- Home

- »

- Pharmaceuticals

- »

-

Antibody Drug Conjugates Market Size & Share Report, 2030GVR Report cover

![Antibody Drug Conjugates Market Size, Share & Trends Report]()

Antibody Drug Conjugates Market Size, Share & Trends Analysis Report By Application (Blood Cancer, Breast Cancer), By Technology (Type-cleavable, Non-cleavable), By Product, By Target, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-741-4

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Antibody Drug Conjugates Market Trends

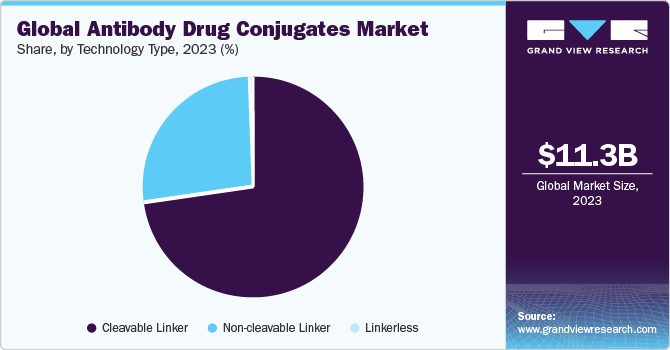

The global antibody drug conjugates market size was estimated at USD 11.29 billion in 2023 and is projected to grow at a CAGR of 9.2% from 2024 to 2030. This can be attributed to the presence of a robust R&D pipeline. This, coupled with the growing incidence of cancer and increased demand for low-toxicity & effective drugs, is expected to drive market growth. Some of the key Antibody Drug Conjugates (ADCs) currently available in the market are Kadcyla (Genentech/Roche), Adcetris (Seattle Genetics), Enhertu (AstraZeneca/Daiichi Sankyo), Besponsa (Pfizer), Mylotarg (Pfizer), and Polivy (Genentech/Roche). ADCs are a novel category of drugs composed of an antibody linked-via a chemical linker-to a cytotoxic drug.

Conventional chemotherapy is intended to eradicate fast-growing tumor cells. However, it can also damage healthy proliferating cells, which may produce undesirable effects. In contrast, ADC is designed to upsurge the efficacy of treatment and decrease systemic toxicity. In this market, the landscape is influenced by reimbursement policies, a crucial factor in developed economies. The production and research costs of ADC drugs are high compared to conventional treatments, such as monoclonal antibodies and chemotherapy. This results in a higher overall treatment cost, which poses a challenge for reimbursement coverage. For instance, a negative review was given by the National Centre for Pharmacoeconomics in Ireland in February 2020 for Roche's Kadcyla (trastuzumab emtansine).

The review was based on the drug's perceived low cost-effectiveness, indicating a potential trend where expensive ADC treatments may face obstacles in gaining reimbursement approval. This dynamic highlights the delicate balance between innovation, cost, and access to cutting-edge medical solutions in the market. In contrast, some countries considered such costly ADC drugs for reimbursement due to high disease prevalence. In April 2021, the UK’s Cancer Drug Fund approved Enhertu (trastuzumab deruxtecan) for the reimbursement of Metastatic Breast Cancer (MBC) treatment. However, countries, such as Scotland, Northern Ireland, and Wales, are yet to provide reimbursement approval for the same. The lack of availability of reimbursement policies in developing economies, such as India and China, might restrict market growth.

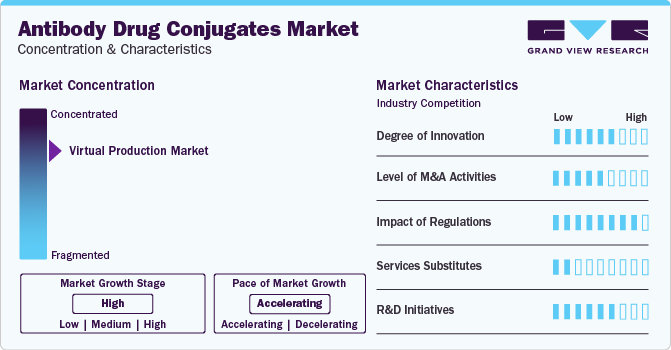

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. It is characterized by a high degree of innovation due to the advanced technologies and methodologies for transforming treatment practices

The market witnesses notable M&A activities by the leading players. Key players, such as AstraZeneca, Takeda Pharmaceutical Company Ltd., F. Hoffmann-La Roche Ltd., ADC Therapeutics, Seagen, Inc., and others, are collaborating to develop & commercialize these products. For instance, in January 2022, Seagen initiated phase 1 clinical trials of two novel drugs SGN-B7H4V & SGN-PDL1V, in patients with advanced solid tumors. Successful completion of clinical trial study and subsequent approval of products is anticipated to drive market growth. In July 2020, AstraZeneca collaborated with Daiichi Sankyo to develop and commercialize new ADC products. This helped AstraZeneca expand its ADC product portfolio

Supportive reimbursement and regulatory policies are anticipated to support the industry growth. For instance, Gilead Sciences, Inc. initiated the “Trodelvy Support Program” in support of cancer patients. Under this program, out-of-pocket expenses up to USD 25,000 for a Trodelvy 180 mg single-dose vial are provided to uninsured patients

ADC products are a novel category of drugs that offer better clinical effectiveness and safety profile over conventional treatment options, which results in a lower threat of substitutes. However, its high cost might force patients to choose low-cost conventional alternatives, such as biosimilar monoclonal antibodies and chemotherapy, despite their lower effectiveness

Most of the companies are conducting clinical trials to gain label expansion for their already approved products and strengthen production capabilities. For instance, in February 2022, CDMO Piramal Pharma Solutions invested about USD 74.6 for the development of two new Antibody-Drug Conjugate (ADC) production facilities at its existing sites in Grangemouth, Scotland to fulfill the growing demand for commercial ADCs in the UK. This investment will boost the R&D of novel ADC drug capabilities in the UK. In April 2021, Adcendo and Adcentrx, two new startups, raised funding of around USD 112 million for the development of ADCs with its new approach to the treatment of cancer. Adcendo raised USD million 51 million for the development of new ADCs that target endocytic receptors, which play the role of the delivery body. Adcentrx raised USD 50 million for its ADC research programs

Application Insights

The breast cancer segment dominated the market in 2023 with a revenue share of 47.76% owing to factors, such as a rise in incidence, promising pipeline products, and high adoption of Kadcyla. Trodelvy, Enhertu, and Kadcyla are the products approved for the treatment of breast cancer. The label expansion of Kadcyla to include patients with early breast cancer and the recent approval of Enhertu & Trodelvy are likely to drive segment growth. The blood cancer segment is expected to grow at a high CAGR from 2024 to 2030.

Blood cancer is the fifth most common cancer and is the second leading cause of cancer deaths globally. According to the National Foundation of Cancer Research, in the U.S., a total of ~186,400 new cases of leukemia, lymphoma, and myeloma were diagnosed in 2022. Furthermore, the approval for multiple products during the forecast period is expected to drive market growth. For instance, a new product, Polivy, was launched in the market in October 2019 for the treatment of diffuse large B-cell lymphoma (DLBCL).

Product Insights

The Kadcyla segment held the largest revenue in the ADC space in 2023. The surge in breast cancer cases, coupled with heightened approvals for ADCs tailored for breast cancer treatment, propels the market's upward trajectory. F. Hoffmann-La Roche Ltd. announced approval for Kadcyla in China's rapidly expanding industry in January 2022 marking a pivotal development.

Kadcyla witnessed a strategic move by Roche in 2023. A strategic price reduction of over 50% for Kadcyla in China aimed to strategically capture a larger market share through competitive pricing. China, once Roche's 10th largest market, has ascended to the second position. Roche's strategic price adjustment underscores the dynamic shift in its market approach, aligning with the evolving landscape in China.

Enhertu is among the fastest-growing segment over the forecast period. DAIICHI SANKYO COMPANY, LIMITED. and AstraZeneca’s Enhertu has experienced a surge in sales projections following recent approvals. Particularly its groundbreaking approval for HER2-low breast cancer in August 2022, marking an industry-first achievement. During a recent earnings call, Daiichi emphasized Enhertu's swift adoption in this new indication, catering to patients with tumors previously classified as HER2-negative. Additionally, since its launch for second-line HER2-positive breast cancer in May 2022, Enhertu has outperformed competitors, securing the largest share of new patients.

Target Insights

The HER2 or human epidermal growth factor receptor 2 target type segment held the largest market share in 2023. HER2 is a pivotal target. It plays a crucial role in breast cancer treatment, where overexpression is common. ADCs designed to target HER2 work by delivering potent drugs directly to cancer cells, minimizing damage to healthy cells, and enhancing therapeutic efficacy. Owing to all such factors, its adoption is high, which contributed to the segment’s industry dominance.

CD22 is among the fastest-growing target segments over the forecast period. This segment stands out for its high adoption in cancer therapy for indications, such as leukemia, making it the fastest-growing niche within the space. The increasing demand for CD22-targeted therapies in leukemia is driven by their efficacy and limited side effects, making them a preferred choice among healthcare professionals and patients alike.

Technology Insights

The cleavable linker segment accounted for the largest revenue share of 72.43% in 2023. The ability of cleavable linkers to remain stable in the bloodstream for longer duration & release of cytotoxins from ADCs makes them the most popular used technology for an effective outcome of ADCs in cancer treatment. For instance, in 2020, Seagen’s & Takeda’s Adcetris was approved by NMPA for use in the treatment of relapsed Hodgkin's lymphoma and relapsed systemic anaplastic large cell lymphoma sALCL in China. Such factors are expected to drive the cleavable linker segment growth.

Non-cleavable linker was the second-largest revenue-generating segment in 2023 owing to the increased usage of Kadcyla, which contains a non-cleavable linker. Non-cleavable linker is used for the production of ADCs that are reliant on the ADC’s lysosomal degradation and prevents the non-specific release of the drug, thus reducing the overall cytotoxicity of the ADC to surrounding healthy cells. This is expected to drive the segment growth. Currently, only FDA-approved ADCs, such as Kadcyla and Blenrep, use non-cleavable linkers for binding the antibody and cytotoxic molecule

Linker is the key component of ADCs and it connects the antibody & cytotoxic payload. It imparts the characteristics to ADCs, such as high stability in circulation and specific release of payload in the target tissue. There are several linkers available in the market, which include VC, Sulfo-SPDB, VA, SPP, Hydrazone, SMCC, MCC, maleimide tetrapeptide, CL2A, and MC, and are used to deliver payloads to their target sites.

Payloads are cytotoxic agents that are used to kill target cancerous cells. There are many payloads available in the market including microtubuline inhibitors (Vinorelbine, Paclitaxel, Epothilone B, Tubulysins (IM-2, B), DNA cleavers (Bleomycin A2), Akt inhibitors (GDC - 0068), DNA intercalators (Doxorubicin hydrochloride, Epirubicin hydrochloride, Duocarmycins, PBD dimers), and MMAF & MMAE. Blenrep (belantamab mafodotin-blmf), developed by GlaxoSmithKline Plc., utilizes MMAF, protease linker, and anti-CD38 monoclonal antibody to kill target cells in adult patients with relapsed multiple myeloma.

Regional Insights

The North America antibody drug conjugate market accounted for the largest revenue share of 52.54% in 2023. Increased awareness about ADCs among healthcare professionals and favorable reimbursement policies are driving market growth. North America is expected to witness significant growth over the forecast period owing to increased awareness about current treatment therapies, favorable reimbursement policies, significant R&D expenditure, and improved patient affordability. Some of the key players operating in this region are Seagen, Inc.; F. Hoffmann La-Roche Ltd.; Gilead Sciences Inc.; and Pfizer Inc.

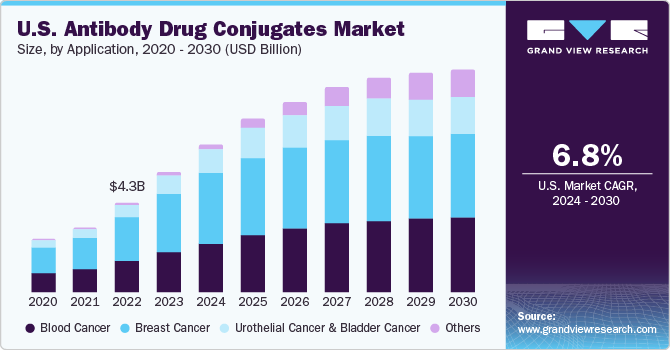

U.S. Antibody Drug Conjugate Market Trends

The antibody drug conjugate market in the U.S. is growing owing to factors, such as high awareness among healthcare professionals about ADCs, presence of advanced ADCs, and high R&D investment by manufacturers. For instance, in April 2021, Gilead received FDA approval for Trodelvy for the treatment of adult patients with locally advanced or metastatic urothelial cancer. Approval for a new indication is expected to boost the market for Trodelvy and other ADC drugs, such as Polivy, Padcev, and Enhertu, sales over a period.

Europe Antibody Drug Conjugate Market Trends

The Europe antibody drug conjugate market is growing significantly owing to new product launches, increasing R&D initiatives, and potential products in pipeline expected to be commercialized in the forecast period.

The antibody drug conjugate market in the UK is expected to grow over the forecast period due to rising awareness of cancer, increasing treatment adoption, and favorable reimbursement schemes. Drugs, such as Besponsa and Kadcyla, are reimbursed by the National Institute for Health and Care Excellence (NICE).

The France antibody drug conjugate market is expected to grow over the forecast period attributed to the increasing patient base and introduction of novel ADC drugs in the country for different types of cancer.

The antibody drug conjugate market in Germany is expected to grow over the forecast period due to the high R&D investments in developing ADCs and improved access & availability of various treatment options.

Asia Pacific Antibody Drug Conjugate Market Trends

The Asia Pacific antibody drug conjugate market is anticipated to witness significant growth over the forecast period due to the presence of emerging economies, increasing investments in the biotechnology sector, improving government initiatives, and rapidly growing clinical research & outsourcing markets. In addition, improvements in healthcare facilities and R&D in drug development are anticipated to propel market growth.

The antibody drug conjugate market in China is expected to grow over the forecast period due to the increasing approval of novel ADCs, increasing prevalence of cancer, and various initiatives undertaken by the governments to improve treatment access to cancer patients.

The Japan antibody drug conjugate market focuses on the geographic expansion of key players to increase their market share and introduction of novel ADC medicines in the country, which are expected to boost market growth. For instance, in May 2021, Japan’s MHLW granted priority review to Astellas’s enfortumab vedotin (Padcev) for the treatment of metastatic or locally advanced urothelial cancer. Furthermore, in September 2020, Enhertu was approved for the treatment of HER2-positive metastatic gastric cancer patients in Japan. Moreover, an increasing number of ADC clinical trials are being conducted in the country. For instance, a Japanese company, Daiichi Sankyo, is investing heavily in ADC development. Currently, it has three ADC products in the clinical pipeline at multiple phases.

Latin America Antibody Drug Conjugate Market Trends

The antibody drug conjugate market in Latin America was identified as a lucrative regional market in this industry owing to the high prevalence rate in countries, such as Mexico, mainly due to lifestyle changes and growing physical inactivity.

The Brazil antibody drug conjugate market is expected to grow over the forecast period due to growing R&D activities conducted by various organizations, such as AC Camargo Cancer Center. The Center has a free, decentralized, universal healthcare system funded by tax revenue from the federal, state, and municipal governments, which is utilized by approximately 75% of its population for services including cancer treatment.

MEA Antibody Drug Conjugate Market Trends

The antibody drug conjugate market in MEA was identified as a lucrative regional market, driven by the high prevalence coupled with increasing unmet medical needs, aided by improvements in healthcare infrastructure.

The Saudi Arabia antibody drug conjugate market is expected to grow over the forecast period owing to collaborations between drug manufacturers, such as F.Hoffmann-La Roche Ltd., and the Government of Saudi Arabia & National Cancer Associations to help educate healthcare workers on examination & diagnosis of cancer, leading to high adoption for treatment options including drugs.

Key Antibody Drug Conjugates Company Insights

Some of the key players operating in the market include Seagen, Inc., (previously Seattle Genetics, Inc.); Takeda Pharmaceutical Company Limited; AstraZeneca PLC, F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; ImmunoGen, Inc.; Gilead Sciences, Inc. (acquired Immunomedics); and Daiichi Sankyo Company Ltd. Companies like F. Hoffmann-La Roche Ltd. hold key products, such as Kadcyla (ado-trastuzumab emtansine) and Polivy (polatuzumab vedotinpiiq). Kadcyla is a HER2-targeted antibody indicated for the treatment of Metastatic Breast Cancer (MBC) and Early Breast Cancer (EBC). Polivy is used in combination with bendamustine and rituximab for the treatment of adults with diffuse large B-cell lymphoma who have received at least 2 prior therapies.

Mersana Therapeutics, Inc., Heidelberg Pharma, and ADC Biotechnology are some of the emerging participants in the antibody drug conjugates market.

Key Antibody Drug Conjugates Companies:

The following are the leading companies in the antibody drug Conjugates market. These companies collectively hold the largest market share and dictate industry trends.

- Seagen, Inc.

- Takeda Pharmaceutical Company Ltd.

- AstraZeneca

- F. Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Ltd.

- GlaxoSmithKline Plc

- Astellas Pharma, Inc.

- ADC Therapeutics SA

Recent Developments

-

In January 2024, Celltrion, Inc., and WuXi XDC signed a Memorandum of Understanding (MOU) for integrated services for ADCs, which includes the development & manufacturing of ADCs

-

In January 2024, Jonhson & Johnson Services, Inc., acquired Ambrx Biopharma, Inc., which has a proprietary ADC technology to develop next-generation novel ADCs for the treatment of cancers. J&J aims to focus on its portfolio of prostate cancer while making use of this proprietary technology

-

In January 2024, MediLink Therapeutics and F.Hoffmann-La Roche Ltd. entered into a license agreement and collaboration to develop a next-generation ADC, YL211

-

In October 2023, BioNTech entered a licensing agreement with MediLink Therapeutics for an antibody-drug conjugate targeting HER3 in cancers. BioNTech paid MediLink USD70 million upfront, with potential milestone-based payments of up to USD 1 billion. The deal grants BioNTech global rights for development, manufacturing, and commercialization, while MediLink retains rights in Mainland China, Hong Kong, and Macau. This collaboration highlights the growing significance of ADCs in cancer treatment, with the financial infusion reflecting industry confidence in the potential therapeutic impact

-

In July 2023, BeiGene secured an exclusive option for the global license of an investigational ADC. This move is set to shape the market landscape as it allows DualityBio to sustain its preclinical research activities and provide support for the Investigational New Drug filing. This strategic acquisition is indicative of the evolving dynamics in the ADC market, reflecting a potential shift in the competitive landscape

Antibody Drug Conjugates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.14 billion

Revenue forecast in 2030

USD 24.01 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, target, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Seagen, Inc., (previously Seattle Genetics, Inc.); Takeda Pharmaceutical Company Ltd.; AstraZeneca PLC, F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; ImmunoGen, Inc.; Gilead Sciences, Inc. (acquired Immunomedics); Daiichi Sankyo Company Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibody Drug Conjugates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antibody drug conjugates market report based on application, product, target, technology, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Cancer

-

Leukemia

-

Lymphoma

-

Multiple Myeloma

-

-

Breast Cancer

-

Urothelial Cancer & Bladder Cancer

-

Other Cancer

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kadcyla

-

Enhertu

-

Adcetris

-

Padcev

-

Trodelvy

-

Polivy

-

Others

-

-

Target Outlook (Revenue, USD Million, 2018 - 2030)

-

HER2

-

CD22

-

CD30

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Type

-

Cleavable Linker

-

Non-cleavable Linker

-

Linkerless

-

-

Linker Technology Type

-

VC

-

Sulfo-SPDB

-

VA

-

Hydrazone

-

Others

-

-

Payload Technology

-

MMAE

-

MMAF

-

DM4

-

Camptothecin

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antibody drug conjugates market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 24.01 billion by 2030.

b. The breast cancer segment dominated the market in 2023 with a revenue share of 47.76% owing to factors, such as a rise in incidence, promising pipeline products, and high adoption of Kadcyla. Trodelvy, Enhertu, and Kadcyla are the products approved for the treatment of breast cancer.

b. Some key players operating in the antibody drug conjugates market include Seagen, Inc., (previously Seattle Genetics, Inc.); Takeda Pharmaceutical Company Ltd.; AstraZeneca PLC, F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; ImmunoGen, Inc.; Gilead Sciences, Inc. (acquired Immunomedics); Daiichi Sankyo Company Ltd.

b. Key factors that are driving the market growth include presence of a robust R&D pipeline, coupled with the growing incidence of cancer and increased demand for low-toxicity & effective drugs, are expected to drive market growth.

b. The global antibody drug conjugates market size was estimated at USD 11.29 billion in 2023 and is expected to reach USD 14.14 billion in 2024.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."