Application Performance Management Market Size, Share & Trends Analysis Report By Platform Type (Software, Service), By Deployment Mode (On-premise, Cloud, Hybrid), By Enterprise Size, By Access Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-452-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

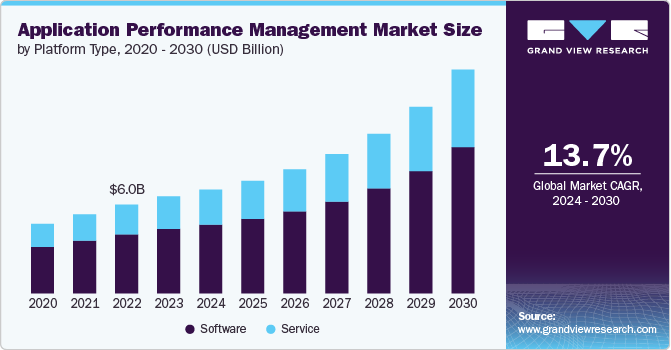

The global application performance management market size was estimated at USD 6.56 billion in 2023 and is anticipated to grow at a CAGR of 13.7% from 2024 to 2030. The market's growth is largely driven by the surge in remote work settings, which has heightened the need for seamless application performance across distributed environments. As organizations increasingly rely on digital platforms to support remote operations, ensuring optimal application functionality has become critical for maintaining productivity and user satisfaction.

Furthermore, the adoption of DevOps methodologies has augmented the focus on application performance management (APM), as development and IT operations teams seek to accelerate software delivery while minimizing downtime. This shift toward continuous integration and continuous deployment mode (CI/CD) has made APM tools indispensable for monitoring application health, troubleshooting issues in real time, and ensuring the performance and reliability of critical business applications, fueling the market's expansion.

The increasing adoption of digital technologies, particularly mobile and cloud computing, is a key driver of the market's growth. As businesses continue to shift towards mobile-first strategies and leverage cloud-based infrastructure, ensuring optimal performance across these platforms has become critical. As of 2024, according to BuildFire, a U.S.-based app development platform, the Google Play Store offers 2.87 billion apps for download. Mobile app usage is particularly high among millennials, with 21% of them opening an app more than 50 times a day. Overall, 49% of users open apps at least 11 times daily, while mobile apps account for 70% of all digital media time in the U.S. On average, smartphone users engage with ten apps daily and use around 30 different apps each month.

APM tools enable organizations to monitor and manage the performance of applications running on diverse and distributed environments, including mobile devices and cloud-based systems. With the rising complexity of multi-cloud environments and the need for consistent performance across mobile applications, APM solutions are becoming essential for tracking and optimizing application health in real time. This growing reliance on mobile and cloud technologies has heightened the demand for APM tools as businesses strive to deliver uninterrupted, high-quality digital experiences to their users, ultimately contributing to the market's expansion.

Platform Type Insights

The software segment accounted for the largest market share of 66.5% in 2023 due to the increasing complexity of modern IT infrastructures and the expanding use of cloud-based applications. As businesses adopt more distributed and hybrid environments, the need for robust software solutions to monitor, manage, and optimize application performance has become essential. APM software tools provide comprehensive insights into application behavior, enabling IT teams to identify bottlenecks quickly, troubleshoot issues, and ensure that applications run smoothly. According to Eurostat, in 2023, 75.3% of enterprises acquired advanced cloud services, including security software, database hosting, or computing platforms for application development, testing, or deployment mode.

The service segment is anticipated to grow at the fastest CAGR over the forecast period due to the increasing focus on improving customer experience and operational efficiency. APM services help organizations identify performance bottlenecks, optimize resource utilization, and reduce downtime, leading to improved application availability and faster issue resolution. By leveraging the insights provided by APM tools and services, businesses can proactively address performance issues before they impact access types, enhancing user satisfaction and retention.

Deployment Mode Insights

The cloud segment accounted for the largest market share of 52.6% in 2023. The scalability and flexibility offered by cloud APM tools are significant growth drivers in this segment. Cloud-based APM solutions allow organizations to scale their monitoring capabilities as their application environments expand without requiring substantial investments in on-premise infrastructure.

The on-premises segment is anticipated to grow at the fastest CAGR over the forecast period due to the growing demand for greater control over data security and privacy. Many organizations, particularly those in heavily regulated industries such as finance, healthcare, and government, prefer on-premises solutions to ensure compliance with stringent data protection laws.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share, 59.5%, in 2023. As these organizations integrate more digital technologies, such as artificial intelligence (AI), big data, and Internet of Things (IoT) systems, into their operations, the need for effective performance management becomes even more critical. APM solutions enable large enterprises to monitor and optimize the performance of these technologies, ensuring that they function seamlessly within the broader IT ecosystem.

The SMEs segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing availability of subscription-based pricing models and cloud-based APM solutions has lowered the entry barrier for SMEs, enabling them to benefit from advanced performance management capabilities without substantial upfront investments.

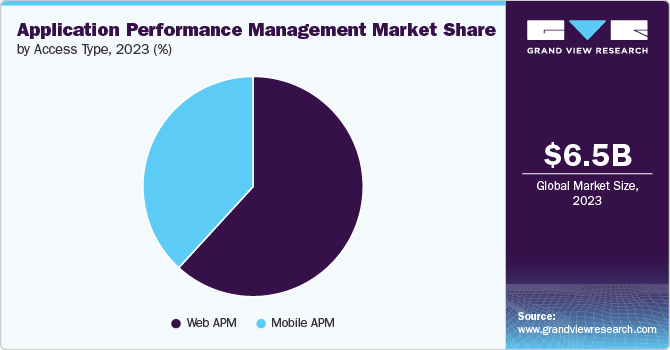

Access Type Insights

The web APM segment had the largest market share of 61.8% in 2023 due to the widespread adoption of cloud computing and the proliferation of hybrid cloud environments. As companies migrate to cloud-based infrastructures, they require APM solutions that can effectively monitor and manage applications across diverse environments, including public, private, and multi-cloud setups.

The mobile APM segment is anticipated to grow at the fastest CAGR over the forecast period. The rise of mobile commerce and transactions has amplified the importance of maintaining high-performance standards. Businesses relying on mobile apps for financial transactions or other critical functions must ensure that their applications perform optimally to prevent disruptions and maintain user trust. Moreover, the integration of APM tools with DevOps practices enhances the development and deployment mode process. By providing real-time performance data and analytics, mobile APM solutions enable development teams to identify and address issues during the development cycle, leading to faster and more efficient releases.

Regional Insights

The application performance management market in North America held the largest global revenue share of 37.0% in 2023 due to the growing demand for real-time monitoring and instant visibility into application performance. Businesses require immediate insights to quickly resolve performance bottlenecks and ensure seamless user experiences. APM solutions that offer real-time dashboards and alerts are becoming more popular in addressing this need.

U.S. Application Performance Management Market Trends

The application performance management market in the U.S. is expected to grow significantly from 2024 to 2030. AI and machine learning technologies are increasingly being integrated into APM solutions. These advancements provide predictive analytics, automated root cause analysis, and anomaly detection, helping businesses proactively manage performance issues and optimize their applications.

Europe Application Performance Management Market Trends

The application performance management market in Europe is growing significantly at a CAGR of 13.9% from 2024 to 2030. There is an increasing demand for APM solutions tailored to specific industry sectors, such as finance, healthcare, and retail. These sector-specific solutions address unique performance management needs and regulatory requirements within different industries.

Asia Pacific Application Performance Management Market Trends

Asia Pacific is growing significantly, with a CAGR of 15.7% from 2024 to 2030. Businesses in the region are accelerating their digital transformation efforts, which include adopting cloud technologies, microservices, and containerization. This shift creates a strong demand for APM solutions that can manage and monitor performance across increasingly complex IT environments.

Key Application Performance Management Company Insights

Key players operating in the application performance management (APM) industry include Akamai Technologies Inc., Broadcom Inc., Datadog Inc., Microsoft, New Relic Inc., and Oracle. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, Broadcom Inc. unveiled VMware Tanzu Platform 10, a new solution for advancing intelligent application delivery within private cloud settings. This platform is designed to streamline teams' development workflows and enhance governance and operational efficiency.

-

In July 2024, New Relic, Inc. introduced an AI-powered Digital Experience Monitoring (DEM), a fully integrated solution designed to optimize application performance and proactively prevent disruptions in digital experiences. This enterprise-grade solution provides real-time insights and comprehensive visibility across web, mobile, and AI applications, enabling organizations to deliver seamless digital experiences across various platforms. Key features include mobile user journeys, logs, and session replay functionality improvements.

-

In June 2024, Akamai Technologies successfully acquired Noname Security, a U.S.-based API security provider. This strategic acquisition is anticipated to enhance Akamai's capacity to address the increasing demand for API security solutions as the use of APIs continues to grow. By integrating Noname Security's expertise, Akamai Technologies aims to strengthen its offerings and better meet evolving market needs.

Key Application Performance Management Companies:

The following are the leading companies in the application performance management market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- AppDynamics

- Broadcom Inc.

- Datadog Inc.

- Dynatrace LLC

- IBM

- OpenText Corporation

- Microsoft

- New Relic Inc.

- Oracle

Application Performance Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.02 billion |

|

Revenue forecast in 2030 |

USD 15.14 billion |

|

Growth rate |

CAGR of 13.7% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform type, deployment mode, enterprise size, access type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Akamai Technologies, AppDynamics, Broadcom Inc., Datadog Inc., Dynatrace LLC, IBM, OpenText Corporation, Microsoft, New Relic Inc., Oracle |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Performance Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application performance management market report based on platform type, deployment mode, enterprise size, access type, and region.

-

Platform Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Deployment and Integration

-

Training and Education

-

Support and Maintenance

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Access Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web APM

-

Mobile APM

-

-

Application Performance Management Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global APM market size was estimated at USD 6.56 billion in 2023 and is expected to reach USD 7.02 billion in 2024.

b. The global APM market is expected to grow at a compound annual growth rate of 13.7% from 2024 to 2030 to reach USD 15.14 billion by 2030.

b. The application performance management market in North America held the share of 37.0% in 2023 due to the growing demand for real-time monitoring and instant visibility into application performance.

b. Some key players operating in the APM market include Akamai Technologies, AppDynamics, Broadcom Inc., Datadog Inc., Dynatrace LLC, IBM, OpenText Corporation, Microsoft, New Relic Inc., and Oracle

b. The growth of the market is largely driven by the surge in remote work settings, which has heightened the need for seamless application performance across distributed environments. As organizations increasingly rely on digital platforms to support remote operations, ensuring optimal application functionality has become critical for maintaining productivity and user satisfaction.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."