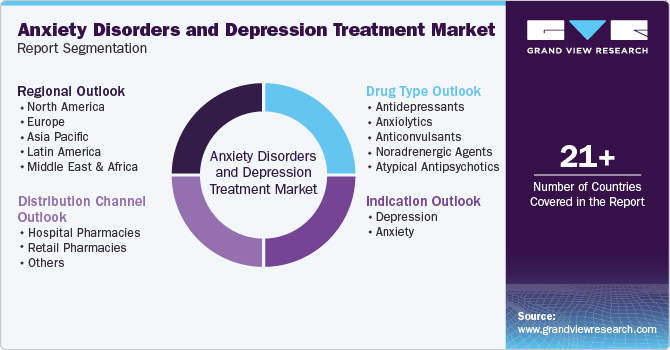

Anxiety Disorders And Depression Treatment Market Size, Share & Trends Analysis Report By Drug Type, By Indication (Depression, Anxiety), By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-731-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

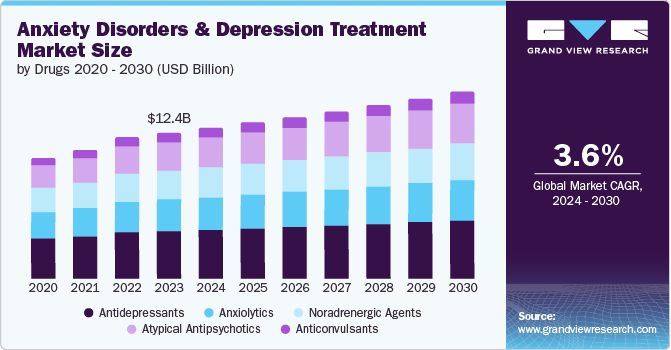

The global anxiety disorders and depression treatment market size was estimated at USD 15.43 billion in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2030. Collaboration among pharmaceutical companies, non-governmental organizations (NGOs), and mental health organizations has played a critical role in raising public awareness and reducing the stigma associated with mental health issues. This cultural shift encourages individuals to seek help, driving demand for effective treatments. Moreover, government initiatives and funding are bolstering mental health research and treatment programs worldwide, ensuring that resources are dedicated to developing and refining therapeutic options for anxiety and depression.

Notable factors for market growth include the escalating prevalence of these conditions among young adults, typically defined as individuals aged 18 to 30. The global rise in anxiety and depression has been pronounced since the mid-twentieth century, primarily influenced by increased academic pressure, financial stress, and excessive social media usage. This alarming trend has adversely impacted the educational and professional achievements of young individuals, resulting in detrimental consequences including substance abuse and heightened suicide rates. The market’s expansion reflects the urgent need for effective treatment solutions.

The increased research and development investment by governments and healthcare institutions has facilitated the approval of innovative treatments. Noteworthy advancements in neuroscience have illuminated the biological mechanisms underlying these disorders, enabling the development of targeted therapies. Innovations in treatment technologies such as Transcranial Magnetic Stimulation (TMS) and Deep Brain Stimulation (DBS) have emerged, with advancements including Theta Burst Stimulation (TBS) and adaptive DBS providing new avenues for intervention. Recent studies have highlighted these technologies’ efficacy for treating treatment-resistant depression, showcasing their potential to reshape clinical approaches.

The integration of mental health services into primary care settings has further streamlined access to treatment, enabling early intervention and comprehensive care. Evidence demonstrates that integrated behavioral health services lead to clinically significant decreases in depressive and anxiety symptoms, bolstering patient outcomes and reducing overall mental healthcare costs. The consolidation of these drivers-rising prevalence, technological innovations, and improved access to services-continues to propel the anxiety disorders and depression treatment market toward a promising future.

Drug Type Insights

The antidepressants segment dominated the market and accounted for the highest revenue share of 32.4% in 2024. The rise in conditions such as major depressive disorder, obsessive-compulsive disorder, generalized anxiety disorder, and panic disorder has significantly contributed to market growth. Increased awareness of mental health, driven by government initiatives and NGO efforts, has also resulted in a higher prescription rate of antidepressant drugs by healthcare professionals, addressing the urgent need for effective treatment solutions.

The atypical antipsychotics segment is projected to grow at the fastest CAGR of 5.2% over the forecast period, supported by the increasing prevalence of anxiety, depression, and bipolar disorders in the population. Patients have shown a preference for these drugs as a first-line treatment due to their improved safety and efficacy, particularly with a lesser side effect profile compared to typical psychotic medications, especially regarding extrapyramidal symptoms.

Indication Insights

Anxiety led the market with a revenue share of 55.4% in 2024, fueled by the increased presence of phobias, social anxiety disorders, and other similar conditions in both established and growing economies. With the rise of population, there is an increase in competition in every field, which has led to unrealistic goal setting by the population. This high competition has led to a decrease in success rates and unrealistic goals lead to anxiety and depression when they are unfulfilled. Growing awareness about anxiety and its cure is acting as a growth factor for the market.

The depression segment is expected to grow lucratively over the forecast period. With increased awareness of mental health, there is a rise in diagnoses, which has increased the number of populations willing to seek medical help. Furthermore, societal pressure, work-life balance challenges, and social media influence have also contributed to the increasing depression cases further contributing to the growth of this market.

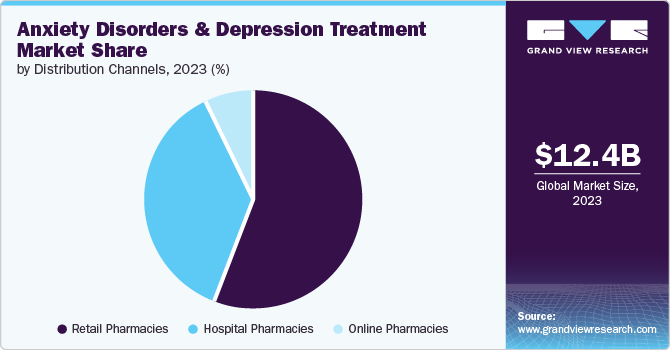

Distribution Channel Insights

The retail pharmacies segment held the largest market share of 55.4% in 2024 due to patients’ preference for nearby, trustworthy pharmacies. These establishments offer both branded and generic medicines along with various medical products. Their ability to provide immediate aid in emergencies, often without prescriptions, fosters loyalty among customers, further contributing to the segment’s growth.

The others segment is expected to grow at the fastest rate over the forecast period, including other means of distribution such as direct-to-consumer marketing, nontraditional services, community-based care, primary care integration, online therapy platforms, and workplace programs. Increased societal awareness of mental health has fostered acceptance of seeking help for anxiety and depression. The rise of direct-to-consumer marketing has promoted psychological treatments and improved treatment-seeking behavior. Telemedicine and online therapy platforms enhanced access to licensed professionals, especially for younger populations, while community-based services and primary care providers integrated mental health care into local settings, addressing diverse patient needs.

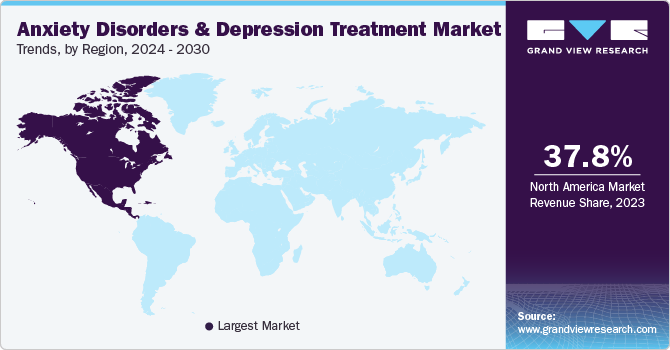

Regional Insights

North America anxiety disorders and depression treatment market dominated the global market with a revenue share of 37.6% in 2024. The region is experiencing a rise in the rate of mental and anxiety disorders within the population. North America is the market leader due to the presence of key market players and strong distribution channels in this segment. Furthermore, the availability of better medical facilities and medicines treating disorders related to mental health also assists in the market growth for this region.

U.S. Anxiety Disorders And Depression Treatment Market Trends

The anxiety disorders and depression treatment market in the U.S. dominated the North America market with a revenue share of 90.5% in 2024, aided by an increase in the symptoms related to mental disorders in the U.S. population such as depression, fear, a feeling of failure, and helplessness. An increase in awareness of mental health due to initiatives taken by the government and NGOs has furthermore assisted the market to grow significantly in this country.

Europe Anxiety Disorders And Depression Treatment Market Trends

Europe anxiety disorders and depression treatment market held substantial market share in 2024 due to significant investments in research and development for the creation of antidepressant medications. Increased sales of products for anxiety and depression disorders due to increasing in mental health awareness have furthermore assisted in the market growth for this region.

The anxiety disorders and depression treatment market in Germany is expected to grow in the forecast period. Advancements in treatment technologies, such as deep brain stimulation and innovative therapies such as ketamine infusions and transcranial magnetic stimulation, offer hope for treatment-resistant depression. The integration of mental health care into primary settings enhances access, while updated guidelines recommend SSRIs or SNRIs as first-line treatments for anxiety disorders.

Asia Pacific Anxiety Disorders And Depression Treatment Market Trends

Asia Pacific anxiety disorders and depression treatment market is expected to register the fastest CAGR of 4.8% in the forecast period. Many countries in the region have begun developing treatment guidelines for depression, emphasizing pharmacological approaches despite the potential for regional collaboration to enhance practices. Rising mental illness prevalence, with rates between 4% in Singapore and 20% in Vietnam and Thailand, highlights significant public health concerns. Efforts to integrate mental health services into primary care and utilize digital health technologies are underway, supported by community initiatives and free counseling services from organizations such as the Vandrevala Foundation.

The anxiety disorders and depression treatment market in Japan dominated the Asia Pacific market in 2024. In Japan, increased public awareness of mental health has reduced stigma, leading to higher diagnosis rates and greater treatment demand. The aging population drives the need for tailored therapies, particularly antidepressants for older adults. Government initiatives aim to integrate mental health services into primary care, while digital health innovations, such as CBT and virtual consultations, enhance access. Preventive care and early intervention strategies are prioritized, supported by updated treatment guidelines that recommend SSRIs as first-line options for managing major depressive disorder.

Key Anxiety Disorders And Depression Treatment Company Insights

Some major companies in the market are Pfizer Inc.; H. Lundbeck A/S; GSK plc; Merck & Co., Inc.; Eli Lilly and Company. Companies in this market focus on offering mental health treatments with drugs and other therapies. The companies also aim to grow by increasing new drug approvals and improving their distribution networks.

-

PRISTIQ (desvenlafaxine) is an SNRI proven effective for major depressive disorder, supported by Phase 4 studies using the HAM-D17 scale. Pfizer actively researches mental health, promotes awareness, and integrates effective treatments into healthcare systems for managing anxiety and depression.

-

H. Lundbeck A/S is involved in researching, developing, producing, promoting, and selling pharmaceutical products worldwide. The company focuses on products designed for brain disorders such as depression, schizophrenia, Alzheimer’s, Parkinson’s, and migraines.

Key Anxiety Disorders And Depression Treatment Companies:

The following are the leading companies in the anxiety disorders and depression treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- H. Lundbeck A/S

- GSK plc

- Merck & Co., Inc.

- Eli Lilly and Company

- AstraZeneca

- Bristol-Myers Squibb Company

- Johnson & Johnson Services, Inc.

- AbbVie Inc.

- Sanofi

View a comprehensive list of companies in the Anxiety Disorders And Depression Treatment Market

Recent Developments

-

In January 2025, Johnson & Johnson announced FDA approval for SPRAVATO® (esketamine) as the first monotherapy for adults with treatment-resistant depression in the U.S., demonstrating rapid efficacy compared to placebo.

-

In December 2024, the FDA approved Eli Lilly’s Zepbound (tirzepatide) for moderate to severe obstructive sleep apnea in adults with obesity, marking a significant advancement in treatment options in the U.S.

-

In October 2024, AbbVie and Gedeon Richter announced a collaboration to explore novel targets for neuropsychiatric conditions, building on nearly two decades of partnership and advancing shared R&D initiatives in the U.S. and Europe.

-

In September 2024, the U.S. FDA approved Bristol Myers Squibb’s COBENFY (xanomeline and trospium chloride), a pioneering treatment for schizophrenia, marking a significant advancement in pharmacological approaches after over 30 years.

Anxiety Disorders And Depression Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.01 billion |

|

Revenue forecast in 2030 |

USD 19.28 billion |

|

Growth rate |

CAGR of 3.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Drug type, indication, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Pfizer Inc.; H. Lundbeck A/S; GSK plc; Merck & Co., Inc.; Eli Lilly and Company; AstraZeneca; Bristol-Myers Squibb Company; Johnson & Johnson Services, Inc.; AbbVie Inc.; Sanofi |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Anxiety Disorders And Depression Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anxiety disorders and depression treatment market report based on drug type, indication, distribution channel, and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antidepressants

-

Anxiolytics

-

Anticonvulsants

-

Noradrenergic Agents

-

Atypical Antipsychotics

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Depression

-

Anxiety

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."