Application Container Market Size, Share & Trends Analysis Report By Service, By Deployment (Hosted, On-premise), By Enterprise Size (SME, Large Enterprises), By End-use (BFSI, Education), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-796-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Application Container Market Size & Trends

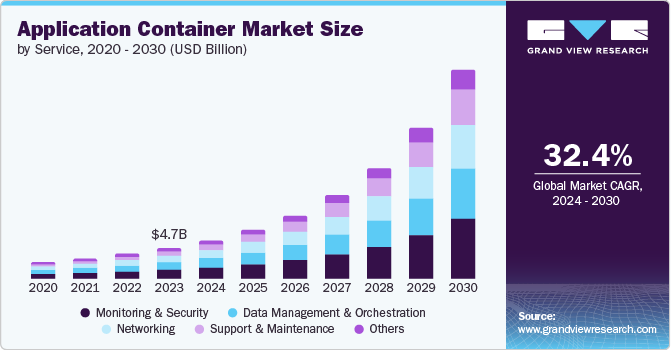

The global application container market size was estimated at USD 5.85 billion in 2024 and is anticipated to grow at a CAGR of 33.5% from 2025 to 2030. The application container market is experiencing significant growth due to the increasing adoption of cloud-native technologies, DevOps practices, and microservices architectures. Application containers have revolutionized software development by offering lightweight, portable, and scalable solutions that enable organizations to deploy applications efficiently across different environments. Businesses are shifting away from traditional monolithic applications toward containerized applications, allowing for faster development, improved resource utilization, and seamless deployment across on-premise, cloud, and hybrid environments.

The growing demand for DevOps and agile software development is driving market growth. Organizations are increasingly adopting DevOps methodologies to accelerate application development, deployment, and updates. Application containers facilitate continuous integration and continuous deployment (CI/CD) by enabling developers to package applications with all their dependencies, ensuring consistency across different environments. This leads to faster development cycles, reduced deployment failures, and improved operational efficiency, making containers a critical component of modern software development pipelines. According to a report published by the Continuous Delivery Foundation (CDF), 83% of developers participated in DevOps-related activities during the first quarter of 2024. This marks a 6% increase compared to 2022, when DevOps involvement stood at 77%.

Additionally, the rising adoption of microservices architecture is driving the adoption of applications. Traditional monolithic applications are difficult to scale and maintain, leading businesses to shift toward microservices-based architectures where applications are broken down into smaller, independent services. Application containers provide the ideal environment for running microservices, allowing organizations to scale services independently, improve fault isolation, and enhance resource efficiency. With leading enterprises, startups, and cloud providers investing heavily in microservices, the demand for application containers continues to grow.

According to a report by O’Reilly, over 90% of companies have either adopted or plan to adopt microservices, highlighting their growing importance in modern software development. This shift has led to substantial improvements in productivity, with research from DevOps Research and Assessment (DORA) indicating a 60% increase in productivity among businesses that have implemented microservices. Furthermore, Research from IBM revealed that businesses experienced a 30% increase in customer retention and a 29% reduction in time-to-market after integrating microservices into their IT infrastructure.

The rapid adoption of multi-cloud and hybrid cloud strategies is also propelling the growth of the application container market. Organizations are increasingly using multiple cloud providers to avoid vendor lock-in, improve redundancy, and optimize costs. Application containers enable seamless application deployment across public, private, and hybrid cloud environments, ensuring portability and flexibility. Kubernetes, the leading container orchestration platform, has further simplified multi-cloud management by providing automated scaling, load balancing, and resource optimization, making containers a preferred choice for businesses adopting hybrid cloud strategies.

Service Insights

The monitoring & security segment accounted for the highest revenue share of over 31.0% in 2024. The dynamism and complexity of containerized applications require robust monitoring solutions to ensure optimal performance, detect anomalies, and prevent disruptions. As organizations progressively adopt containerization to accelerate application delivery, safeguarding containerized workloads against vulnerabilities and threats becomes vital. Security solutions are essential to protect sensitive data and maintain system integrity. Hence, substantial resources are dedicated to monitoring and security to mitigate the potential problems arising out of the complex nature of containerization, leading to segment growth.

The support and maintenance segment is expected to register a significant CAGR during the forecast period. Proactive support and maintenance are essential to prevent application downtime and performance degradation. These services involve monitoring container health, troubleshooting issues, and implementing performance optimizations. Furthermore, containerized environments present unique security challenges. Support and maintenance providers offer expertise in securing containers, mitigating vulnerabilities, and ensuring compliance with industry regulations.

Deployment Insights

The on-premise segment held the largest revenue share of over 59.0% in 2024. On-premise deployment is expected to contribute significantly to market revenue during the forecast period. Stringent data privacy regulations require robust security measures for organizations handling sensitive data, such as financial institutions and government agencies. On-premise deployment offers greater control over data security infrastructure, enabling compliance with industry-specific standards. Moreover, this deployment type allows organizations complete control over their IT environment, allowing for greater flexibility and customization in application management. Thus, concerns regarding enhanced security and customization aid in driving steady segment growth.

Hosted deployment is expected to register a CAGR of 35.7% during the forecast period. By leveraging cloud-based platforms, organizations can eliminate substantial costs and complexities associated with managing and maintaining on-premises infrastructure, such as computer hardware and data processing systems. Hosted deployment offers greater scalability, enabling businesses to adjust resource allocation based on fluctuating workloads rapidly. This elasticity ensures optimal performance and cost efficiency for organizations with limited capital, accounting for a higher share of this segment.

Enterprise Size Insights

The large enterprises segment held the largest revenue share of over 61.0% in 2024. These organizations possess complex IT landscapes consisting of numerous applications and systems. Application containers offer an efficient method to package, deploy, and manage these applications, thus streamlining operations and enhancing scalability. Additionally, large enterprises have significant financial capital to invest in advanced technologies, such as application container platforms. They can afford the utilization of skilled personnel required to operate these services. These factors lead to the dominance of this segment in the overall market share.

The SME segment is expected to register the highest CAGR from 2025 to 2030. Application containers offer SMEs a cost-effective solution for application development and deployment, eliminating the need for extensive computer hardware and infrastructure investments. SMEs are leveraging cloud-based services at a faster pace, and application containers cater to all the requirements of cloud environments. This functional collaboration has accelerated container adoption among small and medium enterprises in recent years, boosting segment expansion.

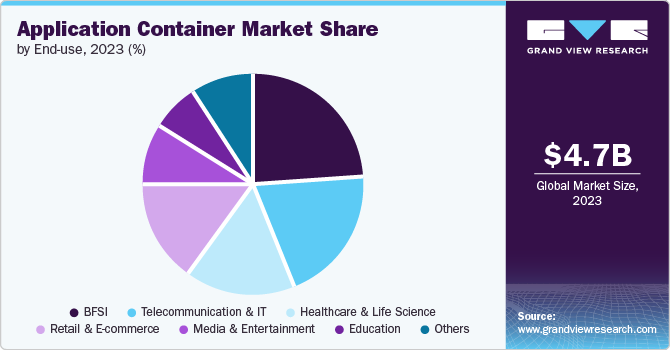

End-use Insights

The BFSI segment dominated the market and accounted for a revenue share of over 23.0% in 2024. The BFSI sector has undergone rapid and extensive digital transformation to enhance customer experience, operational efficiency, and risk management. Application containers provide the necessary agility and scalability to support these initiatives. The sector is under stringent regulatory frameworks by governments and supervisory bodies. Application containers offer a reliable platform for developing and deploying applications that adhere to these complex compliance requirements, leading to their widespread adoption in this industry.

The education segment is anticipated to register the highest CAGR during the forecast period. This is owing to the increasing adoption of digital technologies in this field, which demands extensive and scalable IT infrastructure. Application containers offer an efficient solution for deploying and managing educational applications, enhancing operational efficiency and flexibility. Furthermore, application containers provide a cost-effective solution for educational institutions by optimizing resource utilization and reducing infrastructure expenses when installing computer hardware networks. These factors are expected to propel the widespread adoption of containerization solutions in education.

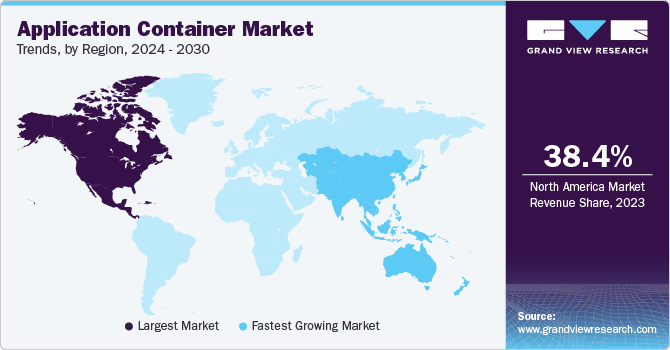

Regional Insights

North America application container market dominated the global market with a revenue share of over 37.0% in 2024. With a robust infrastructure and a mature ecosystem of cloud service providers, the region has experienced a surge in cloud computing adoption. This early adoption has ensured a fertile ground for container technology, as application containers are intrinsically linked to cloud-native architectures. Moreover, the region has numerous technology giants that have been instrumental in driving containerization. These companies have invested heavily in research and development, leading to significant advancements in containerization technologies and their applications.

U.S. Application Container Market Trends

The application container industry in the U.S. dominated in 2024. The country has a well-developed IT infrastructure, including robust data centers and high-speed networks, which are essential for efficient container deployment and management. A thriving venture capital landscape in the U.S. has fueled innovations in the container technology space, with substantial investments in startups developing cutting-edge container solutions. Moreover, the presence of mature players such as Google, Amazon Web Services (AWS), and others is driving the country's market growth.

Europe Application Container Market Trends

The Europe application container market held a notable revenue share in 2024. This share is primarily owing to the efficiency offered by containerization. For instance, containers run on cloud-based technology compared to outdated application deployments, requiring fewer physical computer and data storage systems. It aligns perfectly with the European Union’s focus on finding and deploying sustainable alternatives instead of energy-consuming hardware. Additionally, the inherent portability offered by containers appeals to a more extensive organizational base, leading to increased demand from the region.

The application container market in the UK accounted for a considerable revenue share in Europe in 2024. The suitability of containers in DevOps methodologies and automation has led to heightened demand from organizations in the UK. Furthermore, the scalability offered by containers using orchestration tools has helped address the workload distribution issue. The high operating speeds of containers have proved beneficial for cost control and optimization. These factors have led to a steady demand for this solution from organizations in the country, leading to market growth.

France application container industry is expected to grow rapidly during the forecast period. The rise of edge computing and hybrid cloud deployments is influencing the application container market in France. With industries like automotive, telecommunications and smart cities embracing the Internet of Things (IoT) and 5G technologies, there is a growing need for lightweight, portable, and efficient computing solutions. Containers help deploy and manage applications at the edge, reducing latency and improving real-time data processing capabilities. This trend is expected to accelerate further the demand for application containers in telecom networks, industrial automation, and AI-driven applications.

Asia Pacific Application Container Market Trends

The application container market in the Asia Pacific is expected to register the fastest growth rate during the forecast period. The region is experiencing the emergence of a vibrant start-up ecosystem characterized by innovation and agility. Application containers align with these businesses' rapid development and deployment requirements, fostering market expansion. Furthermore, governments of several regional economies have introduced supportive policies to promote the digital economy and cloud computing, creating a conducive environment for application container adoption.

China application container market accounted for a considerable market share in Asia Pacific in 2024.The rapid expansion of DevOps and agile development methodologies is driving market growth in the country. Chinese enterprises are increasingly adopting continuous integration and continuous deployment (CI/CD) pipelines, where containerization plays a crucial role in streamlining software development, testing, and deployment. By using application containers, DevOps teams can package software with all its dependencies, ensuring consistent performance across different computing environments. This enhances operational efficiency and reduces software delivery time, making containerization a preferred approach for companies looking to maintain a competitive edge in the market.

The application container industry in India is expected to grow rapidly during the forecast period. The economy offers a large pool of IT talent at competitive costs, making it an optimal destination for technology-driven businesses and contributing to the growth of the application container market. Additionally, a surge in cloud computing adoption provides a fertile ground for containerized applications. Cloud service providers in India are investing heavily in container-based services, driving market growth.

Key Application Container Company Insights

The market has a consolidated competitive landscape featuring several global and regional players. Industry players are undertaking strategies such as new developments related to product launches, product updates, partnerships, mergers & acquisitions, and collaborations to survive the highly competitive environment and expand their business footprints. Some key players operating in the market include IBM, Microsoft, and Google LLC, among others.

-

Google LLC offers services in computer software, search engine solutions, online advertising, video streaming, e-commerce, artificial intelligence, and several related fields. The company designed the open-source container orchestration platform Kubernetes, which acts as a platform for managing containerized applications. It simplifies application management by handling routine tasks such as deployment, scaling, and monitoring. Additionally, Google offers a wide range of cloud services for application containerization, such as Borg and Docker (a PaaS software).

-

Microsoft is a U.S.-based multinational computer software company that is well-known for its services in operating systems and Microsoft Office tools. Apart from these, Microsoft offers cloud-based solutions such as Azure. Azure offers over 200 products and application management services such as Azure Kubernetes Services (AKS) for developing and deploying cloud-based applications, Azure app services for creating web and mobile-based apps, Azure Functions, Azure Container Instances, Azure Spring apps, and several related solutions and platforms.

Sysdig, Inc. and Perforce Software, Inc.are some emerging market participants in the target market.

-

Perforce Software, Inc. is a U.S. company specializing in the development of software solutions that support application development and management. The company's flagship product, Perforce Helix Core, is a version control system that efficiently handles large codebases, supporting both centralized and distributed workflows. Perforce offers a comprehensive suite of tools encompassing web-based repository management, developer collaboration, application lifecycle management, web application servers, debugging tools, platform automation, and agile planning software. These integrated solutions cater to diverse industries, including gaming, automotive, financial services, and healthcare, facilitating streamlined development processes and enhanced operational efficiency.

Key Application Container Companies:

The following are the leading companies in the application container market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Broadcom

- Joyent

- Rancher

- SUSE

- Sysdig, Inc.

- Perforce Software, Inc.

Recent Developments

-

In July 2024, Broadcom announced that Nordnet is expected to utilize its VMware Tanzu Platform for building critical connectivity infrastructure in rural France. VMware is a subsidiary of Broadcom that provides services in cloud solutions and virtualization technology. This development is expected to help Nordnet manage its microservices, allowing the company to meet its cost and service commitments.

-

In June 2024, SUSE acquired StackState to integrate StackState into Rancher Prime, SUSE’s premium container management service. The company aims to enhance cloud-native observability for enterprises. With this integration, StackState’s application monitoring will be embedded directly into Rancher Prime. This will enable customers to proactively safeguard user experience, improve cross-team collaboration and innovation, and consolidate their cloud-native applications into a single view spanning the data center, the Edge, and the cloud.

-

In March 2024, Jenzabar, an educational software technology firm, announced its strategic partnership with Google Cloud. As per the agreement, Jenzabar will integrate its solutions with Google Cloud to containerize its applications and run them securely on Google Kubernetes Engine. Besides this, the company would also leverage Google Cloud’s AI solutions to make its applications AI-ready and its security solutions for protection against cyberattacks.

Application Container Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 7.44 billion |

|

Revenue forecast in 2030 |

USD 31.50 billion |

|

Growth rate |

CAGR of 33.5% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

IBM; Amazon Web Services, Inc.; Microsoft; Google LLC; Broadcom; Joyent; Rancher; SUSE; Sysdig, Inc.; Perforce Software, Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Application Container Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application container market report based on service, deployment, enterprise size, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Monitoring & Security

-

Data Management & Orchestration

-

Networking

-

Support & Maintenance

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Healthcare & Life Science

-

Education

-

Retail & E-commerce

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. BFSI segment accounted for a significant revenue share of 23.6% in 2024 and is projected to continue its dominance throughout the forecast period. The rising focus of financial institutions on providing support to improve the overall customer retention rate and provide seamless technical support is driving segment growth. The growing popularity of remote working has fueled the market growth in the BFSI industry.

b. Some key players operating in the application container market include Accenture plc; Adobe Systems Inc.; Broadcom, Inc.; Cisco Systems, Inc.; Dell EMC; Dempton Consulting Group; Google Inc.; Happiest Minds; Hewlett Packard Enterprise Co.; International Business Machines Corporation; Kellton Tech Solutions Ltd.; Microsoft Corporation; Salesforce, Inc.; SAP SE; and TIBCO Software

b. The global application container market size was estimated at USD 5.85 billion in 2024 and is expected to reach USD 7.44 billion in 2025.

b. The global application container market is expected to grow at a compound annual growth rate of 33.5% from 2025 to 2030 to reach USD 31.50 billion by 2030

b. Key factors that are driving the market growth include growing adoption of cutting-edge technologies such as cyber security, Artificial Intelligence (AI), big data analytics, Business Intelligence (BI), and cloud, which sparked transformation and innovation in the business environment, resulting in increased revenue.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."