relays Ltd, Littelfuse, Inc, L&T Electrical & Automation, are some of the emerging market participants in the market.

-

Honeywell International Inc. is a key player in the market, offering a comprehensive range of solutions to shield workers and equipment from the dangers of arc flash incidents. Honeywell's arc flash PPE portfolio includes brands like Salisbury and Miller, providing workers with flame-resistant clothing, arc-rated gloves, face shields, and other essential equipment.

-

DuPont is a major force in the market, renowned for its innovative materials and comprehensive solutions that safeguard workers from the perils of arc flash events. Their Nomex® fabrics are designed for multi-hazard protection, ensuring workers are safeguarded against not only arc flash but also heat, flames, and chemicals.

Key Arc Flash Protection Companies:

The following are the leading companies in the arc flash protection market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Group

- Siemens

- Eaton

- Schneider Electric

- Honeywell International Inc.

- Hubbell Incorporated

- DuPont

- Arcteq Relays Ltd

- Littelfuse, Inc

- L&T Electrical & Automation

Recent Developments

-

In April 2023, Pyramex enhanced workplace safety with the launch of the GL3000 Series Arc Flash Protection gloves. These gloves offer exceptional comfort, fit, and dexterity, ensuring worker well-being while providing premium protection against arc flash hazards.

-

in August 2023, in a move to enhance worker safety and minimize arc flash risks, Rockwell Automation introduced ArcShiel technology for CENTERLINE motor control centers (MCCs). This arc flash safety solution now caters specifically to Canadian manufacturers with high-amp applications common in oil, gas, mining, water treatment, and power generation industries.

Arc Flash Protection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.85 billion

Revenue forecast in 2030

USD 3.84 billion

Growth Rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

ABB Group; Siemens; Eaton; Schneider Electric; Honeywell International Inc.; Hubbell Incorporated; DuPont; Arcteq Relays Ltd; Littelfuse; Inc; L&T Electrical & Automation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arc Flash Protection Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the arc flash protection market on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal Protective Equipment (PPE)

-

Arc Flash Detection & Control

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Utilities

-

Manufacturing & Processing Industries

-

Oil & Gas

-

Transportation & Infrastructure

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the arc flash protection market include ABB Group, Siemens, Eaton, Schneider Electric, Honeywell International Inc., Hubbell Incorporated, DuPont, Arcteq Relays Ltd, Littelfuse, Inc, L&T Electrical & Automation

b. The key factors driving the arc flash protection market include increasing industrialization, rising emphasis on workplace safety, and the expansion of renewable energy projects.

b. The global arc flash protection market size was estimated at USD 2.72 billion in 2023 and is expected to reach USD 2.85 billion in 2024.

b. The global arc flash protection market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 3.84 billion by 2030.

b. North America dominated the arc flash protection market with a revenue share of 32.7% in 2023. The market is driven by stringent regulatory frameworks, a strong focus on occupational safety, and the presence of numerous industries with significant electrical hazard risks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.