- Home

- »

- Pharmaceuticals

- »

-

Antibiotic Resistance Market Size And Share Report, 2030GVR Report cover

![Antibiotic Resistance Market Size, Share & Trends Report]()

Antibiotic Resistance Market (2024 - 2030) Size, Share & Trends Analysis Report By Disease (cUTI, CDI), By Pathogen, By Drug Class, By Mechanism of Action, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-663-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Antibiotic Resistance Market Summary

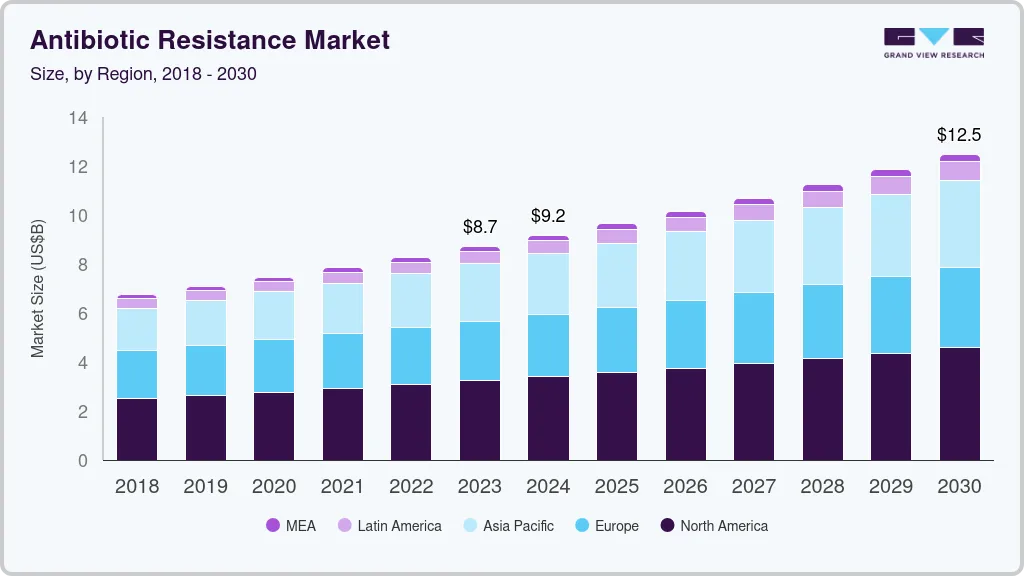

The global antibiotic resistance market size was estimated at USD 8,723.5 million in 2023 and is projected to reach USD 12,487.0 million by 2030, growing at a CAGR of 5.3% from 2024 to 2030. The increasing burden of antibiotic-resistant infections is a major factor contributing to the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, France is expected to register the highest CAGR from 2024 to 2030.

- In terms of disease, cUTI accounted for a revenue share of 23.8% in 2023.

- CDI is the most lucrative disease segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 8,723.5 Million

- 2030 Projected Market Size: USD 12,487.0 Million

- CAGR (2024-2030): 5.3%

- North America: Largest market in 2023

According to the Pew Charitable Trusts article published in July 2023, antibiotic-resistant bacteria represent a rising danger to public health. Annually, more than 2.8 million infections in the U.S. are resistant to antibiotics, leading to over 35,000 deaths. Moreover, increasing need for new antibiotic therapies and rising public health concerns and awareness are expected to drive market growth in the forecast period.

Growing need for new antibiotic therapies to address antibiotic resistance is boosting the demand for the global market. According to the Science Daily article published in July 2023, The World Health Organization has identified antibiotic-resistant bacteria as a major global health threat. A recent discovery by Adela Melcrova, a biophysicist at the University of Groningen in the Netherlands, reveals that the relatively new antibiotic AMC-109 works by disrupting the organization of bacterial cell membranes. This unique mechanism sets AMC-109 apart from most other antibiotics and holds promise for opening new avenues in future treatments and drug development.

Antimicrobial resistance (AMR) poses a significant threat to the global economy, impacting international trade, healthcare costs, and productivity. According to WHO article published in May 2023,WHO, in partnership with the Global AMR R&D Hub, presented a report to G7 Finance and Health Ministers. The report details progress in encouraging the development of new antibacterial treatments. The Global AMR R&D Hub, a collaborative effort involving countries and organizations, adopts a One Health approach to enhance coordination in global AMR R&D. This collaborative effort is significantly growing the demand for the market.

The worldwide increase in antibiotic resistance is a major threat, weakening the effectiveness of common antibiotics against widespread bacterial infections. According to the WHO article published in November 2023, the Global Antimicrobial Resistance and Use Surveillance System (GLASS) report highlights resistance rates observed in prevalent bacterial pathogens. Moreover, the report reveals median rates of 42% for third-generation cephalosporin-resistant E. coli and 35% for methicillin-resistant Staphylococcus aureus in 76 countries. Of significant concern is the finding that 1 in 5 cases of urinary tract infections caused by E. coli exhibited reduced susceptibility to standard antibiotics like ampicillin, co-trimoxazole, and fluoroquinolones in 2020. This is making it increasingly difficult to effectively treat common infections, intensifying the rising public health concern and awareness surrounding antibiotic resistance in the market.

Partnerships and collaborations for the new treatment methods are boosting the demand for the market. According to Karolinska Institutet, in November 2023, the Federico Iovino group at Karolinska Institutet initiated a dynamic collaboration with Therakind to discover innate molecules with antimicrobial power, specifically targeting antibiotic-resistant bacterial infections, especially those affecting the brain. This innovative partnership arises from the recognition of the limited effectiveness of current antibiotics in crossing the protective blood-brain barrier. Focusing on unique molecules within bodies, this collaboration seeks to revolutionize treatments for infections that have become resistant to traditional antibiotics, particularly those challenging brain infections.

Market Concentration & Characteristics

The global market has experienced significant innovation as researchers and market players implement inventive strategies to combat antibiotic-resistant infections. Moreover, the field is undergoing a transformative shift, showcasing a high degree of innovation in pursuing effective solutions.

Several market players, such as Melinta Therapeutics, Basilea Pharmaceutica Ltd., Tetraphase Pharmaceuticals, and Theravance Biopharma, are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories.

Companies are allocating substantial resources toward distribution channels, clinical trials, and regulatory submissions to secure approval for emerging antibiotic resistance technologies in their pipelines. This contributes to the increasing costs associated with developing novel solutions for combating antibiotic resistance.

Companies in the global market are expanding their product offerings, diversifying solutions to address the challenges of antibiotic-resistant infections. Developing innovative products beyond traditional antibiotics, they aim to strengthen the collection against evolving bacterial threats, ensuring a more comprehensive approach to opposing the rise of antibiotic resistance.

Disease Insights

cUTI segment led the market with the largest revenue share of 23.80% in 2023. The prevalence and financial burden associated with urinary tract infection (UTI) emphasizes the urgency to address cUTI, as it represents a critical segment within the market. According to BioMed Central Ltd article published in October 2023, UTI is a significant public health concern, impacting over 150 million individuals with an annual global financial burden of approximately USD 6 billion. UTI poses a substantial challenge as one of the most prevalent infectious disease, second only to upper respiratory tract infections. Over 50% of women and at least 12% of men experience UTI in their lifetime.

CDI segment is anticipated to witness the fastest CAGR over the forecast period. Despite the challenges associated with detecting Clostridioides difficile (C. difficile) infections, including potential over-reporting from PCR testing, these infections have a significant impact. According to theBioMed Central Ltd article published in March 2023, annually in the U.S., CDI is linked to nearly half a million infections and about 30,000 deaths. A recent meta-analysis estimates the incidence of CDI at 8.3 cases per 10,000 patient days, and the CDC's latest surveillance data reports an overall incidence rate of 121.2 cases per 100,000 persons.

Pathogen Insights

The Klebsiella pneumoniae segment held the largest revenue share in 2023. Klebsiella pneumoniae is a notorious gram-negative bacterium known for its ability to develop resistance to multiple antibiotics. The bacterium often harbors various resistance mechanisms, including the production of extended-spectrum beta-lactamases (ESBLs) and carbapenemases, making it challenging to treat infections caused by this pathogen. In addition, Klebsiella pneumoniae has a remarkable capacity for horizontal gene transfer, facilitating the spread of resistance genes among bacterial populations.

The C. difficile segment is estimated to register the fastest CAGR over the forecast period. The prevalence and impact of Clostridioides difficile (C. diff) serve as a major factor for market growth. According to the CDC article published in December 2023, particularly within the C. difficile segment. Responsible for causing diarrhea and colitis, C. diff is estimated to induce nearly half a million infections annually in the United States. The concerning recurrence rate, with 1 in 6 patients experiencing a repeat infection within 2-8 weeks, underscores the persistent challenge in treatment. Furthermore, the significant mortality rate among individuals over age 65 diagnosed with healthcare-associated C. difficile infection emphasizes the urgency for advanced antibiotic solutions tailored to combat C. diff.

Mechanism of Action Insights

The cell wall synthesis inhibitors segment held the largest revenue share in 2023. Cell Wall Synthesis Inhibitors are a crucial category within the market, representing antibiotics that target and disrupt the synthesis of bacterial cell walls. These antibiotics, such as penicillins and cephalosporins, work by interfering with the formation of the protective cell wall, leading to structural instability and eventual bacterial cell death. These inhibitors are crucial in treating a wide range of bacterial infections by specifically targeting a fundamental aspect of bacterial physiology. However, the emergence of resistant strains necessitates ongoing research and development efforts to optimize and innovate within this class, ensuring continued efficacy in the face of evolving resistance mechanisms.

The RNA synthesis inhibitors segment is estimated to register a significant CAGR over the forecast period. RNA synthesis inhibitors constitute another essential segment in the market, encompassing antibiotics that disrupt bacterial RNA synthesis. Rifampin is a remarkable example within this class. Targeting the machinery responsible for bacterial RNA production, these inhibitors impede the ability of bacteria to create essential genetic material, ultimately inhibiting their growth and proliferation. RNA synthesis inhibitors are particularly valuable in treating various bacterial infections, including tuberculosis. As with other antibiotic classes, the emergence of resistance highlights the need for ongoing research to innovate and optimize RNA synthesis inhibitors, ensuring their continued efficacy in the dynamic landscape of antibiotic resistance.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share in 2023. These pharmacies are integral components of healthcare facilities, ensuring the availability and dispensation of antibiotics to patients within the hospital setting. Hospital pharmacies play a vital role in managing and administering antibiotics for various infections, including those involving antibiotic-resistant strains. They facilitate seamless coordination between healthcare professionals, ensuring timely antibiotic access for patients undergoing treatment. In addition, hospital pharmacies contribute to monitoring and controlling antibiotic usage within the healthcare institution.

Retail pharmacies segment is estimated to register the fastest CAGR over the forecast period. One key contributing factor is the widespread accessibility of retail pharmacies, which makes them a convenient and readily available source for antibiotics. Patients often turn to retail pharmacies for quick access to antibiotics without the need for a doctor's prescription, especially in regions where regulations allow over-the-counter sales of certain antibiotics. This ease of access and self-medication practices contribute to increased antibiotic usage, potentially fostering the development and spread of antibiotic-resistant strains.

Drug Class Insights

The oxazolidinones segment dominated the market in 2023. Theoxazolidinones represent a class of antibiotics known for their effectiveness against certain drug-resistant bacteria. Linezolid is a notable class member, often employed in treating skin infections, pneumonia, and certain drug-resistant strains. Oxazolidinones work by inhibiting bacterial protein synthesis, making them valuable in reducing infections resistant to other antibiotics. The unique mechanism of action positions oxazolidinones as a crucial component in the market, offering an alternative in the face of growing bacterial resistance.

The combination therapies segment is estimated to register a significant CAGR over the forecast period. Combination therapies involve the use of multiple antibiotics to target infections. This approach is particularly relevant in addressing complex or multi-drug-resistant bacterial strains. By combining different classes of antibiotics, synergistic effects can be achieved, enhancing the overall efficacy of the treatment and reducing the likelihood of resistance development. Combination therapies contribute to the versatility of treatment options within the market and offer better solutions to stop diverse and evolving resistance patterns.

Regional Insights

North America dominated the market with 37.05% revenue share in 2023, driven by vigorous investment and emphasis on research and development. The region has witnessed substantial funding for scientific research, technological advancements, and the development of innovative antibiotic therapies. According to The Institute for Health Metrics and Evaluation, article published in August 2023, bacterial antimicrobial resistance (AMR) was associated with 569,000 deaths in all 35 countries of the WHO Region of the Americas.Moreover, the region's government initiatives and mandatory insurance policies are anticipated to fuel growth in the forecast years. In the United States, about 85.0% of antibiotics for infection treatment are covered by insurance plans.

Asia Pacific is anticipated to witness the fastest CAGR in the market. The market is driven by strategic development and implementation of national action plans by regional countries. For instance, as per NCBI article published in June 2023, the formulation of the plans, like China's second National Action Plan for 2022–2025, showcases a commitment to addressing antibiotic resistance challenges. These plans often incorporate multisectoral contributions, emphasizing new focus areas such as vaccination, AMR treatment in environmental settings, and establishing intersectoral collaboration mechanisms. The proactive approach of regional governments in formulating and executing strategic plans serves as a key driver in shaping the growth trajectory of the global market.

Key Companies & Market Share Insights

Melinta Therapeutics, Basilea Pharmaceutica Ltd., and Tetraphase Pharmaceuticals are some of the dominant players operating in market.

-

Melinta Therapeutics is a publicly traded American biopharmaceutical company. It specializes in designing and developing innovative broad-spectrum antibiotics specifically tailored for treating antibiotic-resistant infections within hospital settings.

-

Basilea Pharmaceutica Ltd. is a biopharmaceutical company that develops products of the commercial stage to overcome the unmet needs of increasing antibiotic resistance and non-response to current treatment options in the therapeutic areas of microbial infections (bacteria and fungi) and for cancer.

-

ACHAOGEN, INC., Entasis Therapeutics, and AbbVie are some of the emerging market players functioning in global market.

-

Achaogen, Inc. is a biopharmaceutical company that is mainly involved in discovery, development, and commercialization of new antibacterial treatments against Gram-negative multi-drug resistant (MDR) infections. The company was founded in 2004 and has its headquarters in San Francisco, U.S.

- Entasis Therapeutics Inc. is involved in discovering and developing antibiotics, mainly for Gram-negative infections caused by multidrug-resistant (MDR) strains. The company was established in 2015 as a spinout from AstraZeneca with funding obtained from AstraZeneca itself.

Key Antibiotic Resistance Companies:

- Melinta Therapeutics

- Basilea Pharmaceutica Ltd.

- Tetraphase Pharmaceuticals

- Theravance Biopharma

- WOCKHARDT

- Paratek Pharmaceuticals, Inc.

- Seres Therapeutics

- ACHAOGEN, INC.

- Entasis therapeutics

- AbbVie

- Merck & Co. Inc.

Recent Developments

-

In May 2023, Paratek Pharmaceuticals, Inc. partnered with Zai Lab (Shanghai) Co., Ltd. and collaboratively developed and commercialized omadacycline, an innovative therapy based on tetracycline chemistry, specifically for patients in China.

-

In May 2023, Melinta Therapeutics, LLC, and Xediton Pharmaceuticals Inc entered in private agreement for the commercialization and licensing of anti-infective products in Canada, including BAXDELA, KIMYRSA, ORBACTIV, and VABOMERE.

-

In November 2023, Melinta Therapeutics LLC and Venatorx Pharmaceuticals, Inc. formed a License Agreement for a strategic partnership in the U.S. This collaboration aims to commercialize cefepime-taniborbactam, a combination antibiotic designed for complicated urinary tract infections and hospital-acquired bacterial pneumonia in adults.

Antibiotic Resistance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.17 billion

Revenue forecast in 2030

USD 12.48 billion

Growth rate

CAGR of 5.27% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, pathogen, drug class, mechanism of action, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Melinta Therapeutics; Basilea Pharmaceutica Ltd.; Tetraphase Pharmaceuticals; Theravance Biopharma; WOCKHARDT; Paratek Pharmaceuticals, Inc.; Seres Therapeutics; ACHAOGEN, INC.; Entasis therapeutics; AbbVie; Merck & Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibiotic Resistance Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the antibiotic resistance market report based on disease, pathogen, drug class, mechanism of action, distribution channel, and region:

-

Disease Outlook (Revenue, USD Million, 2018- 2030)

-

cUTI (Complicated Urinary Tract Infections)

-

CDI (Clostridioides difficile Infection)

-

ABSSSI (Acute bacterial skin and skin structure infections)

-

HABP (Hospital-acquired bacterial pneumonia)

-

CABP (Community-acquired pneumonia)

-

cIAI (Complicated intra-abdominal infection)

-

BSI (Bloodstream infection)

-

-

Pathogen Outlook (Revenue, USD Million, 2018- 2030)

-

E. coli

-

K. pneumoniae

-

P. aeruginosa

-

S. aureus

-

A. baumannii

-

S. pneumoniae

-

H. influenzae

-

C. difficile

-

E. faecium

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxazolidinones

-

Lipoglycopeptides

-

Tetracyclines

-

Combination therapies

-

Cephalosporins

-

Others

-

-

Mechanism of Action Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Synthesis Inhibitors

-

Cell Wall Synthesis Inhibitors

-

RNA Synthesis Inhibitors

-

DNA Synthesis Inhibitors

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antibiotic resistance market size was estimated at USD 8.72 billion in 2023 and is expected to reach USD 9.17 billion in 2024.

b. The global antibiotic resistance market is expected to grow at a compound annual growth rate of 5.27% from 2024 to 2030 to reach USD 12.48 billion by 2030.

b. cUTI dominated the antibiotic resistance market with a share of 23.8% in 2023 owing to the high treatment cost and limited treatment alternatives for Gram-negative pathogens, which account for the majority of infection cases.

b. Some key players operating in the antibiotic resistance market include Melinta Therapeutics, Merck & Co., Inc., Allergan, Pfizer Inc., and others

b. Key factors that are driving the antibiotic resistance market growth include physician-prescribing patterns shifting to newly launched therapies, increasing innovation in terms of first-in-class therapies, and the growing burden of antibiotic-resistant infections across developed and developing regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.