- Home

- »

- Clothing, Footwear & Accessories

- »

-

Apparel Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Apparel Market Size & Forecast Value Report By Category (Mass, Premium, Luxury), By End Use, By Distribution Channel (Online, Offline (Hypermarkets & Supermarkets, Clothing Stores, Others)), And Segment Forecasts, 2025 - 2030Report]()

Apparel Market (2025 - 2030) Size & Forecast Value Report By Category (Mass, Premium, Luxury), By End Use, By Distribution Channel (Online, Offline (Hypermarkets & Supermarkets, Clothing Stores, Others)), And Segment Forecasts

- Report ID: GVR-4-68040-264-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Apparel Market Summary

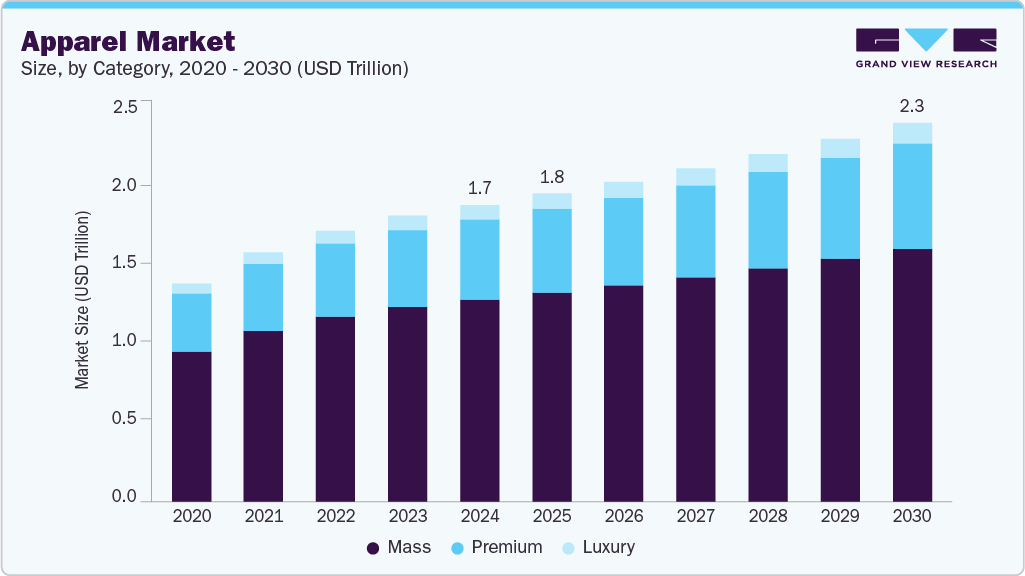

The global apparel market size was valued at USD 1.77 trillion in 2024 and is projected to reach USD 2.26 trillion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The increasing expenditure on apparel by customers worldwide is a key factor driving the market growth.

Key Market Trends & Insights

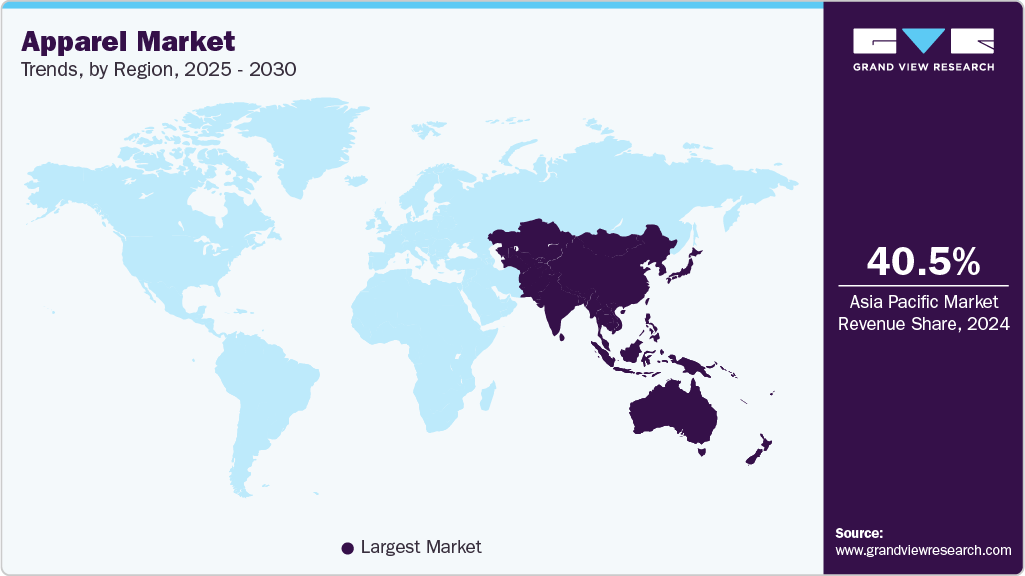

- Asia Pacific dominated the global industry with a revenue share of 40.5% in 2024.

- The U.S. held the largest revenue share of the regional industry in 2024.

- Based category, the mass segment dominated the global industry with a revenue share of 68.0% in 2024.

- By end use, women segment held the largest revenue share of the global market in 2024.

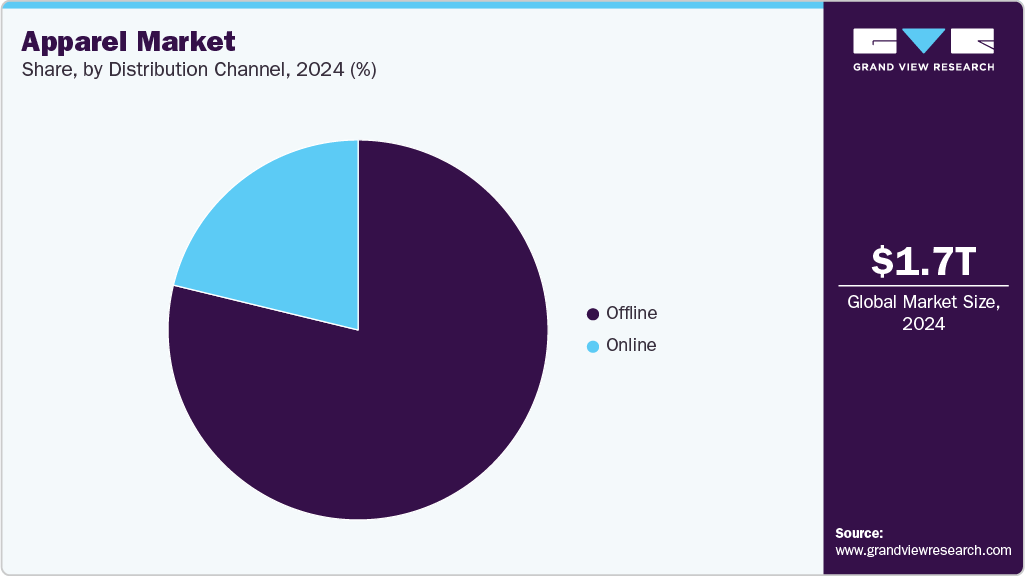

- By distribution channel, the offline segment accounted for the largest revenue share of the global industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.77 Trillion

- 2030 Projected Market Size: USD 2.26 Trillion

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

According to the U.S. Bureau of Labor Statistics, in 2023, the average annual per household expenditure for women’s apparel was approximately USD 655, and USD 406 for men’s apparel. Availability of products through online distribution, increasing market penetration of e-commerce websites, and a large number of collections launched by the key market players are anticipated to drive further growth over the forecast period.

In addition, the increasing disposable income among consumers in emerging economies is significantly driving the global apparel market. Emerging economies such as China, India, Brazil, and others are experiencing rapid urbanization, industrialization, and economic growth, enabling the middle class with higher purchasing power. This demographic shift is fueling a surge in demand for clothing and accessories as consumers seek to upgrade their wardrobes, follow fashion trends, and improve their lifestyles.

Growing consumer demand for sustainable and environmentally friendly products, including apparel, is likely to develop growth trends for this market. Consumers have become conscious of the environmental impact of consumption patterns and materials used in manufacturing. As a result, they are actively seeking out clothing that is sustainably and ethically produced, utilizing eco-friendly materials such as organic cotton, recycled fabrics, and other innovative alternatives. Consumers are urging brands to adopt transparent supply chains, minimize waste, and enforce fair labor practices to meet this demand. Embracing process sustainability is essential for individuals and businesses to lessen their environmental footprint and contribute to a more sustainable future. Sustainable practices mitigate negative ecological, social, and economic impacts while promoting long-term well-being and resilience.

Over the past decade, the apparel industry has witnessed a significant trend related to the emergence of Direct-to-Consumer (D2C) brands. These brands sell their products directly to consumers, eliminating traditional intermediaries, including wholesalers, retailers, or distributors. With the increasing digitalization and prevalence of e-commerce, D2C brands have found favorable conditions to thrive and reshape the apparel industry. Offering competitive pricing, enhanced customer experiences, and customized products and services tailored to individual preferences, D2C brands have garnered significant attention and consumer loyalty.

Social media has greatly influenced fashion preferences, shaping consumer choices and shopping preferences. Through platforms such as Instagram and Facebook, consumers across the globe have easy access to a wide range of fashion content posted by influencers, bloggers, and celebrities. This enhanced accessibility has sparked a growing interest in exploring various styles and experimenting with new looks among consumers. Influencers use social media to showcase multiple fashion trends, offering inspiration and guidance on incorporating these styles into everyday or special occasion attire. In addition, through endorsements, numerous celebrities are popularizing the trend of wearing traditional ethnic attire for weddings and other events.

Innovations in various processes, including manufacturing, designing, display, and distribution, are projected to influence the growth of this market. In recent years, technology advancements have enabled key players to adopt practices that ensure improved brand visibility, enhanced customer engagement, and increased customer interactions. For instance, in June 2023, Google launched virtual try-ons powered by a new AI shopping feature for various women’s apparel brands. Such advancements are expected to facilitate growth in customer engagement for the global apparel industry over the forecast period.

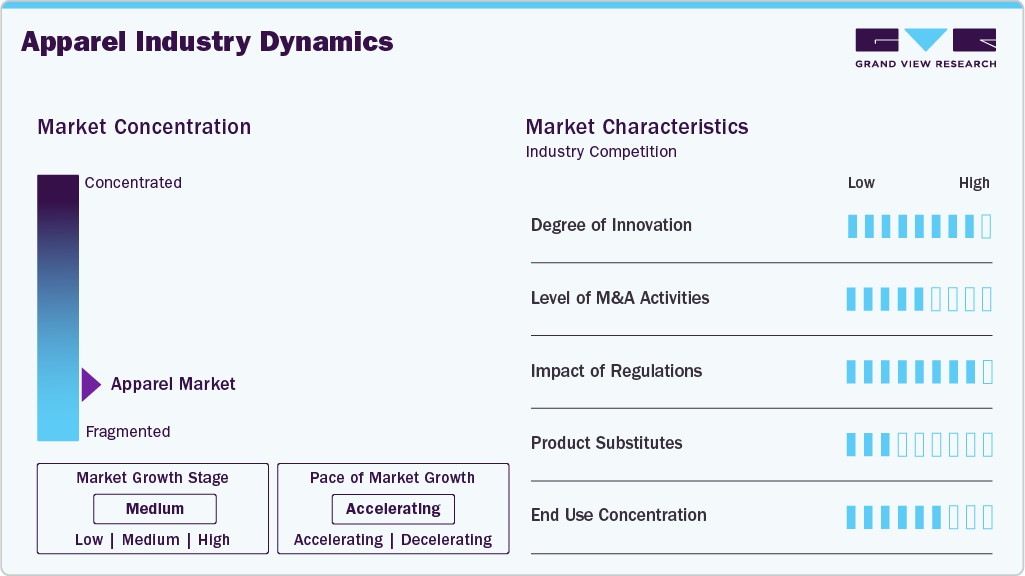

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The presence of several companies in the market, increasing market penetration of e-commerce websites, and a high degree of innovation have developed a fragmented market scenario. Emerging technologies such as 3D apparel printing and artificial intelligence are anticipated to transform the apparel industry. These advancements can potentially revolutionize various aspects of apparel manufacturing, including design, manufacturing, and distribution processes. For instance, in September 2024, Stratasys Ltd. announced the launch of its TechStyle Fabric Alignment Station. This innovative tool assists high-end apparel designers by creating a unique workflow and facilitating integration with various production methods, including embroidery, laser cutting, embossing, and silk printing.

The market navigates a complex regulatory landscape, including safety standards, environmental regulations, and labor laws. For example, clothing items imported, produced, and marketed in the U.S. must adhere to a range of labeling, flammability, substance, testing, and certification regulations. The threat of substitutes in the apparel industry is relatively low due to the essential nature of clothing in everyday life. This factor holds minimal significance within the apparel and fashion industry, as there is no alternative to replace clothing.

Category Insight

The mass apparel segment dominated the global apparel industry with a revenue share of 68.0% in 2024. Mass apparel is constantly produced with the inclusion of new designs and patterns that appeal to customers, leading to increased engagement. Rather than restocking inventory, retailers swap items with the latest arrivals. Fast fashion ensures that shoppers can access desired clothing items promptly and conveniently. Moreover, it has made fashionable clothing more accessible, offering innovative, imaginative, and stylish options. Mass apparel is affordable and provides easy access to trendy clothing, making a large variety of garments accessible to a broader range of customers.

The luxury apparel segment is expected to experience the fastest CAGR from 2025 to 2030. This market is primarily driven by the increasing adoption by high-net-worth individuals, the growing availability of luxury apparel through online portals, and the focus of multiple luxury apparel brands to enhance the market reach across various regions. Increased sales of fashionable luxury apparel and rising interaction between consumers and industry players through social media platforms and online retail channels are pivotal factors driving market expansion. The increasing popularity of luxury apparel among millennials presents a significant opportunity for industry growth. In addition, advancements in digital marketing strategies and the rising prevalence of social media as a marketing platform in emerging markets have opened numerous new business prospects for industry participants.

End Use Insight

Women apparel segment held the largest revenue share of the global apparel market in 2024. The female fashion industry is experiencing a surge in demand for new trends and diverse options. Women's fashion represents a higher demand than men's due to the extensive variety available, including dresses, skirts, blouses, and accessories. This increased demand prompts designers and retailers to prioritize female fashion, catering to consumers' evolving preferences. As a significant consumer market segment, women contribute substantially to global fashion industry trends through their spending habits. Their tendency to invest more in clothing and accessories makes women's fashion a lucrative business sector. Moreover, the vast diversity within women's fashion, from casual wear to haute couture, fosters continuous innovation and adaptation to evolving tastes and preferences.

The children apparel segment is expected to experience the fastest CAGR from 2025 to 2030. In the children's apparel industry, fashion-ability is emphasized as the primary consideration. In addition, many industry players commonly offer multi-pack options, providing added convenience for shoppers. Larger retailers are also increasingly incorporating sustainable options, such as organic cotton, into their children's clothing collections at prices comparable to their core offerings, thereby stimulating market growth. Moreover, the premium kids wear segment capitalizes several long-term trends, including a shift towards more thoughtful purchasing decisions and the increasing age of new parents. With greater disposable income, today's consumers gravitate towards higher-end brands, prioritizing quality and durability.

Distribution Channel Insights

The offline distribution segment accounted for the largest revenue share of the global apparel industry in 2024. Offline shopping provides customers with a personalized experience, enabling them to examine various product features, such as the quality of fabric, designs, and materials incorporated into the product. Store associates can provide tailored assistance, offer styling advice, suggest complementary items, and address any concerns or questions customers may have. This personalized attention enhances the overall shopping experience and fosters a sense of loyalty and trust between the customer and the brand. In addition, the ability to physically see, touch, and try on products in offline stores instills confidence in their quality and fit. Customers can inspect the fabric, examine the craftsmanship, and assess how the garment looks and feels on their body. This hands-on experience helps to ease concerns about purchasing clothing and reduces the likelihood of returns or exchanges due to incorrect sizing or dissatisfaction with the product.

The online distribution segment is projected to experience the fastest growth over the forecast period. Online shopping provides customers with convenience, enabling them to effortlessly browse, compare, and purchase products or services from the comfort of their homes at any time of the day. Moreover, online channels provide competitive prices, coupons, and discounts, owing to which their adoption is increasing among consumers, thus driving the segment’s growth. Online sales channels grant easy access to global brands, eliminating geographical constraints and expanding consumer choices.

Regional Insights

North America held a significant global apparel industry revenue share in 2024. This market is mainly influenced by factors such as the increasing market penetration accomplished by the e-commerce industry, the growing focus of multiple fashion and apparel brands on enhancing their digital footprint, and the rising inclination among young consumers to purchase products equipped with the latest fashion trends and novel designs.

U.S. Apparel Market Insights

The U.S. apparel market held the largest revenue share of the regional industry in 2024, owing to the presence of multiple key companies, growing disposable income levels of young customers, increasing new entrants in the industry, and technological enhancements that enable manufacturers with improved capacities in terms of production, design, and distribution. The rising popularity of e-commerce websites such as Amazon and the increasing market penetration accomplished by online retail platforms are also generating multiple growth opportunities.

Europe Apparel Market Insights

Europe apparel market was identified as one of the key regions of apparel industry in 2024. This market is mainly driven by shifting fashion trends, a focus on sustainability within the industry, the expansion of e-commerce, and ongoing innovation in design and manufacturing techniques. The presence of multiple brands in the region and the launch of brick-and-mortar stores by numerous apparel brands in key cities such as Paris, London, Berlin, Milan, and Munich also contribute to the growth of this market. For instance, in February 2025, Lululemon Athletica, one of the major market participants in the athleisure market, opened its largest store in the EMEA region in London, spanning nearly 8,923 sq ft.

Asia Pacific Apparel Market Insights

Asia Pacific apparel market dominated the global apparel industry with a revenue share of 40.5% in 2024. Growth of this market is mainly driven by the significant growth in demand from highly populated countries such as China and India, increasing focus of multiple global brands on expansion in Asia Pacific, and rising disposable income levels of customers living in countries such as India and Australia.

China held a significant revenue share of the regional industry in 2024. This market is primarily influenced by factors such as a large number of manufacturing facilities in China, easy availability of various materials, and growing demand from the domestic market. Multiple brands that offer a large range of products in numerous apparel categories have manufacturing facilities in China. Mass-manufactured apparel exported from China contributes to the growth experienced by this market.

Key Apparel Company Insights

Some of the key companies operating in the apparel industry are Adidas AG, Puma SE, VF Corporation, Burberry Group plc, Nike Inc., and others. Major market participants have embraced strategies such as new product development, innovation, collaboration with other organizations, and efficient marketing and distribution.

-

Burberry Group plc is a luxury apparel brand specializing in various apparel, including outerwear and scarves. It offers clothes such as t-shirts, shirts, hoodies, knitwear, skirts, blazers, and more. It operates across Asia Pacific, Europe, the Middle East, Africa, and the Americas.

-

Adidas AG offers a wide variety of apparel, including sportswear, athleisure, jerseys, jackets, hoodies, tracksuits, sweatshirts, shorts, t-shirts, and others. Its offerings often originate from sports themes, providing specialized category collections to global sports enthusiasts.

Key Apparel Companies:

The following are the leading companies in the apparel market. These companies collectively hold the largest market share and dictate industry trends.

- VF Corporation

- Burberry Group plc

- Puma SE

- Adidas AG

- NIKE Inc.

- H & M Hennes & Mauritz AB

- LVMH

- KERING

- PVH Corp.

- INDITEX

Recent Developments

-

In March 2025, NIKE, Inc. partnered with TOGETHXR Inc. to launch the Everyone Watches Women’s Sports apparel collection. The collection features T-shirts, hoodies, and caps and reinforces NIKE's commitment to encouraging women's sports through innovation, investment, improved visibility, and inspiration.

-

In November 2024, Burberry opened a store in Wisma Aria shopping mall in Singapore. It opened with Burberry spring collection 2025, featuring inspiration from outdoor and essence of easy elegance.

-

In March 2024, PUMA and PLEASURES announced they are continuing their collaborative partnership with a new collection set to launch in 2024. This upcoming release follows their initial seasonal offering from 2023 including graphic shirts, accessories, and more, as well as their previous sneaker collaborations, the Suede XL and Velophasis.

-

In February 2023, Adidas has introduced a new label, SPORTSWEAR, in collaboration with actress, producer, advocate, and style icon Jenna Ortega. The label is debuting with the Tiro Suit Collection featuring tracksuits, the Express Dress, the Avryn shoe, the Coach Jacket, and the Express Jersey.

-

In June 2023, Nike has introduced Aerogami, a new performance apparel technology featuring moisture-reactive vents that autonomously open and close in response to sweat, providing on-demand ventilation to keep runners cool and comfortable. The first product using this technology, the Nike Run Division Aerogami Jacket, comprises strategically placed vents across the chest and back tailored for men’s and women’s needs, and also includes Storm-FIT ADV material for protection against wind and rain, with releases scheduled for 2023.

Apparel Market Report Scope

Report Attribute

Details

Market Size Value 2025

USD 1.84 trillion

Revenue forecast in 2030

USD 2.26 trillion

Growth Rate

CAGR of 4.2% from 2025 - 2030

Base Year for Estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, end use, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

VF Corporation; Burberry Group plc; Puma SE; Adidas AG; NIKE Inc.; H & M Hennes & Mauritz AB; LVMH; KERING; PVH Corp.; INDITEX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

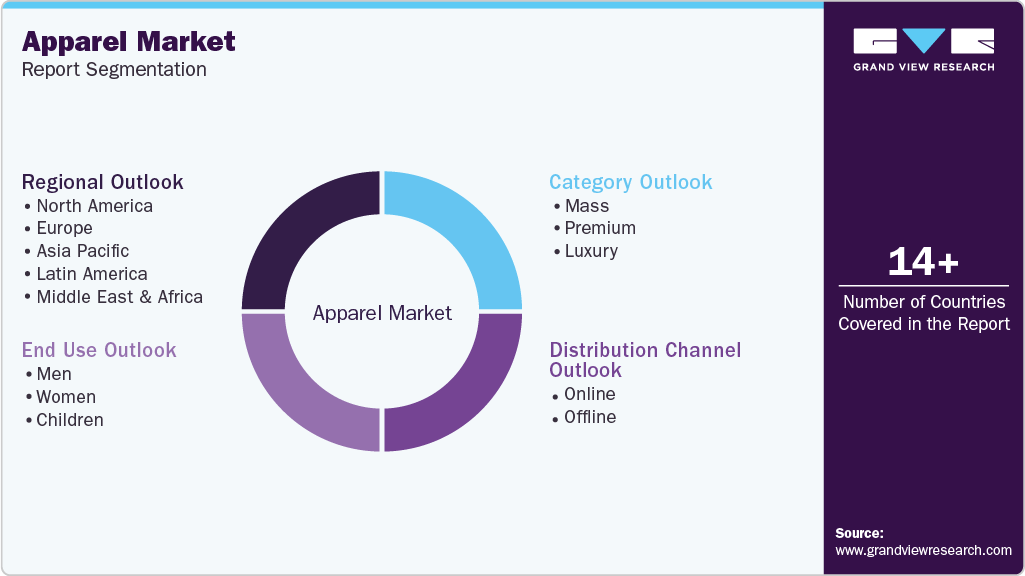

Global Apparel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the apparel market report based on category, end use, distribution channel, and region.

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass

-

Premium

-

Luxury

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Men

-

Casual Wear

-

Formal Wear

-

Sportswear

-

Night Wear

-

Inner Wear

-

Ethnic Wear

-

Others

-

-

Women

-

Casual Wear

-

Formal Wear

-

Sportswear

-

Night Wear

-

Inner Wear

-

Ethnic Wear

-

Others

-

-

Children

-

Casual Wear

-

Formal Wear

-

Sportswear

-

Night Wear

-

Inner Wear

-

Ethnic Wear

-

Others

-

- Men

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Clothing Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global apparel market size was valued at USD 1.77 trillion in 2024.

b. The global apparel market is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2030.

b. The luxury apparel segment is expected to experience the fastest CAGR from 2025 to 2030. This market is primarily driven by the increasing adoption by high-net-worth individuals, the growing availability of luxury apparel through online portals, and the focus of multiple luxury apparel brands to enhance the market reach across various regions. Increased sales of fashionable luxury apparel and rising interaction between consumers and industry players through social media platforms and online retail channels are pivotal factors driving market expansion.

b. Some prominent players in the apparel market include VF Corporation; Burberry Group plc; Puma SE; Adidas AG; NIKE Inc.; H & M Hennes & Mauritz AB; LVMH; KERING; PVH Corp.; INDITEX

b. The increasing expenditure on apparel by customers worldwide is a key factor driving the market growth. According to the U.S. Bureau of Labor Statistics, in 2023, the average annual per household expenditure for women’s apparel was approximately USD 655, and USD 406 for men’s apparel. Availability of products through online distribution, increasing market penetration of e-commerce websites, and a large number of collections launched by the key market players are anticipated to drive further growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.