- Home

- »

- Automotive & Transportation

- »

-

Apparel Logistics Market Size, Share & Growth Report, 2030GVR Report cover

![Apparel Logistics Market Size, Share & Trends Report]()

Apparel Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Services, By Mode Of Transport (Rail Freight, Road Freight, Air Freight, Ocean Freight), By Sales Channel, By End Use (Manufacturers, Retailers), And Region, And Segment Forecasts

- Report ID: GVR-4-68040-461-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Apparel Logistics Market Size & Trends

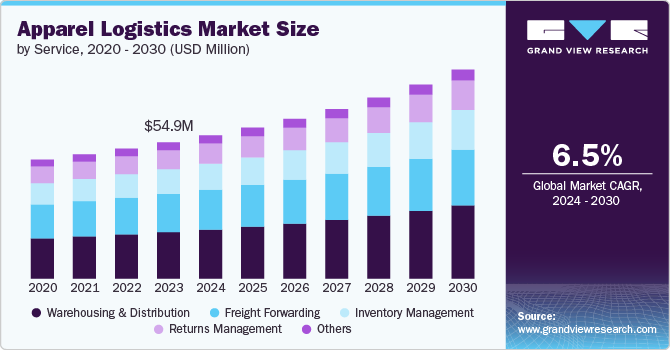

The global apparel logistics market size was estimated at USD 54.96 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The increasing complexity of supply chains in the fashion industry drives market growth. With the rise of fast fashion and e-commerce, logistics providers are facing new challenges in ensuring the efficient delivery of apparel products to consumers across different geographies. The demand for faster, more reliable delivery services has spurred investments in advanced logistics technologies such as automated warehousing, real-time tracking systems, and integrated inventory management. These innovations are helping to streamline operations, reduce transit times, and enhance customer satisfaction, positioning the market for robust and continuous growth.

The expansion of online retail channels, including the growth of direct-to-consumer models, intensified the demand for flexible, scalable logistics solutions that can adapt to fluctuating order volumes. Moreover, the global nature of apparel production, with manufacturing hubs in Asia, Africa, and other regions, underscores the importance of efficient transportation networks to minimize costs and manage long lead times. As brands strive to remain competitive, they are increasingly prioritizing investments in logistics infrastructure to optimize their global supply chains.

Geographically, key markets such as North America, Europe, and Asia Pacific are expected to drive growth in the apparel logistics sector. In North America and Europe, the high penetration of e-commerce and the need for quick last-mile deliveries will support the adoption of advanced logistics systems. Meanwhile, Asia Pacific, home to major manufacturing hubs and rapidly expanding consumer bases, is likely to witness significant growth in apparel logistics. The region's growing middle class, urbanization, and rising disposable income will boost demand for fashion products, placing further emphasis on efficient logistics solutions to meet market demands.

Despite this promising outlook, several factors may restrain growth in the global apparel logistics market. Rising transportation costs, particularly in air and road freight, and fluctuating fuel prices can impact profit margins. Additionally, labor shortages in key logistics hubs, combined with supply chain disruptions caused by geopolitical tensions and global events like pandemics, may hinder the smooth operation of logistics networks.

Service Insights

The warehousing & distribution segment held the largest revenue share of 34.2% in 2023 and is expected to maintain its dominance from 2024 to 2030. As e-commerce expands, efficient warehousing and distribution centers are essential for managing stock levels, processing orders, and facilitating rapid shipping. The segment's growth is driven by investments in automation and AI technologies to optimize operations and reduce costs. Multi-channel distribution strategies require sophisticated warehousing solutions to serve both online and offline channels effectively. Additionally, the trend toward localized distribution hubs to enable faster delivery times is contributing to the segment's continued expansion and market revenue share.

The inventory management segment is expected to register the fastest CAGR of 7.2% from 2024 to 2030. The increasing complexity of multi-channel retail operations drives the rapid growth of the inventory management segment in apparel logistics. Advanced technologies such as AI and IoT are enabling more precise demand forecasting and real-time inventory tracking. Retailers are prioritizing inventory optimization to reduce carrying costs and minimize stockouts while maintaining the flexibility to respond quickly to changing consumer preferences. This focus on efficient inventory management is crucial for maintaining competitiveness in the fast-paced apparel market.

Mode of Transport Insights

The road freight segment held the largest revenue share of 56.0% in 2023 and is expected to maintain its dominance from 2024 to 2030. The market growth is driven by its flexibility and widespread use in both domestic and regional supply chains. Road transport offers cost-effective solutions, particularly for short and medium-haul routes, making it a preferred choice for the fashion industry, which requires frequent and timely shipments to meet fast-changing consumer demands. Additionally, the ability to access remote areas, adjust routes for quicker deliveries, and provide door-to-door services enhances its appeal.

Over the forecast period from 2024 to 2030, the road freight segment is expected to maintain its dominance, supported by ongoing improvements in transportation infrastructure and technological advancements, such as real-time tracking and route optimization, further boosting its efficiency. Moreover, the rise of e-commerce in the apparel sector, which often relies on road transport for last-mile delivery, will continue to fuel the demand for road freight services.

The air freight segment of the global apparel logistics market is projected to register the fastest CAGR of 7.2% from 2024 to 2030, driven by the growing demand for rapid delivery and the need to support fast fashion trends. Air transport offers the fastest shipping times, which is crucial for high-value, time-sensitive apparel products, especially for international shipments. As consumers increasingly expect quick delivery, particularly for online orders, retailers are turning to air freight to meet these demands. Additionally, air freight plays a critical role in global supply chains, enabling brands to respond swiftly to changing market dynamics, seasonal trends, and inventory shortages.

Sales Channel Insights

In 2023, the online retailers (e-commerce) segment captured the largest revenue share of 46.2%, driven by the rising demand for online shopping and the shift in consumer purchasing behavior towards digital channels. This segment is expected to maintain its dominance from 2024 to 2030 as the continued expansion of e-commerce platforms and improvements in delivery infrastructure enhance supply chain efficiency. Additionally, advancements in last-mile delivery, inventory management, and seamless distribution networks are set to further solidify e-commerce's leadership in the apparel logistics space, meeting the growing consumer expectations for fast and reliable service.

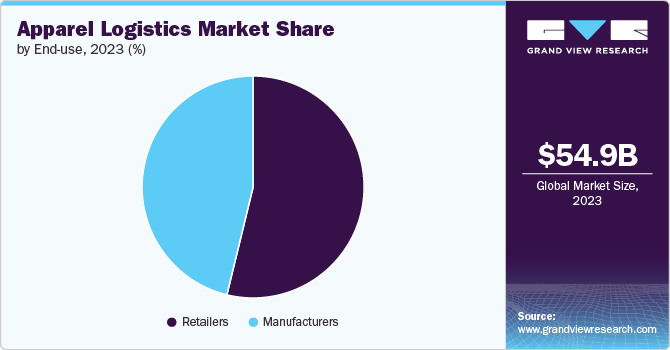

End Use Insights

The retailers segment held the largest revenue share of 58.8% in 2023 and is expected to maintain its dominance from 2024 to 2030. The segment growth is driven by the extensive demand for efficient supply chain solutions to support brick-and-mortar stores and omnichannel operations. Retailers rely heavily on streamlined logistics to manage inventory, ensure timely restocking, and handle seasonal fluctuations in demand. The segment is expected to maintain its dominance from 2024 to 2030 as retailers continue to enhance their logistics capabilities to improve customer experiences, optimize costs, and stay competitive in both physical and digital marketplaces. The rise of omnichannel strategies, combining in-store and online shopping, further reinforces the importance of robust logistics support in this segment.

Regional Insights

North America apparel logistics market growth is attributed to the e-commerce expansion, which has significantly increased demand for efficient supply chain management and last-mile delivery services. Consumers' expectations for faster shipping and seamless returns have pushed companies to optimize their logistics networks. Additionally, the adoption of advanced technologies like AI, IoT, and blockchain in inventory management and tracking has improved operational efficiency. Sustainability concerns are also shaping the market, with companies implementing eco-friendly practices in transportation and packaging. Finally, the need for greater supply chain resilience, highlighted by recent global disruptions, is prompting businesses to diversify sourcing and strengthen their logistics capabilities.

U.S. Apparel Logistics Market Trends

The apparel logistics market in the U.S. is expected to grow at a CAGR of 6.9% from 2024 to 2030. The market’s growth in the country is attributed to the increasing complexity of global supply chains, requiring more sophisticated logistics solutions. The rise of direct-to-consumer (D2C) brands is creating new demands for specialized fulfillment services. Additionally, the growing focus on sustainability in fashion is prompting logistics providers to develop eco-friendly transportation and packaging solutions, appealing to environmentally conscious consumers and brands alike

Asia Pacific Apparel Logistics Market Trends

The apparel logistics market in Asia Pacific held the largest revenue share of 36.0% in 2023. The Asia Pacific region's dominance in the market is primarily driven by its robust e-commerce growth. With a rapidly expanding middle class and increasing internet penetration, countries like China and India are seeing a surge in online shopping for apparel. This trend is compelling retailers and brands to establish efficient logistics networks to manage the high volume of orders and deliveries across diverse geographic areas. Additionally, the region's role as a major apparel manufacturing hub necessitates advanced logistics solutions to connect production centers with global markets.

Europe Apparel Logistics Market Trends

The apparel logistics market in Europe is expected to grow at a significant CAGR of 6.2% from 2024 to 2030. The market is expanding due to several factors. Omnichannel retail adoption is driving demand for integrated inventory and distribution systems. Sustainability initiatives are pushing logistics providers to implement eco-friendly transportation and packaging solutions. The fast fashion trend necessitates agile supply chains for rapid design-to-delivery cycles. Additionally, cross-border e-commerce growth within the EU is increasing the need for efficient international logistics networks.

Key Apparel Logistics Company Insights

Some of the key companies operating in the market include DSV and Kuehne + Nagel.

-

DSV, a global transport and logistics company, has emerged as a key player in the logistics industry operating through three divisions, namely DSV Air & Sea, DSV Road, and DSV Solutions. DSV Road is one of the prominent road freight operators in Europe, boasting distribution networks extending to North America and Africa. On an annual basis, the road transport sector manages over 30 million shipments, deploying a fleet of more than 20,000 trucks daily to efficiently transport goods. DSV Air & Sea provides adaptable routing options and flexible schedules tailored to meet the most intricate logistics needs for shipments to and from global destinations. Annually, this sector manages a cargo volume exceeding 2,600,000 TEUs (twenty-foot equivalent unit) for sea freight and 1,700,000 metric tons for air freight.

Delhivery and CEVA Logistics are some of the emerging companies in the target market.

-

Delhivery is a logistics & supply chain services company. The company’s operations encompass last-mile delivery, freight handling, warehousing, and cross-border logistics. The company’s service lines include Express Parcel Services, Part Truckload Services, Truckload Services, Supply Chain Services, and Cross Border Services. The company operates an extensive pan-India network covering over 18,600 pin codes and a robust infrastructure of 2,880 direct delivery centers and 24 automated sort centers. The company specializes in express parcel delivery services, offering a range of options, including same-day, next-day, and standard delivery.

Key Apparel Logistics Companies:

The following are the leading companies in the apparel logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Ceva Logistics

- DB Schenker

- DHL Group

- DSV

- Hellmann Worldwide Logistics

- Kuehne + Nagel

- Delhivery

- Logwin

- DTDC Express Limited

- Apparel Logistics Group Inc.

- PVS Fulfillment-Service GmbH

- NIPPON EXPRESS HOLDINGS

- GAC

Recent Developments

-

In July 2024, DTDC Express Limited announced the launch of drone-based deliveries through a strategic partnership with Skye Air, an India-based autonomous logistics solution provider. The successful execution of the first drone delivery, covering 7.5 km in 3-4 minutes, highlights DTDC Express Limited's commitment to cutting-edge technology and eco-friendly logistics, with plans to expand drone services to key locations across India to enhance efficiency, delivery speed, and sustainability.

-

In March 2023, DSV signed an agreement to acquire two U.S.-based logistics companies, namely Global Diversity Logistics and S&M Moving Systems West. This strategic acquisition was aimed at enhancing DSV's presence in the semiconductor industry by providing a comprehensive range of services, including domestic road freight, international air and sea freight, tradeshow logistics, warehousing, and specialized solutions.

Apparel Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 57.75 billion

Revenue forecast in 2030

USD 84.31 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, mode of transport, sales channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Ceva Logistics; DB Schenker; DHL Group; Hellmann Worldwide Logistics; Kuehne + Nagel; DTDC Express Limited; Delhivery; Logwin; Apparel Logistics Group Inc.; PVS Fulfillment-Service GmbH; NIPPON EXPRESS HOLDINGS; GAC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Apparel Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global apparel logistics market report based on service, mode of transport, sales channel, end use, and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Warehousing & Distribution

-

Inventory Management

-

Freight Forwarding

-

Returns Management

-

Other

-

-

Mode of Transport (Revenue, USD Million, 2017 - 2030)

-

Rail Freight

-

Road Freight

-

Air Freight

-

Ocean Freight

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online Retailers (E-commerce)

-

Brick-and-Mortar Stores

-

Multi-channel Retailing

-

Direct to Consumer (D2C)

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Manufacturer

-

Retailers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Apparel Logistics market size was estimated at USD 54.96 billion in 2023 and is expected to reach USD 57.75 billion in 2024.

b. The global Apparel Logistics market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 84.31 billion by 2030.

b. Asia Pacific dominated the Apparel Logistics market with a share of over 36.0% in 2023. This is attributable to the robust e-commerce growth. With a rapidly expanding middle class and increasing internet penetration, countries like China and India are seeing a surge in online shopping for apparel.

b. Some key players operating in the Apparel Logistics market include Ceva Logistics, DB Schenker, DHL Group, Hellmann Worldwide Logistics, Kuehne + Nagel, DTDC Express Limited, Delhivery, Logwin, Apparel Logistics Group Inc., PVS Fulfillment-Service GmbH, NIPPON EXPRESS HOLDINGS, and GAC.

b. Key factors driving market growth include the E-commerce growth, the rise of fast fashion, globalization of apparel supply chains, and omnichannel retailing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.