Antibodies Contract Manufacturing Market Size, Share & Trends Analysis Report, By Product (Monoclonal Antibodies, Polyclonal Antibodies, Others), By Source, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-920-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

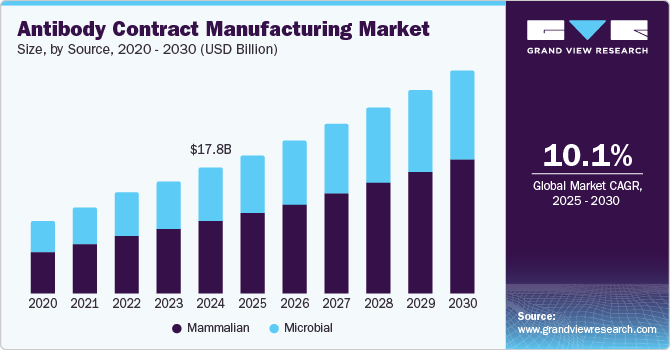

The global antibodies contract manufacturing market size was estimated at USD 17.79 billion in 2024 and is projected to grow at a CAGR of 10.1% from 2025 to 2030. The growing focus of biopharmaceutical and biotechnology companies on manufacturing antibody therapeutics is a significant factor driving market growth. These antibody therapies have proven highly effective in treating various conditions, including cancers, rheumatoid arthritis, and other chronic diseases, increasing demand for therapeutic antibody production. This demand is expanding the antibody contract manufacturing market as companies seek to scale production and meet the rising needs of healthcare providers and patients.

Biopharmaceutical manufacturing is recognized as a leading sector in terms of growth potential. Many healthcare entities believe this sector will be one of the top 10 revenue generators in the coming years. Moreover, the market players are continuously developing this sector to meet the increasing demand for bio-based pharmaceuticals, which is anticipated to result in a surge of CMOs for biopharmaceutical production. For instance, in February 2024, Catalent's acquisition by Novo Holdings and expansion of its European facilities support its antibody production capabilities, particularly targeting small molecules and biologics for advanced therapies. This expansion aligns with their strategy to strengthen therapeutic offerings, including cell and gene therapies. This healthy growth of biopharmaceuticals has resulted in developing a large product pipeline.

Many pharmaceutical and biotechnology businesses have increased their R&D efforts to create biologics, such as monoclonal antibodies, as these are becoming more popular as a select therapy for various lung indications, including lung cancer, asthma, and lung infections. Thus, focusing on R&D is critical for the company's long-term success. Moreover, pharmaceutical and biotechnology businesses are forming strategic alliances and collaborations to obtain market leadership. Also, major players are expanding their global footprint. For instance, in July 2024, Rentschler has recently expanded its U.S. production facilities, enhancing its ability to deliver high-quality biopharmaceuticals for rare and orphan diseases. This investment is geared toward advanced biologics, including bispecific antibodies and recombinant enzymes. Similarly, in January 2022, Fujifilm Diosynth Biotechnologies announced the acquisition of Atara Biotherapeutics, Inc., a company involved in cell therapy manufacturing, thus boosting the product portfolio for advanced therapies.

Moreover, understanding the cost-effectiveness associated with contract manufacturing, many firms have begun to outsource parts of their biopharmaceutical manufacturing to contract manufacturers. Many biopharmaceutical products, including recombinant proteins, monoclonal antibodies, and engineered antibody-like biomolecules, are approved by the U.S. FDA. The number of approvals has increased significantly over the years. For instance, in September 2024, The FDA approved Sarclisa (isatuximab) as a first-line treatment targeting CD38, a protein found on the surface of myeloma cells, for patients with newly diagnosed multiple myeloma. This approval was based on data from the IMROZ phase 3 study, demonstrating a significant improvement in progression-free survival when Sarclisa was added to a standard treatment regimen.

Product Insights

Based on product, the market is segmented into monoclonal antibodies, polyclonal antibodies, and others. Monoclonal antibodies dominated the product segment with a 76.42% share as of 2024. Monoclonal antibody (mAb) formulations have been more popular as a select therapy for various lung indications, including lung cancer, infections, and asthma. They have also been proven effective in treating COVID-19 infections; Casirivimab and imdevimab are designed to block the virus’ attachment and entry into human cells.

Moreover, CMOs collaborate more with biopharmaceutical companies to produce and develop monoclonal antibodies. For instance, WuXi Biologics collaborated with Vir Biotechnology, Inc. to produce antibodies, especially those required to produce sotrovimab for the treatment of COVID-19.

Rising awareness amongst physicians and patients about the applications of mAb therapy is contributing toward further growth. Additionally, the usage rate for mAb therapy is expected to be boosted after receiving approval for the blockbuster mAbs for various indications during the forecast period. For example, revenue-generating drugs such as Remicade, Avastin, Herceptin, and Rituxan, with FDA approval for an array of conditions such as cancer, Crohn's disease, rheumatoid arthritis, ulcerative colitis, etc., further boost the patient base. Thus, monoclonal antibodies accounted for the largest share in 2024.

The polyclonal antibodies segment is expected to grow significantly over the forecast period. Polyclonal antibodies are essential in various diagnostic applications, including immunoassays, enzyme-linked immunosorbent assays (ELISAs), and lateral flow tests. They are also used in therapeutic settings, such as antivenoms, organ transplantation, and certain immune-related treatments. The increase in infectious and chronic diseases worldwide has heightened the need for robust and reliable diagnostic tools, fueling demand for polyclonal antibodies.

Source Insights

The mammalian source segment accounted for the largest share of 57.52% in the market as of 2024. Based on the source, the market is segmented into mammalian and microbial. With the growing demand for antibody contract manufacturing services, several CMOs are expanding their capacity for mammalian cell culture production. In mAb production, the mammalian cell expression system is the most preferred choice, owing to the primary advantage that the cellular mechanism is modified for the processing, production, and secretion of extremely complex molecules.

Major players are investing and expanding their mammalian cell expression system manufacturing facilities. Several CMOs, such as Lonza and Charles River, offer mammalian cell line production services. These firms are investing significantly in advancing their mammalian cell culture manufacturing facilities for antibody development. For instance, WuXi Biologics has over 150,000L of bioreactor capacity for mammalian cell culture supply, and the company increased the capacity to 430,000L by 2023.

The microbial source segment is expected to grow significantly during the forecast period. Microbial systems, particularly Escherichia coli and yeast, offer efficient and cost-effective platforms for antibody production. Their rapid growth rates, simple media requirements, and potential for high-density cultures make them highly scalable, especially compared to mammalian cell systems.

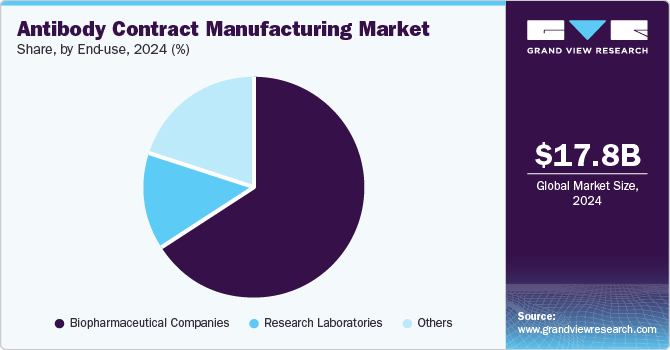

End-use Insights

Based on end use, the market is classified into biopharmaceutical companies, research laboratories, and others. The biopharmaceutical companies segment accounted for the largest share in 2024, with over 66.49%, and is also the fastest-growing during the forecast period. Biopharmaceutical companies play a significant role in developing innovative treatments for patients worldwide.

The market is mainly driven by the rising geriatric population, escalating chronic diseases, and increasing patient acceptance of new and advanced treatments. The capability of biopharmaceutical products to treat previously untreatable conditions has introduced innovative drugs into the market. Moreover, the constant requirement for innovation in the treatment models and advanced treatments such as monoclonal antibody therapy leads to increased R&D investment in biopharmaceuticals. This, in turn, is leading to collaboration among biopharmaceuticals and CMOs to develop advanced treatments, thus leading to a major share and is expected to influence segment growth further.

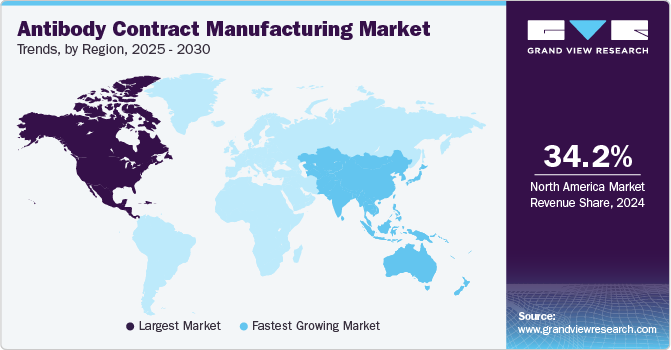

Regional Insights

North America antibody contract manufacturing market dominated the global market in 2024 with a share of around 34.17%. This is attributable to the widespread manufacturing of biopharmaceuticals in the region and the presence of a substantial number of CDMO/CMO facilities. State and other laws about biological development in the region are expected to significantly impact the progress of biopharmaceutical contract manufacturing in this region.

U.S. Antibody Contract Manufacturing Market Trends

The antibody contract manufacturing market in the U.S. dominated in 2024 due to increased research and development (R&D) investment in biologics development and a robust pipeline of FDA-approved biologic drugs. The country hosts many biopharmaceutical candidates across various development stages, with over 900 biologic molecules currently under clinical investigation. Steady growth in new biologic approvals has strengthened market opportunities, contributing to greater revenue potential within U.S. antibody contract manufacturing. This trend is supported by extensive R&D resources, a focus on innovation, and a well-established regulatory framework, all of which continue to drive demand for contract manufacturing services in the antibody sector.

Europe Antibody Contract Manufacturing Market Trends

The antibody contract manufacturing market in Europe accounted for the second-largest share in 2024. The presence of established market players coupled with superior manufacturing capabilities is anticipated to drive market growth. Furthermore, robust pipelines of biopharmaceutical companies working on antibody-drug conjugate R&D are expected to drive market growth.

Germany antibody contract manufacturing market accounts for the highest share of the European market, and Germany's biopharmaceutical companies are actively involved in antibody-drug conjugate research. For example, in September 2022, Tubulis GmbH, in collaboration with the German Cancer Consortium (DKTK), the Leibniz-Forschungsinstitut für Molekulare Pharmakologie (FMP), and the LMU Klinikum Munich conducted research that demonstrated that antibody drug conjugates were highly effective and safe in preclinical in vivo models of Acute Myeloid Leukemia (AML). Such research is expected to improve the development of new antibody-drug conjugates in the country, thereby supporting market growth over the forecast period.

The UK antibody contract manufacturing market plays a significant role, driven by its strong biotech ecosystem and leadership in advanced therapies like cell and gene therapies. Various multinational contract development and manufacturing organizations (CDMOs) are present in the country.

Asia Pacific Antibody Contract Manufacturing Market Trends

The antibody contract manufacturing market in Asia Pacific is projected to be the fastest-growing during the forecast period. This growth can be attributed to factors such as regulatory changes, improving infrastructure, and the presence of a large number of potential study subjects. Several biopharma companies from the U.S. are considering developing pharma products in Asian countries owing to the growing costs of R&D in their home country. Low-cost production facilities and cheap labor are available in Asian countries. The cost of production in Asian countries is 30 to 60% lower than that in Western countries, thus driving the Antibody Contract Manufacturing market.

China antibody contract manufacturing market is positioned for substantial growth in the antibody contract manufacturing sector, primarily due to the strong local presence of prominent market players and increased outsourcing operations from global biopharmaceutical companies.

The antibody contract manufacturing market in India is solidifying its role in the Asia Pacific market, driven by cost-effective production and expanding biosimilar and vaccine development expertise. The country's large, skilled workforce and advanced biomanufacturing infrastructure enable it to produce high volumes at competitive costs, serving domestic and global markets. Government initiatives, such as "Make in India," encourage foreign investment by creating a supportive regulatory framework harmonized with international standards. This alignment helps streamline processes, making India an attractive option for antibody production.

MEA Antibody Contract Manufacturing Market Trends

The antibody contract manufacturing market in MEA is expected to grow significantly over the forecast period. Saudi Arabia’s FDA recently updated the regulatory framework in favor of clinical trials and the development & manufacturing of drugs in the country. Furthermore, the availability of world-class healthcare infrastructure and an increase in the number of industry experts trained in Western medicine support the contract manufacturing market in Saudi Arabia.

The UAE offers favorable incentive policies that attract leading pharmaceutical companies, such as Pfizer, AstraZeneca, and Amgen. The government has been investing significantly in attracting more global companies to the UAE.

Key Antibodies Contract Manufacturing Company Insights

International partnerships are a key strategy among players. For instance, CMOs in the U.S. are increasingly collaborating with players in the Swiss pharmaceutical sector. Additionally, the expansion of the major CMOs to meet the requirements and stay ahead of the competition is also witnessed.

Key Antibodies Contract Manufacturing Companies:

The following are the leading companies in the antibodies contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- Samsung Biologics

- WuXi Biologics.

- Charles River Laboratories

- FUJIFILM Holdings Corporation

- Boehringer Ingelheim Biopharmaceuticals GmbH

- AGC Biologics

- Cytovance Biologics, Inc.

- EMERGENT

- Thermo Fisher Scientific

- Labcorp Drug Development

- Catalent, Inc.

Recent Developments

-

In October 2024, GBI Biomanufacturing and Allterum Therapeutics announced a strategic partnership to produce a therapeutic antibody for clinical trials. This collaboration will focus on manufacturing Allterum's lead candidate, 4A10, a monoclonal antibody designed to target CD127 implicated in various cancers.

-

In March 2024, Lonza announced its plan to acquire Genentech's manufacturing facility in Vacaville, California, for USD 1.2 billion in cash. This acquisition aims to enhance Lonza's large-scale biologics manufacturing capabilities, particularly for commercial mammalian contract manufacturing and clinical projects.

-

In February 2024, Samsung Biologics partnered with LegoChem Biosciences to develop and manufacture ADCs. According to the partnership terms, the company would offer antibody development & drug substance manufacturing services to LegoChem Biosciences as a part of its ADC program designed to treat solid tumors.

-

In October 2023, Lonza announced introducing a new filling line specifically designed for the commercial supply of Antibody-Drug Conjugates (ADCs) for a dedicated customer. This state-of-the-art cGMP filling line at Lonza’s Stein (CH) site is equipped to handle and fill bioconjugates for commercial distribution.

Antibody Contract Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 19.65 billion |

|

Revenue forecast in 2030 |

USD 31.76 billion |

|

Growth rate |

CAGR of 10.07% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Lonza; Samsung Biologics; WuXi Biologics.; Charles River Laboratories; FUJIFILM Holdings Corporation; AGC Biologics; Cytovance Biologics, Inc.; EMERGENT; Thermo Fisher Scientific; Labcorp Drug Development; Catalent, Inc; Boehringer Ingelheim Biopharmaceuticals GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Antibody Contract Manufacturing Market Report Segmentation

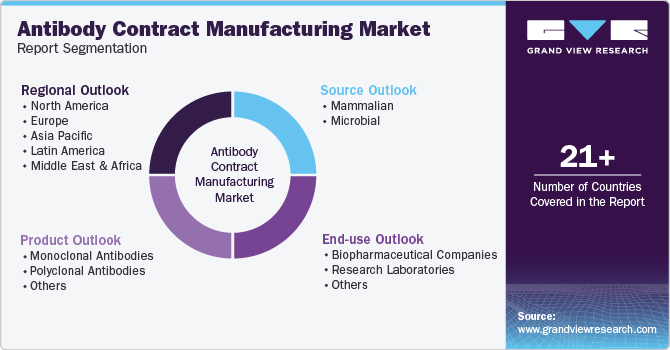

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antibody contract manufacturing market based on product, source, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian

-

Microbial

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Companies

-

Research Laboratories

-

Others

-

-

Regiona lOutlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antibody contract manufacturing market size was estimated at USD 17.79 billion in 2024 and is expected to reach USD 19.65 billion in 2025.

b. The global antibody contract manufacturing market is expected to grow at a compound annual growth rate of 10.07% from 2025 to 2030 to reach USD 31.76 billion by 2030.

b. North America dominated the antibody contract manufacturing market by 34.17 % in 2024. This is attributable to the widespread manufacturing of biopharmaceuticals in the region and the presence of a substantial number of CDMO/CMO facilities. State and other laws about biological development in the region are expected to significantly impact the progress of biopharmaceutical contract manufacturing in this region.

b. Some key players operating in the antibody contract manufacturing market include Lonza; Samsung Biologics; WuXi Biologics.; Charles River Laboratories; FUJIFILM Holdings Corporation; AGC Biologics; Cytovance Biologics, Inc.; EMERGENT; Thermo Fisher Scientific; Labcorp Drug Development; Catalent, Inc; Boehringer Ingelheim Biopharmaceuticals GmbH.

b. Key factors driving the market growth include the rising prevalence of chronic disorders, the increasing aging population, increasing awareness among physicians and patients for the use of advanced therapies, and an increase in R&D investments by major players for the production of antibodies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."