Application Performance Management Software Market Size, Share & Trends Analysis Report By Deployment Mode, By Enterprise Size, By Access Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-478-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global application performance management software market size was estimated at USD 4.36 billion in 2023 and is anticipated to grow at a CAGR of 13.4% from 2024 to 2030. The growth of the application performance management (APM) software market is primarily driven by the increasing complexity of modern IT environments and the rising demand for high-performing, reliable digital applications. As organizations continue to undergo digital transformation, the need to monitor and optimize the performance of both web and mobile applications has become critical. Cloud adoption, the proliferation of microservices, and the integration of DevOps practices contribute to the expanded use of APM tools to ensure seamless application delivery and real-time monitoring.

Moreover, BFSI, healthcare, and retail sectors, which rely heavily on customer-facing applications, require robust APM solutions to enhance user experience, minimize downtime, and maintain operational efficiency. In addition, as cyber threats and compliance requirements grow more stringent, businesses increasingly turn to APM software to ensure secure, resilient applications, further fueling market expansion.

The increasing complexity of modern IT environments, characterized by the widespread adoption of cloud computing, microservices architecture, and containerization, is a key factor driving the growth of the APM software market. These dynamic and distributed systems introduce greater challenges in monitoring, managing, and optimizing application performance across diverse platforms. As businesses strive to deliver seamless digital experiences, the demand for reliable, high-performing applications has surged. End-users expect uninterrupted, fast, and responsive applications, particularly in finance, healthcare, and retail industries, where downtime or performance degradation can significantly impact customer satisfaction and operational efficiency. APM solutions provide real-time insights, predictive analytics, and diagnostics, enabling organizations to proactively address performance issues, ensure scalability, and maintain optimal application performance, thus meeting the rising expectations of both users and business stakeholders.

Cloud adoption, the proliferation of microservices, and the integration of DevOps practices have significantly contributed to the expanded use of APM tools. The shift to cloud-based infrastructure offers flexibility and scalability but also introduces greater complexity in monitoring applications that operate across distributed environments. Similarly, the rise of microservices architecture, which breaks down applications into independent, loosely coupled services, requires granular visibility to ensure each service performs optimally without disrupting the overall system.

DevOps practices, emphasizing continuous integration and continuous delivery (CI/CD), have further accelerated the need for APM tools to monitor application performance throughout the development lifecycle. By providing real-time insights and enabling collaboration between development and operations teams, APM solutions facilitate faster identification and resolution of performance bottlenecks, ensuring consistent application reliability in fast-paced, evolving IT ecosystems.

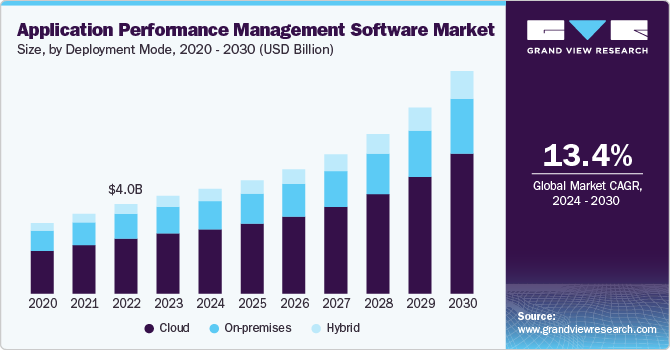

Deployment Mode Insights

The cloud segment accounted for the largest market share of over 61% in 2023 in the application performance management software market. For cloud-based APM, the primary driver is the growing preference for cloud infrastructure across industries due to its scalability, flexibility, and cost-efficiency. As businesses increasingly migrate their applications to the cloud, they require APM tools to monitor performance in dynamic, distributed environments. Cloud-based APM solutions can manage applications in real time without extensive on-site hardware, providing seamless integration with cloud-native technologies, reducing operational overhead, and enabling rapid deployment. In addition, the rise of remote work, global accessibility, and the need for faster innovation cycles have made cloud APM solutions attractive for organizations looking to enhance performance while reducing time-to-market.

The on-premises segment is anticipated to grow at a significant CAGR over the forecast period. The adoption of on-premises APM is driven by industries with strict regulatory and security requirements, such as banking, government, and healthcare, where data sovereignty and control over sensitive information are critical. On-premises APM solutions provide organizations with full control over their infrastructure, ensuring that performance monitoring is conducted within their secured networks. This deployment model particularly appeals to enterprises that manage legacy systems or critical applications where compliance and risk management are prioritized.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2023 in the application performance management software market. For large enterprises, the adoption of application performance management software is primarily driven by the complexity of their IT infrastructure and the critical need to ensure uninterrupted performance for internal and customer-facing applications. Large organizations typically manage vast networks of applications, often deployed across multiple environments, including on-premises, cloud, and hybrid setups.

APM solutions provide these enterprises with advanced capabilities such as real-time monitoring, predictive analytics, and root cause analysis, enabling them to manage performance issues and maintain operational efficiency proactively. Given the high stakes of downtime or performance degradation, especially in finance, telecommunications, and healthcare sectors, large enterprises prioritize robust APM tools to ensure scalability, reliability, and compliance with stringent regulatory requirements.

The small & medium enterprise (SME) segment is anticipated to expand at a compound annual growth rate of over 14 during the forecast period. SMEs adopt APM software primarily to optimize resource usage, enhance customer experience, and remain competitive in fast-evolving digital markets. SMEs often have limited IT resources and budgets, making cloud-based APM solutions' cost-efficiency and ease of use particularly appealing. These tools empower SMEs to monitor and improve the performance of their critical applications without the need for significant upfront investment in infrastructure. As SMEs increasingly leverage digital channels for business growth, quickly identifying and resolving performance issues is essential for maintaining customer satisfaction and supporting business continuity. APM software helps SMEs streamline operations and improve agility, enabling them to scale and compete more effectively in the market.

Access Type Insights

The web APM segment accounted for the largest market share of over 66% in 2023 in the application performance management software market. For Web APM, the primary driver is businesses' reliance on web-based applications for critical functions, including e-commerce, customer portals, and enterprise systems. As organizations increasingly digitize their operations and move services online, ensuring the seamless performance of web applications has become essential to maintaining customer satisfaction and operational efficiency. Web APM solutions allow businesses to monitor key performance metrics such as response times, transaction performance, and user experience across browsers and networks. In addition, the complexity of web applications, often involving multiple layers such as databases, servers, and APIs, necessitates robust APM tools to identify and resolve performance bottlenecks in real time.

The mobile APM segment is anticipated to grow at the highest CAGR during the forecast period. Mobile APM adoption is being driven by the rapid proliferation of mobile applications and the growing expectation for seamless, high-quality mobile user experiences. With the increasing dependence on mobile devices for tasks ranging from banking to social engagement and e-commerce, organizations are placing a greater emphasis on monitoring the performance of their mobile apps to retain users and foster engagement. Mobile APM solutions provide insights into app crashes, latency, load times, and user interactions across diverse mobile platforms and devices. As consumer-facing businesses, particularly in sectors like retail, fintech, and entertainment, continue to prioritize mobile-first strategies, the need for Mobile APM to ensure reliable, fast, and intuitive mobile experiences is paramount.

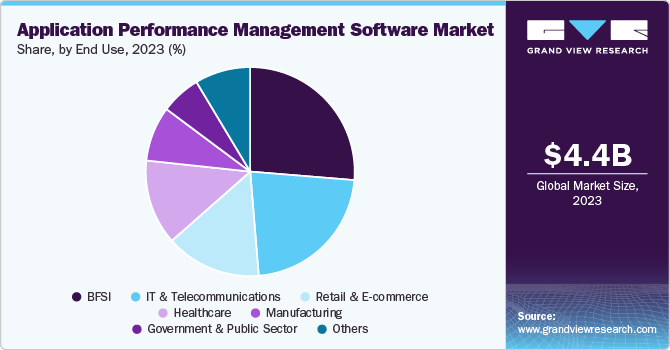

End Use Insights

The BFSI end use segment accounted for the largest market share in 2023 in the application performance management software market. The adoption of APM software in the BFSI sector is driven by the need for high reliability, security, and performance in mission-critical applications. BFSI organizations manage complex, data-intensive systems such as online banking platforms, trading applications, and payment gateways, where even minimal downtime or performance degradation can result in significant financial losses, regulatory breaches, and damage to customer trust. APM tools allow BFSI institutions to monitor and optimize the performance of these systems in real time, ensuring seamless transactions, compliance with stringent industry regulations, and protection against cyber threats. In addition, with the growing adoption of digital banking services and mobile banking apps, APM software is crucial for delivering a superior user experience and ensuring operational continuity in a highly competitive market.

The IT and telecommunications segment is anticipated to grow at a CAGR of over 14% during the forecast period. In the IT and Telecommunications sector, the primary driver for APM adoption is the need to manage the performance of large-scale, complex infrastructures that support a wide range of services and applications, including cloud computing, network services, and software platforms. As telecom providers roll out advanced technologies such as 5G and edge computing, and IT companies shift towards cloud-native architectures, maintaining high performance and low latency is critical for ensuring customer satisfaction and competitive differentiation. APM solutions allow IT and telecom companies to proactively monitor the performance of network systems, software applications, and digital services, allowing them to identify and resolve potential issues before they impact users.

Regional Insights

North America held the major share of over 37% of the application performance management software market in 2023. In North America, the application performance management (APM) software market is driven by the widespread adoption of cloud computing, digital transformation initiatives, and increased reliance on complex IT infrastructure. Organizations in the U.S. and Canada focus on enhancing customer experience, optimizing application performance, and ensuring business continuity, leading to growing demand for advanced APM solutions.

U.S. Application Performance Management Software Market Trends

The application performance management software market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., the APM market is characterized by advanced technological adoption, including artificial intelligence and machine learning integration within APM solutions. Enterprises across sectors such as healthcare, retail, and finance are investing heavily in APM tools to ensure the efficient performance of their digital platforms and reduce downtime, making the U.S. a key market for innovation in APM technologies.

Europe Application Performance Management Software Market Trends

The application performance management software market in Europe is growing significantly at a CAGR of over 13% from 2024 to 2030. In Europe, the APM market is expanding due to the increasing need for performance monitoring in the finance, manufacturing, and telecommunications industries. The region’s focus on data privacy and compliance, along with the rise of cloud-based applications, has created a significant demand for sophisticated APM tools to manage and optimize application performance while ensuring regulatory adherence.

Asia Pacific Application Performance Management Software Market Trends

The application performance management software market in the Asia Pacific is growing significantly at a CAGR of over 14% from 2024 to 2030. In Asia Pacific, rapid digitalization, the expansion of e-commerce, and the growing use of mobile applications fuel the demand for APM software. Countries like China, India, and Japan are witnessing increased adoption of APM solutions to improve application performance and user experience as businesses increasingly migrate to cloud-based platforms.

Key Application Performance Management Software Company Insights

Key players operating in the network emulator market include AppDynamics, Datadog Inc., Dynatrace LLC, IBM Corporation, Microsoft, New Relic Inc., OpenText Corporation, SolarWinds Worldwide, LLC., Splunk LLC, and Zoho Corporation Pvt. Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Datadog Inc. announced the general availability of Datadog Monitoring for Oracle Cloud Infrastructure (OCI), providing Oracle customers with the ability to monitor cloud-native and traditional workloads on OCI. This solution offers comprehensive telemetry across applications, infrastructure, and services, delivering insights in context. With this launch, Datadog supports customers in confidently migrating from on-premises to cloud environments, executing multi-cloud strategies, and monitoring AI/ML inference workloads.

-

In April 2024, New Relic, the comprehensive observability platform for engineers, announced the general availability of New Relic AI monitoring, featuring advanced tools designed to address the changing needs of companies developing AI applications. The new features include detailed AI response tracing insights, model comparison, and real-time user feedback, all aimed at enhancing AI applications' performance, quality, and cost-efficiency while maintaining data security and privacy.

Key Application Performance Management Software Companies:

The following are the leading companies in the application performance management software market. These companies collectively hold the largest market share and dictate industry trends.

- AppDynamics

- Datadog Inc.

- Dynatrace LLC

- IBM Corporation

- Microsoft

- New Relic Inc.

- OpenText Corporation

- SolarWinds Worldwide, LLC.

- Splunk LLC

- Zoho Corporation Pvt. Ltd.

Application Performance Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.65 billion |

|

Revenue forecast in 2030 |

USD 9.90 billion |

|

Growth rate |

CAGR of 13.4% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment mode, enterprise size, access type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

AppDynamics; Datadog Inc.; Dynatrace LLC; IBM Corporation; Microsoft; New Relic Inc.; OpenText Corporation; SolarWinds Worldwide, LLC.; Splunk LLC; Zoho Corporation Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Performance Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application performance management software market report based on deployment mode, enterprise size, access type, end use, and region:

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Access Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web APM

-

Mobile APM

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government & Public Sector

-

Healthcare

-

Retail & E-commerce

-

IT & Telecommunications

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application performance management software market size was estimated at USD 4.36 billion in 2023 and is expected to reach USD 4.65 billion in 2024

b. The global application performance management software market is expected to grow at a compound annual growth rate of 13.4% from 2024 to 2030 to reach USD 9.90 billion by 2030

b. North America dominated the application performance management software market with a market share of 37% in 2023. In North America, the application performance management (APM) software market is driven by the widespread adoption of cloud computing, digital transformation initiatives, and increased reliance on complex IT infrastructure. Organizations in the U.S. and Canada focus on enhancing customer experience, optimizing application performance, and ensuring business continuity, leading to growing demand for advanced APM solutions

b. Some key players operating in the application performance management software market include AppDynamics, Datadog Inc., Dynatrace LLC, IBM Corporation, Microsoft, New Relic Inc., OpenText Corporation, SolarWinds Worldwide, LLC., Splunk LLC, and Zoho Corporation Pvt. Ltd.

b. The growth of the application performance management (APM) software market is primarily driven by the increasing complexity of modern IT environments and the rising demand for high-performing, reliable digital applications. As organizations continue to undergo digital transformation, the need to monitor and optimize the performance of both web and mobile applications has become critical.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."