Applied AI Service Market Size, Share & Trends Analysis Report By Component, By Deployment, By Technology (Machine Learning, Computer Vision), By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-426-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Applied AI Service Market Size & Trends

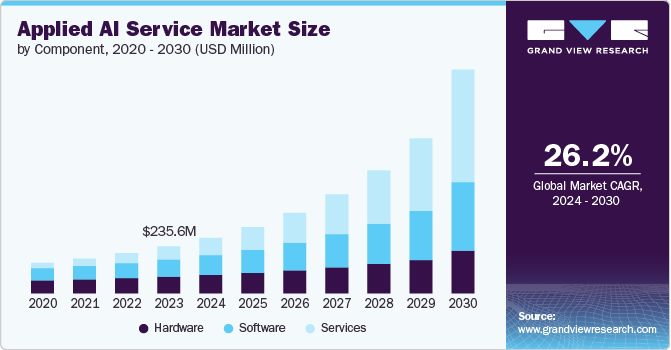

The global applied AI service market size was estimated at USD 235.6 million in 2023 and is expected to register a CAGR of 26.2% from 2024 to 2030. The market is witnessing significant growth, driven by the rising adoption of AI solutions by companies seeking a competitive advantage. The growing recognition of AI's capabilities, coupled with the need for businesses to remain competitive, is likely to accelerate the integration of AI solutions into core business functions. As organizations seek to leverage AI for improved decision-making and automation, the demand for applied AI services is anticipated to surge, making it a critical area for future growth and innovation in the technology landscape. Across various industries, including healthcare, retail, finance, and manufacturing, AI is becoming increasingly influential.

Technological advancements are continually influencing the evolution of the Applied AI market. AI algorithms are growing more advanced, enabling them to manage increasingly complex tasks. The integration of AI with other emerging technologies, such as the Internet of Things (IoT) and blockchain, is creating new opportunities for innovation and automation. Cloud-based AI solutions are also on the rise, favored for their scalability and cost-effectiveness. Additionally, improvements in natural language processing and computer vision are enhancing AI systems' ability to understand and interact with humans, leading to better customer service and user experiences. These technological advancements are poised to drive further growth and innovation in the Applied AI market.

Component Insights

The software segment accounted for the largest market revenue share in 2023. The growth of applied AI service in software development is driven by advancements in AI and machine learning, increased data availability, and the scalability of cloud computing. The integration of AI with existing technologies, rising business demand, and supportive regulatory frameworks further fuel this expansion. Additionally, open-source tools, talent development, ethical AI practices, and global market opportunities play significant roles in accelerating the adoption and innovation of AI-driven software solutions. significant initiatives by key players, for instance in May 2024, SolarWinds, a prominent provider of robust, secure, and user-friendly observability and IT management software, has announced the launch of SolarWinds AI, aimed at revolutionizing IT operations. This generative AI engine, specifically designed to empower technology professionals in managing the complexities of modern digital environments, was developed using the company’s newly introduced AI by Design framework, which prioritizes privacy, security, and reliability in the advancement of AI technologies.

The service segment is predicted to foresee significant growth in the forecast period. The growth is attributed to the rising adoption of edge AI. Edge AI, which involves processing AI algorithms on devices closer to the source of data rather than in a centralized cloud, is gaining traction. This trend is driven by the need for faster processing and reduced latency, especially in applications like autonomous vehicles, IoT, and smart devices. Moreover, As AI adoption grows, there is an increasing focus on ethical AI, data privacy, and transparency. Governments and organizations are developing regulations and frameworks to ensure the responsible use of AI, which is influencing how AI services are designed and deployed.

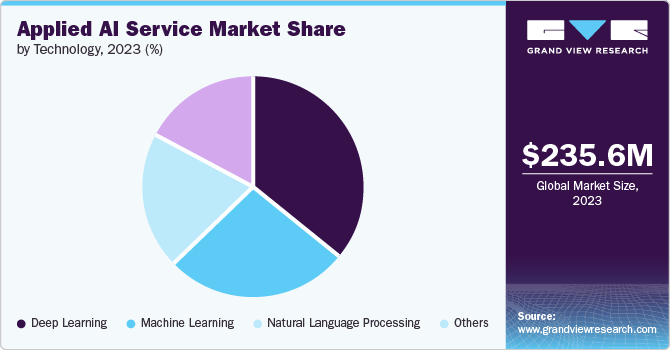

Technology Insights

The deep learning segment led the market and accounted for 36.4% of the global revenue in 2023. The growth of deep learning in applied AI service is being driven by several key factors. Advancements in computational power, particularly through GPUs, TPUs, and scalable cloud computing platforms, have made it easier to train complex deep learning models. The availability of large datasets, fueled by big data and open data initiatives, provides the necessary inputs for these models, enhancing their accuracy and applicability. Improved algorithms, such as convolutional neural networks (CNNs) and transformers, along with techniques like transfer learning, have expanded the range of deep learning applications across industries.

The NLP segment is estimated to grow significantly over the forecast period. Innovations in deep learning, particularly the development of transformer-based models like BERT, GPT, and T5, have significantly improved the ability of NLP systems to understand and generate human language. These models enable more accurate and contextually aware language processing, driving their application in various AI services. The exponential growth of textual data from social media, emails, customer reviews, and other digital sources provides a vast amount of data for training and refining NLP models. This data richness allows for the development of more sophisticated and nuanced language processing systems.

Deployment Insights

The on-premises segment accounted for a significant share of the global revenue in 2023. The on-premises deployment in applied AI service is experiencing a nuanced evolution as organizations balance the need for control, security, and performance with the growing appeal of cloud-based solutions. While cloud deployments have gained significant traction due to their scalability and flexibility, on-premises deployments remain crucial, particularly for industries with stringent data privacy, regulatory, and latency requirements, such as finance, healthcare, and government sectors. Companies are increasingly adopting hybrid approaches, combining on-premises infrastructure with cloud resources to optimize workloads. On-premises deployments are also favored for applications requiring real-time processing, where latency must be minimized, or in scenarios where data sovereignty is a concern.

The cloud segment is estimated to grow significantly over the forecast period. Cloud deployment in applied AI service is rapidly becoming the dominant model, driven by its scalability, flexibility, and cost-efficiency. Organizations increasingly prefer cloud platforms for AI workloads because they offer on-demand access to powerful computational resources and a wide range of AI tools and services, enabling faster development and deployment of AI applications. The cloud also facilitates collaboration and innovation by providing seamless access to large datasets, pre-trained models, and integrated machine learning pipelines. Additionally, the cloud's ability to support distributed computing makes it ideal for processing the vast amounts of data required for AI, particularly in big data analytics, natural language processing, and machine learning.

Industry Vertical Insights

The healthcare segment led the market accounting for a significant share of the global revenue in 2023. The growth factor for applied AI service in healthcare is poised for significant expansion, driven by advancements in technology and increasing adoption across the industry. Key drivers of this transformation include the integration of generative AI (GenAI) in clinical decision support, which is expected to enhance the accuracy and efficiency of healthcare delivery. As healthcare organizations pilot these solutions, the focus will be on reducing administrative burdens, improving decision-making for clinicians, and streamlining research processes. The ongoing evolution of AI capabilities, alongside the increasing demand for data-driven insights and personalized care, positions applied AI service as a critical component of future healthcare innovations.

The BFSI segment is estimated to grow significantly over the forecast period. The growth factor for applied AI service in the Banking, Financial Services, and Insurance (BFSI) sector is substantial, with projections indicating a significant market expansion. AI applications in BFSI are diverse, encompassing areas such as customer service, risk management, fraud detection, and financial advisory services. The demand for personalized customer experiences is particularly influencing growth in the customer service segment, where AI-driven solutions like chatbots and predictive analytics are becoming integral to enhancing client interactions and trust. Furthermore, the automation of routine tasks through AI is expected to streamline operations, reduce errors, and improve compliance with regulatory demands, thereby enhancing overall efficiency in financial institutions.

Regional Insights

North America accounted to hold significant share in the market and accounted for a 31.8% share in 2023. The growth of applied AI service in North America is driven by several key factors that collectively contribute to its robust expansion. The growth of applied AI service in North America is driven by a combination of strong technological infrastructure, significant investment, and a highly skilled talent pool. The region benefits from substantial funding in AI research and development from both private and public sectors, with tech giants and venture capital firms heavily investing in AI startups and technologies. North America's leading universities and research institutions contribute to a continuous supply of AI expertise, while the region's diverse industries, including healthcare, finance, and manufacturing, provide ample opportunities for AI application. Government support through AI-focused initiatives and policies further promotes the adoption of AI, creating a favorable environment for growth.

U.S. Applied AI Service Market Trends

The U.S. market is accounted to hold the highest market share over the forecast period, The U.S. has been investing in AI research and development for more than three decades, positioning it as one of the largest contributors to the global AI market. This sustained investment has led to the development of sophisticated AI algorithms and models, enabling the performance of complex tasks that previously required human intervention.

Europe Applied AI Service Market Trends

The adoption of applied AI service in Europe is particularly strong this growth is driven by the introduction of the EU's AI Act establishes a comprehensive legal framework for AI development and deployment, prioritizing responsible use and ethical considerations. This regulatory environment aims to ensure that AI systems adhere to fundamental rights and safety standards, fostering trust and encouraging businesses to adopt AI technologies more broadly. The General Data Protection Regulation (GDPR) also affects AI development, particularly concerning data privacy and availability, which are critical for effective AI applications.

Asia Pacific Applied AI Service Market Trends

The Asia-Pacific applied AI service market is experiencing rapid growth, and governments in Asia Pacific are actively implementing strategies to promote AI research, innovation, and responsible development. These initiatives often include funding, regulatory frameworks, and collaborations between government bodies, academia, and industry. For example, China has established the "Interim Administrative Measures for Generative Artificial Intelligence Services," the first comprehensive framework to govern generative AI services in the region.

Key Applied AI Service Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, collaborations contracts, and agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In February 2024, FWD Group Holdings Limited had announced an extension of its partnership with Microsoft through a new four-year agreement aimed at accessing the latest generative artificial intelligence (AI) advancements. This collaboration will further support FWD’s cloud-first technology strategy. The company plans to enhance its generative AI initiatives by utilizing Microsoft’s Azure OpenAI Service and other enterprise-grade innovations. FWD Group anticipates benefiting from Microsoft Azure's private networking, monitoring, and security features, along with its advanced AI models.

Key Applied AI Service Companies:

The following are the leading companies in the applied AI service market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services (AWS)

- Apple

- Baidu

- Google (Alphabet Inc.)

- IBM

- Intel

- Meta

- Microsoft

- NVIDIA

- Open AI

Recent Developments

-

In June 2024, Chinese search engine giant Baidu revealed an enhanced version of its artificial intelligence (AI) model, Ernie 4.0 Turbo, in its effort to sustain its leadership in China’s competitive AI market. The new model will be available to the public through mobile app and web interfaces, and developers will be able to integrate the technology via Baidu's Qianfan AI platform.

-

In January 2024, IBM Consulting is launching IBM Consulting Advantage, an AI services platform aimed at helping IBM consultants deliver consistent, repeatable, and swift solutions for clients. The platform features a range of proprietary methods, assets, and assistants that utilize technology from IBM and its strategic partners Early adopter teams achieved productivity improvements of up to 50% by integrating IBM Consulting Advantage into their application design, development, and testing client pilots.

Applied AI Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 278.6 million |

|

Revenue forecast in 2030 |

USD 1.12 billion |

|

Growth rate |

CAGR of 26.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, technology, industry vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, Mexico, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Amazon Web Services (AWS); Apple; Baidu; Google (Alphabet Inc.); IBM; Intel; Meta; Microsoft; NVIDIA; Open AI |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Applied AI Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global applied AI service market report based on component, deployment, technology, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Music & Entertainment

-

Natural Language Processing

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Retail

-

BFSI

-

Manufacturing

-

Retail & e-commerce

-

Transportation & Logistics

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global applied AI service market size was estimated at USD 235.6 million in 2023 and is expected to reach USD 278.6 million in 2023.

b. The global applied AI service market is expected to grow at a compound annual growth rate of 26.2% from 2024 to 2030 to reach USD 1.12 billion by 2030.

b. North America dominated the applied AI service market with a share of 31.8% in 2023. The growth of applied AI service in North America is driven by a combination of strong technological infrastructure, significant investment, and a highly skilled talent pool.

b. Some key players operating in the applied AI service market include Amazon Web Services (AWS); Apple; Baidu; Google (Alphabet Inc.); IBM; Intel; Meta; Microsoft; NVIDIA; Open AI

b. Key factors that are driving the market growth include technological advancements are continually influencing the evolution of the Applied AI market. AI algorithms are growing more advanced, enabling them to manage increasingly complex tasks. The integration of AI with other emerging technologies, such as the Internet of Things (IoT) and blockchain, is creating new opportunities for innovation and automation.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."