Application Transformation Market Size, Share & Trends Analysis Report By Type (Modernization, Cloud Migration), By End-use (BFSI, Retail), By Enterprise Size, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-882-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Application Transformation Market Trends

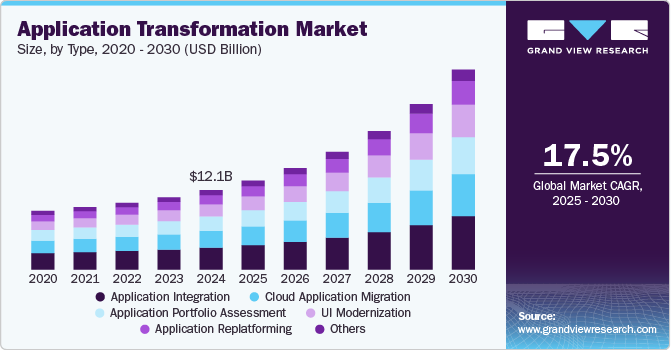

The global application transformation market size was estimated at USD 12.10 billion in 2024 and is projected to grow at a CAGR of 17.5% from 2025 to 2030. The market is experiencing rapid growth due to the increasing demand for cloud-based services and businesses needing to modernize their legacy systems. The shift towards cloud-native applications, which offer greater scalability and flexibility, and the rise of digital transformation initiatives as organizations seek to enhance operational efficiency, improve customer experience, and remain competitive in the digital economy are also fueling the demand for application transformation solutions.

Companies are increasingly embracing microservices architecture and DevOps practices to accelerate software development and deployment. Microservices break down large applications into smaller, independent types, allowing for greater agility and scalability. Coupled with DevOps, which integrates development and operations teams for continuous delivery, organizations can enhance the speed and quality of software delivery. This shift is driving the need for application transformation solutions that support modern architectures and agile methodologies.

In highly regulated industries such as finance, healthcare, and telecommunications, there is growing pressure to comply with evolving regulatory standards and data privacy laws. Application transformation helps businesses modernize their systems to meet compliance requirements while ensuring secure data management, proper reporting, and governance frameworks. This is particularly important for industries dealing with sensitive customer data.

With the increasing frequency and sophistication of cyberattacks, security has become a critical concern for businesses across all sectors. Legacy applications often have outdated security protocols, making them vulnerable to breaches. Application transformation allows businesses to enhance security by integrating modern authentication methods, encryption techniques, and real-time monitoring capabilities. In addition, modernized applications can more easily adhere to new data privacy regulations such as GDPR, CCPA, or HIPAA, reducing the risk of non-compliance and costly penalties.

The shift towards remote and hybrid work models has accelerated the adoption of cloud collaboration tools, communication platforms, and mobile-friendly applications. Businesses now need applications that are easily accessible and functional across multiple devices and networks. Legacy systems, often not designed for such mobility and flexibility, must be transformed to support modern workforce requirements. Application transformation ensures that organizations can provide their employees with secure, scalable, and mobile-friendly applications that enhance productivity and collaboration.

Type Insights

Theapplication integration segment held the largest revenue share of over 28% in 2024. Organizations are adopting new cloud-based services, enterprise applications, and third-party solutions to enhance operational efficiency and improve customer experiences. However, these new systems often operate in silos, making it challenging to share data and workflows across the organization. Application integration solutions enable businesses to connect these disparate systems, ensuring a unified view of data and processes. This integration fosters better collaboration and accelerates innovation, driving the demand for application integration services as part of broader transformation efforts.

The UI modernization segment is expected to grow at a CAGR of 18.7% during the forecast period. Modern consumers expect personalized, seamless experiences across digital channels, which drives organizations to prioritize customer experience. Legacy applications often struggle to deliver the real-time, personalized interactions that customers demand. Application modernization allows organizations to leverage advanced analytics, artificial intelligence (AI), and machine learning (ML) to better understand customer behavior and preferences. By modernizing their applications, businesses can create more engaging, personalized experiences that improve customer satisfaction and loyalty, particularly in sectors such as retail, travel, and hospitality. For instance, in November 2023, Kyndryl, a U.S.-based IT infrastructure services provider, expanded its partnership with Amazon Web Services (AWS) to help customers streamline and expedite their mainframe modernization initiatives. The collaboration introduces new capabilities that enable the integration of mainframe applications and data with AWS technologies and the migration of mainframe workloads to AWS. Kyndryl enables the AWS Mainframe Modernization service, a specialized platform that allows customers to shift their on-premises mainframe applications to a fully managed cloud-native environment on AWS.

Enterprise Size Insights

Thelarge enterprise segment held the largest market share of over 66% in 2024. With the increasing frequency of cyberattacks, large enterprises are prioritizing the security of their applications. Legacy systems may lack the necessary security features to protect against modern threats, putting sensitive data at risk. Application transformation enables organizations to integrate advanced security measures, such as encryption, multi-factor authentication, and real-time monitoring, into their applications. By modernizing their systems, large enterprises can enhance their security posture and reduce vulnerabilities, which is essential for maintaining customer trust and regulatory compliance.

The small and medium enterprises segment is expected to grow at a CAGR of 18.0% during the forecast period as application transformation allows SMEs to streamline their operations by modernizing their applications, automating processes, and reducing manual intervention. By adopting modern, integrated solutions, SMEs can enhance productivity, minimize downtime, and ensure that their resources are allocated effectively, resulting in cost savings and improved overall performance.

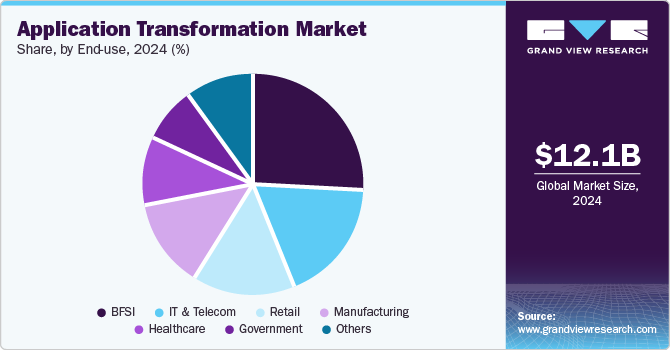

End Use Insights

The BFSI segment held the largest market share of over 26% in 2024. The rise of digital payments and contactless solutions, accelerated by the COVID-19 pandemic, has transformed the BFSI sector. Financial institutions have modernized their applications to support various payment methods, including mobile wallets, peer-to-peer transactions, and cryptocurrency. Application transformation enables organizations to integrate these functionalities, enhancing customer convenience and satisfaction.

The manufacturing segment is expected to grow at a CAGR of 18.8% during the forecast period. The shift toward Industry 4.0, characterized by the integration of advanced technologies such as IoT, big data analytics, artificial intelligence (AI), and automation, is a major driver of application transformation in the manufacturing sector. Manufacturers are modernizing their applications to connect machines, systems, and processes in real time, enabling enhanced visibility and control over operations. By transforming legacy systems into smart applications that can leverage real-time data analytics, manufacturers can optimize production schedules, reduce downtime, and improve overall equipment effectiveness (OEE). This shift towards connected manufacturing is facilitating smarter decision-making and fostering greater innovation in production processes.

Regional Insights

The North America application transformation market held the largest revenue share of over 36% in 2024. North America leads in cloud adoption, with businesses migrating legacy systems to platforms such as AWS, Microsoft Azure, and Google Cloud. The need for scalability, flexibility, and cost efficiency drives this shift. As enterprises look to optimize their operations and enhance their competitive edge, application transformation becomes crucial in modernizing legacy systems to take full advantage of cloud capabilities. Cloud migration also supports hybrid cloud strategies, where organizations leverage a mix of public and private clouds, creating additional demand for transformation services.

U.S. Application Transformation Market Trends

The application transformation market in the U.S. is growing significantly at a CAGR of 15.5% from 2025 to 2030. In the U.S., companies are heavily investing in digital transformation initiatives aimed at improving customer experience, streamlining operations, and increasing competitiveness. These initiatives often require the modernization of legacy applications to integrate with emerging technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and the Internet of Things (IoT). Modern applications that support real-time data processing, automation, and personalization are critical to achieving these goals. The need for organizations to stay relevant in a digitally driven economy is a key driver behind application transformation in the U.S.

Asia Pacific Application Transformation Market Trends

The application transformation market in Asia Pacific is growing significantly at a CAGR of 20.0% from 2025 to 2030. The Asia Pacific region has one of the highest mobile penetration rates globally, with millions of people accessing services via smartphones and mobile devices. As a result, businesses are increasingly adopting a mobile-first approach, modernizing their applications to deliver seamless, user-friendly experiences on mobile platforms. In addition, customer expectations for real-time, personalized services are driving the need for applications that can integrate with advanced technologies such as AI, machine learning (ML), and data analytics.

The China application transformation market is expanding rapidly due to the country’s ongoing digitalization efforts and the government's focus on building a robust digital economy. The Chinese government’s initiatives, such as the “New Infrastructure” plan, which emphasizes the development of 5G, AI, and cloud computing, are key drivers of application modernization across various industries.

The Japan application transformation market is driven by the need to modernize aging IT systems across industries such as manufacturing, automotive, and financial services. Japanese companies are focusing on integrating emerging technologies like AI, machine learning, and IoT into their existing applications to improve operational efficiency and meet customer demands.

Europe Application Transformation Market Trends

The application transformation market in Europe is growing significantly at a CAGR of 16.6% from 2025 to 2030. Businesses are investing heavily in digital transformation as they seek to improve operational efficiency, enhance customer experiences, and drive innovation across Europe. Legacy applications, however, often struggle to integrate with new digital technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics. Application transformation enables businesses to modernize their systems, making them more flexible, scalable, and capable of supporting emerging technologies. Sectors such as banking, retail, and manufacturing are particularly focused on transforming applications to support digitalization efforts, allowing them to provide seamless, data-driven experiences to customers and improve operational processes.

The UK application transformation market is driven by the increasing adoption of cloud technologies and the push for digital transformation across industries such as finance, healthcare, and retail.

The Germany application transformation market is propelled by the country’s strong industrial base and the rise of Industry 4.0 initiatives. German companies are increasingly modernizing their IT applications to support automation, IoT, and advanced manufacturing processes.

Key Application Transformation Company Insights

Key players operating in the market include Microsoft, IBM Corporation, Accenture, Cognizant, and Capgemini. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2024, Accenture announced the acquisition of Navisite, a U.S.-based provider of digital transformation and managed services, to enhance its application and infrastructure management services in North America. This acquisition strengthens Accenture’s capabilities in helping clients modernize their IT systems for the AI-driven future. Navisite brings extensive expertise in cloud platforms, enterprise applications, and digital technologies, serving industries such as technology, healthcare, life sciences, manufacturing, and business services.

-

In January 2024, Eviden, a French technology company that specializes in data-driven digital transformation, and Microsoft unveiled a five-year strategic partnership that enhances their current collaboration by introducing innovative solutions powered by Microsoft Cloud and AI for various industries. This initiative is part of Eviden's broader strategy to strengthen and expand its global partnership network by reinforcing existing relationships and establishing new ones. Through its DevSecOps framework, Eviden aims to expedite IT application transformation with a focus on security and sustainability while also enhancing agility and optimizing cloud spending using FinOps to create significant business value. The partnership also emphasizes migrating and modernizing legacy systems with rapid migration and application innovation accelerators, as well as modernizing applications and developing new AI-driven solutions using Power Platform and Dynamics 365.

Key Application Transformation Companies:

The following are the leading companies in the application transformation market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Atos SE

- BELL-INTEGRATION.COM

- Capgemini

- Cognizant

- Fujitsu

- HCL Technologies Limited

- International Business Machines Corporation

- Infosys Limited

- Microsoft

- Open Text

- Oracle

- Trianz

Application Transformation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.58 billion |

|

Revenue forecast in 2030 |

USD 34.47 billion |

|

Growth rate |

CAGR of 17.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa. |

|

Key companies profiled |

Accenture, Atos SE, BELL-INTEGRATION.COM, Capgemini, Cognizant, Fujitsu, HCL Technologies Limited, International Business Machines Corporation, Infosys Limited, Microsoft, Open Text, Oracle, Trianz |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Transformation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global application transformation market report based on type, enterprise size, end use, and region:

-

Type Outlook (Revenue; USD Billion, 2018 - 2030)

-

Application Integration

-

Cloud Application Migration

-

Application Portfolio Assessment

-

Application Replatforming

-

UI Modernization

-

Others

-

-

Enterprise Size Outlook (Revenue; USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue; USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Government

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue: USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application transformation market size was estimated at USD 12.10 billion in 2024 and is expected to reach USD 13.58 billion in 2025.

b. The global application transformation market is expected to witness a compound annual growth rate of 17.5% from 2025 to 2030 to reach USD 34.47 billion by 2030.

b. The application integration segment accounted for the largest market share of over 28% in 2024. Organizations are adopting new cloud-based services, enterprise applications, and third-party solutions to enhance operational efficiency and improve customer experiences.

b. Key industry players operating in the application transformation market include Accenture, Atos SE, BELL-INTEGRATION.COM, Capgemini, Cognizant, Fujitsu, HCL Technologies Limited, International Business Machines Corporation, Infosys Limited, Microsoft, Open Text, Oracle, Trianz

b. The application transformation market is experiencing rapid growth due to the increasing demand for cloud-based services and businesses needing to modernize their legacy systems. The shift towards cloud-native applications, which offer greater scalability and flexibility, and the rise of digital transformation initiatives as organizations seek to enhance operational efficiency, improve customer experience, and remain competitive in the digital economy are also fueling the demand for application transformation solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."