Application Gateway Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-392-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Application Gateway Market Size & Trends

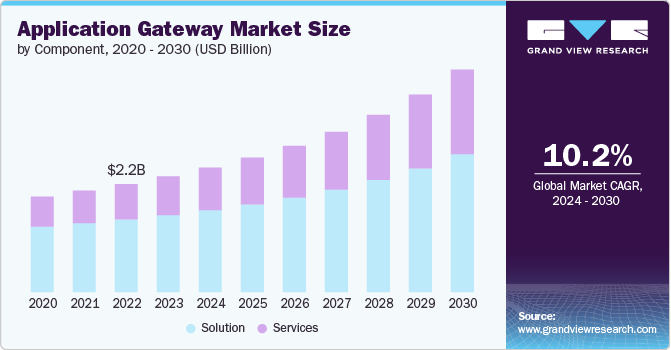

The global application gateway market size was estimated at USD 2.36 billion in 2023 and is expected to grow at a CAGR of 10.2% from 2024 to 2030. As mobile apps, cloud computing, and various user devices proliferate, the demand for secure and efficient application delivery has grown significantly. Application gateways are essential in protecting applications and data by integrating robust security features such as authentication, encryption, and intrusion prevention.

The rising demand for cloud-based and hybrid deployment models for application gateways is a major driver of market growth. Businesses are increasingly looking for flexible solutions that can be tailored to their unique requirements, whether those involve on-premises infrastructure, cloud environments, or a combination of both. This shift towards adaptable application gateway options is propelling market expansion as enterprises seek to leverage the benefits of these customizable and scalable solutions to enhance their security and operational efficiency. This growing preference underscores the need for application gateways that can seamlessly integrate with diverse IT architectures, providing robust protection and performance across various deployment scenarios.

Many enterprises struggle with the complexities of maintaining their application gateway infrastructure, which can lead to suboptimal performance and security vulnerabilities. Therefore, they are turning to service providers who can offer the specialized knowledge and support required to implement, manage, and maintain these systems effectively. These service providers can ensure that application gateways are optimally configured and continuously monitored, providing businesses with reliable performance and robust security without the burden of in-house management.

The rise of emerging technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and Software-Defined Networking (SDN) presents substantial opportunities for the Application Gateway Market. IoT devices generate vast amounts of data that need secure and efficient handling, while AI applications require reliable data processing and security measures. SDN technology, which decouples the control plane from the data plane in networking, demands management of network traffic.

Application gateways are essential in integrating these technologies by providing the necessary security, traffic management, and performance optimization, thereby driving market growth. For instance, in July 2024,Solo.io, a U.S.-based cloud-native networking platform, unveiled the Gloo AI Gateway to meet the increasing demand for AI-driven application development. This cloud-native application networking solution enables organizations to build high-performance, scalable AI applications while integrating seamlessly with existing API management systems. Gloo AI Gateway offers the tools and infrastructure to handle AI-specific tasks, ensuring application reliability and security.

Component Insights

The solution segment dominated the market in 2023 and accounted for a 66.7% share of the global revenue. The growing emphasis on DevOps practices within organizations is contributing to the growth of the solution segment. As companies adopt agile methodologies and continuous integration/continuous deployment (CI/CD) pipelines, they require application gateways that can integrate seamlessly into their development workflows. These gateways facilitate automated deployment, monitoring, and management of applications, enabling faster release cycles and improved collaboration between development and operations teams.

The services segment is projected to witness significant growth from 2024 to 2030. Many organizations are opting to outsource the management of their application gateway infrastructure to specialized service providers to focus on core business functions. Managed services offer comprehensive support, including proactive monitoring, incident response, and routine maintenance, which helps businesses achieve operational efficiency and security without the burden of in-house management. This shift towards outsourcing IT services is fueling the growth of the services segment within the market.

Enterprise Size Insights

The large enterprises segment dominated the market in 2023 and accounted for a 57.9% share of the global revenue due to their heightened focus on security and regulatory compliance. With sensitive data and critical applications at risk, these organizations require advanced security measures to protect against cyber threats. Application gateways provide essential features such as authentication, encryption, and intrusion prevention, enabling large enterprises to safeguard their data and meet stringent regulatory requirements. This commitment to security enhances trust with customers and encourages continuous investment in application gateway solutions.

The small and medium enterprises (SMEs) segment is projected to witness significant growth from 2024 to 2030.SMEs are increasingly pursuing digital transformation to enhance competitiveness and improve customer experiences. As they adopt new digital tools and platforms, the need for secure and efficient application delivery becomes essential. Application gateways facilitate this transformation by enabling seamless integration of applications, ensuring optimal performance, and providing essential security measures, thereby driving adoption among SMEs.

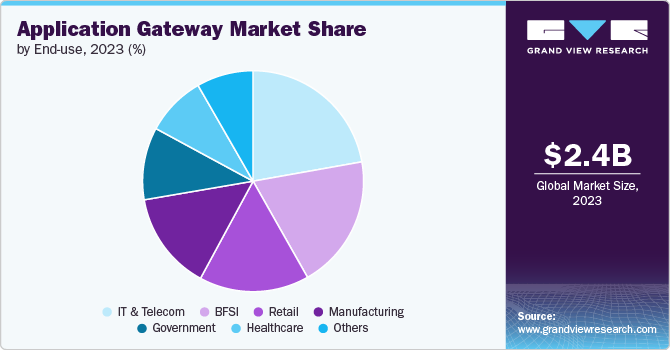

End-use Insights

The IT and telecommunication segment dominated the market in 2023 and accounted for a 22.2% share of the global revenue. The expansion of 5G technology and the ongoing enhancement of network infrastructure drives the growth of the IT and telecommunications segment. With 5G enabling higher speeds, lower latency, and increased connectivity, telecommunication providers require advanced application gateways to manage the complex traffic and diverse applications that accompany this transformation. Application gateways facilitate efficient data flow and service delivery, ensuring that telecom operators can meet the demands of next-generation applications while maintaining optimal performance and reliability.

The BFSI segment is projected to witness significant growth from 2024 to 2030 due to the growth of cybersecurity threats and the growing use of mobile banking applications, making robust security measures essential. Application gateways provide critical features such as encryption, authentication, and intrusion detection, which are vital for protecting sensitive financial data and ensuring compliance with regulatory requirements. As financial institutions prioritize safeguarding customer information and maintaining trust, the demand for sophisticated application gateway solutions continues to rise, driving growth in the BFSI segment. A recent 2024 Chase Digital Banking Attitudes Survey found that 62% of consumers view their mobile banking app as essential, with 78% using it weekly. Users prefer a single app to manage all their financial needs rather than just performing transactions. Younger demographics show a heightened interest in financial health tools, budgeting, including credit monitoring, and saving.

Regional Insights

The North America application gateway market dominated globally in 2023 and accounted for a 36.0% share of the global revenue. The rising number of cybersecurity threats and data breaches in North America has significantly increased the demand for strong application gateways. With a large number of cyber-attacks targeting enterprises, there is a need for solutions that offer comprehensive security features such as authentication, encryption, and intrusion prevention. The heightened focus on cybersecurity compliance and regulatory requirements also contributes to the growing adoption of application gateways.

U.S. Application Gateway Market Trends

The application gateway market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The rapid growth of cloud computing and the widespread use of mobile applications are major drivers for the market. Businesses are increasingly adopting cloud-based services to enhance scalability, flexibility, and cost efficiency. This shift necessitates robust application gateways to ensure secure and seamless data transmission across diverse platforms. Similarly, the proliferation of mobile applications requires reliable and secure gateways to manage traffic, authenticate users, and protect sensitive data. As organizations prioritize digital transformation, the demand for application gateways continues to surge.

Asia Pacific Application Gateway Market Trends

The application gateway market in Asia Pacific is expected to grow at the fastest CAGR of 12.0% from 2024 to 2030. The proliferation of Internet of Things (IoT) devices and the development of smart city initiatives across the Asia Pacific are significantly contributing to the growth of the market. IoT devices generate vast amounts of data that require secure and efficient management. Application gateways play a vital role in ensuring the security and performance of IoT ecosystems by managing data traffic and preventing unauthorized access. In addition, smart city projects, which aim to enhance urban infrastructure and services through technology, rely heavily on robust application delivery mechanisms.

Europe Application Gateway Market Trends

The application gateway market in the Europe region is expected to witness notable growth from 2024 to 2030, driven by several key factors. The widespread adoption of cloud services and the emergence of hybrid IT environments drives the market in Europe. As organizations migrate to cloud platforms and integrate on-premises infrastructure with cloud-based services, the demand for flexible and scalable application gateways increases. These gateways facilitate secure and efficient data flow between diverse environments, ensuring consistent application performance and security. The ability to support complex hybrid architectures makes application gateways indispensable, contributing significantly to market expansion.

Key Application Gateway Company Insights

Key players operating in the market include Akamai Technologies, Avi Networks, Barracuda Networks, Inc., Cloud Software Group, Inc., F5, Inc., Forcepoint, Fortinet, Inc., Imperva, Juniper Networks, Inc., Microsoft, Orange Business, Palo Alto Networks Inc., Progress Software Corporation, SAP SE, and Zscaler Inc.

-

In July 2024, Microsoft announced the launch of Azure Application Gateway for Containers, a new SKU in the application gateway offerings. This solution combines Application Gateway with the Application Gateway Ingress Controller (AGIC), offering layer seven load balancing and traffic management for workloads within Kubernetes clusters. Additionally, it introduces Gateway API support for a more expressive and role-based approach to Kubernetes service networking, as well as enabling weighted and split traffic distribution for blue-green deployments and various routing strategies.

-

In December 2023, IBM announced a definitive agreement to acquire StreamSets and webMethods from Software AG, which is primarily owned by Silver Lake, a U.S.-based technology investment firm. This acquisition is expected to enhance IBM's AI and data platform, watsonx, by integrating StreamSets' data ingestion capabilities, while webMethods provide clients and partners with advanced integration and API management tools for hybrid multi-cloud environments. webMethods serves as a comprehensive integration and API management platform, available for deployment both on-premises and in the cloud, offering features such as B2B integration, managed file transfer, and a modern API gateway for managing, monitoring, and monetizing APIs.

Key Application Gateway Companies:

The following are the leading companies in the application gateway market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- Avi Networks

- Barracuda Networks, Inc.

- Cloud Software Group, Inc.

- F5, Inc.

- Forcepoint

- Fortinet, Inc.

- Imperva

- Juniper Networks, Inc.

- Microsoft

- Orange Business

- Palo Alto Networks Inc.

- Progress Software Corporation

- SAP SE

- Zscaler Inc.

Application Gateway Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.53 billion |

|

Revenue forecast in 2030 |

USD 4.53 billion |

|

Growth rate |

CAGR of 10.2% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Base year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Akamai Technologies; Avi Networks; Barracuda Networks, Inc.; Cloud Software Group, Inc.; F5 Inc.; Forcepoint; Fortinet, Inc.; Imperva; Juniper Networks, Inc.; Microsoft; Orange Business; Palo Alto Networks Inc.; Progress Software Corporation; SAP SE; Zscaler Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Gateway Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application gateway market report based on component, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Manufacturing

-

Government & Public Sector

-

IT & Telecommunication

-

Retail

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application gateway market size was estimated at USD 2.36 billion in 2023 and is expected to reach USD 2.53 billion in 2024.

b. The global application gateway market is expected to grow at a compound annual growth rate of 10.2% from 2024 to 2030 to reach USD 4.53 billion by 2030.

b. The solution segment dominated the market in 2023 and accounted for 66.7% of global revenue. The growing emphasis on DevOps practices within organizations contributed to its growth.

b. Some key players operating in the application gateway market include Akamai Technologies, Avi Networks, Barracuda Networks, Inc., Cloud Software Group, Inc., F5, Inc., Forcepoint, Fortinet, Inc., Imperva, Juniper Networks, Inc., Microsoft, Orange Business, Palo Alto Networks Inc., Progress Software Corporation, SAP SE, and Zscaler Inc.

b. As mobile apps, cloud computing, and various user devices proliferate, the demand for secure and efficient application delivery has grown significantly. Application gateways protect applications and data by integrating robust security features such as authentication, encryption, and intrusion prevention.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."