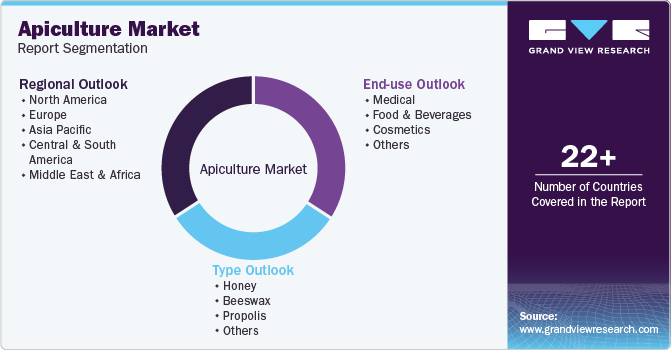

Apiculture Market Size, Share & Trends Analysis Report By Type (Honey, Beeswax, Propolis), By End-use (Medical, Food & Beverages, Cosmetics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-423-8

- Number of Report Pages: 98

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Apiculture Market Size & Trends

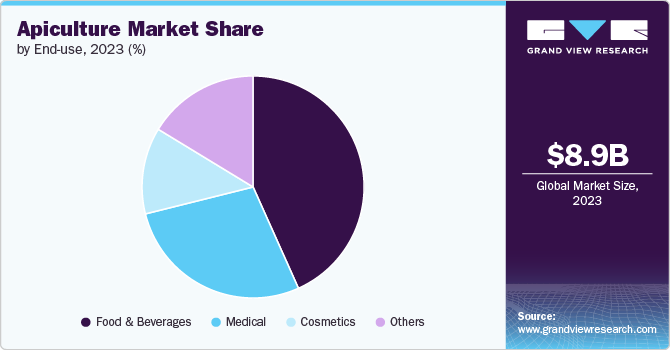

The global apiculture market size was estimated at USD 8.95 billion in 2023 and is projected to grow at a CAGR of 4.0% from 2024 to 2030, owing to the versatility of bee products extends beyond food and beverages. They are integral to various sectors, including pharmaceuticals, cosmetics, and agriculture. For instance, honey and royal jelly are commonly used in dietary supplements, while beeswax is a popular ingredient in skincare products. This broad applicability enhances the market's resilience and growth potential as different industries increasingly invest in bee-related products to meet consumer demands.

Moreover, beeswax is utilized in the pharmaceutical industry as a binding agent and a time-release mechanism for medications, enhancing the efficacy of drug delivery systems. The ongoing research into the medicinal properties of these products continues to unveil new applications, further solidifying their place in modern healthcare.

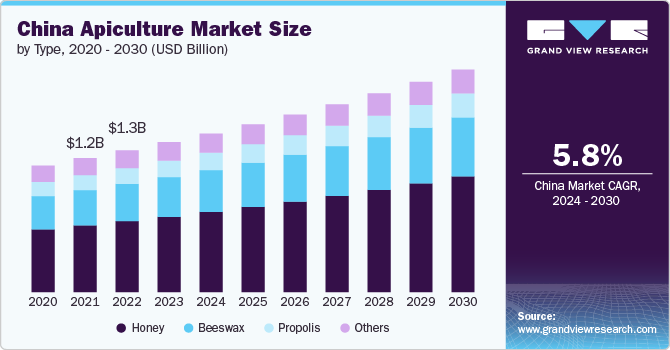

The demand for bee products, particularly honey and its derivatives, is experiencing significant growth both in China and globally. This surge is driven by various factors, including health consciousness, sustainability trends, and the versatility of these products across multiple industries.

One of the primary drivers of this market expansion is the increasing consumer preference for natural and organic products. As people become more health-conscious, they are turning away from artificial sweeteners and processed foods, opting instead for honey as a natural alternative. This shift is particularly evident in the food and beverage sector, where honey is being used not only as a sweetener but also as a flavor enhancer and a source of health benefits. The growing awareness of the nutritional advantages of honey, such as its antioxidant properties and potential health benefits, further fuels this demand.

In China, which is the largest honey-producing country, the government is actively promoting beekeeping as a sustainable agricultural practice. This support includes incentives for beekeepers and initiatives aimed at increasing awareness of the ecological benefits of bees, such as their role in pollination. The economic viability of beekeeping, characterized by low maintenance costs and high returns, is attracting more individuals and businesses to enter the market.

Type Insights

Honey product dominated the market with a revenue share of 50.2% in 2023. Honey is the most prominent product in the apiculture market, known for its natural sweetness and numerous health benefits. Initially valued primarily for its medicinal properties, honey has evolved into a staple ingredient in the food and beverage industry. Its popularity is driven by a rising consumer preference for natural sweeteners over artificial alternatives, leading to increased exploration and innovation within the honey sector.

Beeswax is another significant product derived from bees, valued for its multifunctional properties. It is widely used in the cosmetics industry, where it serves as a natural emulsifier and thickening agent in products such as lip balms, creams, and lotions. The increasing consumer shift towards organic and chemical-free personal care products has bolstered the demand for beeswax.

Additionally, beeswax is utilized in food packaging, particularly in eco-friendly wraps, and as a glazing agent in various food products. Its applications extend to the pharmaceutical sector, where it is used in ointments and as a coating for pills. The growing awareness of sustainability and the benefits of natural ingredients further enhance the appeal of beeswax across multiple industries.

Royal jelly is a nutrient-rich substance secreted by worker bees, primarily used to nourish queen bees and larvae. This product is gaining traction in the health and wellness market due to its potential health benefits, including immune system support and energy enhancement. Royal jelly is often marketed as a dietary supplement, available in various forms such as capsules, powders, and liquid extracts. The increasing consumer interest in natural health products and supplements is driving the demand for royal jelly, as more individuals seek out its unique properties to enhance their overall well-being. Its incorporation into health-focused diets positions royal jelly as a valuable product in the apiculture market.

End-use Insights

Food & beverages end use dominated the market with a revenue share of 43.3% in 2023.The food and beverage sector remains the largest end-use application for bee products, particularly honey. As consumers become more health-conscious, there is a notable shift from artificial sweeteners to natural alternatives, with honey being a preferred choice due to its rich flavor and health benefits.

In the medical field, bee products are gaining recognition for their therapeutic properties. Honey, for instance, is known for its wound-healing capabilities and is increasingly used in medical-grade dressings. Its natural antibacterial properties make it effective in treating burns and other skin injuries.

Furthermore, royal jelly and propolis are being explored for their potential health benefits, including immune support and anti-inflammatory effects. The growing trend towards natural remedies and the increasing focus on preventive healthcare are significant factors driving the demand for bee products in the medical sector. As consumers seek alternatives to synthetic medications, the appeal of natural bee-derived products continues to rise.

The cosmetics industry is another major end-user of bee products, particularly beeswax and royal jelly. Beeswax is prized for its emollient properties, making it a popular ingredient in lip balms, creams, and lotions. Its ability to create a protective barrier on the skin while allowing it to breathe enhances its desirability in skincare formulations. Meanwhile, royal jelly is increasingly incorporated into anti-aging products due to its rich nutrient profile, which is believed to promote skin health and vitality. The growing consumer preference for organic and cruelty-free cosmetics is driving brands to invest in natural ingredients, further boosting the demand for bee products in this sector.

Regional Insights

Asia Pacific Apiculture Market Trends

Asia Pacific dominated the market segment with a revenue share of 35.6% in 2023. The demand for honey is surging in the Asia Pacific region, fueled by a shift towards natural sweeteners in food and beverages. Consumers are increasingly aware of the health benefits of honey, which is being recognized as a healthier alternative to refined sugars and artificial sweeteners. This trend is further supported by the growing popularity of honey in culinary applications, including baking, cooking, and as a natural remedy for various ailments.

China is the world's leading honey producer, accounting for approximately 30% of global honey production. This dominance is supported by a vast number of beekeepers and a favorable climate for beekeeping. The country's extensive production capabilities enable it to meet both domestic and international demand, making it a key player in the global market.

North America Apiculture Market Trends

The apiculture market in North America is witnessing robust growth, driven by increasing consumer demand for natural products, heightened health awareness, and supportive government initiatives. This region, particularly the U.S. and Canada, plays a significant role in the global apiculture landscape.

Europe Apiculture Market Trends

European governments are increasingly recognizing the importance of bees for biodiversity and agriculture. Initiatives aimed at supporting beekeeping practices, including funding and educational programs, are contributing to the growth of the apiculture market. This support is crucial for maintaining bee populations and promoting sustainable practices.

Key Apiculture Company Insights

Some of the key players operating in the market include

-

Capilano Honey Ltd. is a prominent Australian honey manufacturer based in Richlands, Queensland. Established over 60 years ago, the company has grown from humble beginnings to become one of the world's leading suppliers of honey, known for its commitment to quality and innovation. Capilano is proudly Australian-owned and operates a robust supply network consisting of over 600 beekeeping families across Australia, ensuring a steady supply of high-quality honey products.

-

Y.S. Organic Bee Farms is a pioneering company in the organic beekeeping industry, established in 1995. With a foundation built on four generations of beekeeping experience, the company has become a leader in the production of certified organic honey and bee products in North America. Y.S. Organic Bee Farms is committed to sustainable practices and the health benefits of bee products, making it a trusted name among health-conscious consumers.

Key Apiculture Companies:

The following are the leading companies in the apiculture market. These companies collectively hold the largest market share and dictate industry trends.

- Capilano Honey Ltd.

- Organic Bee Farms

- Dabur Ltd.

- NOW Foods

- Koster Keunen LLC

- Barkman Honey

- Heavenly Organics

- Strahl & Pitsch Inc.

- Miller’s Honey

- Durham’s Bee Farm

Recent Developments

-

In March 2024, RAK Samar Honey, sourced from the pristine and arid landscapes of Ras Al Khaimah in the United Arab Emirates, has made its debut in the UK market. This raw and rare honey is celebrated for its unique flavor profile and nutritional benefits, making it a sought-after product among honey enthusiasts.

-

In August 2022, Bagrrys India has expanded its product portfolio by launching Bagrrys Organic Wild Honey. This new offering aims to cater to the growing demand for natural and organic food products among health-conscious consumers.

Apiculture Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.31 billion |

|

Revenue forecast in 2030 |

USD 11.78 billion |

|

Growth rate |

CAGR of 4.0% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa, Saudi Arabia |

|

Key companies profiled |

Capilano Honey Ltd.; Organic Bee Farms; Dabur Ltd.; NOW Foods; Koster Keunen LLC; Barkman Honey; Heavenly Organics; Strahl & Pitsch Inc.; Miller’s Honey; Durham’s Bee Farm |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Apiculture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global apiculture market report based on type, end-use, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Honey

-

Beeswax

-

Propolis

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Medical

-

Food & Beverages

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global apiculture market was valued at USD 8.95 billion in 2023 and is expected to reach USD 9.31 billion in 2024.

b. The global apiculture market was valued at USD 8.95 billion in 2023 and is projected to reach USD 11.78 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030

b. Asia Pacific dominated the market segment with a revenue share of 35.60% in 2023. The demand for honey is surging in the Asia Pacific region, fueled by a shift towards natural sweeteners in food and beverages

b. Some key players operating in the apiculture market include Capilano Honey Ltd. Organic Bee Farms, Dabur Ltd., NOW Foods, Koster Keunen LLC, Barkman Honey, Heavenly Organics, Strahl & Pitsch Inc., Miller’s Honey, Durham’s Bee Farm

b. Key factors that are driving the market growth include the versatility of bee products extends beyond food and beverages.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."