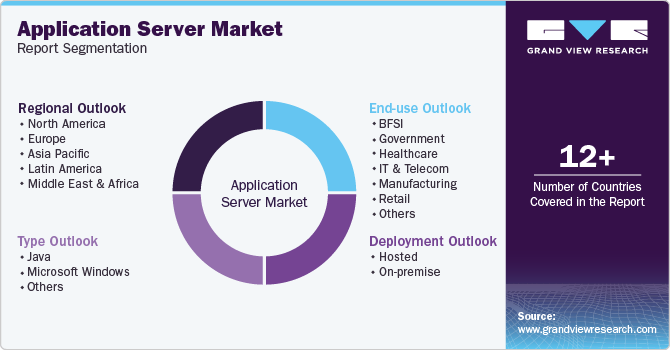

Application Server Market Size, Share & Trends Analysis Report By Type (Java, Microsoft Windows), By Deployment (Hosted, On-premise), End-use (BFSI, Government, Manufacturing, Retail, Healthcare, IT & Telecom), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-241-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Application Server Market Size & Trends

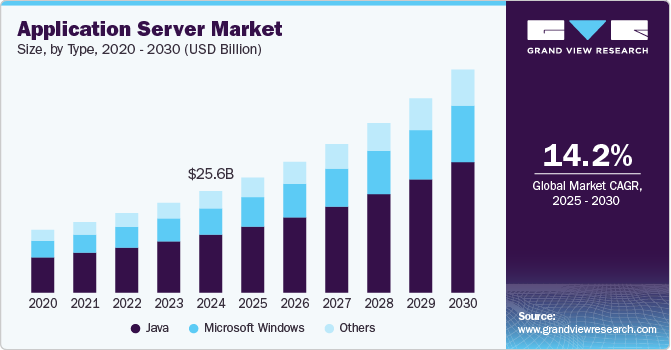

The global application server market size was valued at USD 25.64 billion in 2024 and is anticipated to grow at a CAGR of 14.2% from 2025 to 2030. The increasing reliance on web-based applications for business operations and customer engagement is a primary growth driver in the application server market. Businesses are undergoing significant digital transformation to remain competitive, which requires robust platforms capable of hosting, managing, and scaling dynamic web applications. Application servers play a pivotal role in enabling businesses to offer responsive, interactive, and high-performance services, especially in customer-centric industries such as retail, banking, and healthcare.

Cloud computing has revolutionized the way businesses operate, with application servers being at the heart of this transformation. Cloud-based servers offer scalability, flexibility, and cost efficiency, allowing enterprises to adapt to varying demands with ease. By enabling businesses to deploy applications without significant upfront investments in hardware, cloud application servers empower startups and SMEs to compete with larger enterprises. Leading cloud providers such as AWS, Microsoft Azure, and Google Cloud integrate application server functionalities, facilitating seamless deployment and management of cloud-native applications.

The exponential growth in mobile applications has significantly impacted the application server market. As mobile apps become essential for businesses to reach customers, application servers ensure seamless integration of backend services, providing a consistent experience across devices. This is particularly evident in sectors such as retail, banking, and entertainment, where mobile applications are a primary channel for customer interaction. For example, banking apps rely on application servers to manage secure transactions, display real-time account updates, and support communication between various systems.

In addition, the rise of progressive web applications (PWAs) and mobile-first strategies underscores the need for scalable and efficient application servers. These servers handle the growing complexity of mobile app ecosystems, supporting features such as offline functionality, push notifications, and real-time data synchronization. By providing the backbone for such applications, application servers enable businesses to meet consumer expectations for fast, reliable, and feature-rich mobile experiences.

Type Insights

The Java segment accounted for the largest revenue share of over 57.0% in 2024. Java's versatility and reliability make it a cornerstone for enterprise software development, particularly in industries such as finance, retail, and telecommunications. Its compatibility with multiple platforms and ability to handle large-scale, complex applications drive its continued adoption. Enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management (SCM) systems frequently rely on Java due to its robust libraries and frameworks such as Spring and Hibernate, enabling secure, scalable, and efficient operations.

The Microsoft Windows segment is expected to grow at a significant CAGR of 13.8% over the forecast period. Microsoft Windows application servers, such as Windows Server IIS (Internet Information Services), are widely used in enterprises for hosting and managing applications. The strong presence of Windows in enterprise IT infrastructure ensures seamless integration of application servers with existing systems. Organizations rely on Windows servers for their compatibility with various enterprise applications, databases, and business tools, including Microsoft SQL Server and Office 365. This widespread adoption continues to drive demand in industries like healthcare, finance, and manufacturing.

Deployment Insights

The hosted segment accounted for a significant revenue share of nearly 75.0% in 2024. Organizations are shifting toward hosted application servers to reduce the complexities associated with on-premises infrastructure management. Hosted solutions provide managed services that handle server deployment, maintenance, security, and updates, allowing businesses to focus on core operations. This is particularly beneficial for small and medium-sized enterprises (SMEs) with limited IT resources. By outsourcing these functions to hosting providers, businesses gain access to expert management while ensuring reliable application performance.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. Organizations in industries such as finance, healthcare, and government continue to prioritize on-premise application servers due to the stringent security and data privacy requirements associated with their operations. On-premise setups provide complete control over server access, enabling organizations to safeguard sensitive data against external threats. This control is especially critical in environments where regulatory compliance, such as HIPAA, GDPR, or PCI DSS, mandates stringent data protection measures.

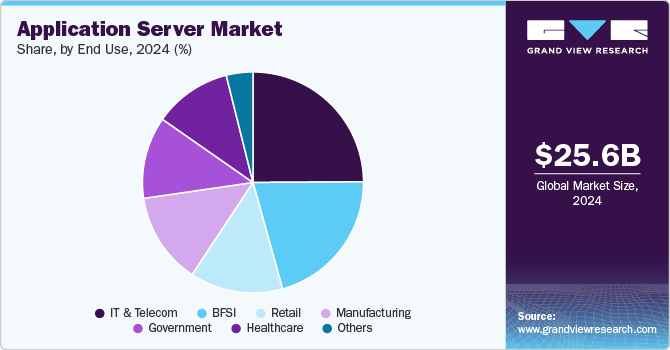

End-use Insights

The IT & telecom segment accounted for a significant revenue share of nearly 25.0% in 2024. The IT & telecom industry is at the forefront of global digital transformation, driving the demand for scalable and resilient application servers. With the explosion of data-driven applications, 5G networks, and IoT solutions, telecom companies require servers that can handle large-scale workloads efficiently. Application servers provide the backend support needed for managing traffic, ensuring seamless connectivity, and optimizing service delivery.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. Healthcare providers are embracing digital transformation to enhance patient care, streamline operations, and improve health outcomes. Application servers facilitate the deployment and management of healthcare applications such as electronic health records (EHRs), telemedicine platforms, and mobile health apps. These servers enable seamless data exchange between systems, ensuring that patient information is accessible, accurate, and up-to-date across various touchpoints in the application server industry.

Regional Insights

The application server market in North America held a share of over 44.0% in 2024. The growing adoption of cloud computing and hybrid IT solutions in North America is significantly boosting the application server market. Organizations are increasingly adopting cloud-native applications and hybrid environments, where application servers provide the backbone for operations. Cloud platforms, such as AWS, Microsoft Azure, and Google Cloud, often rely on application servers to offer businesses the flexibility to scale their IT infrastructure according to demand.

U.S. Application Server Market Trends

The application server market in the U.S. is expected to grow significantly at a CAGR of 12.7% from 2025 to 2030. The increasing integration of artificial intelligence (AI) and automation in U.S. businesses is driving demand for application servers. AI-driven applications, such as chatbots, predictive analytics, and intelligent automation, require robust backend support to process large volumes of data and execute complex algorithms in real time. Application servers provide the computational power and resources needed to deploy AI models efficiently and enable machine learning applications.

Europe Application Server Industry Trends

The application server market in Europe is growing with a significant CAGR of from 2025 to 2030. Europe's stringent data privacy and security regulations, such as the General Data Protection Regulation (GDPR), are driving the demand for secure and compliant application servers. Businesses across the continent need to ensure that their IT infrastructure meets these regulatory requirements, particularly in industries such as finance, healthcare, and e-commerce, where sensitive customer data is handled. The increased focus on cybersecurity and data privacy in Europe is pushing businesses to adopt advanced application server solutions that meet regulatory standards.

The UK application server market is expected to grow rapidly in the coming years. The UK is witnessing a significant shift towards cloud computing and hybrid IT solutions, driving the growth of the application server market. Businesses are increasingly adopting cloud services to benefit from cost savings, scalability, and improved flexibility. Application servers are integral to this shift as they facilitate the deployment, management, and integration of cloud-based and on-premises applications.

The Germany application server market held a substantial market share in 2024. Germany’s manufacturing sector, which is one of the largest in Europe, is a significant driver of the application server market. As the country embraces Industry 4.0 the integration of smart technologies such as IoT, AI, and big data into manufacturing there is a growing need for application servers that can handle real-time data processing, support complex automation systems, and manage the large volumes of data generated.

Asia Pacific Application Server Industry Trends

Asia Pacific is growing significantly at a CAGR of 16.8% from 2025 to 2030. Asia Pacific has seen an accelerated pace of digital transformation, driven by the increasing adoption of technology across sectors such as banking, healthcare, retail, and manufacturing. Governments and businesses are investing heavily in IT infrastructure to improve operational efficiencies and customer experiences. Application servers are crucial in supporting this transformation, as they provide the necessary infrastructure to deploy, manage, and scale cloud-based and on-premises applications.

The Japan application server market is expected to grow rapidly in the coming years due to growing use of smart city technologies and Internet of Things (IoT) innovations. The government’s focus on creating smart cities, particularly in urban areas is driving the adoption of IoT solutions across various industries. Application servers are critical for processing the vast amounts of data generated by IoT devices and for enabling real-time analytics in smart city systems, such as traffic management, energy monitoring, and public safety.

The China application server market held a substantial market share in 2024. China’s growing use of cloud computing technology is a significant drivers of the application server market. Major players such as Alibaba Cloud, Tencent Cloud, and Huawei Cloud are expanding their infrastructure, providing businesses with flexible and scalable cloud solutions. The growth of cloud adoption across industries, combined with the rise of hybrid cloud models, requires businesses to utilize application servers that can manage workloads both on-premises and in the cloud.

Key Application Server Company Insights

Key players operating in the application server industry are Microsoft, IBM Corporation, Oracle, Red Hat, Inc., TIBCO Software, Inc., FUJITSU, and VMware, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Dell Inc. partnered with Red Hat to bring Red Hat Enterprise Linux AI (RHEL AI), a platform created on an AI-optimized operating system, to Dell PowerEdge servers. This collaboration focuses on making it easier for organizations to develop, test, and deploy artificial intelligence and generative AI models. By integrating RHEL AI as the preferred platform on Dell's PowerEdge R760xa server, the partnership helps businesses implement effective AI/ML strategies to scale IT systems and enhance enterprise applications across their operations.

-

In September 2024, Oracle introduced Generative Development (GenDev), an AI-driven application development infrastructure designed to enable enterprises to rapidly create refined applications. This platform integrates several advanced Oracle technologies, including Oracle Database 23ai, AI Vector Search, and APEX, to streamline the development process using generative AI. GenDev facilitates the creation of modular applications with declarative languages, automating scalability, reliability, consistency, and security requirements. By leveraging AI-powered natural language interfaces and human-centric data, GenDev accelerates AI adoption while helping businesses manage its associated risks.

Key Application Server Companies:

The following are the leading companies in the Application Server market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- F5, Inc.

- FUJITSU

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft

- Nastel Technologies.

- NEC Corporation

- Oracle

- Payara Services Ltd

- Red Hat, Inc.

- SAP SE

- The Apache Software Foundation

- TIBCO Software, Inc.

- VMware, Inc.

Application Server Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 29.06 billion |

|

Revenue forecast in 2030 |

USD 56.34 billion |

|

Growth rate |

CAGR of 14.2% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Adobe; F5, Inc.; FUJITSU; Hewlett Packard Enterprise Development LP; IBM Corporation; Microsoft; Nastel Technologies; NEC Corporation; Oracle; Payara Services Ltd; Red Hat, Inc.; SAP SE; The Apache Software Foundation; TIBCO Software, Inc.; VMware, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Server Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the application server market report based on type, deployment, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Java

-

J Boss

-

Jetty

-

Tomcat

-

Others

-

-

Microsoft Windows

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application server market size was estimated at USD 25.64 billion in 2024 and is expected to reach USD 29.06 billion in 2025.

b. The global application server market is expected to grow at a compound annual growth rate of 14.2% from 2025 to 2030 to reach USD 56.34 billion by 2030.

b. The Java segment accounted for the largest market share of more than 57.0% in 2024 in line with the continued adoption of application servers by the incumbents of the e-commerce industry.

b. The hosted segment accounted for the largest application server market share of around 75% in 2024 and is expected to register the highest CAGR over the forecast period.

b. North America dominated the market for application servers in 2024 and accounted for a revenue share of over 44%.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."