Application Performance Monitoring Software Market Size, Share, & Trends Analysis Report By Type, By Deployment, By Access Type (Web APM, Mobile APM), By Enterprise Size, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-436-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

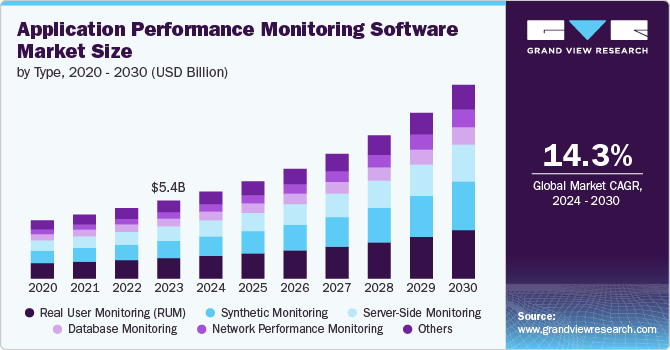

The global application performance monitoring software market size was estimated at USD 5.36 billion in 2023 and is anticipated to grow at a CAGR of 14.3% from 2024 to 2030. The market is experiencing significant growth due to several key factors. The increasing adoption of cloud computing has amplified the need for robust monitoring tools to manage the complexities of cloud-native architectures. As organizations undergo digital transformation, application performance monitoring (APM) tools become essential for ensuring seamless user experiences and operational efficiency. The rise of mobile applications and the need for consistent performance across diverse platforms further drive demand.

In addition, businesses emphasize real-time monitoring and customer experience, making APM solutions critical for quickly detecting and resolving performance issues. The growing complexity of IT infrastructures and compliance and regulatory requirements also necessitate advanced APM capabilities, positioning the market for continued expansion. The increasing adoption of cloud computing is a significant driver of the market. Organizations migrating to cloud-based environments encounter more complex and dynamic infrastructures, including multi-cloud and hybrid cloud deployments, microservices, and containerized applications. These advancements necessitate sophisticated APM tools that provide comprehensive visibility and control across distributed systems. Cloud environments demand real-time monitoring and proactive management to ensure optimal application performance, reliability, and security. Consequently, the need for APM solutions that can seamlessly integrate with cloud-native architectures and deliver actionable insights has become paramount, fueling the growth of the APM software market.

The rise of mobile applications and the need for consistent performance across diverse platforms are key factors driving the APM software market growth. As businesses increasingly rely on mobile apps to engage customers and deliver services, ensuring a seamless and responsive user experience across various devices and operating systems becomes crucial. The diversity in hardware, software environments, and network conditions introduces significant challenges in maintaining consistent performance. APM tools are essential in this context, providing real-time monitoring, diagnostics, and optimization capabilities that help organizations identify and resolve performance issues specific to mobile platforms. This growing reliance on mobile applications, combined with the need for high performance across all user touchpoints, is fueling the demand for advanced APM solutions to address the unique complexities of mobile ecosystems.

Type Insights

The real user monitoring (RUM) segment accounted for the largest revenue share of over 26% in 2023. The adoption of application performance monitoring (APM) software for real user monitoring (RUM) is driven by the increasing emphasis on understanding actual user experiences. Organizations seek to capture real-time data on how end-users interact with applications, including page load times, error rates, and navigation paths. This data is invaluable for identifying performance issues in the real world, enabling businesses to optimize applications based on actual user behavior and improve overall customer satisfaction. RUM is particularly crucial for applications that serve a global audience, as it provides insights into performance variations across different regions, devices, and network conditions.

The synthetic monitoring segment is anticipated to grow at the highest CAGR from 2024 to 2030. The adoption of APM software for synthetic monitoring is driven by the need for proactive performance management. Synthetic monitoring involves simulating user interactions with an application through automated scripts to continuously test and measure performance from various locations and under different conditions. This approach allows organizations to detect potential issues before they affect real users, ensuring that applications perform optimally even during peak usage or in diverse environments. Synthetic monitoring is especially valuable for identifying bottlenecks, verifying service level agreements (SLAs), and conducting regression testing during development cycles, thus contributing to a more reliable and resilient application infrastructure.

Deployment Insights

The on-premise deployment segment accounted for the largest revenue share in 2023. The adoption of APM software on-premise is driven by the need for greater control, security, and compliance, particularly in industries with stringent regulatory requirements or sensitive data concerns. Organizations that maintain on-premise infrastructure often prioritize APM solutions that can be fully managed and customized internally, ensuring that performance data remains within the organization’s control.

On-premise APM tools also appeal to businesses with legacy systems or complex, highly personalized environments that require tailored monitoring solutions. In addition, organizations in finance, healthcare, and government sectors may prefer on-premise APM to meet specific data residency, privacy, and regulatory obligations, ensuring that all performance monitoring activities align with stringent internal policies and industry standards.

The cloud segment is anticipated to grow at a CAGR of over 15% during the forecast period. The adoption of application performance monitoring (APM) software on cloud platforms is primarily driven by the flexibility, scalability, and ease of integration offered by cloud-based solutions. As organizations increasingly migrate their operations to the cloud, they seek APM tools that seamlessly integrate with cloud-native architectures, offering real-time monitoring and analytics without significant infrastructure investments.

Cloud-based APM solutions also support agile development practices by providing rapid deployment, continuous updates, and the ability to scale resources according to demand, making them particularly attractive for businesses prioritizing innovation and responsiveness in a dynamic market environment.

Access Type Insights

The web APM segment accounted for the largest market share of over 59% in 2023 in the application performance monitoring (APM) software market. The adoption of web APM tools is primarily driven by the need for organizations to ensure optimal performance and reliability of their web applications. As digital experiences become increasingly integral to business operations, companies seek web APM solutions to proactively monitor application performance, diagnose issues, and optimize user experience. This proactive approach helps mitigate downtime, enhance customer satisfaction, and maintain competitive advantage in a crowded digital marketplace. In addition, web APM tools provide valuable insights into application behavior and user interactions, facilitating data-driven decision-making and continuous improvement.

The mobile APM segment is anticipated to grow at the highest CAGR from 2024 to 2030. The adoption of mobile APM tools is motivated by the rapid growth of mobile applications and the unique performance challenges they present. Mobile APM solutions are essential for managing the performance of applications across diverse mobile devices and operating systems, where issues such as network variability, device fragmentation, and varying user contexts can impact performance. Mobile APM tools offer real-time monitoring, crash reporting, and user experience analytics specific to mobile environments, enabling developers to address performance bottlenecks, improve app stability, and deliver a seamless user experience. As mobile applications become increasingly critical to business strategy, the need for specialized mobile APM tools to ensure high performance and user satisfaction is ever more pronounced.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 62% in 2023. Adopting APM software among large enterprises is driven by the need to manage complex, distributed IT environments that support mission-critical applications. As enterprises increasingly rely on many applications to drive business operations, ensuring optimal performance becomes crucial. APM software enables these organizations to monitor, diagnose, and resolve real-time performance issues, thereby minimizing downtime, improving operational efficiency, and ensuring a high-quality user experience. Furthermore, the scalability and advanced analytics offered by APM tools align with the needs of large enterprises to handle extensive data volumes, support rapid innovation, and maintain a competitive edge in the market.

The SME segment is anticipated to grow at the highest CAGR from 2024 to 2030. The adoption of APM software among small and medium-sized enterprises (SMEs) is primarily driven by the need to maintain application performance without the extensive IT resources typically available to larger organizations. For SMEs, APM tools offer a cost-effective solution to monitor and optimize application performance, ensuring that limited resources are used efficiently and that customer experiences remain positive. Quickly identifying and resolving issues can be critical for SMEs, where even minor disruptions can have significant business impacts. Additionally, APM software supports SMEs in scaling their operations by providing the necessary insights and tools to manage growing digital infrastructures effectively.

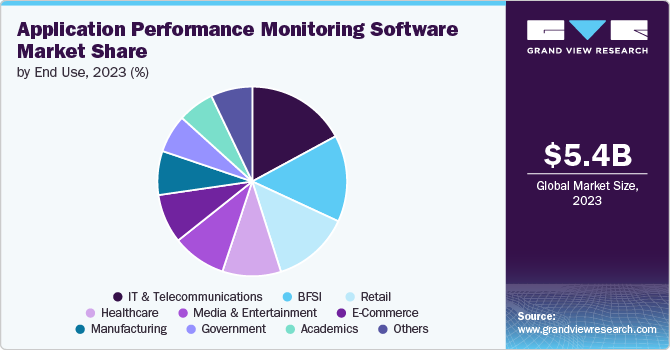

End Use Insights

The IT and telecommunications end use segment accounted for the largest revenue share in 2023. The adoption of APM software in the IT and telecommunications sector is driven by the need to ensure the reliability, scalability, and efficiency of highly complex and dynamic networked environments. This sector relies on interconnected applications and systems that must seamlessly support critical communication services and IT infrastructure. APM tools provide real-time monitoring, fault detection, and performance optimization, enabling IT and telecommunications companies to maintain service quality, reduce downtime, and manage large-scale deployments effectively. As these companies face increasing demands for high-speed, reliable services, APM software becomes indispensable for maintaining competitive advantage and meeting customer expectations.

The academics segment is anticipated to grow at a CAGR of over 16% during the forecast period. In the academic sector, the adoption of APM software is motivated by the growing reliance on digital platforms for research, learning management, and administrative operations. Educational institutions are increasingly integrating advanced technologies to support remote learning, research collaboration, and data management, which requires robust application performance to ensure smooth and uninterrupted access. APM tools assist academic institutions in monitoring the performance of these applications, ensuring they operate efficiently and securely. By adopting APM software, academic institutions can enhance the user experience for students, faculty, and staff, safeguard the integrity of critical research data, and optimize the performance of their IT resources, thereby supporting their educational mission in a digital age.

Regional Insights

North America application performance monitoring software market held the major share of over 32% of the market in 2023. In North American market is characterized by strong demand driven by the region’s advanced IT infrastructure and high adoption of cloud computing and DevOps practices. In addition, the focus on improving customer experience and meeting stringent regulatory requirements further accelerates APM adoption in this region.

U.S. Application Performance Monitoring Software Market Trends

The application performance monitoring (APM) software market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., the APM software market is characterized by the rapid adoption of advanced analytics and AI-driven solutions that enable predictive monitoring and proactive performance management. U.S. companies are at the forefront of integrating APM tools with broader IT operations management (ITOM) frameworks, reflecting a trend towards more holistic approaches to performance monitoring. The market also sees increased demand for APM solutions that support microservices and containerized environments, reflecting the ongoing shift towards modern application architectures.

Europe Application Performance Monitoring Software Market Trends

The Europe application performance monitoring (APM) software market is growing significantly at a CAGR of over 14% from 2024 to 2030. In Europe, the market is experiencing growth fueled by increasing digitalization across industries and a rising emphasis on compliance with data protection regulations such as GDPR. European organizations are increasingly adopting APM tools to ensure the performance and security of their applications, especially as they expand their cloud and mobile capabilities. The market is also driven by the need for robust solutions to manage the performance of applications in multi-cloud and hybrid IT environments, which are becoming more prevalent in Europe.

Asia Pacific Application Performance Monitoring Software Market Trends

The application performance monitoring (APM) software market in Asia Pacific is growing significantly at a CAGR of over 16% from 2024 to 2030. The market in the Asia Pacific region is expanding rapidly due to the growing adoption of digital technologies, particularly in emerging economies like China and India. The region’s booming e-commerce sector and the widespread use of mobile applications are key drivers of APM adoption as businesses strive to deliver high-performance digital experiences to a rapidly expanding user base. Additionally, the increasing complexity of IT infrastructures, driven by cloud computing and IoT adoption, is prompting organizations to invest in advanced APM solutions.

Key Application Performance Monitoring Software Company Insights

Key players are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Application Performance Monitoring Software Companies:

The following are the leading companies in the application performance monitoring software market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- AppDynamics

- BMC Software

- Broadcom

- Datadog

- Dynatrace LLC.

- Google Cloud

- IBM

- Micro Focus

- Microsoft

- New Relic, Inc.

- Oracle

- Riverbed Technology

- SolarWinds

- Splunk

Recent Developments

-

In June 2023, New Relic, a comprehensive observability platform catering to all engineering roles, introduced New Relic APM 360. This latest advancement in application performance monitoring (APM) represents a significant evolution, extending beyond traditional incident troubleshooting insights aimed at specialized experts to offer daily performance, security, and development insights accessible to all engineers. APM 360 integrates and correlates crucial telemetry data across the entire application stack and development lifecycle, encompassing elements such as deployment changes, key transactions, service-level objectives (SLOs), infrastructure, logs, errors, debugging, and security, among others.

-

In June 2024, Datadog, Inc., the security and monitoring platform for cloud applications, announced enhancements to its security product portfolio, including the introduction of Agentless Scanning, Code Security, and Data Security. These new features are designed to facilitate DevOps and security teams in effectively securing their code, cloud environments, and production applications.

Application Performance Monitoring Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.97 billion |

|

Revenue forecast in 2030 |

USD 13.31 billion |

|

Growth rate |

CAGR of 14.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, access type, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific;, Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Amazon Web Services, Inc.; AppDynamics, BMC Software; Broadcom; Datadog; Dynatrace LLC.; Google Cloud; IBM; Micro Focus; Microsoft; New Relic, Inc.; Oracle; Riverbed Technology; SolarWinds; Splunk |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Performance Monitoring Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application performance monitoring (APM) software market report based on type, deployment, access type, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Real User Monitoring (RUM)

-

Synthetic Monitoring

-

Server-Side Monitoring

-

Database Monitoring

-

Network Performance Monitoring

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Access Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web APM

-

Mobile APM

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Retail

-

IT and Telecommunications

-

Manufacturing

-

E-Commerce

-

Media and Entertainment

-

Academics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application performance monitoring software market size was estimated at USD 5.36 billion in 2023 and is expected to reach USD 5.97 billion in 2024

b. The global application performance monitoring software market is expected to grow at a compound annual growth rate of 14.3% from 2024 to 2030 to reach USD 13.31 billion by 2030

b. North America dominated the APM software market with a market share of 32.0% in 2023. In North America, the Application Performance Monitoring (APM) software market is characterized by strong demand driven by the region’s advanced IT infrastructure and high adoption of cloud computing and DevOps practices. Additionally, the focus on improving customer experience and meeting stringent regulatory requirements further accelerates APM adoption in this region.

b. Some key players operating in the application performance monitoring (APM) software market include Amazon Web Services, Inc., AppDynamics, BMC Software, Broadcom, Datadog, Dynatrace LLC., Google Cloud, IBM, Micro Focus, Microsoft, New Relic, Inc., Oracle, Riverbed Technology, SolarWinds, and Splunk.

b. The application performance monitoring software market is experiencing significant growth due to several key factors. The increasing adoption of cloud computing has amplified the need for robust monitoring tools to manage the complexities of cloud-native architectures. As organizations undergo digital transformation, APM tools become essential for ensuring seamless user experiences and operational efficiency. The rise of mobile applications and the need for consistent performance across diverse platforms further drive demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."