Antipsychotic Drugs Market Size, Share & Trends Analysis Report By Disease (Schizophrenia, Bipolar Disorder), By Drug, By Therapeutic Class, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-408-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Antipsychotic Drugs Market Size & Trends

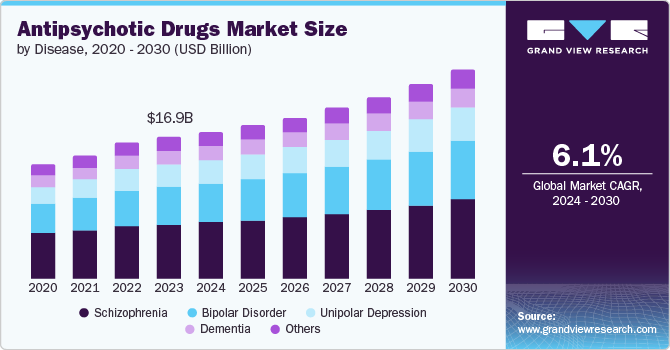

The global antipsychotic drugs market size was valued at USD 16.88 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. The antipsychotic drugs market is driven by an increase in the prevalence of mental health disorders, advancements in drug development, and growing awareness about mental health issues. Antipsychotic medications are mainly prescribed for treating disorders such as schizophrenia, bipolar disorder, and other types of psychotic disorders.

Antipsychotic medications, also known as neuroleptics, are commonly employed to alleviate symptoms linked to psychosis. Antipsychotic medications can effectively decrease and manage various symptoms, such as paranoia and auditory hallucinations, including delusions and hearing voices. Antipsychotic medications work by inhibiting the activity of dopamine and other neurotransmitters in the brain. First and second-generation antipsychotic medications are currently available on the market.

The increasing prevalence of psychotic disorders is expected to drive the demand in the market. According to the article published by the World Health Organization in June 2022, in 2019, one in every eight people in the world lived with mental disorders. The COVID-19 pandemic also had a significant impact on the market, as there was an estimated increase of 26% and 28% in anxiety and major depressive disorders in one year. This rise led to an increased demand for antipsychotic drugs, which is expected to foster growth in the market.

Advancements in technology and research in drug development have also resulted in the creation of newer and more efficient antipsychotic medications. Pharmaceutical companies are making significant investments in researching and developing drugs that have fewer side effects, higher effectiveness, and enhanced patient adherence. In January 2023, Eisai Co., Ltd. obtained FDA approval for Leqembi through the Accelerated Approval Pathway for Alzheimer's disease treatment. The introduction of advanced pharmaceutical choices for neurological disorders is increasing the use of antipsychotic drugs among patients worldwide.

Disease Insights

Schizophrenia accounted for the largest market revenue share of 39.2% in 2023. Schizophrenia is a serious mental illness that impacts a significant amount of individuals worldwide. According to the article published by the World Health Organization in January 2022, Schizophrenia affects approximately 24 million people worldwide. The rising occurrence of Schizophrenia and related conditions and an increasing proportion of elderly individuals who are at a higher risk for developing late-onset Schizophrenia are expected to drive the segmental growth.

Bipolar disorder is expected to register the fastest CAGR of 7.0% during the forecast period due to the intense utilization of these medications to manage the disease's symptoms. Medications and therapies for bipolar disorder are used to control symptoms of the illness. These medicines help stabilize emotions, decrease the intensity and frequency of mood changes, and enhance the overall well-being of those affected. The medication for bipolar disorder includes haloperidol, olanzapine, quetiapine, and risperidone.

The increasing efforts by government and private players to increase awareness regarding these disorders are further expected to add to the market growth. For instance, in May 2021, BioXcel Therapeutics introduced a campaign to raise awareness regarding agitated bipolar and schizophrenia patients. The company has also submitted its investigational drug BXCL501, developed to help in treating agitation in schizophrenia and bipolar disorders, to the Food and Drug Administration (FDA).

Drug Insights

Aripiprazole accounted for the largest market revenue share in 2023. The sales of this segment increase with the adoption of third-generation products. Furthermore, it is anticipated that product approvals are expected to experience the most significant growth during the projected period. For instance, in September 2022, H. Lundbeck A/S and Otsuka America Pharmaceutical, Inc. reported the approval of a New Drug Application (NDA) for ABILIFY ASIMTUFII (aripiprazole) from the U.S. FDA. It is an extended-release injectable suspension for intramuscular use, a bi-monthly injection for treating schizophrenia in adults, or as a standalone maintenance therapy for bipolar I disorder in adults.

Brexpiprazole is expected to register the fastest CAGR of 9.8% during the forecast period. Brexpiprazole is a medication that alters serotonin and dopamine activity. It is used as an add-on treatment for major depressive disorder, schizophrenia, and agitation linked to Alzheimer's disease. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2023, about 6.7 million Americans aged 65 and above suffered from Alzheimer's, with most of them being 75 or older. This is expected to add to the demand for Brexpiprazole and drive segmental growth.

Therapeutic Class Insights

The second generation therapeutic class accounted for the largest market revenue share of 62.9% in 2023. The growth of this segment can be attributed to the presence of a number of second-generation medications available in the market, such as HAFYERA, INVEGA, SEROQUEL, XR, ZYPREXA, and others. Furthermore, the market's growth is expected to be propelled by the enhanced efficiency and safety of the drugs in this generation.

The third generation is expected to register the fastest CAGR of 10.1% during the forecast period. Increasing advancements in drug development methods are a major factor driving growth in the market. For instance, according to the study published by the National Library of Medicine in February 2024, the development of molecules that act as partial agonists and dopaminergic receptors in the treatment of psychosis has led to the development of new and advanced drugs. This innovation has led to third-generation antipsychotics, which include medications such as aripiprazole, brexpiprazole, lurasidone, and cariprazine.

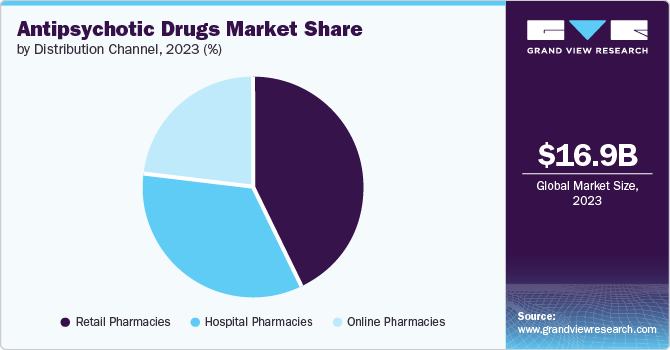

Distribution Channel Insights

The retail pharmacies segment dominated the market and accounted for the largest share in 2023. Retail pharmacies are easily available to patients, and they often act as the initial point of contact for individuals in need of prescription medications. Retail pharmacies carry a wide selection of antipsychotic medications to meet the needs of individuals with different mental health disorders. They offer advice and support to patients regarding how to use medications and potential side effects, which helps increase their popularity. Many patients prefer retail pharmacies for antipsychotic medication due to their convenience, especially for long-term therapy.

Online pharmacies are projected to grow at the fastest CAGR over the forecast period by providing more patient convenience and providing easy access to medication. Online pharmacies also offer convenient access to common medications and to crucial medicines for serious illnesses that may not be consistently stocked in brick-and-mortar pharmacies. The increasing commerce becomes more prevalent, medicine are also expected to become available for purchase online.

Regional Insights

North America dominated the market with revenue share of 37.67% in 2023. Some of the critical factors attributable to the region’s market dominance include the strong prevalence of psychiatric illnesses in the region and the market presence of prominent biopharmaceutical companies. For instance, according to the National Institute of Health (NIH), approximately 57.8 million individuals in the U.S. had a mental illness in 2021. This high prevalence of mental illnesses is likely to drive market growth in the region. Other contributive factors include the strong adoption of antipsychotics with technological superiority in the region.

U.S. Antipsychotic Drugs Market Trends

The U.S. antipsychotic market accounted for a significant share of 33.6% in 2023 due to high rates of mental illnesses such as schizophrenia and bipolar disorder in the country. In addition, there is significant healthcare spending, including extensive insurance coverage for mental health services. For instance, according to the article published by The White House in May 2022, the U.S. Federal Government covers some costs related to mental health disorder treatments and spent approximately USD 280 billion on mental health services in 2020. The spending on mental health services can help improve people’s access to quality mental health facilities, which is likely to drive market growth.

Europe Antipsychotic Drugs Market Trends

Europe's antipsychotic drugs market was identified as a lucrative region in this industry. This is due to growing awareness of mental illness and its high prevalence in the region. For instance, according to the WHO, more than 150 people in the WHO European Region lived with a mental health condition in 2021, and only one in three people with depression received the care they needed. The increasing number of patients with mental disorders and the need for treatment options is a key driver of the growth of the antipsychotic drugs market in Europe.

UK antipsychotic drugs market is expected to grow rapidly in coming years as government entities are becoming more aware of and allocating more resources towards psychiatric disorders. For instance, according to a report from the House of Commons Library in 2023, the National Health Service in the UK allocated USD 18,372.4 million for mental health services in 2021/22.

Asia Pacific Antipsychotic Drugs Market Trends

Asia Pacific antipsychotic drugs market to witness significant growth in the antipsychotic drugs market due to a large portion of the population experiencing chronic and mental illnesses, and increasing indications, strong healthcare spending, and growing investments in healthcare infrastructure are the main factors fueling the demand for antipsychotic drugs in the Asia Pacific region. The increasing efforts by government and private players to increase mental health awareness are further expected to drive growth in the region.

China's antipsychotic drugs market is expected to grow rapidly in the coming years due to the high prevalence of mental illnesses and efforts by authorities to create awareness and improve access to treatments. For instance, according to the WHO, approximately 41 million people in China suffer from depression. In addition, at least 80% of primary and secondary schools are aimed to be equipped with mental health personnel by 2022, according to Healthy China targets. Such initiatives are expected to add growth to the market.

Latin America Antipsychotic Drugs Market & Trends

Latin America's antipsychotic drugs market is expected to witness growth due to the systemic gaps in mental health care access and quality and ongoing policy and clinical initiatives. However, government initiatives, such as intersectoral coordination and collaborations between emergency mental health and psychosocial support stakeholders in Brazil, are expected to help increase awareness and access to treatment in the region and drive market growth.

The antipsychotic drugs market in Argentina is likely to witness a significant growth over the forecast period owing to the rising prevalence of mental health disorders and subsequent government efforts to increase the related awareness. For instance, in 2022, Argentina collaborated with WHO for its Director General's Special Initiative for Mental Health, which is expected to help scale up mental health services, increase access, and improve coverage of about 5.2 million Argentinians by creating community-based services and strengthening secondary-level mental health services. These efforts made by the government would help people become aware of mental health, its medications, and drugs for treatment and help the antipsychotic drugs market to grow over the forecast period

MEA Antipsychotic Drugs Market & Trends

The MEA antipsychotic drugs market is to witness significant growth in the antipsychotic drugs market during the forecast period. Although it accounts for a limited market share, the current increased healthcare expenditures and awareness initiatives in this region are driving the growth in the antipsychotic market. For instance, the South African CDC launched the Mental Health Leadership Programme, which is expected to create awareness among people regarding mental health disorders.

South Africa antipsychotic drugs market is anticipated to witness a significant growth over the forecast period pertaining to the high prevalence of mental illnesses in the country. According to a report of Mental State of the World in 2023 report released by Sapien Labs, South Africa had the highest percentage of people with mental health disorders out of 64 countries. Various collaborations and efforts by the government to create awareness regarding mental health and treatment in the country are also expected to add to the market growth. For instance, in 2023, the South African government, for the first time, collaborated with mental health professionals to host a conference dedicated to mental health

Key Antipsychotic Drugs Company Insights

Some of the key companies in the antipsychotic drugs market include H. Lundbeck A/S; Otsuka Pharmaceutical Co., Ltd.; Janssen Global Services, LLC; Eli Lilly and Company. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Teva Pharmaceutical Industries Ltd. is a pharmaceutical company that focuses mainly on producing generic drugs, and also have business endeavors in branded drugs, active pharmaceutical ingredients (API's), contract manufacturing services, and an out-licensing platform. The company develops drugs for multiple medical areas including psychiatry, oncology, and respiratory.

-

Alkermes is a biopharmaceutical company that specializes in creating medications for psychiatric and neurological conditions. Alkermes has received approval for four of its own commercial drug products, which are used to treat schizophrenia, bipolar I disorder, alcohol dependence, and opioid dependence.

Key Antipsychotic Drugs Companies:

The following are the leading companies in the antipsychotic drugs market. These companies collectively hold the largest market share and dictate industry trends.

- H. Lundbeck A/S

- Otsuka Pharmaceutical Co., Ltd.

- Janssen Global Services, LLC

- Eli Lilly and Company

- AbbVie, Inc.

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Sumitomo Pharma

- Alkermes

- Bristol-Myers Squibb Company

Recent Developments

-

In April 2024, Alkermes presented clinical data at the 2024 Congress of the Schizophrenia International Research Society (SIRS) from a phase 3 extension study. It was aimed at assessing the impact of the safety, durability, tolerability, and effectiveness of their antipsychotic drug, LYBALVI.

-

In May 2024, Otsuka Pharmaceutical Co., Ltd. reported that its U.S. branch, OPDC, and Lundbeck shared results from the Phase II (Trial 061) and Phase III trials (Trial 071 and 072) on the safety and effectiveness of brexpiprazole with sertraline for treating PTSD in adults. The results were presented at the ASCP annual meeting in Miami.

-

In October 2022, Lupin announced the launch of Paliperidone extended tablets, which are used in the treatment of mental disorders

Antipsychotic Drugs Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 17.53 billion |

|

Revenue forecast in 2030 |

USD 24.97 billion |

|

Growth rate |

CAGR of 6.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Disease, drug, therapeutic class, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; South Arabia; UAE; Kuwait |

|

Key companies profiled |

H. Lundbeck A/S; Otsuka Pharmaceutical Co., Ltd. ; Janssen Global Services, LLC; Eli Lilly and Company ; AbbVie, Inc.; Teva Pharmaceutical Industries Ltd. ; Dr. Reddy’s Laboratories Ltd.; Sumitomo Pharma ; Alkermes ; Bristol-Myers Squibb Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Antipsychotic Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antipsychotic drugs market report based on disease, drug, therapeutic class, distribution channel, and region:

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Schizophrenia

-

Bipolar Disorder

-

Unipolar Depression

-

Dementia

-

Others

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Risperidone

-

Quetiapine

-

Olanzapine

-

Aripiprazole

-

Brexpiprazole

-

Paliperidone Palmitate

-

Others

-

-

Therapeutic Class Outlook (Revenue, USD Million, 2018 - 2030)

-

First Generation

-

Second Generation

-

Third Generation

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."