- Home

- »

- Clinical Diagnostics

- »

-

Antinuclear Antibody Test Market Size, Industry Report, 2033GVR Report cover

![Antinuclear Antibody Test Market Size, Share & Trends Report]()

Antinuclear Antibody Test Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reagents & Assay Kits, Systems, Software & Services), By Test Technique (ELISA, Multiplex Assay), By Application, By End Use, By Region, and Segment Forecasts

- Report ID: GVR-2-68038-476-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antinuclear Antibody Test Market Summary

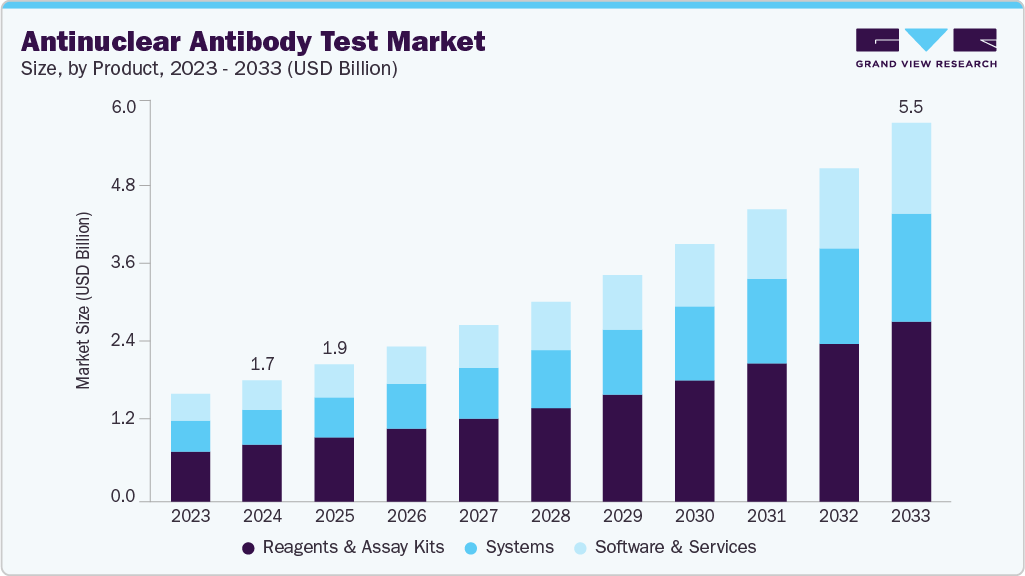

The global antinuclear antibody test market size was estimated at USD 1.76 billion in 2024 and is projected to reach USD 5.47 billion by 2033, growing at a CAGR of 13.49% from 2025 to 2033. The market growth is accelerated by advancements in antinuclear antibody test (ANA) diagnostics, as it shifts toward standardization and high-throughput autoimmune testing.

Key Market Trends & Insights

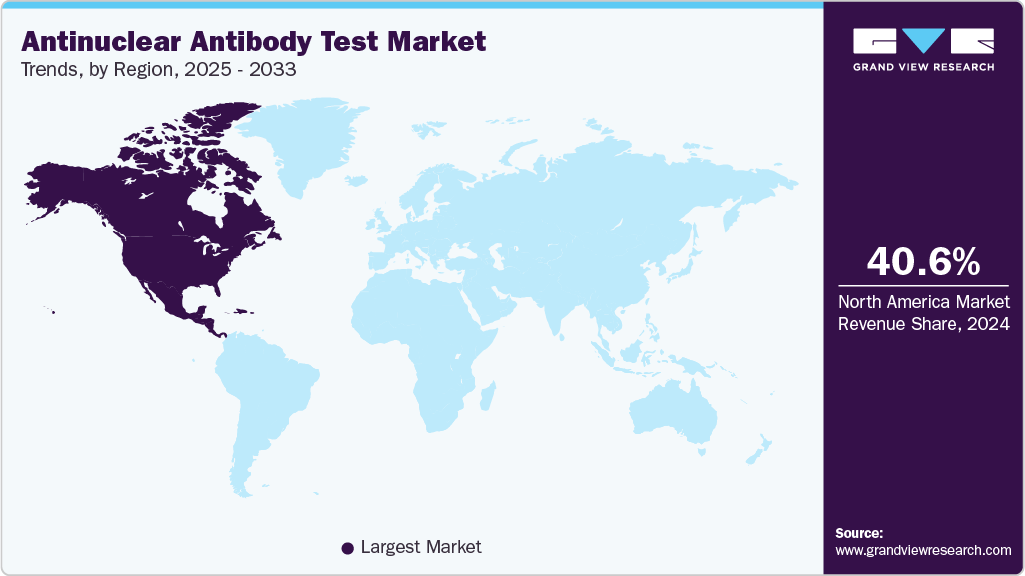

- North America antinuclear antibody test industry dominated the global market and accounted for the largest revenue share of 40.61% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- By product, the reagents & assay kits segment dominated the global market with a 46.80% market share in 2024.

- By test technique, the immunofluorescence assay segment held the largest revenue share of 52.46% in 2024.

- By application, the rheumatoid arthritis segment held the largest revenue share of 33.71% in 2024.

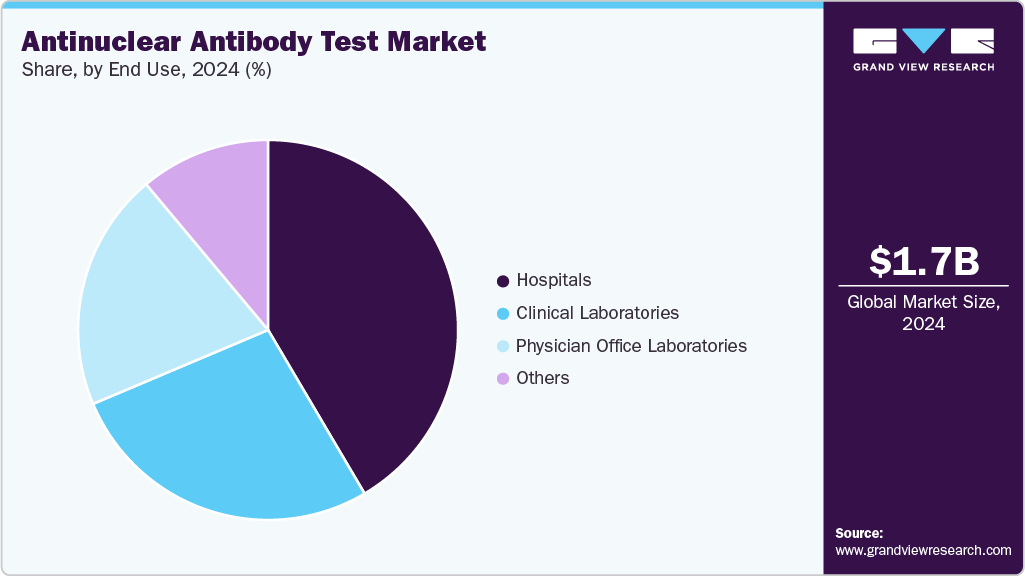

- By end use, the hospitals segment held the largest revenue share of 41.52% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.76 Billion

- 2033 Projected Market Size: USD 5.47 Billion

- CAGR (2025-2033): 13.49%

- North America: Largest Market in 2024

The industry is increasingly adopting AI-enabled immunofluorescence platforms that enhance accuracy, consistency, and workflow efficiency.For instance, in August 2025, Journal of Clinical Medicine demonstrated the value of AI-assisted ANA IIFT, showing good concordance with classical visual interpretation and significantly improving reproducibility in pattern recognition, especially at clinically relevant cut-offs. These findings reinforce AI’s emerging role in minimizing observer variability and supporting reliable ANA screening. In parallel, digital IFA imaging solutions are reshaping routine diagnostics.

For instance, in January 2022, ZEUS Scientific, Inc. launched the dIFine platform with an integrated HEp-2 Pattern Atlas, providing automated slide scanning, intelligent pattern recognition, and side-by-side reference image comparison to elevate standardization and operator. AI-driven interpretation, automated digital microscopy, and improved pattern-classification tools are all improving ANA diagnostics, allowing laboratories to meet rising autoimmune disease testing demand with greater precision and operational efficiency.

The increasing prevalence of major autoimmune diseases including rheumatoid arthritis, systemic lupus erythematosus (SLE), Sjögren’s syndrome, and scleroderma is a key driver supporting the growth of the market. The rising SLE burden is particularly significant; in 2022 PubMed Central article reported a global prevalence of 43.7 cases per 100,000 people, representing an estimated 3.41 million individuals worldwide. In 2024, ScienceDirect highlighted region-wide variations, noting SLE prevalence ranging from 11.3 to 25.3 cases per 100,000 individuals across different geographical zones. In addition, in the U.S., the disease burden remains high in 2021, CDC-funded analysis estimated that approximately 204,295 Americans live with SLE based on stringent diagnostic criteria. Similarly, Sjögren’s syndrome continues to add to autoimmune disease burden, with NCBI indicating it affects 0.5%-1.0% of the global population, marking a substantial incidence that approaches half that of rheumatoid arthritis. Thus, the growing clinical burden of these chronic autoimmune conditions reinforces the demand for early detection tools, strengthening the adoption of ANA testing across healthcare systems.

Furthermore, the increasing detection of asymptomatic and subclinical autoimmunity is serving as a major catalyst for the growth of the market. Recent clinical observations indicate that individuals without overt autoimmune symptoms are increasingly testing positive for ANA, necessitating earlier screening and ongoing diagnostic follow-ups. A study found that a significant proportion of ANA-positive people remained clinically silent but showed immunological activity that warranted ongoing monitoring. In India, reports indicate a 30% increase in ANA positivity following post-infectious immune dysregulation, particularly after COVID-19, which has accelerated preventive testing. Genetic research (RheumNow) shows that asymptomatic ANA-positive people have molecular signatures associated with future autoimmune disease progression, reinforcing clinicians' preference for proactive screening. Pediatric rheumatology clinics report an increase in referrals for children with unexplained ANA positivity, indicating an expanding at-risk population. These trends are driving higher test volumes, increased adoption of sensitive assays, and global demand for ANA diagnostics.

The increasing adoption of reflex testing and comprehensive autoantibody panels is becoming a major accelerator for the global antinuclear antibody test (ANA) market. Clinical laboratories worldwide are shifting from single-step ANA screening to automated reflex pathways, where a positive ANA result seamlessly triggers follow-up testing for ENA profiles and disease-specific autoantibodies. This transition ensures faster, more standardized diagnostic workups. Although the Journal of Skin and Sexually Transmitted Diseases (India) primarily focuses on testing interpretation, its recommendations emphasize structured diagnostic approaches that support more efficient identification of clinically significant autoantibody patterns, reinforcing the value of reflexive testing workflows. Multi-marker panels are proving essential in early-stage or ambiguous autoimmune cases, helping clinicians detect immune signatures that conventional ANA tests may overlook. In 2025, American Academy of Pediatrics reported a surge in pediatric referrals for unexplained inflammatory symptoms, driving broader adoption of multi-analyte panels to manage complex cases. Together, these developments are fueling demand for advanced assay kits, automated platforms, and sophisticated interpretive software, thereby strengthening overall market growth.

Market Concentration & Characteristics

Innovation in the ANA market is moderate; new multiplex and automated assays are built on existing technology rather than introducing entirely new paradigms. For instance, the BioPlex 2200 ANA Screen uses bead-based multiplex immunoassay technology to measure multiple autoantibodies (dsDNA, Sm, RNP, SSA, etc.) in a single run. Studies show its sensitivity and specificity are comparable to traditional immunofluorescence, while reducing time and sample volume. These incremental improvements improve lab workflows without dramatically reinventing autoantibody diagnostics.

M&A activity in the ANA diagnostics industry has been moderate. Established immunodiagnostic companies prefer to invest in improving their existing assay platforms such as automating current IFA or multiplex bead panels rather than acquiring smaller firms. This cautious approach reduces integration risk while maintaining development agility. Companies that focus on internal R&D can fine-tune already-proven test systems, efficiently manage regulatory pathways, and maintain control over quality and cost, rather than diverting resources into large-scale mergers or acquisitions.

The regulatory impact in the market is moderate, as diagnostic manufacturers must comply with evolving quality and performance standards while avoiding excessive barriers. Regulatory bodies require demonstrable evidence of analytical validity, such as sensitivity, specificity, reproducibility, and inter-laboratory consistency. Standardization requirements, such as adhering to the International Consensus on ANA Patterns (ICAP), have improved reporting and assay interpretation reliability. While these regulations ensure test reliability, they require ongoing updates to product documentation, quality systems, and validation protocols. Overall, the regulatory environment encourages steady innovation while requiring manufacturers to maintain continuous compliance efforts, ensuring that the impact is balanced rather than restrictive.

Product expansion in the ANA testing industry is moderate. Instead of developing entirely new platforms, companies are improving existing assay lines by adding more antigen targets, combining screening and confirmatory panels, and fine-tuning algorithms for result interpretation. For example, multiplex bead-array systems now include 13 or more nuclear antigen targets, allowing for broader autoantibody coverage in a single test. These enhancements make the test more useful for clinicians without significantly altering the test format.

The ANA diagnostics sector has experienced moderate regional expansion. Demand is highest in developed markets such as North America and Europe, where laboratory infrastructure and reimbursement systems easily support automated and multiplex platforms. In contrast, adoption in emerging markets is slow due to cost, limited lab automation, and low clinical awareness of comprehensive ANA panels. Manufacturers are entering new markets with caution, using partnerships, pilot programs, and scalable systems rather than aggressive global product launches.

Product Insights

By product, the reagents & assay kits segment held the largest market share of 46.80% in 2024, because of increased adoption of advanced immunoassay platforms, increased test standardization requirements, and the expansion of automated laboratory workflows. Growing demand for high-sensitivity ANA diagnostics, fueled by rising autoimmune disease prevalence, has accelerated reagent consumption in hospitals and reference laboratories. The transition to reproducible, ready-to-use kits with validated performance has increased customer demand for dependable assay formats. For example, Krishgen BioSystems' 2024 documentation highlighted the adoption of the GENLISA GS-ANA ELISA kit, which was noted for its double-antibody sandwich design, improved precision, and applicability across serum and plasma, demonstrating how technically advanced kits continue to drive segment advancement. Furthermore, the segment is the fastest-growing segment during the forecast period as the incidence of bacterial enteric infections rises, rapid molecular diagnostics become more widely used, and public-health surveillance efforts aimed at early pathogen detection grow in scope. Growing awareness among clinicians about the clinical significance of bacterial pathogens, as well as higher testing frequency during outbreak seasons, contributes to their rapid growth.

The systems segment is the second largest in the market, owing to widespread adoption of automated analyzers, multiplex molecular platforms, and integrated workflow solutions. The demand for high-throughput processing, improved test accuracy, and reduced manual handling in clinical laboratories is driving the growth. The growing preference for fully automated systems that provide faster turnaround times, standardized results, and seamless integration with laboratory information systems accelerates adoption. Moreover, rising testing volumes in hospitals and public health labs, combined with the need to manage a wide range of bacterial, viral, and parasitic pathogens, are driving up demand for advanced diagnostics.

Test Technique Insights

The immunofluorescence assay segment held a revenue share of 52.46% in 2024. This large share is attributed to its gold-standard status, superior sensitivity, and ability to detect a wide range of nuclear antigen patterns using HEp-2 substrates. Its widespread use in diagnosing autoimmune rheumatological diseases such as systemic lupus erythematosus, scleroderma, and dermatomyositis drives up demand. The demand for expert interpretation of complex fluorescence patterns has fueled research into automation. In 2023, the Springer Nature study found that deep learning-based models with transfer learning can accurately classify ANA IIF patterns, reduce subjectivity, and saving expert time. This technological advancement improves diagnostic consistency and reinforces the growing preference for advanced IIF-based platforms in high-volume laboratories.

In addition, the ELISA segment is expected to be the fastest-growing segment in the market over the forecast period, owing to its high specificity, quantitative capability, and strong suitability for routine clinical workflows. Adoption is further aided by rising laboratory demand for low-cost, high-throughput testing solutions capable of reliably detecting a wide range of autoantibodies. The rising global prevalence of autoimmune diseases, as well as the shift toward standardized, automation-friendly platforms, are driving the adoption of ELISA-based ANA testing. Continuous improvements in assay sensitivity and the expansion of antigen panels support the segment's rapid growth trajectory.

Application Insights

Based on application, the rheumatoid arthritis segment accounted for the largest market share of 33.71% in 2024, owing to growing clinical recognition that ANA positivity influences disease presentation, diagnostic pathways, and treatment decisions in RA. According to the rheumatologist, ANA-positive RA patients frequently have delayed diagnosis and different therapeutic patterns, including a higher likelihood of using hydroxychloroquine rather than methotrexate. These diagnostic nuances, combined with a growing emphasis on early stratification and differentiation from other autoimmune conditions, have increased reliance on ANA testing, resulting in widespread adoption in RA-focused clinical settings.

Further, the systemic lupus erythematosus (SLE) segment is anticipated to be the fastest-growing category over the forecast period, due to increased awareness of early symptom recognition and a surge in first-line ANA screening in hospitals and specialty rheumatology centers. The use of multiparametric testing, which combines HEp-2 IFA, ELISA, and extended ENA panels, enables more precise detection of complex autoantibody signatures associated with SLE. Clinicians are increasingly turning to high-sensitivity immunoassay platforms to distinguish early SLE from overlap syndromes, mixed connective tissue disorders, and post-infection immune activation. In addition, expanded clinical guidelines recommending earlier immunological workups in patients with ambiguous inflammatory symptoms are driving demand for advanced ANA diagnostics in this segment.

End Use Insights

Hospitals dominated the market in 2024, accounting for a 41.52% share, Driven by high patient influx for autoimmune disease evaluation, a strong reliance on comprehensive diagnostic panels, and the availability of advanced laboratory infrastructure. The growing emphasis on early disease detection, physician preference for accurate and standardized testing methods, and the integration of automated ANA testing platforms in hospital laboratories all contributed to this segment's leadership. Hospitals routinely manage complex cases that necessitate confirmatory and follow-up testing, contributing to increased testing volumes and sustained demand for ANA diagnostics.

Moreover, the clinical laboratories segment is expected to grow the fastest during the forecast period, due to increased investments in laboratory infrastructure and rising demand for accurate, high-throughput tests. The expansion of modern laboratories equipped with advanced diagnostic instruments allows for faster and more reliable detection of infectious and chronic diseases, meeting the increasing demands of healthcare providers and patients. The growing of laboratory networks and partnerships, combined with the adoption of automation and digital solutions, facilitates the efficient processing of large volumes of samples, improving workflow and reducing turnaround times.

Regional Insights

The antinuclear antibody test industry in North America is driven by region-specific structural and commercial drivers that distinguish it from other geographies. Countries such as U.S. carries substantial disease burden, which sustains baseline clinical demand for ANA screening and reflex testing. Strong commercial laboratory networks and consolidation led by national players that enable high-volume distribution, rapid product rollouts, and centralized reference testing accelerate uptake of automated and multiplex assays. A more interventionist regulatory landscape is increasing quality standards and favoring vendors with validated, scalable platforms. Canada’s provincially coordinated lab systems prioritize standardized assays and public-funded diagnostic pathways, supporting adoption of high-specificity assays. Mexico’s growing diagnostics market and rising access to point-of-care and centralized services create incremental volume and diversification opportunities. Robust R&D investment and frequent introductions in North America sustain innovation cycles keeping the region globally dominant.

U.S. Antinuclear Antibody Test Market Trends

The U.S. antinuclear antibody test industry is gaining momentum as testing increasingly supports the diagnosis and monitoring of rheumatoid arthritis (RA), systemic lupus erythematosus (SLE), Sjögren’s syndrome, scleroderma, and other connective-tissue diseases. While RA is typically associated with rheumatoid factor and anti-CCP, many RA patients undergo ANA testing to detect overlapping autoimmune features, roughly 30-50% shows ANA positivity in U.S.-based cohorts. In SLE, ANA remains a foundational marker with 57-62% of SLE patients showing anti-dsDNA. For Sjögren’s syndrome and scleroderma, the inclusion of ENA panels for instance SS-A/SS-B, Scl-70 is common practice. Diagnostic labs like Quest Diagnostics offer reflex ANA IFA panels paired with ENA antibody testing for these diseases. Technological innovation is accelerating in U.S. labs; automated IIF systems and AI-based image analysis tools are being deployed to improve consistency and reduce human error. A recent study showed that AI trained on IIF images increased pattern-identification accuracy to more than 87%. Automated IIF readers, such as the EUROPattern Suite, have demonstrated ~94% concordance with manual microscopy, boosting laboratory efficiency in high-throughput settings. These advancements enhance the clinical utility of ANA testing across rheumatologic disease management and support broader adoption in the U.S.

Europe Antinuclear Antibody Test Market Trends

The antinuclear antibody test industry in Europe is expected to grow steadily during the forecast period, owing to strong diagnostic infrastructure, increased autoimmune disease awareness, and the rapid adoption of automated ANA testing platforms in both public and private laboratories. The rising prevalence of conditions like systemic lupus erythematosus, Sjögren's syndrome, and systemic sclerosis continues to drive test volumes, especially as physicians across Europe adopt earlier screening strategies. Growth is boosted by increased harmonization efforts, such as ICAP pattern-standardization initiatives, which improve test uniformity across European labs. Investing in digital pathology, AI-based IIF interpretation systems, and high-throughput platforms helps to reduce result variability and improve diagnostic accuracy. Favorable reimbursement policies and large national health-care systems, particularly in Western Europe, ensure consistent demand.

The UK antinuclear antibody test industry is growing due to a unique combination of factors: centralized NHS pathology networks and procurement allow for rapid scaling-up of validated ANA platforms; strong, widely adopted clinical guidelines from the British Society for Rheumatology encourage standardized testing pathways; and significant public funding and reimbursement for diagnostic services support routine ANA use. The NHS AI Lab and other AI-in-healthcare initiatives are accelerating trials of automated IIF interpretation, reducing expert workload and increasing throughput. Consolidation and automation pilots in pathology services are reducing turnaround times and encouraging the use of high-value assays. Rising hospital admissions for autoimmune conditions, combined with a growing emphasis on health disparities that require earlier testing in underserved populations, are driving up test volumes. Thus, these factors make the UK market particularly receptive to automation, cloud-enabled reporting, and AI-assisted ANA solutions, setting it apart from markets that rely on private-pay or fragmented lab infrastructure.

The Germany antinuclear antibody test industry is growing strongly, driven by a unique mix of factors: a dense network of high-quality clinical laboratories and hospital reference centers that favor advanced immunoassays; leading domestic diagnostics manufacturers (supporting local supply and innovation); strict national quality standards that increase demand for standardized, validated assays; and broad statutory health-insurance reimbursement that supports routine ANA tests. These drivers are bolstered by active clinical research and an increasing diagnosed prevalence of autoimmune disorders, which together result in consistent testing volumes and a favorable environment for higher-value, automated ANA solutions.

Asia Pacific Antinuclear Antibody Test Market Trends

The antinuclear antibody test industry in Asia-Pacific is experiencing significant growth, driven by region-specific drivers that differ from Western markets. India's expanding private laboratory networks and increased rheumatology service penetration are propelling volume growth beyond metropolitan areas. Australia and Singapore serve as regional validation and clinical-research hubs, accelerating the adoption of multiplex assays and regulatory approval for novel diagnostics. Throughout Southeast Asia, public-private screening initiatives and improved reimbursement frameworks are increasing access to immunology testing. Local manufacturers and diagnostic distributors are designing lower-cost, high-throughput platforms to fit emerging-market laboratory budgets, increasing adoption outside of tier-1 cities. Moreover, expanding specialist training programs and tele-rheumatology services boost test utilization and follow-up care. Overall, these market mechanics network expansion, research hub effects, policy support, localized affordability, and workforce development set Asia-Pacific's ANA market apart and help it maintain a leading position. Rapid digitization of lab workflows, as well as increased collaboration between hospitals and diagnostics players, are driving long-term global growth.

The Japan antinuclear antibody test industry is driven by rising autoimmune disease incidence, growing demand for multiplex autoantibody profiling, and rapid adoption of advanced line-immunoassay technologies in clinical laboratories. The growing demand for precise identification of disease-associated autoantibody patterns, particularly in conditions such as SLE, mixed connective tissue disease, Sjögren's syndrome, and scleroderma, is driving the transition to high-specificity diagnostic platforms. Fujirebio's (Japan) INNO-LIA ANA, CE-marked, IVDR-compliant demonstrates this trend by detecting 13 autoantigens in a single run with ≥98% target specificity and high sensitivity. Automated ANA testing, such as Auto-LIA 48 and LiRAS software-based interpretation, is increasingly preferred by laboratories due to its ability to generate results within three hours. These capabilities are consistent with Japan's focus on improving early diagnosis and monitoring of connective tissue diseases, where autoantibody specificity such as anti-Sm for SLE, anti-Scl-70 for diffuse sclerosis, and anti-Jo-1 for PM/DM-is critical in clinical decision-making. As clinicians rely more on detailed autoantibody panels for diagnosis, treatment planning, and patient follow-up, multiplex assays such as INNO-LIA ANA Update continue to drive market growth in Japan.

The China antinuclear antibody test industry is experiencing rapidly due to rising autoimmune disease prevalence, expanded diagnostic capabilities, and increased adoption of advanced immunoassay platforms in hospitals and independent laboratories. Growing awareness of early autoimmune disease detection, government-led healthcare modernization, and increased insurance coverage for immunological testing are all driving up demand. The transition to automation, which includes automated IIF systems, multiplex immunoassays, and high-throughput ELISA analyzers, has improved testing efficiency and consistency. In addition, China's improving clinical laboratory quality standards and increased investment in rheumatology and immunology departments promote consistent test utilization. PubMed Central study reported in 2024 that autoimmune diseases such as systemic lupus erythematosus and Sjögren's syndrome are on the rise in China, contributing to increased diagnostic workloads. In 2022, the article highlighted the continued expansion of tertiary hospital laboratory infrastructure, thereby improving access to ANA testing. These factors, taken together, account for China's ANA testing market's rapid growth.

Latin America Antinuclear Antibody Test Market Trends

The antinuclear antibody test industry in Latin America is experiencing steady growth, driven by rising autoimmune disease detection rates, increased access to immunology services, and growing adoption of automated ANA testing platforms across urban diagnostic networks. Countries such as Brazil, Mexico, and Argentina are seeing increased clinician awareness of early autoimmune symptom evaluation, resulting in increased ANA test utilization in both public and private healthcare settings. Moreover, laboratories are upgrading workflows with high-throughput analyzers and multiparametric autoantibody panels to improve result accuracy and reduce turnaround times. Growing investments in laboratory quality accreditation and standardized testing protocols help to drive market growth, as health systems prioritize early diagnosis to avoid late-stage complications and reduce long-term treatment burdens.

The Brazil antinuclear antibody test industry is fueling owing to the rising prevalence of autoimmune diseases, increased demand for early diagnostic testing, and steady improvements in laboratory capacity across public and private healthcare systems. Hospitals and diagnostic chains are increasingly using ANA testing as clinicians place a greater emphasis on early detection of conditions like lupus, scleroderma, and Sjögren's syndrome. The country's expanding universal healthcare system (SUS) is facilitating greater access to autoimmune disease diagnostics, resulting in increased test volumes at regional and state laboratories. Technological advancements, such as automated immunofluorescence systems and efficient ELISA-based platforms, improve test accuracy while reducing technicians' manual workload. Medical societies' growing awareness campaigns in Brazil are encouraging more patients to seek medical attention at an early stage of the disease.

Middle East and Africa Antinuclear Antibody Test Market Trends

The antinuclear antibody test industry in the Middle East and Africa is expanding as autoimmune diseases such as systemic lupus erythematosus, rheumatoid arthritis, and Sjögren's syndrome become more common. The growing awareness among clinicians and patients about early autoimmune disease detection has increased demand for antinuclear antibody test testing in hospitals and diagnostic laboratories. The region's diagnostic accessibility and accuracy are improving as sophisticated immunoassay technologies and healthcare infrastructure expand. Governments in Gulf Cooperation Council (GCC) countries are investing heavily in laboratory automation, digital healthcare, and clinical research, which will drive market growth. For example, growing collaborations between international biotechnology companies and regional diagnostic centers are fostering capacity building and technology transfer.

The UAE antinuclear antibody test industry is driven by the country's rapidly evolving healthcare system, which includes advanced diagnostic infrastructure and significant investment in biotechnology innovation. The rising incidence of autoimmune diseases, as well as growing awareness of early disease detection, have increased the demand for antinuclear antibody test testing in hospitals and private laboratories. The widespread use of sophisticated immunoassay platforms has been aided by government programs that promote laboratory automation and digital health transformation. In addition, the introduction of ELISa services in the country is driving market growth. For example, the UAE's status as a regional center for medical tourism continues to increase the number of diagnostic procedures, allowing the immunoassay industry to grow. Strategic partnerships between global diagnostics companies and healthcare providers enable innovative assay technologies and improved test accuracy. Furthermore, the UAE's emphasis on personalized medicine and research collaborations with academic institutions and biotech companies are bolstering biomarker discovery initiatives, which will drive the market's long-term growth.

Key Antinuclear Antibody Test Company Insights

The antinuclear antibody test industry features several key players driving innovation and adoption. Leading companies include Abbott, Bio-Rad Laboratories, Inc., Erba Mannheim, Trinity Biotech Plc., Thermo Fisher Scientific, Inc., Antibodies Incorporated, QuidelOrtho Corporation, ZEUS Scientific, Inc., Merck KGaA, Revvity, EUROIMMUN Medizinische Labordiagnostika AG, Immuno Concepts NA Ltd., ORGENTEC, and Transasia Bio-Medicals. These firms are heavily investing and rapidly evolving with continuous product innovation, focusing on developing more sensitive, automated, and high-throughput ANA testing solutions. Many players are expanding their geographic footprint through new diagnostic centers, distribution networks, and partnerships in emerging markets.

Key Antinuclear Antibody Test Companies:

The following are the leading companies in the antinuclear antibody test market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Bio-Rad Laboratories, Inc.

- Erba Mannheim

- Trinity Biotech Plc.

- Thermo Fisher Scientific, Inc.

- Antibodies Incorporated

- QuidelOrtho Corporation

- ZEUS Scientific, Inc.

- Merck KGaA

- Revvity

- EUROIMMUN Medizinische Labordiagnostika AG

- Immuno Concepts NA Ltd.

- ORGENTEC

- Transasia Bio-Medicals.

Recent Developments

-

In October 2025, Tellgen invested in CytoCares to expand its autoimmune diagnostics capabilities and advance its “Diagnosis-Therapy-Monitoring” model. The company CAP-recognized flow fluorescence platform detects 46 autoantibody targets, including a 16-item ANA panel, and aims to improve early detection, disease stratification, and patient monitoring while accelerating integrated diagnostic-therapy solutions in the growing autoimmune disease landscape.

-

In February 2025, Hipro Biotechnology Co., Ltd. (China) showcased cutting-edge diagnostic innovations at MedLab Middle East 2025, including the Fluorescence Immunoassay analyzer (PalmF). However, infrastructure gaps, unequal laboratory capabilities, and lower overall adoption when compared to leading Western markets somewhat limit the pace and penetration of these technologies. Because of this, even though innovation is essential and developing, it is still at a medium level rather than a high one.

-

In January 2025, Anbio Biotechnology participated in the 2025 Medlab Middle East exhibition, taking place from 3rd to 6th February at the Dubai World Trade Centre. The event is one of the region's largest and most important medical and laboratory equipment trade exhibitions, bringing together top manufacturers, distributors, and healthcare professionals from all over the world.

Antinuclear Antibody Test Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.99 billion

Revenue forecast in 2033

USD 5.47 billion

Growth rate

CAGR of 13.49% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test technique, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Bio-Rad Laboratories, Inc.; Erba Mannheim; Trinity Biotech Plc.; Thermo Fisher Scientific, Inc.; Antibodies Incorporated; QuidelOrtho Corporation; ZEUS Scientific, Inc.; Merck KGaA; Revvity; EUROIMMUN Medizinische Labordiagnostika AG; Immuno Concepts NA Ltd.; ORGENTEC; Transasia Bio-Medicals

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antinuclear Antibody Test Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global antinuclear antibody test market report based on product, test technique, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reagents & Assay Kits

-

Systems

-

Software & Services

-

-

Test Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

ELISA

-

Immunofluorescence Assay

-

Multiplex Assay

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Rheumatoid Arthritis

-

Systemic Lupus Erythematosus

-

Sjogren’s Syndrome

-

Scleroderma

-

Other Diseases

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Clinical Laboratories

-

Physician Office Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antinuclear antibody test market size was estimated at USD 1.76 billion in 2024 and is expected to reach USD 1.99 billion in 2025.

b. The global antinuclear antibody test market is expected to grow at a compound annual growth rate of 13.49% from 2025 to 2030 and is expected to reach USD 5.47 billion by 2033.

b. The reagents & assay kits segment is expected to dominate the antinuclear antibody test market with a share of 46.80% in 2024, because of increased adoption of advanced immunoassay platforms, increased test standardization requirements, and the expansion of automated laboratory workflows.

b. Some key players operating in the antinuclear antibody test market include Abbott, Bio-Rad Laboratories, Inc., Erba Mannheim, Trinity Biotech Plc., Thermo Fisher Scientific, Inc., Antibodies Incorporated, QuidelOrtho Corporation, ZEUS Scientific, Inc., Merck KGaA, Revvity, EUROIMMUN Medizinische Labordiagnostika AG, Immuno Concepts NA Ltd., ORGENTEC, and Transasia Bio-Medicals.

b. The market is driven by advancements in antinuclear antibody test (ANA) diagnostics as it is shifting toward standardization and high-throughput autoimmune testing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.