- Home

- »

- Plastics, Polymers & Resins

- »

-

Appliance Adhesive Market Size And Share Report, 2030GVR Report cover

![Appliance Adhesive Market Size, Share & Trends Report]()

Appliance Adhesive Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Rubber, Acrylic, Silicone), By Application (Washing Machine, Cooktops, Air Conditioners, Microwaves & Ovens), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-462-4

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Appliance Adhesive Market Size & Trends

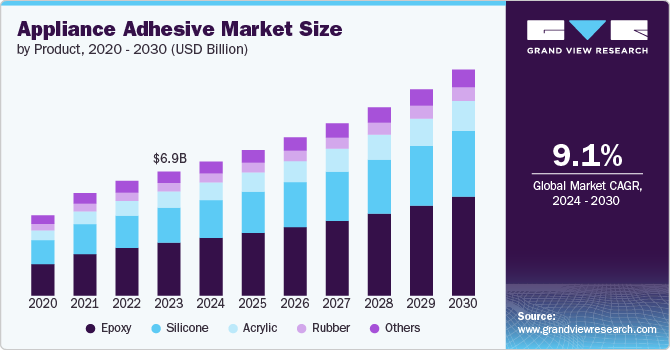

The global appliance adhesive market size was estimated at USD 6.93 billion in 2023 and is expected to grow at a CAGR of 9.1% from 2024 to 2030. The market is being driven by a combination of factors, including consumer preferences, technological advancements, environmental concerns, and industry trends. Consumers are increasingly seeking appliances that are durable, long-lasting, and energy-efficient. The development of eco-friendly and sustainable adhesives is driving market growth.

Additionally, advancements in adhesive technology, such as innovative formulations and customized solutions, contribute to market growth. The expanding construction and renovation market, both residential and commercial, is also a significant driver for the market.

To cater to evolving consumer needs, manufacturers have increased their focus on developing adhesives tailored to specific industries. The global automotive sector's growth has spurred demand for electronics adhesives, which are used in various applications, including LED packaging, power electronics modules, anti-theft systems, engine status displays, and collision avoidance systems.

The rising demand for energy-efficient appliances is a major force behind the growth of the global market. As they become more conscious of environmental sustainability, consumers increasingly choose appliances that consume less energy. This trend will persist as governments worldwide implement stricter energy efficiency regulations.

Appliance adhesives play a crucial role in ensuring that appliances meet these energy efficiency standards. By sealing gaps and seams, these products prevent air and heat leakage, improving overall appliance efficiency and reducing energy consumption. Consequently, the increasing demand for energy-efficient appliances is a key factor driving the global market expansion.

Product Insights

Based on product, the market is segmented into rubber, silicone, epoxy, and acrylic. The epoxy segment dominated the market with the largest revenue share in 2023. Epoxy is a versatile adhesive and coating material widely used in appliance manufacturing due to its excellent bonding properties, durability, and resistance to various environmental factors. It is also used as an insulating material in appliances, particularly electrical components. Its dielectric properties help prevent electrical short circuits and ensure safe operation. Epoxy encapsulates electronic components within appliances, protecting them from moisture, dust, and mechanical shock, improving their reliability and lifespan.

Acrylic is a versatile material commonly used in appliances due to its durability, resistance to scratches and stains, and ease of maintenance. These create transparent or translucent panels in appliances like refrigerators, ovens, and dishwashers, allowing users to see the contents inside without opening the door. Acrylic is used to manufacture various appliance components, such as knobs, handles, and control panels. Its lightweight and durable nature makes it ideal for these applications.

Rubber isolates appliances from vibrations, reducing noise and preventing damage to sensitive components. This is particularly important in appliances like washing machines and refrigerators. Rubber handles and knobs provide a comfortable and non-slip grip for users. They are also resistant to wear and tear, ensuring long-lasting performance. It absorbs appliance shocks and impacts, protecting delicate components and preventing damage.

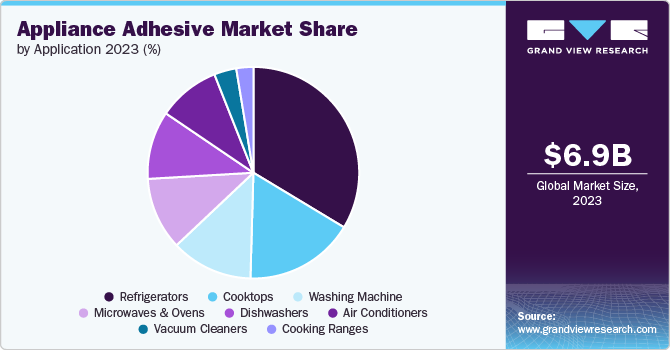

Application Insights

Based on application, the market is segmented into washing machines, refrigerators, air conditioners, cooking ranges, cooktops, vacuum cleaners, dishwashers, microwaves, & ovens. Refrigerators dominated the market with the largest revenue share in 2023. Adhesives play a crucial role in the construction and assembly of refrigerators, ensuring the structural integrity, insulation, and overall performance of these appliances. They are used to bond the various components of the refrigerator cabinet, such as the sides, top, bottom, and door. They are used to bond polyurethane foam insulation to the interior walls of the refrigerator cabinet, ensuring effective insulation and preventing heat transfer.

Adhesives are essential for constructing, assembling, and performing air conditioners. They provide structural integrity, insulation, sealing, and vibration damping, ensuring these appliances function efficiently and effectively. They also bond the various components of the washing machine cabinet, such as the top, bottom, sides, and door. They also attach internal components, like the drum, motor, and tub, to the cabinet. Finally, they attach shelves, drawers, and other accessories to the washing machine interior.

Regional Insights

North America appliance adhesive marketis growing due to the emphasis on sustainability in the region, which drives the demand for eco-friendly and sustainable adhesives for appliance manufacturing. Consumers are increasingly opting for energy-efficient appliances to reduce their environmental impact and utility bills, leading to a higher demand for product used in the construction of these appliances.

Government regulations on energy efficiency and product safety have influenced the use of adhesives in appliances, driving demand for specific types of adhesives that meet these standards. The overall economic growth in North America has led to increased consumer spending on appliances, driving market demand.

U.S. Appliance Adhesive Market Trends

As the people invest more in their homes and appliances, the demand for adhesives to secure and repair these appliances is growing. More people are opting to repair their appliances themselves rather than calling professionals. This trend has led to a higher demand for adhesives. Manufacturers are also developing specialized adhesives that are more durable, versatile, and easy to use, catering to the needs of both professionals and DIY enthusiasts.

Asia Pacific Appliance Adhesive Market Trends

The appliance adhesive market in Asia Pacific held a revenue share of 52.8% of the global industry in 2023 and is expected to grow at a significant rate over the forecast period. The region's strong economic growth has led to a surge in demand for appliances, driving the need for the product in their production. Consumers are becoming more aware of the importance of appliance quality and durability, leading to a preference for high-performance adhesives. Advances in appliance technology, such as smart appliances and IoT-enabled devices, require specialized adhesives for their assembly and components.

Europe Appliance Adhesive Market Trends

The appliance adhesive market in Europe is growing as the European Union (EU) has implemented stringent regulations regarding energy efficiency and product safety, which influence the use of adhesives in appliances. Manufacturers must comply with these regulations to sell their products in the European market. A growing focus on sustainability in Europe is driving the demand for eco-friendly and sustainable adhesives for appliance manufacturing.

Central & South America Appliance Adhesive Market Trends

The appliance adhesive market in the Central & South America region is experiencing rapid economic growth, leading to a surge in demand for appliances, especially in urban areas. As disposable incomes increase, consumers purchase more appliances, fueling market growth. Trade agreements between countries in the region have facilitated the movement of goods, including appliance adhesives, contributing to market growth.

Key Appliance Adhesive Company Insights

Some of the key players operating in the market are 3M and Sika AG:

-

3M is a global diversified technology company known for its innovative products and solutions. Founded in 1902, 3M has a long history of applying science and innovation to create products that improve lives and communities around the world.

-

Sika AG is a Swiss multinational specialty chemicals company. It is one of the world's largest manufacturers of adhesives, sealants, and waterproofing products. Sika specializes in solutions for the construction, industrial, and automotive markets.

RPM International Inc. and Wacker Chemie AG are some of the emerging participants in the market.

-

RPM International Inc. is a global leader in the specialty chemicals industry, primarily focused on coatings, sealants, and building materials. The company offers a wide range of products used in various applications, including construction, industrial, and consumer markets.

-

Wacker Chemie AG is a German chemical company that specializes in silicones, polyvinyl acetate (PVAc), and hyperpure polysilicon. Founded in 1914, Wacker is one of the world's leading producers of these materials.

Key Appliance Adhesive Companies:

The following are the leading companies in the appliance adhesive market. These companies collectively hold the largest market share and dictate industry trends.

- Pidilite Industries Ltd.

- Arkema

- Wacker Chemie AG

- Huntsman International LLC

- RPM International Inc.

- H.B. Fuller Company

- Henkel Corporation

- 3M

- Sika AG

- Dow

Recent Developments

- In May 2024, Arkema acquired Dow’s flexible packaging laminating adhesives business, one of the leading producers of adhesives for the flexible packaging market, generating annual sales of around US$250 million.

Appliance Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.5 billion

Revenue forecast in 2030

USD 12.6 billion

Growth Rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Pidilite Industries Ltd., Arkema , Wacker Chemie AG, Huntsman International LLC, RPM International Inc., H.B. Fuller Company, Henkel Corporation, 3M , Sika AG, Dow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Appliance Adhesive Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the appliance adhesive market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rubber

-

Acrylic

-

Silicone

-

Epoxy

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Washing Machine

-

Cooktops

-

Cooking Ranges

-

Dishwashers

-

Refrigerators

-

Air Conditioners

-

Microwaves & Ovens

-

Vacuum Cleaners

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the appliance adhesives market include Pidilite Industries Ltd., Arkema, Wacker Chemie AG, Huntsman International LLC, RPM International Inc., H.B. Fuller Company, Henkel Corporation, 3M, Sika AG, Dow

b. Key factors that are driving the market growth include consumer preferences, technological advancements, environmental concerns, and industry trends

b. The global appliance adhesive market size was estimated at USD 6.93 billion in 2023 and is expected to reach USD 7.5 billion in 2024.

b. The global appliance adhesive market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 12.6 billion by 2030.

b. Asia Pacific dominated the appliance adhesive market with a share of 52.8% in 2023. This is attributable to rising awareness among consumers about the importance of appliance quality and durability, leading to a preference for high-performance adhesives

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.