Application Modernization Services Market Size, Share & Trends Analysis Report By Service Type, By Deployment (Public Cloud, Private Cloud), By Enterprise Size (Large Enterprise, SMEs), By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-266-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global application modernization services market size was estimated at USD 17.80 billion in 2023 and is projected to grow at a CAGR of 16.7% from 2024 to 2030. Furthermore, the need to reduce IT complexity and operational costs drives the adoption of application modernization services. Legacy applications typically require extensive maintenance, support, and infrastructure resources to keep them running smoothly, resulting in high IT overhead costs and operational inefficiencies.

Application modernization services providers offer solutions such as re-platforming, re-hosting, and refactoring legacy applications to modern platforms, such as cloud environments, containerized architectures, and microservices-based architectures. By modernizing legacy applications, organizations can streamline their IT operations, reduce infrastructure costs, and improve resource utilization, resulting in significant cost savings and operational efficiencies.

Increasing focus on enhancing cybersecurity and compliance drives the demand for application modernization services. Legacy applications often lack robust security features and are susceptible to cyber threats, vulnerabilities, and compliance risks. Modernizing legacy applications allows organizations to implement advanced security controls, encryption mechanisms, and compliance frameworks to protect sensitive data, mitigate security risks, and ensure regulatory compliance. Application modernization services providers offer expertise in implementing security best practices, conducting security assessments, and implementing security features such as identity and access management, data encryption, and threat detection capabilities, thereby enhancing the overall security posture of organizations' IT environments. In March 2024, Fujitsu Limited partnered with Amazon Web Services (AWS) to accelerate the modernization of legacy applications through deployment on the AWS Cloud. Fujitsu and AWS deliver evaluation, migration, and enhancement services for legacy mission-critical applications currently operating on on-premise mainframes and UNIX servers, facilitating their transition to the AWS Cloud. This collaborative effort targets customers spanning various sectors such as finance, retail, and automotive, aiding them in the modernization of legacy applications on the AWS Cloud. This endeavor aims to equip businesses with the agility and robustness of modern applications, enabling them to adapt swiftly to evolving market conditions.

The COVID-19 pandemic had a positive impact on the market as businesses accelerated their digital transformation initiatives to adapt to the changing landscape. The increased reliance on remote work highlighted the importance of scalable, cloud-based solutions, prompting organizations to modernize their legacy applications for improved agility and accessibility. The need for efficient and secure digital operations drove a heightened demand for services that facilitate cloud migration, containerization, and the adoption of modern architectures. Companies sought to enhance their digital capabilities to meet evolving customer expectations and navigate disruptions effectively. Consequently, the application modernization services industry experienced growth during the pandemic as organizations recognized the strategic imperative of modernizing their IT infrastructure to ensure resilience and continuity in an increasingly digital-centric business environment.

Regulations directly governing application modernization services are not typically found at the federal level, as application modernization primarily focuses on technological improvements rather than legal compliance. However, application modernization efforts must align with regulatory requirements to ensure that updated applications continue to meet modern security and privacy standards. Critical aspects of application modernization that relate to regulatory compliance include ensuring compatibility where modernized applications must conform to relevant legislation, such as HIPAA, PCI DSS, GDPR, and other regional or sector-specific regulations; Data Privacy and Protection in which modernization initiatives should incorporate robust measures to protect sensitive data and prevent unauthorized access. While direct regulatory oversight of application modernization services does not exist, organizations must ensure that their modernization efforts result in compliant applications.

Market Concentration & Characteristics

The application modernization services industry growth stage is high, and the pace is accelerating. The degree of innovation is high due to the rapid advancement in technologies such as machine learning, artificial intelligence, and the Internet of Things (IoT). Modernization assists in reducing operational costs, optimizing resources, and enhancing overall efficiency. The rise in government support for promoting the use of application modernization services is fueling the industry's growth. Conventional applications are often exposed to security threats, and maintaining compliance with evolving regulations can be challenging. It allows businesses to ensure adherence to regulatory requirements, mitigate potential risks, and apply robust security measures.

The market is fragmented in nature, featuring several global and regional players. The industry players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. For instance, in May 2023, Kyndryl launched a range of innovative services and features aimed at assisting Red Hat OpenShift customers in bolstering and broadening their capacity to seamlessly modernize and transition core business applications to hybrid cloud environments. These integrated services and capabilities, forming part of a comprehensive suite of container management and security offerings, have been meticulously crafted to facilitate customers' progress in their cloud transformation endeavors by streamlining application modernization through novel services.

Service Type Insights

Based on service type, the market is further bifurcated into cloud application migration, UI modernization, application re-platforming, application portfolio assessment, post-modernization, and application integration. The application re-platforming segment held the largest revenue share of 22.9% in 2023 and is expected to continue to dominate the industry over the forecast period. The shift towards hybrid and multi-cloud environments drives the adoption of application re-platforming services. Organizations increasingly adopt a hybrid or multi-cloud strategy to leverage the strengths of different cloud providers, avoid vendor lock-in, and optimize costs.

Re-platforming services enable organizations to migrate applications seamlessly between different cloud environments or deploy applications across multiple clouds while maintaining interoperability, portability, and consistency. In November 2023, NTT DATA partnered with Amazon Web Services (AWS) to integrate its UniKix Mainframe Replatforming software into the AWS Mainframe Modernization service. This software from NTT DATA aids in streamlining the process of modernizing legacy systems and applications, thereby assisting businesses in cutting down on expenses and complexities. This partnership enables NTT DATA to offer cost-effective cloud migration solutions to their clients.

Cloud application migration is expected to witness the fastest CAGR over the forecast period. The need for DevOps and continuous delivery practices drives the adoption of the cloud application migration segment. Cloud platforms enable organizations to adopt agile development methodologies, automate software delivery pipelines, and accelerate time-to-market for new features and services. Application modernization services providers offer expertise in implementing DevOps frameworks, CI/CD pipelines, and infrastructure as code (IaC) practices, enabling organizations to automate application deployment, provisioning, and scaling in cloud environments.

Deployment Insights

Based on deployment, the market is segmented into public cloud, private cloud, and hybrid cloud. The hybrid cloud segment held the largest revenue share in 2023. The increasing adoption of multi-cloud strategies drives the demand for the hybrid cloud segment. Many organizations adopt a multi-cloud strategy to avoid vendor lock-in, optimize costs, and leverage the strengths of different cloud providers for different workloads and use cases. By modernizing applications for multi-cloud deployment, organizations can maximize agility, resilience, and innovation while minimizing dependencies on any single cloud provider and maximizing their cloud investments.

The private cloud segment is expected to witness the fastest CAGR over the forecast period. The need for business continuity and disaster recovery drives the adoption of application modernization services in the private cloud segment. Private clouds offer dedicated infrastructure and advanced disaster recovery capabilities, enabling organizations to ensure high availability and resilience for critical applications and data. Application modernization services providers help organizations modernize applications for private cloud deployment, leveraging features such as data replication, failover clustering, and automated backup and recovery to minimize downtime and data loss in the event of hardware failures, natural disasters, or cyber-attacks.

Enterprise Size Insights

Based on enterprise size, the market is further bifurcated into large enterprises and SMEs (small & medium enterprises) segments. The SMEs segment accounted for the largest revenue share in 2023. The growing reliance on digital technologies and online presence is driving SMEs to invest in application modernization. As consumers increasingly rely on digital channels to purchase goods and services, SMEs must ensure that their applications are up-to-date, user-friendly, and capable of delivering seamless digital experiences. Modernizing applications allows SMEs to enhance their digital presence, optimize e-commerce platforms, and provide customers with intuitive and engaging user experiences. AMS providers assist SMEs in redesigning user interfaces, improving application performance, and integrating with e-commerce platforms and other digital tools, thereby enhancing customer satisfaction and loyalty.

The large enterprises segment is expected to witness the fastest CAGR over the forecast period. The need for compliance and risk management drives the adoption of AMS among large enterprises. Large enterprises operate in highly regulated industries and must comply with various industry regulations, data protection laws, and security standards to protect sensitive data and mitigate legal and financial risks. Legacy applications may lack robust security features, encryption mechanisms, or audit trails, exposing large enterprises to potential security breaches or compliance violations. AMS providers offer modernization solutions that enhance security and compliance by implementing advanced encryption, access controls, and audit logging directly into applications.

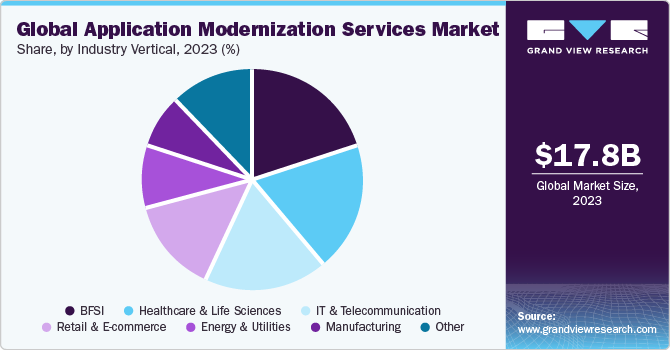

Industry Vertical Insights

Based on industry vertical, the market is further bifurcated into BFSI, retail & E-commerce, manufacturing, IT & telecommunication, energy, and utilities, healthcare & life sciences, and others (education, media, and entertainment, etc.) segments. The BFSI segment held the largest revenue share in 2023. Security and compliance considerations play a significant role in propelling the adoption of application modernization services within the BFSI sector. With the rise of cybersecurity threats and stringent regulatory frameworks, such as GDPR and PSD2, financial institutions are under immense pressure to fortify their IT infrastructures and ensure data protection. By modernizing their applications, BFSI firms implement robust security measures, such as encryption and multi-factor authentication, to safeguard sensitive customer information and comply with regulatory standards.

The IT & telecommunication segment is anticipated to register the fastest CAGR over the forecast period. The expansion of big data and analytics drives the IT & telecommunication segment growth. Traditional applications need help to handle the massive volumes of data generated by today's interconnected digital ecosystems. By modernizing applications and incorporating advanced analytics capabilities, organizations gain actionable insights from their data, drive informed decision-making, and gain a competitive edge through data-driven innovation. From predictive maintenance in telecommunications networks to personalized marketing campaigns in IT services, modernized applications enable organizations to optimize performance.

Regional Insights

North America dominated the industry with a share of 39.7% in 2023. Increasing focus on cybersecurity and data privacy is driving the adoption of application modernization services in North America. With the proliferation of cyber threats and regulatory mandates such as GDPR and CCPA, organizations face heightened risks related to data breaches, cyberattacks, and compliance violations. Legacy applications, with their outdated security protocols and vulnerabilities, pose significant risks to sensitive data and intellectual property. By modernizing these applications and implementing robust security measures, such as encryption, access controls, and threat detection mechanisms, organizations enhance their cyber resilience and mitigate risks.

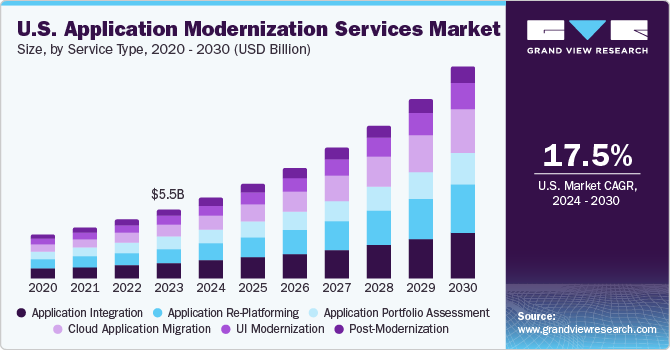

U.S. Application Modernization Services Market Trends

The application modernization services market in the U.S. accounted for a global share of 31.1% in 2023. Growing demand for personalized and omnichannel experiences is driving the adoption of application modernization services in the U.S. Clients expect seamless interactions with businesses across various touchpoints, including web, mobile apps, social media, and physical stores. Legacy applications often need more flexibility and integration capabilities to deliver cohesive omnichannel experiences. By modernizing applications and adopting microservices architecture, API-driven integration, and data-driven personalization, organizations can drive engagement and build brand loyalty in an increasingly competitive market.

Asia Pacific Application Modernization Services Market Trends

The application modernization services market in Asia Pacific is expected to witness significant growth during the forecast period. The region has an established digital infrastructure that allows firms to modernize legacy systems and increase profits quickly. There are increased government investments in technology-related services that encourage the adoption of application modernization services. The highly established BFSI and healthcare industries, along with the presence of several large IT firms, contribute to the demand for application modernization services. Rapid industrialization and a burgeoning startup ecosystem drive the demand for modernization solutions.

The China application modernization services market is anticipated to witness significant growth over the forecast period. The rise of emerging technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) has catalyzed the need for modernized applications capable of adopting these innovations. Application modernization services providers enable organizations to incorporate these advanced technologies seamlessly into their software applications, providing new opportunities for innovation and competitive advantage in the market.

The application modernization services market in India is expected to witness the fastest growth during the forecast period. The application modernization services market in India is driven by the growing adoption of cloud computing technologies. As businesses increasingly migrate their operations to the cloud, they require expertise in modernizing their existing applications to leverage the scalability, flexibility, and cost-effectiveness offered by cloud platforms. This trend is further fueled by the government's initiatives, such as Digital India and the growing emphasis on data localization, driving organizations to modernize their IT infrastructure to meet regulatory requirements while utilizing the benefits of cloud-native architectures.

Middle East & Africa Application Modernization Services Market Trends

Increasing focus on sustainability and environmental responsibility is influencing organizations in MEA to modernize their applications. Legacy systems often consume significant resources and energy, contributing to carbon emissions and environmental degradation. By modernizing their applications and migrating to energy-efficient, cloud-based infrastructures, organizations can reduce their carbon footprint, optimize resource utilization, and promote sustainability initiatives, aligning with global environmental goals and enhancing their corporate social responsibility (CSR) efforts.

Key Application Modernization Services Company Insights

Some of the key players operating in the market include Accenture, IBM, and Infosys.

-

Accenture is a multinational professional services firm. Accenture's application modernization services excel in driving digital transformation for businesses. Accenture emphasizes microservices architecture and containerization for improved agility and resource utilization. The integration of DevOps practices ensures accelerated development cycles and collaboration between teams. Security is paramount, and data modernization strategies are implemented for enhanced analytics and compliance. Accenture's expertise extends to seamless legacy system integration, offering organizations a phased and strategic approach to modernization, reducing technical debt, and positioning them for sustained success in today's dynamic digital landscape.

-

IBM is a multinational technology and consulting company that emphasizes a DevOps culture, fostering collaboration and efficiency in software development. Their approach includes thorough security measures, ensuring robust protection for applications and data. With a commitment to user experience, IBM modernization services offer revamped interfaces and intuitive interactions. Incorporating analytics and data modernization strategies further solidifies IBM's role in empowering organizations to navigate the complexities of modern digital landscapes while optimizing legacy systems integration.

-

Infosys Limited is a multinational corporation that offers consulting, technology, and outsourcing services. One of the core offerings within its service portfolio is application modernization services. Leveraging its domain expertise, robust methodologies, and cutting-edge technologies, Infosys assists organizations in transforming their legacy applications into modern, agile, and scalable solutions. From legacy system assessment and strategy formulation to execution and support, Infosys offers end-to-end modernization solutions tailored to meet the unique business needs and objectives of its clients. Through a combination of automation, cloud migration, DevOps practices, and agile methodologies, Infosys accelerates the modernization process, enabling clients to improve operational efficiency and drive digital innovation.

Key Application Modernization Services Companies:

The following are the leading companies in the application modernization services market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Accenture

- Infosys

- Cognizant

- Capgemini

- Tata Consultancy Services

- DXC Technology

- HCL Technologies

- Wipro

- NTT DATA Corporation

Recent Developments

-

In January 2024, AveriSource launched the AveriSource Platform 2.0, a solution for analyzing and modernizing applications. This version offers enterprises an enhanced user experience whether they are transitioning from mainframe to cloud or accelerating their modernization efforts. Featuring visually appealing and interactive dashboards, along with comprehensive reporting and analytics, the AveriSource Platform 2.0 provides intelligent guidance throughout every stage of the application modernization process.

-

In January 2024, IBM Corporation acquired application modernization capabilities from Advanced, increasing IBM Consulting's offerings in mainframe application and data modernization services. The acquisition is intended to enhance IBM's ability to provide a comprehensive range of options for modernizing mainframe applications, aligning with the abilities of IBM Watsonx Code Assistant for Z, a generative AI-assisted tool designed to expedite mainframe application modernization.

-

In November 2023, Rocket Software acquired OpenText's Application Modernization and Connectivity business (AMC). AMC offers top-tier tools such as COBOL and host connectivity. These tools enable organizations to utilize their core applications and provide adaptability for modernization, enabling them to operate applications in various environments. Through this acquisition, Rocket Software expands its modernization portfolio to better cater to customer needs, whether on-premises or via a hybrid cloud approach.

-

In November 2023, Kyndryl collaborated with Amazon Web Services (AWS) to streamline customers' efforts in modernizing their mainframe systems. Furthermore, Kyndryl's integration of AWS services with its Kyndryl Bridge open integration platform offers real-time visibility into operational data. This integration facilitates improved planning, utilization, and understanding of mainframe applications and data in the cloud, thereby enhancing overall business outcomes.

-

In September 2023, Rocket Software acquired B.O.S., a software company specializing in data integration solutions. This acquisition enhances Rocket Software's ability to provide organizations with enhanced scalability, flexibility, and security for their existing infrastructure. With tcVISION integrated into Rocket Software's offerings, customers can seamlessly store, manage, control, and replicate data across mainframe, on-premise, and public cloud platforms in nearly real-time. This integration enables customers to leverage the security, availability, and reliability of mainframe systems while harnessing the analytical capabilities of cloud-based tools.

-

In November 2022, Neudesic, an IBM company, partnered with CAST to expedite organizations' application migration and modernization processes onto the Microsoft Azure cloud platform. This partnership enables Neudesic to utilize CAST's products, offering valuable insights into custom-built applications' intricate workings and structural health. These insights are crucial for ensuring swifter and more secure modernization migrations on Microsoft Azure.

Global Application Modernization Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.73 billion |

|

Revenue forecast in 2030 |

USD 52.46 billion |

|

Growth rate |

CAGR of 16.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service Type, deployment, enterprise size, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled |

IBM; Accenture; Infosys; Cognizant; Capgemini; Tata Consultancy Services; DXC Technology; HCL Technologies; Wipro; NTT DATA Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Modernization Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application modernization services marketreport based on service type, deployment, enterprise size, industry vertical, and region:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Application Portfolio Assessment

-

Cloud Application Migration

-

Application Re-Platforming

-

Application Integration

-

UI Modernization

-

Post-Modernization

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprise

-

SMEs

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

Manufacturing

-

IT & Telecommunication

-

Energy and Utilities

-

Healthcare & Life Sciences

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application modernization services market size was estimated at USD 17.80 billion in 2023 and is expected to reach USD 20.73 billion in 2024

b. The global application modernization services market is expected to grow at a compound annual growth rate of 16.7% from 2024 to 2030, reaching USD 52.46 billion by 2030

b. North America dominated the application modernization services market with a revenue share of 39.7% in 2023. Regional growth is attributed to the increasing focus on cybersecurity and data privacy.

b. Some key players operating in the application modernization services market include IBM, Accenture, Infosys, Cognizant, Capgemini, Tata Consultancy Services, DXC Technology, HCL Technologies, Wipro, NTT DATA Corporation

b. Factors such as the increasing need to reduce IT complexity and operational costs are driving the growth of the application modernization services market

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."