Antifouling Coatings Market Size, Share & Trends Analysis Report By Product (Copper-based Antifouling Paints, Hybrid Antifouling Paints, Self-polishing Copolymer), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-727-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Antifouling Coatings Market Size & Trends

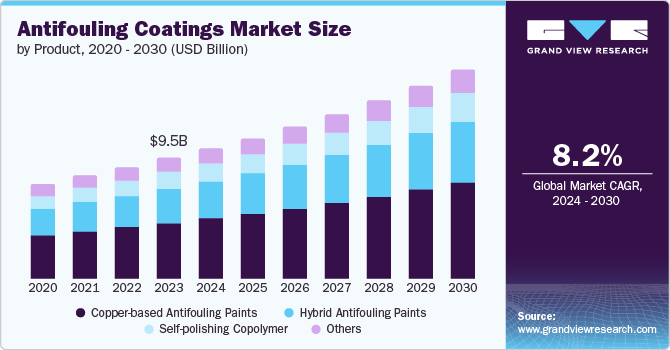

The global antifouling coatings market size was valued at USD 9.48 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. This growth is primarily driven by increasing demand from the shipping industry, the assistance provided by antifouling paints and coatings in reducing friction and enhancing fuel efficiency, and the growing demand for drilling rigs and production platforms. This industry is expected to experience rapid growth owing to several other factors, such as availability, effectiveness, and affordable pricing.

An increase in the marine and shipbuilding industry is another significant factor driving market growth. According to the UNCTAD Handbook of Statistics 2023, the total world fleet accounted for an overall carrying capacity of 2.3 billion dead weight tons (dwt) in 2023. This was identified as an increase of 70 million dwt compared to 2022. With growing concerns regarding the unceasing rise in fuel costs and stringent regulations closing upon fleet maintenance and management, every business in the industry is seeking solutions to reduce expenditure and enhance the performance of vessels. This is projected to result in growing demand for antifouling paints and coatings.

Another significant growth factor influencing this industry is an expansion of oil & gas and offshore wind farm energy installation. With increasing focus on renewable and clean energy sources, demand for antifouling coatings is likely to rise in these industries. For instance, sizeable offshore oil & shale gas exploration in North America and the South Asia Pacific region is driving demand for the antifouling market offerings, which are utilized in the prevention of equipment and infrastructure from aquatic-based organisms that weaken the metals. North America has massive deposits of natural gas and oil, continuously drilled for energy and fuel development. Oil and gas extraction is one of the key businesses for the region’s economy.

Furthermore, rising international trade and shipping also drive market growth. The unceasing increase in global trade has resulted in an increasing number of vessels, a rising need for maintenance and prevention from corrosion, and a growing demand for antifouling coatings. Moreover, increasing focus on sustainability coupled with reformed government regulation and advancements in the product itself are among the key factors likely to accelerate market growth during the forecast period.

Product Insights

Copper-based antifouling paints segment dominated the global industry and accounted for a revenue of 45.8% in 2023. The segment is primarily driven by growth in new shipbuilding and repair activities along with increasing demand for the leisure boat market. Copper-based category of product offerings by this market are highly effective in preventing fouling, which reduces drags, fuel consumption, and emissions as well. Moreover, copper-based antifouling paints provide long-lasting protection, reducing the need for frequent recoating and minimizing maintenance costs.

The hybrid antifouling paints segment is anticipated to witness the fastest CAGR of 8.5% during the forecast period. Rising environmental concerns, advanced performance requirements, and growing awareness about adoption of sustainable solutions drive the forecasted growth. Hybrid antifouling paints are one of the environment-friendly alternatives, as it contains lesser harmful substances. Hybrid antifouling paints offer enhanced fouling protection, combining the benefits of different technologies such as copper-based and silicon-based systems. In addition, ship owners are seeking more effective and sustainable solutions, driving demand for hybrid antifouling paints. Furthermore, rising technological advancements in hybrid antifouling paints development are likely to further accelerate segment growth.

Application Insights

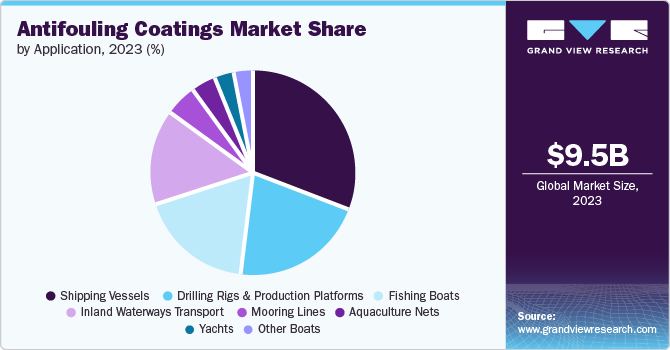

Shipping vessels segment dominated the market and accounted for revenue of 30.8% in 2023. The growth is driven by increasing demand for global trade and transportation. The expansion of maritime tourism and leisure boating increases the demand for antifouling coatings in non-commercial sectors, such as recreational yachts and cruise ships. Furthermore, rising trade sectors across the globe are fueling demand for shipping vessels as they are crucial for the transportation of goods and services. According to World Economic Forum, nearly 90% of the traded goods are shipped by the routes of sea through busiest waterways across the world such as the English Channel, the Malacca Strait, the Hormuz Strait, the Suez Canal, the Panama Canal, and others.

Fishing boats segment is expected to witness a significant CAGR over the forecast period. The growth is attributed to increasing demand for seafood and fishing activities. The growing fishing fleet across the Asia-Pacific and European region is expected to further drive segment growth. Multiple fishing boat owners are focusing on enhancing performance and durability by adopting protections delivered by antifouling coats. Availability of eco-friendly coats to address issue of biocides causing harm to marine ecosystem has also contributed to the growth of this segment. For instance, AQUATERRAS, a patented polymer technology-based fouling prevention product offers biocide free coating.

Regional Insights

North America antifouling coatings market is expected to experience noteworthy growth during forecast period. The market is primarily driven by the environmental regulations, growth experienced by shipping and marine-based industries, and advancements in technology experienced by the market. The innovation strategies adopted by the some of the prime organizations are expected to assist this market in terms of growth.

U.S. Antifouling Coatings Market Trends

The U.S. antifouling coatings market held significant share of the regional industry in 2023. The projected growth is primarily attributed to the alarming need for solution that can assist shipping and marine industry to resolve issues related with adverse effects caused by fouling on vessel performance and efficiency. This market is also influenced by growing number of luxury yachts used in the country and government regulations on copper-based antifouling coatings market.

Asia Pacific Antifouling Coatings Market Trends

Asia Pacific antifouling coatings market held largest revenue share of the global industry and accounted for 70.3% in 2023. According to UNCTAD Handbook of Statistics 2023, businesses in Asia owned 1199 millions of dwt, which accounted for 53.8% of total world’s tonnage. The dominance of the region is attributed to the robust presence of shipbuilding & offshore oil and gas projects and increasing maritime infrastructure development. Rising demand from emerging economies such as India, Indonesia, and Vietnam for antifouling coatings, driving growth of the region. According to UN Trade and Development (UNCTAD), Asia Pacific is world’s largest manufacturer and producer of ship fleets. Countries such as China, Japan, and South Korea are the dominant in ship-building activity. Moreover, the region is also the hub to recycling ships, leading to demand for antifouling coatings. Countries such as Bangladesh, India and Pakistan are major areas engaging in the recycling of ships.

China antifouling coatings market is expected to experience significant growth during forecast period. This market is primarily driven by the presence of large ship-building industry in the country, not only limited to commercial ships, but warships as well for the fleet capacity of People's Liberation Army Navy (PLAN). Some of the key growth driving factors for this market are strategic government support, infrastructure development and expansion in dry dock capacity.

Europe Antifouling Coatings Market Trends

Europe antifouling coatings market held a significant revenue share of global industry in 2023. The growth for this regional market is driven by the increasing demand through marine applications, growing number of ship fleets and the rise in global trade through the region’s waterways. Furthermore, the rising tourism increasing demand for luxury ships, cruise and leisure yachts leading to demand for antifouling coatings. According to Eurostat, in 2023, when measured in value, 47 % of total goods traded with rest of world and between EU were through sea transportation.

Germany antifouling coatings market dominated the market in 2023. The growth is primarily driven by a strong shipping industry and hub to some of the largest enterprises in the region. The region is one the largest shipbuilding makers in the region, thus driving demand for antifouling coatings. According to German National Tourist Board (GNTB), the country ranks 3rd in exports in Europe and stands at 11th position in global tourism. In addition, The Observatory of Economic Complexity (OEC) states that from April 2023 to April 2024, the country has experience 15.3% of growth in its exports, growth in the imports accounted for 7.8% for same duration. The growing trade and tourism by the country is expected to generate greater demand for this market in approaching years.

Key Antifouling Coatings Company Insights

Some key companies involved in the antifouling coatings market are Akzo Nobel N.V., PPG Industries, The Sherwin-Williams Company, Gruppo Boero, Axalta Coating Systems and others. Owing to growth in competition and stringent regulations major market participants are investing more in research & development and focusing on innovation-backed new product launches.

-

Akzo Nobel N.V., one of the prominent organizations in paints & coatings industry, active in more than 150 countries, offers range of products such as decorative paints, automotive & specialty coatings, industrial coatings, marine, protective & yacht coatings, powder coatings, and more.

-

Hempel, a global coatings brand that manufactures and delivers coating solutions for multiple functions and industries. Some of the key functions where company’s products are primarily used include antifouling marine, linings, cargo holds, fouling release, defense (marine), PFP cellulosic, pipe coating, topcoats, thinner, varnish, fillers and others.

Key Antifouling Coatings Companies:

The following are the leading companies in the antifouling coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- Jotun

- Hempel A/S

- PPG Industries

- The Sherwin-Williams Company

- Gruppo Boero

- Axalta Coating Systems

- BASF SE

- Nippon Paint Marine Coatings Co., Ltd.

- Kansai Paint Co., Ltd.

- Altex Coatings

Recent Developments

-

In March 2024, PPG Industries launched new innovation based antifouling coatings product PPG NEXEON 810 ultra low-fiction. The product offers an advanced, ultra-low-friction, and copper-free antifouling coating designed primarily for the marine industry. Amidst the discussions about potential ban on copper-based antifouling coatings, the innovation adds strong alternative in the market with the new launch.

Antifouling Coatings Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.24 billion |

|

Revenue Forecast in 2030 |

USD 16.40 billion |

|

Growth Rate |

CAGR of 8.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, Volume Tons, and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, South Africa, Saudi Arabia |

|

Key companies profiled |

Akzo Nobel N.V.; Jotun; PPG Industries; Hempel A/S; The Sherwin-Williams Company; Gruppo Boero; Axalta Coating Systems; BASF SE; Nippon Paint Marine Coatings Co., Ltd.; Kansai Paint Co.,Ltd.; Altex Coatings |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Antifouling Coatings Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the antifouling coatings market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, Volume Tons, 2018 - 2030)

-

Copper-based Antifouling Paints

-

Hybrid Antifouling Paints

-

Self-polishing Copolymer

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume Tons, 2018 - 2030)

-

Fishing Boats

-

Drilling Rigs & Production Platforms

-

Shipping Vessels

-

Mooring Lines

-

Aquaculture Nets

-

Yachts

-

Inland Waterways Transport

-

Other Boats

-

-

Regional Outlook (Revenue, USD Million, Volume Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."