- Home

- »

- Micro Molding & Microspheres

- »

-

Antimony Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Antimony Market Size, Share & Trends Report]()

Antimony Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Trioxides, Alloys), By Application (Flame Retardants, Lead Acid Batteries, Chemicals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-385-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antimony Market Summary

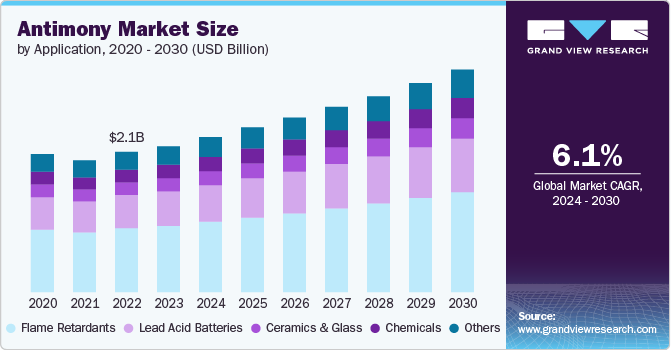

The global antimony market size was estimated at USD 2.17 billion in 2023 and is projected to reach USD 3.30 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The market expansion is significantly driven by increasing applications in flame retardants, lead-acid batteries, and semiconductors.

Key Market Trends & Insights

- Asia Pacific was the largest revenue generating market in 2023.

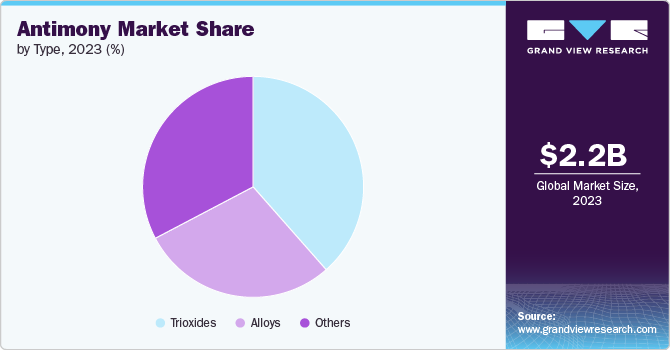

- By type, trioxides held the largest revenue share of the antimony market in 2023.

- By application, flame retardants held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.17 Billion

- 2030 Projected Market Size: USD 3.30 Billion

- CAGR (2024-2030): 6.1%

- Asia Pacific: Largest market in 2023

Drivers, Opportunities & Restraints

The demand for antimony stems from its key roles in flame retardants and lead-acid batteries, thanks to its properties like high heat resistance and electrical conductivity. Due to fire safety needs, it's vital in sectors such as construction, textiles, and electronics and is increasingly used in electric vehicle batteries in the automotive industry. This boosts its market as antimony enhances battery performance and longevity, aligning with the demand for sustainable transportation.

The antimony market is diverse but faces several challenges, including environmental issues from mining and processing, high energy consumption, elevated production costs, and supply chain vulnerabilities. Geopolitical tensions and regulatory barriers further complicate access to raw materials and market stability. Health concerns linked to antimony exposure add to the constraints, limiting adoption in industries careful of strict environmental regulations.

The antimony market is thriving, fueled by tech advancements and its growing role in new industries. Efforts to improve antimony’s efficiency and lower costs are expanding its market. Its crucial role in electronics, along with increasing use in healthcare and consumer electronics, signals strong growth. Investments in sustainability within its supply chain underscore antimony's importance in future technologies.

Price Trends Of Antimony

The antimony market has experienced notable price fluctuations driven by various factors, including supply chain disruptions and increased demand from key industries. In 2022, antimony prices surged due to heightened demand from the flame retardant and battery sectors. However, in 2023, prices began to stabilize as supply chain issues eased and production resumed in major antimony-producing countries such as China, where the government implemented measures to enhance mining efficiency. By early 2024, the market saw a slight decline in prices as the market adjusted to the new supply dynamics and demand levels. This trend reflects a broader stabilization in the commodities market, influenced by global economic conditions and shifts in consumer demand.

Type Insights

“Trioxides held the largest revenue share of the antimony market in 2023.”

Trioxides dominate the market due to their extensive applications in flame retardants, where antimony trioxide is a critical additive. It accounts for a significant share in the construction, textiles, and electronics industries, where stringent fire safety regulations necessitate effective fire protection measures. Antimony trioxide acts as a synergist in flame retardant formulations, enhancing the efficacy of materials without compromising their mechanical properties.

The alloys segment is the fastest-growing segment in the antimony market, driven by increasing demand from the automotive and aerospace industries for specialized alloys. Antimony alloys, particularly those with lead, enhance the mechanical properties of materials, making them ideal for applications requiring high strength and durability. In the automotive sector, antimony alloys are crucial components in lead-acid batteries, where they improve battery performance and longevity. The growing adoption of electric vehicles globally further propels demand for antimony alloys in battery manufacturing.

Application Insights

“Flame retardants held the largest revenue share of antimony market in 2023.”

The flame retardants segment is expected to continue dominating, driven by stringent fire safety regulations across the construction, electronics, and textile industries. Antimony compounds such as antimony trioxide are crucial additives in flame retardant formulations, providing effective fire protection without compromising material integrity. As industries increasingly prioritize safety and regulatory compliance, the demand for antimony in flame retardant applications is anticipated to grow robustly during the forecast period.

Lead-acid batteries are the fastest-growing segment in the market. This growth is driven by increasing demand from the automotive sector, particularly for EVs, where antimony plays a crucial role in enhancing battery performance and longevity. Antimony improves the efficiency and durability of lead-acid batteries, making them suitable for the high demands of EV applications.

Moreover, the global push towards sustainability and the transition to cleaner energy sources are further propelling the adoption of EVs, thereby boosting the demand for antimony in lead-acid batteries. This trend highlights the significant growth prospects for the antimony market in the automotive sector, driven by ongoing innovations and increasing investments in electric mobility infrastructure worldwide.

Regional Insights

In North America, the electronics sector remains a pivotal consumer of antimony compounds. The region's antimony market is characterized by steady demand from the electronics sector, where antimony is used in semiconductors and electronic components. The stringent regulatory landscape concerning flame retardants also supports market growth, particularly in the construction and consumer goods industries.

U.S. Antimony Market Trends

The U.S. antimony market is essential for industries such as flame retardants, lead-acid batteries, and ceramics, thanks to its high heat resistance and conductivity. Growth is fueled by strict fire safety regulations and the automotive sector's demand for antimony in electric vehicle batteries.

Asia Pacific Antimony Market Trends

“China held largest revenue share of the overall Asia Pacific antimony market.”

Asia Pacific leads the global antimony market, with China being the primary contributor owing to its significant production capacity and consumption across various end-use industries. The region's dominance is highlighted by robust demand from electronics manufacturing, automotive sector growth, and expanding construction activities. In addition, government initiatives promoting infrastructure development and technological advancements in semiconductor production further drive the demand for antimony in Asia Pacific, solidifying its position as a key market for antimony metal globally.

Europe Antimony Market Trends

The European antimony market is supported by strong demand from automotive manufacturers for lead-acid batteries and from the chemical sector for chemicals and stabilizers. Germany's automotive industry, in particular, drives significant consumption of antimony in battery technologies, while advancements in industrial applications further stimulate market growth. The region's focus on reducing environmental footprint and enhancing product efficiency through technological innovations underscores its role in shaping the future of the global antimony market.

Key Antimony Company Insights

Some of the key players operating in the market include TiFast S.r.l. and Lanxess

-

United States Antimony Corporation, headquartered in the U.S., is a prominent supplier of antimony products globally. The company's diversified portfolio includes antimony oxide, metal, and chemicals used across various industrial applications. The company continues to expand its market presence through strategic partnerships and investments in advanced manufacturing technologies.

-

Mandalay Resources, based in Canada, is a leading producer of antimony concentrates and other precious metals. The company's operations span multiple countries, supplying high-grade antimony products to global markets. Mandalay Resources' focus on operational excellence and sustainable mining practices highlights its role in meeting the global demand for antimony.

Key Antimony Companies:

The following are the leading companies in the antimony market. These companies collectively hold the largest market share and dictate industry trends.

- Campine NV

- Huachang Antimony Industry

- Korea Zinc

- Lambert Metas International Limited

- Lanxess

- Mandalay Resources Ltd.

- Nyacol Nano Technologies, Inc.

- Suzuhiro Chemical Co., Ltd

- Umicore

- United States Antimony Corporation

Recent Developments

-

In January 2024, CMR expanded its mining portfolio significantly by acquiring 26 exploration permits in central Morocco through Hesperis Resources. This strategic acquisition, which includes permits with potential for critical metals such as antimony, strategically positions CMR for growth and success in the clean energy sector.

-

In August 2023, Hyundai Motor Group (HMG) announced a comprehensive strategic partnership within the nickel value chain alongside Korea Zinc Company Ltd, a leading non-ferrous metal smelting company.

-

In July 2022, Slovak Antimony Corp successfully finalized the acquisition of an Antimony/Tin processing circuit located in Eastern Slovakia. The acquisition aims to enhance the company's production capacity.

-

In January 2021, Campine, located near Antwerp in Beerse, is enhancing its recycling capabilities by introducing advanced technology to extract chemicals directly from post-consumer and industrial metal waste. The company focuses on two core operations: recycling lead and manufacturing antimony trioxide, a critical chemical additive.

Antimony Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.31 billion

Revenue forecast in 2030

USD 3.30 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Russia; China; India; Japan; Brazil

Key companies profiled

Campine NV; United States Antimony Corporation; Lambert Metas International Limited; Lanxess; Umicore; Korea; Zinc; Huachang Antimony Industry; Mandalay Resources Ltd.; Suzuhiro Chemical Co., Ltd; Nyacol Nano Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antimony Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antimony market report on the basis of type, application, and region.

-

Type Outlook (Volume, Kil0tons; Revenue, USD Billion, 2018 - 2030)

-

Trioxides

-

Alloys

-

Others

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Billion, 2018 - 2030)

-

Flame Retardants

-

Lead Acid Batteries

-

Chemicals

-

Ceramics & Glass

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global antimony market size was estimated at USD 2.17 billion in 2023 and is expected to reach USD 2.31 billion in 2024.

b. The global antimony market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 3.30 billion by 2030.

b. By application, flame retardants dominated the market with a revenue share of over 30.0% in 2023.

b. Some of the key vendors of the global antimony market are Campine NV, United States Antimony Corporation, Lambert Metas International Limited, Lanxess, Umicore, Korea, Zinc, Huachang Antimony Industry, Mandalay Resources Ltd., Suzuhiro Chemical Co., Ltd, Nyacol Nano Technologies, Inc.

b. The key factor driving the growth of the global antimony market is increasing applications in flame retardants, lead-acid batteries, and semiconductors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.