Aquaculture Market Size, Share & Trends Analysis Report By Environment (Fresh Water, Marine Water, Brackish Water), By Fish Type (Carps, Brown Seaweeds, Marine Shrimps & Prawns), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-148-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Aquaculture Market Size & Trends

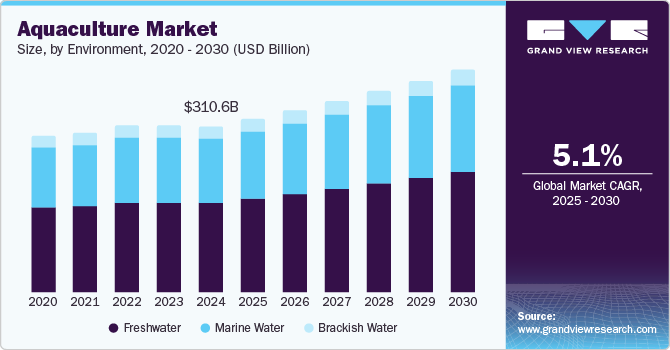

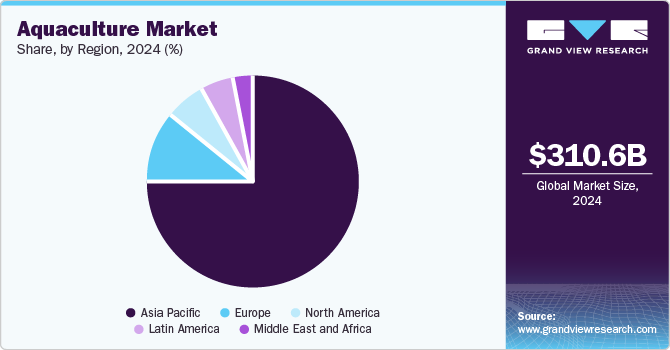

The global aquaculture market size was valued at USD 310.6 billion in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2030. This growth is attributed to the increasing fish consumption, fueled by rising health awareness and the nutritional benefits of seafood. In addition, technological advancements in farming practices and a shift towards sustainable aquaculture methods enhance productivity and efficiency. Furthermore, the decline in wild fish stocks and changing dietary preferences further propel the demand for farmed seafood, particularly in regions such as Asia-Pacific, which dominates the market due to its advanced aquaculture techniques and high consumption rates.

Aquaculture, commonly called aqua farming, involves cultivating various aquatic species, including finfish, carp, mollusks, crabs, and aquatic plants. This method encompasses several interventions in the rearing process, such as regular stocking, feeding, and predator protection, to enhance productivity. Both small-scale farmers in developing countries and large international corporations participate in aquaculture. Fish is a vital source of protein and plays a significant role in many cultural traditions, offering essential nutrients like fatty acids, vitamins, and minerals that contribute to human health.

As the global workforce grows, people have less time for home-cooked meals, leading to a marked increase in dining out. This trend has heightened the demand for high-protein diets, with more consumers incorporating meat and seafood into their meals. Consequently, full-service and quick-service restaurants are experiencing a surge in demand for various meats and seafood, further boosting the aquaculture industry.

Ongoing research and development efforts in aquaculture are enhancing production systems and improving efficiency and product quality while promoting sustainability. Innovations in fish genetics, reproductive management, chromosome modifications in shellfish, and parasite control are pivotal in driving market growth. Furthermore, technological progress in offshore and open ocean aquaculture is also expected to expand the industry further. Ensuring technical robustness, economic viability, environmental sustainability, and social acceptance is crucial for long-term success. By introducing new aquaculture methods and integrating fish with animal production techniques, the global aquaculture market is poised for significant advancement.

Environment Insights

Freshwater dominated the market and accounted for the largest revenue share of 54.3% in 2024. This growth is attributed to the widespread availability of freshwater resources, making it accessible in many regions. In addition, freshwater environments such as rivers, lakes, and ponds require simpler management and infrastructure than marine systems. The demand for adaptable species such as carp, tilapia, and catfish, which have lower production costs, further supports this segment's growth. Moreover, integrating freshwater aquaculture with agriculture enhances sustainability and cost-effectiveness, making it particularly appealing in developing countries.

The marine water segment is expected to grow at a CAGR of 5.3% over the forecast period, owing to its numerous advantages, including a lower carbon footprint and reduced freshwater usage. As overfishing depletes wild fish stocks, marine aquaculture offers a sustainable alternative to meet growing seafood demands. In addition, technological advancements like recirculating aquaculture systems (RAS) are improving efficiency and environmental sustainability within this segment. Furthermore, the increasing consumer preference for diverse seafood options drives expansion in marine aquaculture. These factors collectively contribute to the anticipated growth of the marine water environment in the global aquaculture market.

Fish Type Insights

Carps, barbels, and other cyprinids led the market and accounted for the largest revenue share of 25.5% in 2024. This growth is attributed to their adaptability to various environmental conditions and high market demand in many regions. In addition, these species are known for their resilience and ability to thrive in diverse water quality, making them suitable for extensive farming practices. Furthermore, carps are often favored for their low production costs and rapid growth rates, enhancing farmers' profitability. Their cultural significance in many Asian countries further boosts their popularity, contributing to increased aquaculture production.

Brown seaweeds are expected to grow at a CAGR of 5.6% over the forecast period, owing to the rising demand for sustainable food sources and health-conscious diets. Brown seaweeds are rich in nutrients, including vitamins and minerals, appealing to consumers seeking plant-based alternatives. In addition, advancements in cultivation techniques, such as integrated multi-trophic aquaculture (IMTA), allow for efficient farming alongside fish species, promoting ecological balance. Furthermore, the increasing recognition of brown seaweeds' potential in various industries ranging from food to pharmaceuticals drives their market growth, positioning them as a valuable resource within the aquaculture sector.

Regional Insights

The North America aquaculture market held a significant revenue share of 4.7% in 2024, driven by increasing consumer demand for seafood due to its health benefits and nutritional value. The region's seafood consumption is rising as people seek sustainable protein sources. In addition, government support and favorable policies promote aquaculture development with initiatives to enhance production efficiency and sustainability. Furthermore, technological advancements, such as recirculating aquaculture systems (RAS), have also improved environmental impacts and productivity, positioning North America as a competitive player in the global aquaculture market.

U.S. Aquaculture Market Trends

The aquaculture sector in the U.S. is expected to grow substantially over the forecast period, owing to technological innovations and strong institutional support. The U.S. government has established policies to promote a competitive and sustainable aquaculture industry, aiming to increase production value significantly by 2025. In addition, the rising popularity of seafood as a healthy dietary choice drives demand, while efforts to offset the trade deficit in edible seafood products further bolster the industry. Furthermore, advancements in feed formulations and farming techniques enhance farmed species' health and growth rates, contributing to market expansion.

Asia Pacific Aquaculture Market Trends

Asia Pacific aquaculture market dominated the global market and accounted for the largest revenue share of 75.6% in 2024. This growth is attributed to its abundant natural water resources, including rivers, lakes, and coastal areas that create ideal farming conditions. In addition, the tropical and subtropical climates allow year-round fish farming, meeting the increasing demand for seafood from a growing population with rising incomes. Furthermore, advancements in aquaculture techniques enhance productivity and sustainability within the sector.

The aquaculture market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, owing to the country's vast population and rich culinary traditions, which drive high seafood consumption rates. In addition, economic growth and urbanization increase demand for aquaculture products, while advancements in farming practices improve efficiency. Furthermore, China's focus on sustainability and innovation in aquaculture technologies ensures its continued dominance in the global market, meeting both domestic needs and international supply.

Europe Aquaculture Market Trends

Europe aquaculture market is expected to grow at a CAGR of 5.1% over the forecast period, owing to increasing consumer awareness of sustainable food sources and the health benefits associated with seafood consumption. The European Union's policies promoting sustainable fishing practices encourage investments in aquaculture. In addition, technological advancements in farming methods enhance production efficiency and product quality. Furthermore, the growing trend towards organic and locally sourced seafood further supports the expansion of aquaculture across various European countries.

The aquaculture market in the UK is expected to grow significantly in revenue share in 2024. This growth is attributed to the government’s support for innovative farming practices and environmental sustainability initiatives that enhance production capabilities. Moreover, rising health consciousness among consumers drives demand for fish as a lean protein source. The UK's focus on developing local aquaculture infrastructure aims to reduce reliance on imported seafood, contributing to market growth while ensuring food security.

Key Aquaculture Company Insights

Some of the key companies in the market include Blue Ridge Aquaculture, Cermaq ASA, Cooke Aquaculture Inc., and others. These companies adopt strategies, such as strategic collaborations, mergers and acquisitions, and new product launches, to gain a competitive edge. Collectively, these strategies position companies to capture greater market share and drive sustainable growth.

-

Cooke Aquaculture Inc. operates vertically integrated aquaculture systems, managing every stage, from broodstock and juvenile rearing to marine farming and processing. The company also engages in seabass and seabream farming in Spain, emphasizing quality control and sustainability while serving markets in North America, South America, and Europe.

-

Eastern Fish Company distributes and processes a wide range of seafood products. It sources various species from wild fisheries and aquaculture farms, including shrimp, crab, and fish. The company emphasizes responsible sourcing practices and offers value-added products to meet consumer demand. With a strong presence in the North American market, it caters to retail and food service sectors, ensuring high-quality seafood reaches customers efficiently.

Key Aquaculture Companies:

The following are the leading companies in the aquaculture market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Ridge Aquaculture

- Cermaq ASA

- Cooke Aquaculture Inc.

- Eastern Fish Co.

- Huon Aquaculture Group Pty Ltd.

- International Fish Farming Co. - Asmak

- RoyMarine Harvest ASA

- Nireus Aquaculture S.A

- Promarisco

- Selonda Aquaculture S.A.

Recent Developments

-

In June 2024, Huon Aquaculture announced a significant investment of USD 110 million for the expansion of its freshwater Atlantic salmon nursery facility at Whale Point in Port Huon, Tasmania. This project is expected to introduce a new Recirculating Aquaculture System (RAS), allowing Huon to grow fish longer on land. The expansion aims to produce a larger smolt for sea transfer, reducing marine grow-out time. The initiative will create over 150 construction jobs and eight permanent positions, reinforcing Huon's commitment to sustainable aquaculture practices.

-

In March 2024, Cermaq Group AS renewed its collaboration with Cognizant, a leading global salmon producer, to enhance operational efficiencies in aquaculture. This partnership builds on a decade-long relationship to modernize Cermaq's technology landscape across Norway and Canada. Cognizant is set to focus on simplifying and securing infrastructure while integrating advanced technologies such as AI. This initiative supports Cermaq's commitment to sustainable food production, ensuring a stable value chain for its clients in the evolving aquaculture industry.

Aquaculture Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 325.6 billion |

|

Revenue forecast in 2030 |

USD 417.8 billion |

|

Growth rate |

CAGR of 5.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Environment, fish type, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, India, China, South Korea, Brazil, Argentina, Saudi Arabia, and South Africa. |

|

Key companies profiled |

Blue Ridge Aquaculture; Cermaq ASA; Cooke Aquaculture Inc.; Eastern Fish Co.; Huon Aquaculture Group Pty Ltd.; International Fish Farming Co. - Asmak; RoyMarine Harvest ASA; Nireus Aquaculture S.A; Promarisco; Selonda Aquaculture S.A. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Aquaculture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global aquaculture market report based on environment, fish type, and region:

-

Environment Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Marine water

-

Freshwater

-

Brackish water

-

-

Fish Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carps, Barbels, and Other Cyprinids

-

Brown Seaweeds

-

Red Seaweeds

-

Marine Shrimps and Prawns

-

Oysters

-

Tilapias and Other Cichlids

-

Catfishes

-

Clams, Cockles, Arkshells

-

Salmons, Trouts, Smelts

-

Freshwater Fishes nei

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

Japan

-

China

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."