Application Specific Integrated Circuit Market Size, Share & Trends Analysis Report By Product (Full Custom, Semi-Custom, Programmable), By Application (Telecommunication, Industrial, Automotive, Consumer Electronics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-548-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

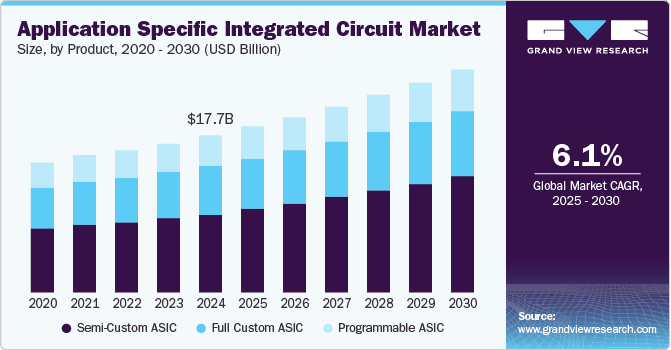

The global application specific integrated circuit market size was estimated at USD 17.65 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. The global market is poised to experience a surge in demand primarily driven by the increasing utilization of Application-Specific Integrated Circuits (ASICs) in consumer electronics, including smartphones, smartwatches, and tablets, among other devices. The growing demand for tailored solutions that deliver maximum performance for specific applications has led to a rise in demand for ASICs. Industries are opting for ASICs to achieve optimal efficiency, speed, and reliability, which general-purpose chips cannot offer.

The rapidly growing demand for smartphones and tablets is expected to drive market growth over the forecast period. According to GVR analysis, approximately 75% of the total mobile phone owners will own a smartphone by 2025. ASICs help in providing the high-bandwidth, smaller size & weight, low-cost, and long battery life requirements of next-generation smartphones. Also, with the advent of ‘smart’ devices, electrical products such as televisions, laptops, wearables, digital cameras, and gaming consoles offers various advanced technologies such as touch screen displays, flat screens, and Bluetooth functions are generating a demand for a larger number of ICs. Furthermore, due to the constantly growing adoption of mechatronics across industrial and automotive applications, the demand for electronic components with ASICs has witnessed massive growth over the forecast period.

Governments across the globe are investing heavily in semiconductor manufacturing to support ASIC production. For instance, the U.S. government’s CHIPS Act, passed in 2022, has allocated over USD 52 billion to semiconductor research and development, which is expected to benefit the ASIC sector significantly by encouraging domestic manufacturing and reducing dependency on overseas production. Furthermore, the automotive sector, particularly in North America and Europe, has seen significant investments in autonomous and electric vehicles. ASICs, with their low-power and application-specific features, are essential in processing data from sensors and ensuring energy efficiency in EVs, driving growth in this sector.

As the demand for compact devices increases, there is a shift towards smaller technology nodes in ASIC manufacturing. Such as 5nm and 3nm. This miniaturization allows for more powerful and efficient ASICs, as smaller nodes increase transistor density, leading to higher performance and energy efficiency. Moreover, 3D stacking and heterogeneous integration have become prominent technology trends in ASIC manufacturing. 3D stacking enables designers to place multiple layers of circuits on a single chip, improving performance and reducing latency. Heterogeneous integration allows for the contribution of different components on the same chip, supporting multifunctional applications in compact devices.

On the other hand, factors such as the high cost of manufacturing customized circuits, circuit designing costs, and functional reliability issues are anticipated to hinder market growth over the years. However, with technological advancements such as Internet of Things (IoT), blockchain, big data analytics, and machine learning, the unit cost for ASICs has been declining, which in turn led to a positive impact on the market across the globe. The above-mentioned advancements are being extensively used in connected devices, data center facilities, and public clouds that allow organizational data to move faster across the IT network. Thus, organizations are incorporating these ICs to support the functioning of advanced technologies in devices, resulting in less operational cost. Also, the continuous evolution of the electronics industry is generating a constant need for improvement in ASIC designs to cater to users’ exact requirements.

Product Insights

The semi-custom ASIC segment dominated the market with a revenue share of 49.9% in 2024. This growth can be attributed to its comparatively lower complexity and extensive range of applications in comparison to the other segments. Manufacturers in the ASIC market predominantly offer three distinct types of ASICs: semi-custom ASIC, full custom ASIC, and programmable ASIC. Within the semi-custom ASIC category, there are two sub-segments: cell-based ASIC and array-based ASIC.

Moreover, within the semi-custom ASIC segment, the cell-based ASIC sub-category held the largest share, accounting for more than 70% of the market in 2024. This can be attributed to its digital-logic and electrical features, which encompass attributes like inductance and capacitance. Such features enable improved electrical performance and high component density. In addition, cell-based ASICs offer versatility and can be utilized across various products, regardless of design complexity, owing to the integration of advanced static random-access memory and internet protocol cores, facilitating seamless system functionality.

The full custom ASIC segment is projected to register a considerable growth rate during the forecast period. These ICs deliver enhanced speed and reliability, accompanied by intellectual property protection, while consuming a lesser amount of electrical power. Designers benefit from the ability to customize logic cells, layouts, mechanical structures, and circuits and optimize memory cells on the IC, thereby reducing processing time and mitigating risks. However, the manufacturing time for full custom ASICs is comparatively longer, taking approximately eight weeks for a specific application, as opposed to semi-custom ASICs.

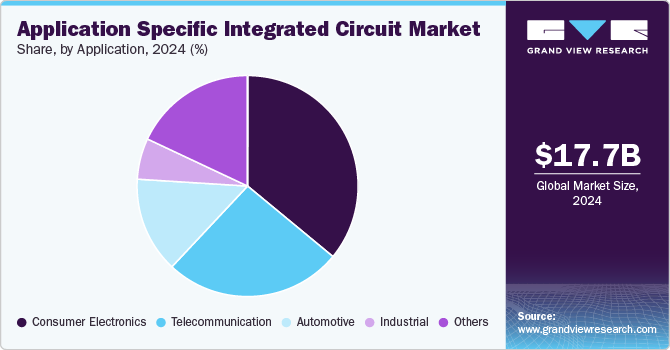

Application Insights

The consumer electronics segment dominated the market with a revenue share of over 36.0% in 2024. The segment is poised to present lucrative growth prospects for all stakeholders within the value chain, primarily driven by the escalating utilization of Application-Specific Integrated Circuits (ASICs) in smartphones, tablets, and laptops worldwide. ASICs offer many advantages, including low power consumption, IP security, compact size, and enhanced bandwidth, thus fostering widespread adoption in the consumer electronics industry. Furthermore, the rapid advancements in electronic devices have enabled heightened stability and energy efficiency, further fueling the growth of the application-specific integrated circuit (ASIC) market. Beyond the consumer electronics vertical, these ICs find extensive applications across various sectors, such as telecommunications, industrial, and healthcare.

The industrial segment of the ASIC market is expected to witness considerable growth over the forecast period. ASIC chips replace traditional components such as solder joints, and PCB traces with one IC, which in turn helps to reduce the chances of failure and offer reliable industrial systems. Furthermore, the increasing adoption of various components such as programmable timers, microcontrollers, and thermal controllers in industrial applications is propelling the market growth. Besides, numerous manufacturers in the market offer IC chips specifically designed for industrial usage. For instance, Custom Silicon Solutions, Inc., a semiconductor company offering custom "Mixed Signal" technology. The company’s CSS555C industrial ASIC is an improved version of its 555 timers. This CSS555C industrial ASIC draws 10 percent less power than other 555 timer devices.

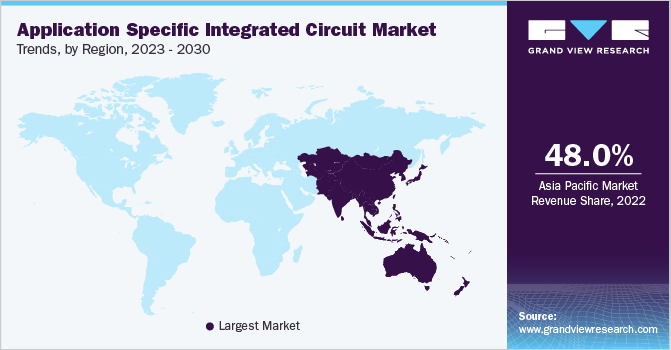

Regional Insights

North America application specific integrated circuit market is expected to grow at a CAGR of 5.9% during the forecast period. The growth is attributed to the significant presence of prominent players in the region, including Maxim Integrated Products Inc., Qualcomm Inc., Intel Corporation, and Texas Instruments Inc., among others. Furthermore, companies, particularly in the tech industry, are using ASICs for AI applications, where custom circuits provide the processing power and efficiency needed for real-time data analysis, predictive modeling, and machine learning.

U.S. Application-Specific Integrated Circuit Market Trends

The U.S. has remained at the forefront of ASIC innovation, primarily due to its robust technology sector and strong semiconductor manufacturing capabilities. With a growing focus on AI, IoT, and electric vehicles, U.S. companies are increasingly adopting ASICs to meet specific performance and power requirements. The demand for custom ASICs in advanced driver assistance systems (ADAS) and electric vehicle battery management is also gaining traction, positioning the U.S. as a significant country in automotive-specific ASIC applications.

Asia Pacific Application-Specific Integrated Circuit Market Trends

The Asia Pacific application specific integrated circuit market held a significant share of around 36.0%. The regional growth can be attributed to several key factors propelling the demand for ASICs in the region. The growing need for energy-efficient devices is driven by the region's rapid economic growth and increasing industrialization. Moreover, the proliferation of smartphones in the Asia Pacific region has contributed significantly to market expansion. The rising penetration of these devices, especially in developing economies such as China, Japan, and India, has created a conducive environment for ASIC market growth. In addition, factors such as the ongoing process of digitization, the increasing adoption of high-tech gadgets, advancements in automotive electronics, and a rising demand for miniaturization have collectively bolstered the market.

Key Application Specific Integrated Circuit Company Insights

Some of the key players operating in the market include Broadcom, Inc., Intel Corporation, STMicroelectronics N.V., and Seiko Epson Corporation, among others.

-

Broadcom Inc. (Broadcom) is a technology firm specializing in the design, development, and provision of a diverse range of semiconductor and infrastructure software solutions. The company’s product lineup encompasses storage adapters, controllers, ICs, wireless and wired products, and optical products. In addition, it provides mainframe and enterprise software, along with cybersecurity software, focusing on automation, systematic cybersecurity, and factory automation. The company distributes its offerings through an extensive network, including distributors, contract manufacturers, original equipment manufacturers, and a direct sales force. It has a global business presence, spanning North America, Asia, Europe, the Middle East, and Africa.

DWIN Technology, Socionext America Inc., and Comport Data are some of the emerging market participants in the target market.

-

Socionext America Inc. is specializing in the design, development, and delivery of System-on-Chip (SoC) products. With a focus on innovation and customer-centricity, the company consistently strives to pioneer groundbreaking solutions that anticipate and address evolving market demands. Leveraging its expertise and commitment to excellence, the company is engaged in providing customers with cutting-edge SoC products tailored to meet future needs and expectations.

Key Application Specific Integrated Circuit Companies:

The following are the leading companies in the application specific integrated circuit market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- STMicroelectronics

- Faraday Technology Corporation

- FUJITSU

- Infineon Technologies AG

- Comport Data

- Intel Corporation

- ASIX Electronics

- OmniVision Technologies, Inc.

- Semiconductor Components Industries, LLC

- Seiko Epson Corporation

- DWIN Technology

- Socionext America Inc.

- Tekmos Inc.

Recent Developments

-

In October 2024, OpenAI, an artificial intelligence company, partnered with Broadcom, Inc., a provider of ASICs, to develop an artificial intelligence chip to enhance the efficiency of AI model inference.

-

In July 2023, Faraday Technology Corporation announced the launch of SerDes total solution. The newly launched solution comprises the SerDes IP design on UMC 28nm and the corresponding IP Advanced (IPA) service. In addition, it is designed to accelerate customer integration.

Application Specific Integrated Circuit Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 18.65 billion |

|

Revenue forecast in 2030 |

USD 25.08 billion |

|

Growth rate |

CAGR of 6.1% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Segments covered |

Product, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Singapore; Brazil; UAE; Saudi Arabia; South Africa |

|

Key Companies Profiled |

Broadcom Inc; STMicroelectronics; Faraday Technology Corporation; Comport Data; FUJITSU; Infineon Technologies AG; Intel Corporation; ASIX Electronics; OmniVision Technologies, Inc.; Semiconductor Components Industries, LLC; Seiko Epson Corporation; DWIN Technology; Socionext America Inc.; Tekmos Inc. |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Specific Integrated Circuit Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global application specific integrated circuit market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Full Custom ASIC

-

Semi-Custom ASIC

-

Cell-Based

-

Array-Based

-

-

Programmable ASIC

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecommunication

-

Industrial

-

Automotive

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application specific integrated circuit market size was estimated at USD 17.65 billion in 2024 and is expected to reach USD 18.65 billion in 2025.

b. The global application specific integrated circuit market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 25.08 billion by 2030.

b. Asia Pacific dominated the application specific integrated circuit market with a more than 49.0% share in 2024. This is attributable to increasing demand for energy-efficient devices and rising exponential growth in smartphone sales in the region.

b. Some key players operating in the application specific integrated circuit market include Infineon Technologies AG, Semiconductor Components Industries, LLC, OmniVision Technologies, Tekmos Inc., Seiko Epson Corporation, Socionext America Inc., and Intel Corporation.

b. Key factors that are driving the market growth include growing use of ASICs in consumer electronics such as smartphones, smartwatches, tablets, and increasing adoption of mechatronics across the industrial and automotive applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."