Application Integration Market Size, Share & Trends Analysis Report By Offering, By Deployment, By Enterprise Size, By Integration Type, By Application, By Vertical (BFSI, Manufacturing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-425-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Application Integration Market Size & Trends

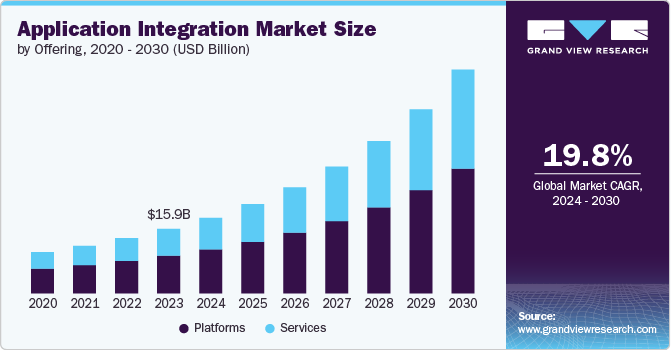

The global application integration market size was valued at USD 15.90 billion in 2023 and is projected to grow at a CAGR of 19.8% from 2024 to 2030. Organizations invest in application integration to streamline business processes, enhance operational efficiency, and support digital transformation initiatives. Integration solutions help organizations automate workflows, reduce manual intervention, and improve efficiency. As businesses adopt more specialized applications, integrating these disparate systems becomes crucial for seamless operations. Integration enables better data synchronization and consistency, improving customer experiences and personalized services.

The shift to cloud-based services and infrastructure requires robust integration solutions to connect cloud applications with on-premises systems. The growing volume of data from various sources necessitates efficient integration to ensure accurate and timely data flow between applications. Integration helps ensure that data across systems adheres to regulatory requirements and industry standards. Advanced integration solutions, particularly Integration Platform as a Service (iPaaS), offer scalable and flexible options that can adapt to changing business needs and technologies. The blending of on-premises, private cloud, and public cloud infrastructures creates complex environments that require seamless integration to ensure smooth operations and data flow.

Businesses require real-time data access and processing to make informed decisions quickly. Integration solutions help ensure that data flows efficiently between systems in real time. The increasing use of APIs (Application Programming Interfaces) to enable communication between applications is driving the need for advanced integration solutions to manage and orchestrate these interactions. Moreover, the rise of IoT devices and the need to integrate the data generated by these devices into existing systems is driving demand for robust integration solutions.

Offering Insights

The platforms segment led the market in 2023, accounting for over 58.0% share of the global revenue. The rise of API-first strategies in software development is driving the need for platforms that can efficiently manage, expose, and integrate APIs across different applications and services. Businesses require real-time data synchronization and processing to enhance decision-making and operational efficiency. Integration platforms are crucial in enabling real-time data flows between different applications. Integration platforms provide built-in security features and compliance management tools, helping organizations meet regulatory requirements and secure data transfers.

The services segment is predicted to foresee the highest growth in the coming years. Organizations require tailored integration services to address their unique IT environments and business needs. Customization drives the demand for professional services that can design, develop, and implement these solutions. As businesses adopt complex multi-cloud and hybrid IT environments, the need for expert services to integrate diverse applications, data sources, and platforms increases. This complexity drives demand for consulting, integration, and managed services.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. Cloud integration solutions offer the scalability needed to accommodate growing volumes of data and expand business operations. They provide flexibility to adapt to changing business needs without the constraints of on-premises infrastructure. Cloud-based integration reduces the need for significant upfront capital investments in hardware and software. The pay-as-you-go model allows businesses to manage costs effectively while accessing powerful integration capabilities.

The on-premises segment is anticipated to exhibit a significant CAGR over the forecast period. Organizations handling sensitive data prefer on-premises solutions to maintain control over data security. Thus, industries with stringent data residency and sovereignty requirements necessitate on-premises deployments. Moreover, organizations with predictable workloads and growth patterns prefer on-premises solutions, as they can scale their infrastructure in a controlled manner without depending on cloud providers.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises have complex and diverse IT environments, often consisting of a mix of legacy systems, cloud applications, and on-premises software. Application integration is crucial for ensuring seamless communication and data flow across these disparate systems. In addition, large enterprises are undergoing digital transformation to stay competitive. This requires integrating new digital technologies with existing systems, making application integration a key enabler of this transformation.

The SME segment is anticipated to exhibit the highest CAGR over the forecast period. SMEs need to be agile to respond quickly to market changes. Flexible and scalable application integration solutions allow them to adapt to new business needs, integrate new tools, and scale operations without significant disruption. Improving customer experience is a priority for many SMEs looking to differentiate themselves in competitive markets. By integrating customer relationship management (CRM) systems, e-commerce platforms, and other customer-facing applications with backend systems, SMEs can provide a seamless and personalized customer experience.

Integration Type Insights

The Integration Platform as a Service (iPaaS) segment accounted for the largest market revenue share in 2023. The widespread adoption of cloud services by organizations of all sizes is a significant driver for iPaaS. As businesses move to the cloud, they need robust integration solutions to connect various cloud-based applications with each other and with existing on-premises systems. Various organizations operate in hybrid environments, with a mix of on-premises and cloud applications. iPaaS platforms are well-suited to support these environments, enabling seamless integration across different platforms and ensuring data consistency and workflow continuity.

The hybrid integration segment is anticipated to exhibit the highest CAGR over the forecast period. Organizations have a mix of legacy on-premises systems and modern cloud-based applications. Hybrid integration solutions enable these organizations to connect and integrate both environments, ensuring seamless data flow and business processes across old and new technologies. Organizations in regulated industries or regions with strict data sovereignty laws often need to keep certain data on-premises while using cloud services for other functions. Hybrid integration helps them maintain compliance by allowing sensitive data to remain on-premises while integrating with cloud-based applications.

Application Insights

The customer relationship management (CRM) segment accounted for the largest market revenue share in 2023. Integrating CRM systems with other applications, such as marketing automation, e-commerce platforms, and customer support tools, helps businesses provide a seamless and personalized customer experience. This integration allows for a unified view of customer interactions and data, improving service quality and customer satisfaction. Integration enables real-time data access across various platforms. Sales teams can get real time customer information and insights, which helps in making timely decisions and responding quickly to customer needs.

The Business Intelligence (BI) segment is anticipated to exhibit the highest CAGR over the forecast period. As organizations generate and collect vast amounts of data from various sources, integrating BI tools with diverse data systems such as databases, cloud storage, and ERP systems is essential for consolidating and analyzing this data effectively. Integration with BI platforms allows for advanced data visualization and reporting capabilities. This helps organizations transform complex data into understandable and actionable insights through dashboards, charts, and reports.

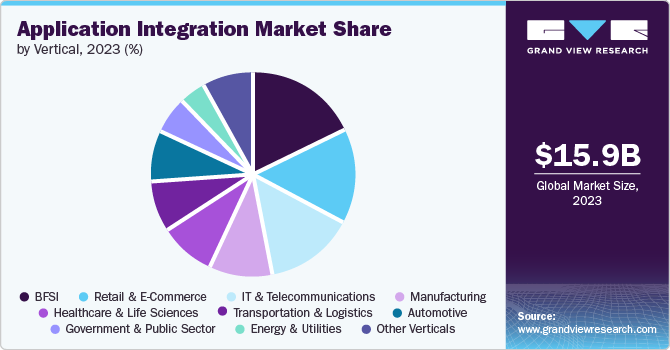

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2023. BFSI organizations need scalable solutions to handle growing transaction volumes and new business demands. Integration platforms provide the flexibility to scale operations and incorporate new services or technologies as needed. By automating and streamlining processes, integration helps reduce operational costs. It also enables better resource allocation and minimizes the need for redundant systems and manual interventions. Moreover, the BFSI industry works with various third-party service providers, such as payment processors and data providers. Integration ensures seamless interaction and data exchange between these external services and internal systems.

The retail & e-commerce segment is anticipated to exhibit the highest CAGR over the forecast period. Retailers provide a seamless shopping experience across multiple channels, such as, online, in-store, and mobile. Integration connects various systems such as, e-commerce platforms, POS systems, and CRM, to ensure consistent product information, inventory levels, and customer data across all touchpoints. Integration with CRM and analytics platforms allows retailers to leverage customer data for personalized marketing and recommendations. This enhances customer engagement and boosts sales by providing tailored promotions and offers based on purchasing behavior and preferences.

Regional Insights

North America application integration market dominated the global industry with a revenue share of over 39.0% in 2023. North America is a hub for technological innovation, with rapid advancements in cloud computing, AI, and machine learning. These technologies are integral to modern application integration, enabling more efficient and intelligent systems. The region has high rates of cloud adoption among businesses of all sizes. Integration solutions are essential for connecting cloud-based applications with on-premises systems, supporting hybrid and multi-cloud environments.

U.S. Application Integration Market Trends

The application integration market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period. Companies in the U.S. are heavily investing in digital transformation initiatives to stay competitive. Application integration plays a crucial role in connecting new digital tools and platforms with existing IT infrastructure. Moreover, the increasing emphasis on data-driven decision-making and business intelligence requires robust integration solutions to consolidate data from diverse sources for comprehensive analysis and reporting.

Europe Application Integration Market Trends

The application integration market in Europe is expected to witness significant growth over the forecast period. European organizations are investing in innovation and research & development. Integration solutions support these efforts by enabling the connectivity and data flow needed for advanced technologies and solutions. There is a strong focus on improving customer experience and personalization. Integration of CRM systems with other applications helps create a unified view of customer interactions, enabling more targeted and effective customer engagement.

Asia Pacific Application Integration Market Trends

The application integration market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The adoption of cloud services is accelerating in APAC. Integration solutions are needed to connect cloud-based applications with on-premises systems, supporting hybrid and multi-cloud environments. The region is a hub for technological innovation, including advancements in artificial intelligence, machine learning, and IoT. Integration is essential for leveraging these technologies and ensuring interoperability across various applications.

Key Application Integration Company Insights

Key application integration companies include Broadcom, Dynatrace, Inc., and GitLab B.V. Companies active in the application integration market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in April 2024, Salesforce, Inc. launched AI-powered integration and automation to its MuleSoft automation, integration, and API management. It enables end users and developers to boost productivity, streamline processes, and quicken the value delivery.

Key Application Integration Companies:

The following are the leading companies in the application integration market. These companies collectively hold the largest market share and dictate industry trends.

- Celigo, Inc.

- Cloud Software Group, Inc.

- Informatica Inc.

- International Business Machines Corporation

- Microsoft

- Oracle

- Salesforce, Inc.

- SAP

- SnapLogic Inc.

- Workato

Recent Developments

-

In July 2024, SnapLogic Inc., partnered with Syndigo LLC, a SaaS commerce data management provider, to enable companies to quickly incorporate Master Data Management (MDM), Product Information Management (PIM), and content syndication solutions throughout their essential data systems and transactional platforms. Through this partnership, Syndigo Inc.'s premier PIM and MDM solutions are easily integrated with a wide range of business applications, data repositories, and operational systems.

-

In February 2024, Encora Digital LLC, digital engineering services provider, partnered with Celigo, Inc. to collaborate Celigo, Inc.'s user-friendly platform with Encora Digital LLC's digital engineering skills, facilitating for seamless integration and enhanced efficiency for corporate clients.

-

In January 2024, International Business Machines Corporation launched the general availability of several new features in the IBM watsonx, AI and data platform. This includes new capabilities such as, IBM watsonx Code Assistant for Z, IBM watsonx Code Assistant for Red Hat Ansible Lightspeed, IBM watsonx Orchestrate, and IBM watsonx Assistant. They are designed for custom applications to automate workflows and are seamlessly integrated with business processes, data, and applications.

Application Integration Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 18.66 billion |

|

Revenue forecast in 2030 |

USD 55.22 billion |

|

Growth Rate |

CAGR of 19.8% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/ billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment, organization size, integration type, application, vertical, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, Australia, South Korea, Brazil, UAE, South Africa, KSA |

|

Key companies profiled

|

Celigo, Inc.; Cloud Software Group, Inc.; Informatica Inc.; International Business Machines Corporation; Microsoft; Oracle; Salesforce, Inc.; SAP; SnapLogic Inc.; and Workato |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Integration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global application integration market report based on offering, deployment, organization size, integration type, application, vertical, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Platforms

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Integration Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Point-To-Point Integration

-

Enterprise Application Integration

-

Enterprise Service Bus

-

Integration Platform as a Service

-

Hybrid Integration

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Customer Relationship Management

-

Enterprise Resource Planning

-

Human Resource Management System

-

Supply Chain Management

-

Business Intelligence

-

Electronic Health Record Management

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail & E-Commerce

-

Manufacturing

-

Healthcare & Life Sciences

-

Energy & Utilities

-

Automotive

-

Transportation & Logistics

-

IT & Telecommunications

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global application integration market size was estimated at USD 15.90 billion in 2023 and is expected to reach USD 18.66 billion in 2024.

b. The global application integration market is expected to grow at a compound annual growth rate of 19.8% from 2024 to 2030 to reach USD 55.22 billion by 2030.

b. North America dominated the application integration market with a share of 39.4% in 2023. North America is a hub for technological innovation, with rapid advancements in cloud computing, AI, and machine learning. These technologies are integral to modern application integration, enabling more efficient and intelligent systems. The region has high rates of cloud adoption among businesses of all sizes. Integration solutions are essential for connecting cloud-based applications with on-premises systems, supporting hybrid and multi-cloud environments.

b. Some key players operating in the application integration market include Celigo, Inc., Cloud Software Group, Inc., Informatica Inc., International Business Machines Corporation, Microsoft, Oracle, Salesforce, Inc., SAP, SnapLogic Inc., and Workato.

b. Organizations invest in application integration to streamline business processes, enhance operational efficiency, and support digital transformation initiatives. Integration solutions help organizations automate workflows, reduce manual intervention, and improve efficiency. As businesses adopt more specialized applications, integrating these disparate systems becomes crucial for seamless operations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."