Application Performance Monitoring Market Size, Share & Trends Analysis Report By Solution (Software, Services), By Deployment (Cloud, On-Premise), By Enterprise, By Access Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-269-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global application performance monitoring market size was estimated at USD 7.52 billion in 2023 and is projected to grow at a CAGR of 15.1% from 2024 to 2030. The rise in digitalization and globalization of businesses is driving the demand for APM. As businesses expand globally, APM becomes crucial for monitoring applications across diverse geographical locations and ensuring consistent performance for users worldwide.

Due to the increasing trend of globalization, businesses are expanding their operations to different regions with the help of digital platforms. These businesses operate through various applications and software, including different websites. As such, they often have operations and users spread across different geographical locations. Operating in a global context means encountering diverse network infrastructures and varying network conditions, which can lead to many problems related to the working and experience of the digital platform. To address these challenges, APM provides organizations with an automated discovery and mapping of the software to evaluate and measure its performance. By doing so, APM enables the identification of the root cause of any issue, streamlining the resolution process. Through APM, organizations can maintain the optimal performance of their digital platforms and ensure that their global users have a seamless and positive experience.

The advent of Industry 4.0 is increasing the proliferation of digital platforms that offer services, resulting in the expansion of the e-commerce industry. As a result, the number of digital touchpoints, such as websites and mobile applications, has increased significantly. The architecture of the software and applications are more complex, making them more susceptible to errors and making it difficult to constantly identify and rectify the errors manually. APM tools are essential in monitoring the performance of these touchpoints to ensure a seamless and responsive user experience. APM tools provide real-time insights and the ability to pinpoint bottlenecks, which is critical for driving market growth.

Moreover, APM provides seamless integration with data security systems. This integration enhances the reliability of cyberattack and data breach detection by effectively addressing system performance issues. By offering real-time alerts, APM ensures timely notifications of anomalies or suspicious activities, thus strengthening the organization's overall security.

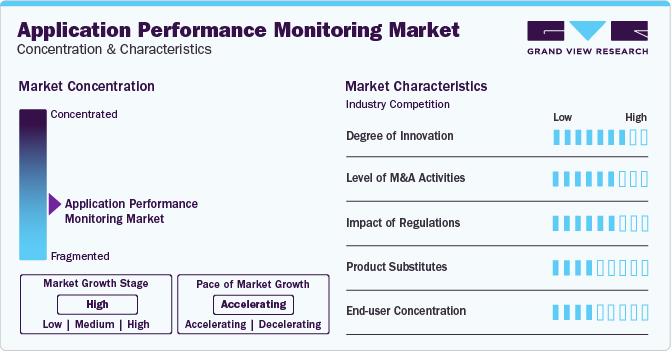

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The degree of innovation is high due to technological advancements made to enhance the APM performance. One of the significant developments in APM is incorporating Artificial Intelligence (AI) and Machine Learning (ML) technologies. These advanced technologies empower APM tools to automatically detect anomalies, predict potential issues, and provide actionable insights to enhance application performance. Moreover, APM solutions focus on monitoring the end-user experience over infrastructure metrics. By monitoring user interactions with applications, organizations are understanding performance issues from the user’s perspective. This approach enables businesses to provide a superior experience to their users and gain a competitive edge in the market.

The market is fragmented, featuring several global and regional players. The market players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. For instance, in November 2023, Datadog acquired Actiondesk, a spreadsheet application based on the cloud, aiming to provide a platform for data handling. Autodesk is integrated with the Datadog APM, enabling editing and managing data on the cloud and empowering multidisciplinary team collaborations.

Component Insights

Based on component, the software segment led the market with the largest revenue share of over 70% in 2023 and is expected to continue to dominate the industry over the forecast period. The increasing complexity of IT environments is driving the segment growth. The increasing complexity of IT environments, characterized by the adoption of cloud services, microservices, and distributed architectures, necessitates robust APM solutions to monitor and optimize performance effectively. Moreover, as organizations strive to deliver seamless user experiences and align IT performance with business objectives, software-based APM solutions offer the flexibility and scalability needed to meet these evolving demands. These solutions enable organizations to monitor application performance across diverse environments, from on-premises infrastructure to cloud-based deployments, ensuring optimal user satisfaction and operational efficiency.

Companies are developing innovative solutions for IT and other industries to cater to the rise in demand. For instance, in October 2022, Datadog launched new products and features at the Dash 2022 event aimed at enhancing team collaboration, improving testing processes, and boosting cloud and application security. Datadog offers several capabilities, such as the ability to analyze cloud cost data in conjunction with other telemetry. It also provides the ability to create synthetic tests for mobile applications and block malicious activity by directly preventing IPs from accessing Datadog.

The services segment is expected to witness at the fastest CAGR over the forecast period, owing to the increasing focus on performance optimization of digital platforms. In the digital age, applications are at the core of business operations. Organizations are placing a heightened emphasis on performance optimization to deliver seamless user experiences, enhance operational efficiency, and maintain a competitive edge. Service providers within the APM market offer specialized services such as performance tuning, proactive monitoring, and troubleshooting to help organizations identify and address performance bottlenecks, ensuring that their digital platforms operate at peak performance levels.

Deployment Insights

Based on deployment, the on-premise segment held the market with the largest revenue share of 50.6% in 2023. This can be attributed to the need for data privacy and data security. With the rise in digital platforms, there has been an increase in cyberattacks and data breaches, making cybersecurity of paramount importance to companies, especially those handling sensitive information such as personal data, financial records, or proprietary business data. The on-premise deployment model offers organizations a higher level of control and security over their data compared to cloud-based solutions. By hosting APM tools on-premise, organizations can keep their data within their secure environment, ensuring compliance with data protection regulations and minimizing the risk of data breaches.

The cloud segment is anticipated to grow at the fastest CAGR during the forecast period. Cloud APM solutions often follow a cost-efficient subscription-based pricing model, allowing organizations to pay for the resources they use on a pay-as-you-go basis. This cost-effective approach eliminates the need for significant upfront investments in hardware and software, enabling organizations to align their APM expenses with actual usage and scale resources cost-effectively as their needs evolve.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 61.1% in 2023 and is projected to grow at a significant CAGR over the forecast period. Large enterprises rely on a wide range of business-critical applications to support their operations. Ensuring the optimal performance and availability of these applications is essential for maintaining productivity, customer satisfaction, and competitive advantage. APM solutions tailored for large enterprises offer advanced monitoring capabilities to identify and address performance issues in real-time proactively.

The small and medium-sized enterprises (SME) segment is expected to witness at the fastest CAGR during the forecast period. This can be attributed to the rise of cloud-based APM, which provides SMEs with the scalability and flexibility needed to adapt to changing business requirements and scale their APM capabilities as their operations grow. SMEs can easily adjust resources based on demand, ensuring that their APM tools accommodate evolving IT environments and performance monitoring needs. Furthermore, SMEs prioritize solutions that offer quick time-to-value, enabling them to start monitoring and improving application performance rapidly without lengthy implementation processes or steep learning curves.

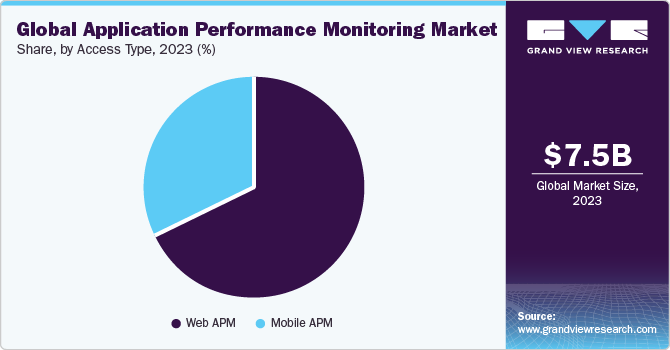

Access Type Insights

Based on access type, the web APM segment led the market with the largest revenue share of 67.9% in 2023. Web APM solutions are driven by the need to optimize user experience on websites and web applications. By monitoring and analyzing web performance metrics, organizations identify bottlenecks, improve load times, and enhance overall user satisfaction. Load times play a crucial role in shaping user experience, as slow-loading websites lead to user frustration and high bounce rates. Web APM tools allow organizations to monitor and optimize load times by analyzing factors such as server processing speed, content delivery efficiency, and resource utilization. By optimizing load times, organizations enhance user engagement and retention.

The mobile APM segment is expected to grow at a significant CAGR during the forecast period. With the increasing use of smartphones and mobile devices, organizations are adopting a mobile-first approach to engage with customers. Mobile APM solutions are driven by the need to ensure smooth performance and user experience for mobile applications, as users expect quick loading times and seamless functionality on their mobile devices.

End-use Insights

Based on end-use, the IT and telecommunications segment led the market with the largest revenue share in 2023. The need for capacity planning and optimization is promoting the demand for APM in the segment. IT & telecommunications companies require effective capacity planning to scale infrastructure resources and accommodate the growing demand for services. APM solutions assist organizations in analyzing performance trends, forecasting capacity requirements, and optimizing resource allocation to ensure optimal performance under varying workloads.

The academics segment is expected to witness at the fastest CAGR over the forecast period. APM helps academic institutions ensure that their digital platforms, such as learning management systems (LMS) and student portals, deliver optimal performance, enhancing the user experience for students, faculty, and staff. It also finds uses in application resource utilization, allowing academic IT departments to allocate resources efficiently. Furthermore, the emergence of e-learning and e-courses is driving the demand for APM in the segment.

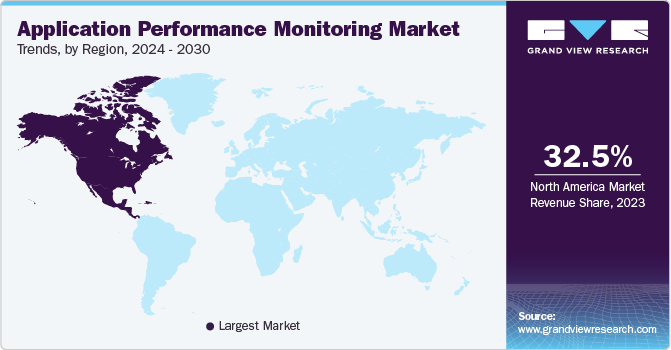

Region Insights

North America dominated the application performance monitoring market with a revenue share of 32.5% in 2023. The regional growth is attributed to the increasing e-commerce market in the region. As online shopping continues to gain popularity among consumers, businesses are trying to deliver accurate, consistent, and engaging product information across various digital channels. APM solutions provide optimization of web and mobile applications to deliver information, process purchases, and handle customer queries effectively.

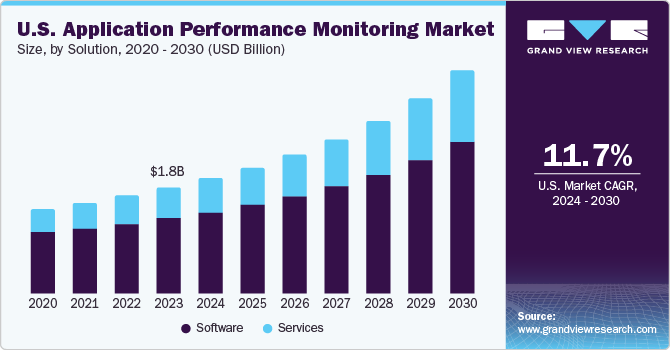

U.S. Application Performance Monitoring Market Trends

The application performance monitoring market in U.S. accounted for a revenue share of 24.5% in 2023. The U.S. has a robust digital economy with a high level of internet penetration, e-commerce activity, and online services. APM tools are crucial in ensuring the smooth functioning of digital platforms, supporting e-commerce transactions, and delivering seamless user experiences in the highly competitive digital landscape. The country's digital economy is driving the market growth.

Asia Pacific Application Performance Monitoring Market Trends

The application performance monitoring market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Many countries in Asia Pacific have adopted a mobile-first approach due to the widespread use of smartphones and mobile devices. APM tools are essential for organizations to monitor the performance of mobile applications and ensure seamless user experiences on various devices, screen sizes, and operating systems.

The China market is expected to grow at a significant CAGR over the forecast period. China is one of the global leaders in e-commerce, with platforms such as Alibaba and JD.com driving massive online retail transactions. APM is used widely to monitor the performance of e-commerce applications, ensure fast loading times, secure transactions, and seamless user experiences to support the high volume of online shopping activities in the country.

The application performance monitoring market in India is expected to grow at a significant CAGR over the forecast period, due to the flourishing start-up ecosystem. The start-up ecosystem in India is characterized by rapid innovation and experimentation across various industries, such as e-commerce, fintech, healthcare, and education. APM tools help start-ups monitor the performance of their innovative applications, identify areas for improvement, and ensure that new features and updates are rolled out smoothly to enhance user experiences.

Key Application Performance Monitoring Company Insights

Some of the key players operating in the market include Datadog, Inc., Dynatrace, Inc., and New Relic.

-

Datadog is a cloud-based platform that uses AI to monitor servers, databases, tools, and services through a data analytics platform. It offers features like infrastructure monitoring, application performance monitoring, log management, and user experience monitoring

-

Dynatrace is a company specializing in software intelligence that offers services such as application performance management, cloud infrastructure monitoring, and digital experience management. Additionally, Dynatrace provides artificial intelligence for operations, including features for resolving performance issues and automatically identifying application dependencies

ServiceNow, Thundra are some of the other market participants in the global market.

-

ServiceNow provides LightstepAPM solutions that help developers keep track of and improve their application performance. Lightstep offers a variety of valuable features to help developers monitor and optimize their application performance. Some of the key features of Lightstep include distributed tracing, real-time analytics, anomaly detection, and root cause analysis. These features allow developers to gain insights into their applications' performance and troubleshoot any issues that may arise

-

Thundra APM offers solutions for monitoring and managing the performance of cloud-native applications. Their APM platform provides various features, such as distributed tracing, log analysis, and customized metrics, which allow developers to identify and resolve performance issues efficiently. Thundra's APM solutions are designed to support cloud-native architectures and can scale with the needs of modern applications, making them a valuable addition to any development team

Key Application Performance Monitoring Companies:

The following are the leading companies in the application performance monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Datadog, Inc.

- Dynatrace, Inc.

- New Relic

- SolarWinds Worldwide, LLC.

- Zoho Corporation Pvt. Ltd.

- AppDynamics

- Splunk, Inc.

- LogicMonitor, Inc.

- Hound Technology, Inc.

- Platform.sh SAS

- ServiceNow

- Thundra

Recent Developments

-

In November 2023, New Relic launched New Relic AI Monitoring (AIM), the sector’s initial APM solution dedicated to AI-powered applications. AIM offers engineers visibility across the AI stack, easing troubleshooting and optimization processes for performance, quality, cost, and compliance. Integrated with Amazon Bedrock, AIM allows AWS customers to optimize applications. It provides end-to-end observability, empowering engineers to troubleshoot and optimize AI prompts and responses

-

In January 2023, Splunk launched Autodetect feature in its APM solution automates alert configuration using ML. It establishes performance baselines for each service and creates detectors for sudden changes in latency, errors, and request rates. This significantly reduces manual effort for engineers, who can subscribe to recommended alerts, customize thresholds, and manage notifications more efficiently. With Autodetect, engineers benefit from smarter, more accurate alerting based on real-time performance analysis across their services

-

In June 2022, Cisco launched the new AppDynamics Cloud, an APM platform designed to simplify the monitoring of modern applications in cloud-native environments. The solution offers a unified view of cloud-native landscapes, leveraging industry standards like OpenTelemetry for data collection. Unlike add-on solutions from competitors, AppDynamics Cloud is purpose-built for cloud-native monitoring, providing seamless cross-domain insights and cohesive health analysis without the need for users to navigate between disparate data silos

Application Performance Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.43 billion |

|

Revenue forecast in 2030 |

USD 19.62 billion |

|

Growth rate |

CAGR of 15.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, enterprise size, access type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled |

Datadog, Inc.; Dynatrace, Inc.; New Relic; SolarWinds Worldwide, LLC.; Zoho Corporation Pvt. Ltd.; AppDynamics; Splunk, Inc.; LogicMonitor, Inc.; Hound Technology, Inc.; Platform.sh SAS; ServiceNow; Thundra |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Performance Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global application performance monitoring market research report based on the solution, deployment, enterprise size, access type, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

Integration & Deployment

-

Training & Education

-

Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium-Sized Enterprises

-

Large Enterprises

-

-

Access Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Web APM

-

Mobile APM

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

E-Commerce

-

Manufacturing

-

Healthcare

-

Retail

-

IT and Telecommunications

-

Media and Entertainment

-

Academics

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application performance monitoring market size was estimated at USD 7.52 billion in 2023 and is expected to reach USD 8.43 billion in 2024

b. The global application performance monitoring market is expected to grow at a compound annual growth rate of 15.1% from 2024 to 2030, reaching USD 19.62 billion by 2030

b. North America dominated the application performance monitoring market with a revenue share of 32.5% in 2023. Regional growth is attributed to the increasing e-commerce market in the region. As online shopping continues to gain popularity among consumers, businesses are trying to deliver accurate, consistent, and engaging product information across various digital channels.

b. Some key players operating in the application performance monitoring market include Datadog, Inc.; Dynatrace, Inc.; New Relic; SolarWinds Worldwide, LLC.; Zoho Corporation Pvt. Ltd.; AppDynamics; Splunk, Inc.; LogicMonitor, Inc.; Hound Technology, Inc.; Platform.sh SAS; ServiceNow; Thundra

b. Factors such as the rise in digitalization and globalization of businesses are driving the growth of the application performance monitoring market

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."