- Home

- »

- Next Generation Technologies

- »

-

Aquaponics Market Size And Share, Industry Report, 2030GVR Report cover

![Aquaponics Market Size, Share & Trends Report]()

Aquaponics Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment, By Component, By Facility Type (Greenhouse, Building Based Indoor Farms), By Growing Mechanism, By Produce (Fish, Fruits & Vegetables), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-071-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aquaponics Market Summary

The global aquaponics market size was estimated at USD 1,087.2 million in 2024 and is projected to reach USD 2,294.5 million by 2030, growing at a CAGR of 13.5% from 2025 to 2030. The target market includes equipment and components required to build an aquaponics system.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, South Africa is expected to register the highest CAGR from 2024 to 2030.

- By equipment, the pumps & valves segment held the market share of 28.4% in 2024 and is expected to grow at a CAGR of 13.6% throughout the forecast period.

- By component, the rearing tank segment dominated the market in 2024, with a share of 23.9%.

- By facility type, the greenhouse segment dominated the market in 2024, with a revenue share of 45.3%.

Market Size & Forecast

- 2024 Market Size: USD 1,087.2 Million

- 2030 Projected Market Size: USD 2,294.5 Million

- CAGR (2025-2030): 13.5%

- North America: Largest market in 2023

The market has tremendous growth opportunities in the coming years as the aquaponics system eliminates the use of inorganic fertilizers and pesticides. There is a high demand for organic fruits and vegetables, and the organic trend is expected to gain more traction in the future, thus supporting the growth of the market.

The positive environmental impact of aquaponics is expected to further contribute to the growth of the target market. The water required to grow crops in these systems is 90% less than traditional farming techniques. Also, it requires 90% less area than traditional farming methods. The growing demand for food owing to the exponentially increasing global population and limitations of water and land resources is expected to significantly boost the demand for aquaponics setups. Additionally, the better quality of yield obtained with these systems will drive the demand for aquaponics agriculture produce over conventional produce.

The aquaponics sector faces several challenges, including a high cost of initial investment and maintenance. The operational costs of an aquaculture system are high as it requires regular maintenance. Moreover, the aquaponics system is unsuitable for all crops, and it’s expensive to upscale production with these systems. Moreover, the lack of a specialized skilled workforce for both managing the aquaculture systems and soilless farming techniques hampers the growth of the market.

COVID-19 Impact on the Aquaponics Market

The agriculture sector and related industries across the globe were severely impacted during the COVID-19 pandemic. Strict lockdowns and border closures were announced by governments all over the world, which severely affected the global supply chains. To ensure employee safety and maintain social distancing, the manufacturing facilities were shut down entirely or operated at reduced capacity. Additionally, the shortage of labor significantly impacted the operations of the aquaponics facilities. The pandemic also made it difficult to find a market for the obtained produce.

However, the pandemic accelerated the adoption of alternative and sustainable farming techniques such as aquaponics systems. The pandemic highlighted the importance of urban and peri-urban farming in order to cater to the local markets and provide fresh produce. The demand for aquaponics equipment and components witnessed a rise from the hobbyists or home gardeners as many people installed the aquaponics systems at their homes as they had more disposable time owing to the lockdowns and home quarantine.

Equipment Insights

The pumps & valves segment held the market share of 28.4% in 2024 and is expected to grow at a CAGR of 13.6% throughout the forecast period. Pumps help in the transportation of water in the aquaponics systems. It also ensures oxygenation and nutrient supply in the system. Pump types used in the system include submersible pumps and inline pumps. Along with the pumps, valves are installed in the system to regulate and control the water flow in the system.

The grow light segment is anticipated to grow at the fastest CAGR of 14.7% throughout the forecast period. Different plants and fishes require different light conditions for healthy growth. Some thrive in dark conditions, while some require timely exposure to light for average growth. LED grow lights, induction, high-intensity discharge, and fluorescent grow lights can be used in aquaponics systems. Grow lights assist in the year-round production of plants and also ensure increased growth and yield of crops.

Component Insights

The rearing tank segment dominated the market in 2024, with a share of 23.9%. It is anticipated to grow at a CAGR of 12.9% throughout the forecast period. Different types of rearing tanks can be utilized in aquaponics systems. Even a small aquarium can be used for home-based units. Glass tanks, plastic tanks, Rubbermaid stock tanks, and intermediate bulk container totes are different types of rearing tanks or fish tanks.

The bio-filters segment is expected to grow at the fastest CAGR of 14.2% throughout the forecast period. Bio-filters in aquaponics system converts ammonia into nutrient for plants. It is made by filling a container with bio media which increases the surface area for nitrifying bacteria. Moving bed filters, static filters, and drop filters are different bio-filters used. Although bio-filters are not an absolute necessity for aquaponics, their usage improves the efficiency of these systems and are thus installed religiously.

Facility Type Insights

The greenhouse segment dominated the market in 2024, with a revenue share of 45.3%. It is anticipated to grow at a CAGR of 13.2% throughout the forecast period. Passive solar greenhouses are most suitable for aquaponics systems. All growing mechanisms, including deep water culture, nutrient film technique, media filled grow beds, and vertical aquaponics, can be accommodated in a greenhouse facility. The rearing and sump tank placements vary in a greenhouse, as sump tanks are partially buried in a greenhouse and placed below grow beds.

The building-based indoor farms segment is expected to grow at a considerable CAGR of 14.3% throughout the forecast period. Building-based indoor farms are being increasingly installed in order to produce crops throughout the year and in areas with unsuitable climates for plant growth, such as arid regions. Aquaponics systems are installed in urban warehouses, homes, and containers. Aquaponics systems can also be installed in an outdoor environment. However, indoor facilities are preferred over outdoor setups as the environment can be controlled and thus avoid crop damage.

Growing Mechanism Insights

The media filled grow beds segment dominated the market in 2024, with a revenue share of 37.6% and is anticipated to grow at a CAGR of 13.4% from 2025 to 2030. The media filled grow beds is a simple and inexpensive type of aquaponics system. The media beds support several fruit and vegetable plants with large root masses. However, this method is not space efficient and also requires a high amount of labor.

The vertical aquaponics segment is expected to grow at a considerable CAGR of 14.2% throughout the forecast period. In vertical aquaponics, the grow beds are stacked above the rearing tank on one another. Plants that require less support, such as strawberries and leafy greens, are compatible with growing vertically. Vertical aquaponics is a space-efficient system and is being increasingly adopted in urban facilities. Nutrient Film Technique (NFT) is also expected to witness significant growth over the forecast period owing to its space-efficient design and low labor costs.

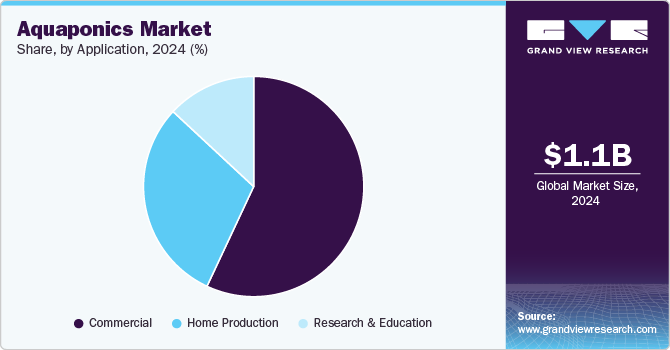

Application Insights

The commercial application segment dominated the market with a share of 57.0% in 2024. Commercial growers widely adopt aquaculture to produce vegetables and different breeds of fish. The dual production of fish and plants obtained in aquaculture is improving its adoption among commercial growers. Several types of fish, such as tilapia, bass, trout, carp, catfish, koi, fingerlings, and different ornamental fishes, can be reared in aquaculture.

The research & education application segment is anticipated to register the fastest CAGR of 13.9% during the forecast period. Aquaponics are valuable tools for research and educational institutions in the fields of agriculture, horticulture, and plant biology. Research institutes require aquaponics systems to conduct experiments by manipulating growing conditions, temperature, humidity, light, and nutrient levels. In-house systems allow researchers to manipulate these factors and test hypotheses about the impact of different environmental conditions on plant growth, yield, and quality.

Produce Insights

The fish segment led the market with a share of 53.9% in 2024. It is anticipated to grow at a CAGR of 13.4% throughout the forecast period. Tilapia is one of the most commonly bred fishes in aquaponics owing to the highly adaptable nature of the fish. The fish type decides the size of the rearing tank, as some fishes require more space to thrive and grow. For example, catfish can grow up to 45-50lbs and hence require more than the 250-gallon size of the rearing tank.

The fruits & vegetables segment is expected to grow at the fastest CAGR of 13.9% throughout the forecast period. Tomatoes, herbs, lettuce, spinach, kale, marijuana, watercress, peppers, lettuce, squash, leafy greens, zucchini, peppers, cucumber, and eggplant are some of the commonly and successfully produced plants with aquaponics systems. Several herbs such as basil, chive, lemongrass, parsley, and fruits such as pineapple, blueberries, strawberries, and tangerine can be produced in these facilities.

Regional Insights

North America aquaponics market led overall market in 2024, with a revenue share of 31.4%. The region's growth can be attributed to the presence of several key players and the high adoption of controlled environment agriculture in North America. In addition, the rising awareness about alternative and sustainable farming techniques and increasing demand for organic food are improving the adoption of aquaponics systems. The U.S. government has implemented various indoor farming initiatives to promote sustainable agriculture, support local food systems, and reduce the environmental impact of farming.

U.S. Aquaponics Market Trends

The Aquaponics market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. This growth is driven by the increasing demand for sustainable and organic food sources, as consumers and businesses seek alternatives to traditional agriculture amid climate concerns. Government initiatives supporting urban farming and sustainable food production further promote aquaponics, especially in urban areas where space and resources are limited. The U.S. market benefits from technological advancements, such as smart farming technologies and automated systems, which make aquaponics more efficient and scalable for commercial farming.

Asia Pacific Aquaponics Market Trends

The Asia-Pacific auaponics market is expected to grow at the fastest CAGR of 15.0% over the forecast period. The growth attributed to strong government support for sustainable farming in agricultural countries such as India, China, and Southeast Asian countries. The Indian government provides subsidies up to 50% under its various schemes, such as the National Horticulture Mission (NHM), which mainly focuses on constructing vertical farms across the country. Various state governments in the country are providing an additional 10-15% subsidies for the implementation of modern technologies in the agriculture sector.

The Aquaponics market in China is expected to grow at a significant CAGR from 2025 to 2030. China's growth in this sector is fueled by rising food safety concerns, rapid urbanization, and the need for sustainable agricultural practices to feed its large population. The Government of China has introduced policies encouraging sustainable farming techniques, with aquaponics seen as a way to reduce pesticide use and improve resource efficiency. Furthermore, investments in research and development in aquaponics technology, as well as a focus on food security, are expected to drive adoption across both urban and peri-urban areas in China.

India aquaponics market is expected to grow at a significant CAGR from 2025 to 2030. India’s expansion in aquaponics is propelled by the growing need for water-efficient agricultural solutions in response to frequent droughts and water shortages. As awareness increases about the benefits of aquaponics-especially among farmers seeking higher yields with limited resources-adoption rates are rising. The government’s focus on sustainable agriculture and support for rural and semi-urban farming initiatives are creating a favorable environment for aquaponics in India, particularly in regions with water scarcity.

The Aquaponics market in Japan is expected to grow at a significant CAGR from 2025 to 2030. Japan's market growth is largely attributed to space constraints and a strong emphasis on sustainable agriculture, particularly as urbanization limits available farmland. Japanese consumers are highly receptive to organic produce, driving demand for aquaponics, which offers a reliable, pesticide-free method of food production. Additionally, Japan’s focus on technological innovation in agriculture, including advancements in indoor and vertical farming systems, supports the adoption of aquaponics for both commercial and residential applications, helping to meet local food demand efficiently.

Key Aquaponics Company Insights

The target market is a fragmented market and highly competitive in nature owing to the presence of several global and regional companies. Key players in the market include Nelson and Pade Aquaponics, Pentair Aquatic Eco-System, Inc. (PAES), The Aquaponic Source, Hydrofarm Holdings Group, Inc, Practical Aquaponics (Pty) Ltd, Greenlife Aquaponics, and Backyard Aquaponics Pty Ltd, among others.

Market players focus on developing innovative products to stay relevant in the market. Companies are engaging in research and development activities and acquiring patents for their products. Key players in the market are conducting awareness programs and offering services such as training courses, consulting services, and design services, among others. For instance, The Aquaponic Source offers training programs such as Immersion Weekend and The Flourish Farm Course to educate and train enthusiasts in order to improve the adoption of aquaponics farming techniques. Additionally, the company also offers design solutions, installation services, and consulting services.

Some of the key companies operating in Aquaponics market include Nelson and Pade Aquaponics, Pentair Aquatic Eco-System, Inc. (PAES), and Hydrofarm Holdings Group, Inc, among others.

-

Nelson and Pade Aquaponics is a leader in aquaponics technology and education, known for its practical, science-based approach to system design and training. Their competitive edge lies in their patented Clear Flow Aquaponic Systems®, which are designed for efficiency, reliability, and scalability. These systems allow for optimized plant and fish growth with minimal water use, making them ideal for commercial and educational applications. The company also offers a comprehensive educational program, including online courses and in-person workshops, which builds a loyal customer base and establishes them as experts in the industry. Their dedication to knowledge sharing and quality equipment positions Nelson and Pade as a trusted provider, helping growers of all levels to establish and maintain successful aquaponic systems worldwide.

-

Pentair Aquatic Eco-System (PAES) holds a strong competitive position in the aquaponics market through its integration of high-quality water filtration, aeration, and pumping solutions tailored to aquaponic applications. Leveraging its expertise in water technology, PAES offers a wide range of products that support efficient water management in aquaponic systems, ensuring high standards of water quality essential for both fish and plants. Their systems are known for durability and energy efficiency, catering to both small-scale and commercial growers. Additionally, PAES benefits from Pentair’s global reach, which allows them to serve customers around the world and support diverse applications. This, combined with their emphasis on product innovation and customer support, cements PAES’s role as a reliable, high-quality provider in the aquaponics sector.

-

Hydrofarm Holdings Group, Inc. is a prominent player in the aquaponics and hydroponics markets, with a strong focus on providing growers with an extensive range of supplies and equipment. Their competitive advantage lies in their ability to deliver a complete suite of products, from grow lights and nutrient solutions to climate control systems, which supports an end-to-end approach for growers in aquaponics. Known for its commitment to sustainability, Hydrofarm emphasizes eco-friendly products that appeal to environmentally conscious growers. Their expansive distribution network across North America further strengthens their market position, enabling rapid access to quality products for commercial growers, hobbyists, and educational institutions alike. By focusing on high-quality supplies and effective distribution, Hydrofarm has established itself as a versatile and dependable choice for aquaponic solutions.

The Aquaponic Source and Greenlife Aquaponics are some of the emerging companies in the target market.

-

The Aquaponic Source is an emerging player in the aquaponics market, bringing a unique advantage through its focus on DIY and home-scale aquaponics systems, which make aquaponics accessible to a wider audience. The company stands out by offering kits, educational resources, and support tailored for beginners and small-scale growers, which lowers the barriers to entry in aquaponics. Their emphasis on customer education-through workshops, online courses, and hands-on training-helps new users gain confidence in managing their systems successfully. By combining affordability with accessible learning resources, The Aquaponic Source positions itself as an attractive choice for those new to aquaponics, fostering a loyal customer base in the growing hobbyist and small-scale commercial market segments.

-

Greenlife Aquaponics is quickly establishing itself as an innovative provider in the aquaponics industry by focusing on sustainable and high-efficiency system designs that appeal to environmentally conscious consumers. The company differentiates itself with modular, customizable aquaponic solutions that can adapt to various scales, from urban gardening projects to commercial operations. Greenlife Aquaponics also emphasizes the use of eco-friendly materials and energy-efficient components, aligning with a rising demand for sustainable farming methods. Their commitment to customer support, from initial consultation through system maintenance, enhances user satisfaction and retention. By offering both flexibility and sustainability, Greenlife Aquaponics is well-positioned to attract a growing number of urban and eco-focused customers, giving it a competitive edge in the emerging aquaponics market.

Key Aquaponics Companies:

The following are the leading companies in the aquaponics market. These companies collectively hold the largest market share and dictate industry trends.

- Nelson and Pade Aquaponics

- Pentair Aquatic Eco-System, Inc. (PAES)

- The Aquaponic Source

- Hydrofarm Holdings Group, Inc.

- Practical Aquaponics (Pty)Ltd

- Greenlife Aquaponics

- Backyard Aquaponics Pty Ltd

- My Aquaponics

- Aquaponic Lynx LLC

- Portable Farms Aquaponics Systems

- aquaponik manufactory GmbH

- Aponic Ltd

Recent Developments

-

In November 2024, Nelson and Pade introduced new aquaponic systems designed to make starting an aquaponic farm more accessible. These systems are offered at a reduced base price and include essential, hard-to-find components along with comprehensive assembly and operation manuals. This approach allows customers to save on costs while benefiting from Nelson and Pade’s reliable designs and guidance, creating a flexible yet supported path for successful aquaponic farming.

-

In September 2024, Fine Bubble Technologies launched a nanobubble aquaponics pilot plant at De Grendel School of Skills in Cape Town, in partnership with the Technology Innovation Agency (TIA), to potentially boost yield by 50%. This pilot integrates aquaculture and hydroponics to showcase the benefits of nanobubble technology in improving water efficiency, oxygen uptake, and nutrient delivery. The initiative aims to reduce reliance on chemical fertilizers, demonstrating an advanced, sustainable approach to aquaponics.

-

In January 2024, Himalaya Technologies, Inc. expanded its aquaponics offering through Infood Technologies, Inc., adding new features designed for K12 education and commercial applications. The enhancements include micro farms and larger systems, enabling Infood to cater to schools aiming to integrate aquaponics into classroom learning and nutrition programs.

Aquaponics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1218.7 million

Revenue forecast in 2030

USD 2,294.5 million

Growth rate

CAGR of 13.5% from 2025 to 2030

Historic data

2017 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, component, facility type, growing mechanism, produce, application, region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; China; India; Japan; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Nelson and Pade Aquaponics; Pentair Aquatic Eco-System, Inc. (PAES); The Aquaponic Source; Hydrofarm Holdings Group, Inc; Practical Aquaponics (Pty)Ltd; Greenlife Aquaponics; Backyard Aquaponics Pty Ltd; My Aquaponics; Aquaponic Lynx LLC; Portable Farms Aquaponics Systems; aquaponik manufactory GmbH; Aponic Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aquaponics Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global aquaponics market based on equipment, component, facility type, growing mechanism, produce, application, and region.

-

Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

Pumps & Valves

-

Grow Light

-

Aeration Systems

-

Water Heaters

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Rearing Tank

-

Settling Basin

-

Bio-Filters

-

Sump Tank

-

Others

-

-

Facility Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Greenhouse

-

Building Based Indoor Farms

-

Others

-

-

Growing Mechanism Outlook (Revenue, USD Million, 2017 - 2030)

-

Media Filled Grow Beds

-

Nutrient Film Technique (NFT)

-

Deep Water Culture (DWC)

-

Application Aquaponics

-

-

Produce Outlook (Revenue, USD Million, 2017 - 2030)

-

Fish

-

Fruits & Vegetables

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Home Production

-

Research & Education

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aquaponics market size was estimated at USD 1,087.3 million in 2024 and is expected to reach USD 1,218.7 million in 2025.

b. The global aquaponics market is expected to grow at a compound annual growth rate of 13.5% from 2025 to 2030 to reach USD 2,294.5 million by 2030.

b. The greenhouse facility type segment led the global market for aquaponics in 2024, accounting for the highest share of about 45%. However, the building based indoor farm facility type segment is expected to register the fastest CAGR during the forecast period owing to the increasing adoption of indoor farming owing to its ability of producing crops throughout the year.

b. Some key players operating in the aquaponics market include Nelson and Pade Aquaponics, Pentair Aquatic Eco-System, Inc. (PAES), The Aquaponic Source, Hydrofarm Holdings Group, Inc, Practical Aquaponics (Pty) Ltd, Greenlife Aquaponics, and Backyard Aquaponics Pty Ltd.

b. The major factors attributing to the growth of the aquaponics market are the increasing adoption of alternative and sustainable farming techniques such as aquaponics; increasing adoption of indoor farming methods; and increasing demand for organic fruits and vegetables.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.