Application Virtualization Market Size, Share, & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-440-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Application Virtualization Market Trends

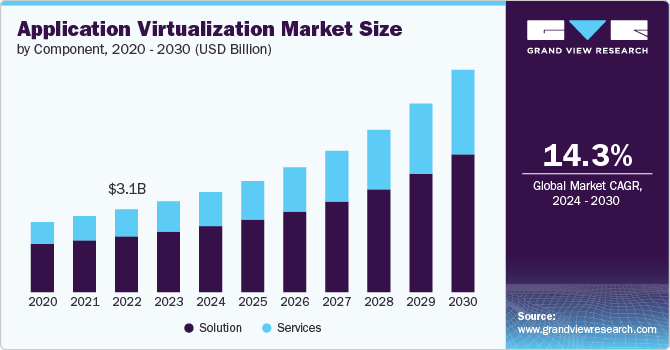

The global application virtualization market size was estimated at USD 3.43 billion in 2023 and is anticipated to grow at a CAGR of 14.3% from 2024 to 2030. The application virtualization market is significantly driven by the growing adoption of remote work solutions and cloud computing. The shift to remote work has increased the demand for virtualized applications, which allow employees to access and use software from any location while maintaining centralized control and security. In addition, the rise of cloud computing drives market growth by enabling businesses to deploy, manage, and scale applications more efficiently and cost-effectively, reducing the need for on-premises infrastructure and enhancing flexibility.

The rapid adoption of cloud computing is another major driver for the application virtualization market. Cloud services offer scalable and cost-effective solutions for deploying and managing applications, which aligns with the needs of modern enterprises seeking to reduce their on-premises infrastructure and operational costs. Application virtualization leverages cloud platforms to provide users with access to applications via the internet, allowing for streamlined updates, easier maintenance, and greater scalability. This integration with cloud environments enables organizations to enhance their agility, reduce IT overhead, and support dynamic workloads, driving further adoption of virtualization technologies.

According to Eurostat, the statistical office of the European Union, in 2023, 45.2% of enterprises within the European Union utilized cloud computing services, primarily for managing email systems, storing digital files, and using office software. Among these, 75.3% opted for advanced cloud services, including security software applications, database hosting, or platforms for application development, testing, and deployment. This represents a 4.2% point increase from 2021 in the proportion of enterprises adopting cloud computing.

The growth of Software as a Service (SaaS) and Desktop as a Service (DaaS) is also shaping the landscape of application virtualization. SaaS applications continue to gain popularity, driving the need for effective virtualization solutions to deliver these services. Similarly, DaaS solutions are becoming more prevalent, offering virtual desktops as a managed service that simplifies deployment and management for businesses. These trends reflect a broader move towards more flexible, scalable, and cost-effective IT solutions.

Organizations are increasingly prioritizing security and compliance due to stringent regulations and the growing threat of cyberattacks. Application virtualization enhances security by centralizing application management and data storage in a secure server environment, thereby reducing the risk of data breaches and unauthorized access. By isolating applications from local devices, organizations can better control security policies, monitor access, and ensure compliance with industry regulations, contributing to the market’s growth. Moreover, the rise of remote work, accelerated by the COVID-19 pandemic, further fueled demand for application virtualization solutions. With many employees working from various locations, the ability to access applications securely from any device has become essential. This shift has prompted organizations to invest in virtualization technologies that support flexible work environments while maintaining operational efficiency.

Component Insights

The solution segment accounted for the largest market share of 66.7% in 2023. As enterprises grow, managing multiple applications across various platforms can become increasingly complex. Virtualization simplifies this by enabling centralized management of applications, making it easier for IT teams to maintain and update software. This results in reduced complexity in software distribution, patches, and upgrades, allowing IT departments to standardize environments and improve operational efficiency.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The growing emphasis on data security and compliance is propelling the demand for professional services in this market. As more companies move their applications to the cloud or virtual environments, they face increasing pressure to safeguard sensitive data and comply with regulatory requirements. Service providers offering expertise in security protocols, compliance standards, and risk management are becoming invaluable partners in the application virtualization space.

Deployment Insights

The public cloud segment accounted for the largest market share of 46.3% in 2023 driven by the increasing adoption of cloud services by businesses of all sizes. Companies can leverage public cloud platforms to access computing resources on-demand, which helps them to avoid the capital expenditures and maintenance costs associated with traditional on-premises infrastructure.

The private cloud segment is anticipated to grow at the fastest CAGR over the forecast period driven by the increasing need for security, control, and customization in cloud computing. Enterprises are adopting private clouds to maintain strict control over sensitive data and meet compliance requirements in industries such as finance, healthcare, and government. The ability of private clouds to provide enhanced security measures and greater control over data location and management has made them a preferred option for organizations with specific regulatory requirements. For instance, Google's acquisition of Cameyo, Inc., a U.S.-based application virtualization product, in June 2024 brings Windows app virtualization to ChromeOS, aimed at businesses transitioning from Windows or incorporating ChromeOS devices. Cameyo’s Virtual App Delivery (VAD) allows seamless running of virtualized Windows apps alongside Chrome and web apps without needing a full Windows OS. IT infrastructure is expected to benefit from better control over application management, optimizing resource usage and reducing security risks.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share 57.9% in 2023. For large enterprises, application virtualization reduces downtime by allowing IT teams to quickly patch or upgrade software centrally without interrupting the workforce. Moreover, it simplifies disaster recovery processes since virtualized applications can be easily restored or moved to another server in the event of a failure. In addition, the growing trend of remote work and BYOD (Bring Your Own Device) policies further underscores the importance of virtualization technologies in large organizations, enabling employees to access enterprise applications from any device or location without compromising security or performance.

The SMEs segment is anticipated to grow at the fastest CAGR over the forecast period. The availability of user-friendly virtualization platforms and the growing number of managed service providers (MSPs) offering tailored solutions to SMEs have accelerated the adoption of application virtualization in this segment. As these platforms become more affordable and easier to integrate into existing business processes, SMEs are increasingly embracing virtualization as a key part of their IT strategy for both cost reduction and enhanced performance.

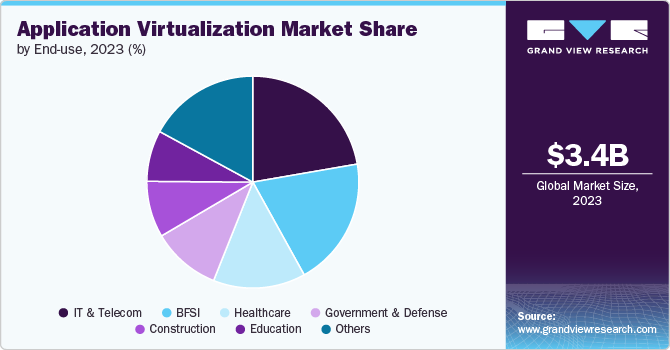

End Use Insights

The IT and telecom segment accounted for the largest market share of 22.3% in 2023 fueled by advances in technology, digitalization, and the demand for robust communication infrastructures. As enterprises expand their digital transformation and adopt modern technologies such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), IT and telecom companies have been at the forefront of providing the required infrastructure and services to support these innovations. The segment is marked by the deployment of 5G networks, enhanced data security systems, and the rising demand for scalable, high-speed data transfer solutions. According to the International Telecommunication Union (ITU), as of 2023, nearly 40% of the global population has 5G coverage, with 89% in high-income countries. Europe leads with 68% coverage, followed by the Americas at 59% and Asia Pacific at 42%.

The education segment is anticipated to grow at the fastest CAGR over the forecast period due to the growing emphasis on personalized learning experiences. Application virtualization facilitates the deployment of specialized educational tools and software tailored to individual learning needs, without the constraints of traditional software installations. This capability supports adaptive learning technologies and helps educators customize their teaching methods to better engage students.

Regional Insights

North America Application Virtualization Trends

The application virtualization market in North America held the share of 36.0% in 2023 due to the growing adoption of application virtualization among small and medium-sized enterprises (SMEs). These businesses are increasingly leveraging virtualization to reduce costs associated with application installation and maintenance. By centralizing applications on a single server, SMEs can improve operational efficiency, enhance employee productivity, and ensure business continuity without the burden of extensive IT infrastructure investments.

U.S. Application Virtualization Trends

The application virtualization market in the U.S. is expected to grow significantly from 2024 to 2030. With increasing concerns about cyber threats and stringent data protection regulations such as GDPR, CCPA, and HIPAA, organizations are prioritizing robust security measures. Advanced features such as encryption, multi-factor authentication, and comprehensive endpoint protection are becoming standard in virtualized environments to safeguard sensitive data and ensure regulatory compliance.

Europe Application Virtualization Trends

The application virtualization market in Europe is growing significantly at a CAGR of 13.9% from 2024 to 2030 due to the growing trend towards multi-cloud and hybrid cloud strategies, where businesses utilize a combination of public, private, and on-premises cloud environments. This approach allows for greater flexibility and risk management, enabling companies to optimize their IT infrastructure across different cloud platforms.

Asia Pacific Application Virtualization Trends

Asia Pacific is growing significantly at the CAGR of 16.1% from 2024 to 2030. Several APAC nations, including India and China, have implemented data localization laws, requiring data to be stored within the country’s borders. This has led to a rise in demand for application virtualization solutions that offer localized data storage and compliance with local regulations. China's Personal Information Protection Law (PIPL), effective from November 2021, and the Cybersecurity Law (CSL), enacted in June 2017, form the core of the country's data localization framework, often compared to the EU's GDPR. The PIPL mandates that companies handling large volumes of personal data or sensitive information store this data within China, allowing cross-border transfers only under specific conditions. Similarly, the CSL requires that operators of critical information infrastructure (CII) keep all personal information and important data collected or generated within China stored domestically, reinforcing the country's focus on data sovereignty and security.

Key Application Virtualization Company Insights

Key players operating in the application virtualization market include Google, Microsoft, Red Hat Inc., VMware Inc., and Hewlett Packard Enterprise Development LP. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, Hewlett Packard Enterprise Development LP agreed to acquire Morpheus Data, a U.S.-based software company. This acquisition aligns with HPE’s goal to simplify IT complexity by enhancing the hybrid operations capabilities within its HPE GreenLake platform. By integrating Morpheus Data's tools, HPE aims to offer a unified solution for managing increasingly diverse and complex IT environments, particularly improving application virtualization and hybrid cloud management.

-

In May 2024, Red Hat, Inc. and Pure Storage, a U.S.-based technology company, announced an enhancement for Portworx on Red Hat OpenShift by Pure Storage. This optimization streamlines integration, offering enterprises a more straightforward path to modern virtualization. The partnership between Pure Storage and Red Hat accelerates application development and deployment while enhancing enterprise reliability and operational flexibility in complex hybrid cloud environments.

-

In July 2023, Citrix Systems released Citrix Virtual Apps and Desktops 7 2407, which includes new versions of the Windows Virtual Delivery Agents (VDAs) and several core components. This release allows to install or upgrade core components and VDAs using the ISO, enabling to take advantage of the latest features.

Key Application Virtualization Companies:

The following are the leading companies in the application virtualization market. These companies collectively hold the largest market share and dictate industry trends.

- Citrix Systems

- Hewlett Packard Enterprise Development LP

- Microsoft

- NextAxiom Technology

- Oracle

- Red Hat Inc.

- Sangfor Technologies

- Symantec

- VMware Inc.

Application Virtualization Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.78 billion |

|

Revenue forecast in 2030 |

USD 8.40 billion |

|

Growth rate |

CAGR of 14.3% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end use and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Citrix Systems; Google; Hewlett Packard Enterprise Development LP; Microsoft; NextAxiom Technology; Oracle; Red Hat Inc.; Sangfor Technologies; Symantec; VMware Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Virtualization Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the application virtualization market report based on component, installation type, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Agent Based Solution

-

Agent Less Solution

-

-

Services

-

Support & Maintenance

-

Training & Consulting

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

IT and Telecom

-

Government and Defense

-

Construction

-

Education

-

Other

-

-

Application Virtualization Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application virtualization market size was estimated at USD 3.43 billion in 2023 and is expected to reach USD 3.78 billion in 2024.

b. The global application virtualization market is expected to grow at a compound annual growth rate of 14.3% from 2024 to 2030 to reach USD 8.40 billion by 2030.

b. The application virtualization market in North America held a share of 36.0% in 2023 due to the growing adoption of application virtualization among small and medium-sized enterprises (SMEs). These businesses are increasingly leveraging virtualization to reduce application installation and maintenance costs.

b. Some key players operating in the application virtualization market include Cisco Systems, Inc., Huawei Technologies Co., Ltd., Palo Alto Networks, Inc., Juniper Networks, Inc., Fortinet, Inc., Symantec Corporation (Broadcom Inc.), Sandvine Corporation, Check Point Software Technologies Ltd., Blue Coat Systems, Inc. (Symantec), BAE Systems, Viavi Solutions Inc., Qosmos (Enea), Allot Ltd., NetScout Systems, Inc., and SolarWinds Worldwide, LLC

b. The growing adoption of remote work solutions and cloud computing significantly drives the application virtualization market. The shift to remote work has increased the demand for virtualized applications that allow employees to access and use software from any location while maintaining centralized control and security.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."