- Home

- »

- Pharmaceuticals

- »

-

Antiarrhythmic Drugs Market Size, Industry Report, 2030GVR Report cover

![Antiarrhythmic Drugs Market Size, Share & Trends Report]()

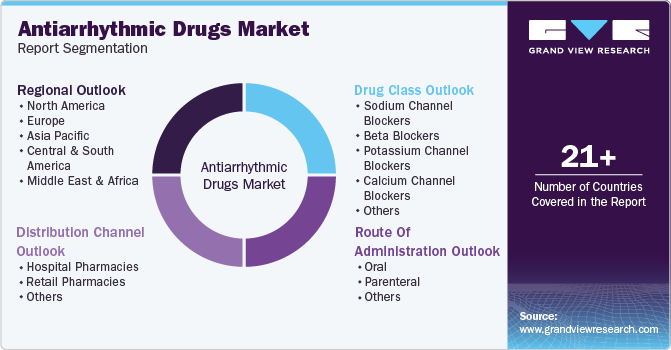

Antiarrhythmic Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Beta Blockers, Sodium Channel Blockers), By Route of Administration (Oral, Parenteral), By Distribution Channel, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-479-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antiarrhythmic Drugs Market Size & Trends

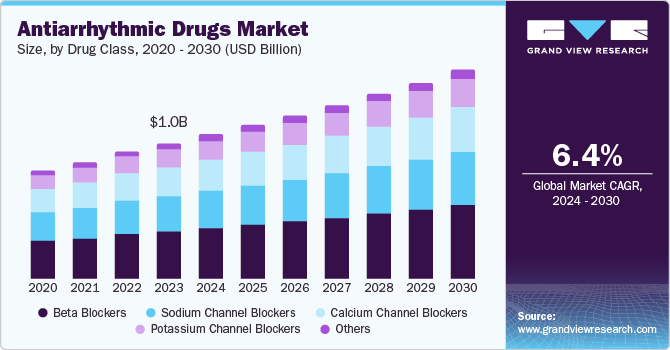

The antiarrhythmic drugs market size was valued at USD 1.1 billion in 2024 and is projected to grow at a CAGR of 6.35% from 2025 to 2030. This anticipated growth is driven by several critical factors, including the rising prevalence of cardiovascular diseases, innovations in drug development, supportive regulatory frameworks, and ongoing government initiatives focused on enhancing healthcare outcomes. A report from the National Library of Medicine published in June 2023 highlights that the prevalence of arrhythmias in the general population is expected to range from 1.5% to 5%, with atrial fibrillation being the most prevalent type. This increasing incidence underscores the urgent need for effective antiarrhythmic therapies, positioning the market for significant expansion in the coming years.

Cardiovascular diseases (CVDs) are a leading cause of morbidity and mortality worldwide, with arrhythmias being a common manifestation. According to the World Health Organization (WHO), CVDs are responsible for approximately 32% of global deaths, highlighting the urgent need for effective treatment options. The prevalence of conditions such as atrial fibrillation (AF), which affects about 33 million people globally, is rising, particularly in aging populations. This demographic shift is projected to continue, as WHO indicates that the number of people aged 60 years and older is expected to reach 2.1 billion by 2050. The increasing incidence of AF and other arrhythmias necessitates the development and use of antiarrhythmic drugs, driving market growth.

Recent advancements in drug development also play a crucial role in the market's expansion. Pharmaceutical companies are focusing on the innovation of new antiarrhythmic agents that offer improved efficacy and safety profiles. For instance, the introduction of novel medications such as antiarrhythmic agents that target specific ion channels is a significant advancement in personalized medicine. Furthermore, the increasing use of advanced technologies like machine learning in drug discovery is streamlining the development of these drugs, thus accelerating their entry into the market. The U.S. Food and Drug Administration (FDA) and other regulatory bodies are also facilitating faster approvals for these innovations, which helps to meet the growing demand promptly.

Government initiatives aimed at enhancing healthcare infrastructure and accessibility also contribute to market growth. Many countries are investing in healthcare systems to improve diagnosis and treatment options for cardiovascular diseases. For instance, the U.S. government has implemented programs to expand access to cardiac care through telehealth services, which have gained popularity, especially during the COVID-19 pandemic. This increased accessibility facilitates timely diagnosis and treatment of arrhythmias, further driving the demand for antiarrhythmic drugs. Additionally, awareness campaigns focusing on the importance of heart health are encouraging patients to seek treatment earlier, which subsequently increases the market for antiarrhythmic therapies.

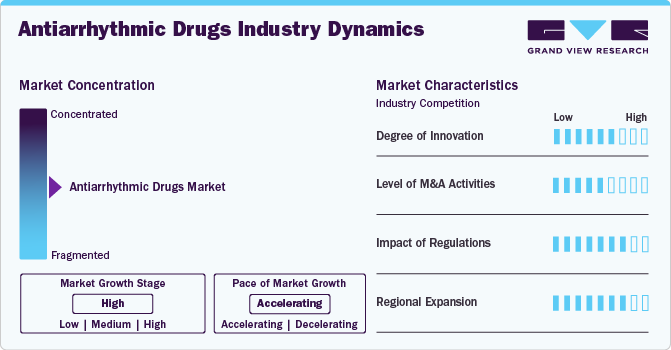

Market Concentration & Characteristics

The antiarrhythmic drugs market has seen significant innovation driven by advancements in pharmacology and technology. Recent developments include the introduction of novel agents, such as direct oral anticoagulants (DOACs) and catheter ablation techniques, enhancing the efficacy and safety profiles of treatments. The emergence of precision medicine also plays a crucial role; drugs are increasingly tailored to individual genetic profiles, improving outcomes. Additionally, digital health technologies, including wearable devices that monitor heart rhythms, are providing real-time data to refine treatment protocols.

Mergers and acquisitions (M&A) in the antiarrhythmic drugs market are on the rise as companies seek to expand their product offerings and boost innovation. This trend is driven by the growing demand for effective treatments for cardiovascular diseases, which impact millions worldwide. By integrating innovative start-ups focused on digital health and biotechnology, larger corporations aim to develop new drugs and improve access to advanced therapies.

Regulatory bodies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a pivotal role in the antiarrhythmic drugs market by establishing guidelines that ensure safety and efficacy. Recent regulatory initiatives have aimed at expediting the approval process for novel therapies through pathways like Breakthrough Therapy Designation and Accelerated Approval, which support rapid access to life-saving medications. Regulatory scrutiny around drug pricing and transparency is also rising, compelling companies to balance innovation with affordability. The global regulatory environment, characterized by harmonization efforts, has enhanced market access for new treatments, fostering competitive dynamics while ensuring patient safety.

The regional expansion of the global antiarrhythmic drugs market is notable, with North America, Europe, and Asia-Pacific being key growth areas. North America remains a leading market due to its advanced healthcare infrastructure, significant investment in research and development, and high prevalence of cardiovascular diseases. The American Heart Association estimates that approximately 121 million adults in the U.S. have some form of cardiovascular disease. In contrast, the Asia-Pacific region is witnessing rapid growth, driven by increasing awareness of heart health, improving healthcare access, and rising geriatric populations. Additionally, government initiatives aimed at enhancing healthcare access and awareness are vital in promoting the use of antiarrhythmic therapies. As a result, the market is expected to see diverse growth patterns across regions, reflecting localized healthcare needs and regulatory environments.

Drug Class Insights

In 2024, beta blockers segment accounted for the largest revenue share of 34.80% of the global antiarrhythmic drugs market. Beta blockers are well-established in the management of cardiovascular conditions, particularly arrhythmias such as atrial fibrillation and ventricular tachycardia. Their efficacy in reducing heart rate and controlling blood pressure has made them a cornerstone in the treatment of these disorders. Research published in the New England Journal of Medicine in August 2024 demonstrates that beta blockers significantly lower the risk of stroke and cardiovascular events in patients with atrial fibrillation, reinforcing their role in treatment protocols. Additionally, the broad acceptance of guidelines from the American Heart Association and the European Society of Cardiology recommends beta blockers as first-line therapy for arrhythmias, ensuring their continued utilization in clinical practice.

Potassium channel blockers is anticipated to experience the fastest CAGR within the global antiarrhythmic drugs market. Primarily, these medications, such as dofetilide and sotalol, are increasingly recognized for their effectiveness in managing various arrhythmias, including atrial fibrillation (AF) and ventricular tachycardia. For instance, Flecainide is a Na+ blocker approved for prevention of both atrial and ventricular arrhythmias and cardioversion of recent-onset AF in patients without known relevant structural heart disease Clinical study published by National Library of Medicines in February 2024 have shown that potassium channel blockers can significantly reduce the incidence of arrhythmic events and improve patient outcomes, which is crucial given the projected rise in AF cases, expected to affect over 12 million individuals in the U.S. by 2030, according to the American Heart Association.

Route of Administration Insights

The oral segment accounted for the largest revenue share of around 71.00% in 2024. Oral formulations allow patients to self-administer treatments at home, eliminating the need for invasive procedures or hospital visits, which can be particularly appealing in managing chronic conditions such as atrial fibrillation and ventricular tachycardia.Additionally, advancements in drug formulation have led to the development of newer oral agents with improved safety profiles and reduced side effects, further promoting their adoption. Moreover, the recent developments in the market highlight the approval of innovative oral therapies, such as antiarrhythmic drugs that target specific genetic markers, enhancing treatment personalization. For instance, the FDA's approval of drugs like Dronedarone and the introduction of novel oral anticoagulants reflect a shift toward more effective oral options that align with patient needs.

The other segments such as injectable, intranasal, and implantable device segments is expected to grow at a fastest CAGR driven by several key factors. The injectable segment benefits from its ability to provide rapid therapeutic effects, especially in emergency situations. Injectable formulations, such as Amiodarone and Lidocaine, are critical in acute arrhythmias and are commonly administered in hospital settings. Similarly, intranasal administration is gaining traction due to its ease of use and quick onset of action. Recent innovations in nasal delivery systems allow for efficient absorption and the potential for self-administration, making it a promising option for patients who may face barriers to traditional administration routes.

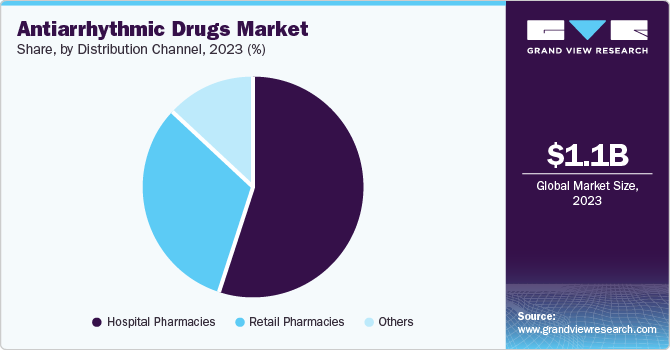

Distribution Channel Insights

The hospital pharmacies segment accounted for the largest revenue share of around 60.53% in global antiarrhythmic drugs market in 2024. Hospital pharmacies are often involved in clinical research and trials, leading to the adoption of innovative therapies. As new antiarrhythmic agents are developed and approved, hospitals remain at the forefront of implementing these advancements. Regulatory bodies, such as the FDA, continue to prioritize the approval of novel therapies, which hospital pharmacies are well-positioned to provide. Moreover, the increased investment in hospital infrastructure and technology, alongside the integration of electronic health records (EHRs), has improved medication management and patient outcomes. This technological advancement facilitates better monitoring of patients, ensuring timely administration of antiarrhythmic medications.

The other distribution channels, including online pharmacies, long-term care pharmacies, and specialty pharmacies, are projected to experience the fastest-growing CAGR in the global antiarrhythmic drugs market. This growth is largely driven by the rising demand for convenient access to medications, technological advancements, and a shift towards patient-centric care. According to the ASOP Foundation 2023 Survey, 52% of Americans aged 18 and older used an online pharmacy in 2022, marking a notable increase of 10 percentage points from 2021 and 17 points from 2020. Furthermore, 71% of respondents reported that they began utilizing online pharmacies within the last 1-3 years, highlighting a significant trend toward digital medication access. Currently, 85% of individuals with online pharmacy experience continue to use these platforms for one or more medications, and 61% report purchasing most or all of their prescriptions online. This shift reflects broader consumer preferences for convenience and accessibility in healthcare. Online pharmacies offer not only ease of ordering but also features like home delivery, telehealth consultations, and user-friendly interfaces, enhancing the overall patient experience

Regional Insights

North America Antiarrhythmic Drugs Market Trends

The North America antiarrhythmic drugs market held a majority of share of around 37.55% in 2024 and is primarily driven by the U.S., which has a high prevalence of cardiovascular diseases. According to the CDC, about 702,880 Americans died from heart disease in 2022, underscoring a critical need for effective antiarrhythmic therapies. Regulatory support from agencies like the FDA facilitates the rapid approval of innovative drugs, further stimulating market growth.

U.S. Antiarrhythmic Drugs Market Trends

The U.S. antiarrhythmic drugs market is characterized by a robust pipeline of innovative treatments and a strong emphasis on research and development. The high prevalence of arrhythmias, with millions affected by conditions like atrial fibrillation, drives significant investment in therapeutic solutions. The FDA has accelerated the approval process for novel antiarrhythmic agents, which has led to the introduction of several new drugs in recent years. Additionally, initiatives to improve healthcare access, such as the Affordable Care Act, have enhanced patient reach, contributing to increased medication adherence and, consequently, market growth.

Canada Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in Canada is shaped by a rising incidence of heart disease, with cardiovascular conditions being a leading cause of mortality. The Canadian government’s focus on healthcare reforms, such as the implementation of the Canada Health Act, ensures broader access to essential medications, including antiarrhythmics.

Europe Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in Europe is experiencing rapid growth due to a high prevalence of cardiovascular diseases across the region. The European Society of Cardiology estimated that prevalence rate of atrial fibrillation will increase by 89% by 2060 in Europe. Stringent regulations from the European Medicines Agency (EMA) ensure the safety and efficacy of new drugs, encouraging innovation in antiarrhythmic therapies. Moreover, government initiatives aimed at enhancing cardiovascular health, such as the European Heart Health Initiative, further bolster the market.

UK Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in the UK is bolstered by a strong focus on cardiovascular health, driven by high prevalence rates of conditions such as arrhythmias. The National Health Service (NHS) plays a pivotal role in regulating access to antiarrhythmic medications, ensuring that innovative treatments are available to patients. Recent initiatives, including the NHS Long Term Plan, aim to enhance cardiovascular disease management through better screening and treatment pathways.

France Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in France is strongly supported by an aging population, with cardiovascular diseases being a leading health concern. According to Foundation de France, every four minutes, someone in France experiences a cardiovascular event. CVD is the second leading cause of death in France, and it's affecting younger people more and more. The French government’s commitment to improving cardiovascular health through the National Health Strategy has led to increased funding for research and development of antiarrhythmic medications. Moreover, the Haute Autorité de Santé (HAS) ensures that new treatments meet high safety and efficacy standards, facilitating market entry for innovative drugs. This regulatory support, coupled with advancements in personalized medicine, is driving market growth.

Asia Pacific Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in the Asia Pacific region is experiencing rapid growth due to a rising incidence of cardiovascular diseases and increasing healthcare expenditure. According to the World Health Organization, heart disease is a leading cause of death in many Asia Pacific countries. The region’s expanding middle class is driving demand for better healthcare services and access to innovative treatments. Regulatory bodies are also streamlining approval processes for new drugs, encouraging pharmaceutical companies to invest in the region. Additionally, initiatives aimed at improving public awareness about heart health are contributing to increased demand for antiarrhythmic medications.

India Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in India is characterized by rapid growth driven by a significant rise in cardiovascular disease prevalence. The Indian government has implemented various health initiatives, such as the National Health Mission, to improve access to healthcare services, including medications for heart conditions. Additionally, increased investment in healthcare infrastructure and the rising adoption of digital health technologies are facilitating better patient management and adherence to antiarrhythmic therapies.

China Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in China is heavily influenced by the rising prevalence of cardiovascular diseases (CVD). According to the report published by National Library of Medicines in December 2023, approximately 330 million individuals in China are currently affected by CVD. Key statistics include 245 million with hypertension, 13 million with stroke, and 4.87 million with atrial fibrillation. Contributing factors to CVD include tobacco use, poor diet, lack of physical activity, and environmental issues. Regulatory support from the National Medical Products Administration (NMPA) is expediting the approval of innovative therapies, facilitating the introduction of advanced antiarrhythmic drugs. Furthermore, increasing health awareness among the population is driving demand for effective treatment options for heart conditions.

Latin America Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in Latin America is expanding due to rising cardiovascular disease prevalence and growing healthcare access. According to the Pan American Health Organization, in 2019, 2.0 million people died from CVD in the region. Efforts to improve healthcare infrastructure, alongside government initiatives aimed at increasing access to essential medicines, are facilitating market growth. Moreover, increasing awareness of heart health and the importance of early intervention are driving demand for antiarrhythmic medications. The collaboration between local pharmaceutical companies and international firms is also enhancing the availability of innovative treatments in the region.

Brazil Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in Brazil is driven by a high incidence of cardiovascular diseases, with studies showing that heart disease is a leading cause of death in the country. The Brazilian government has implemented health programs aimed at reducing mortality from cardiovascular conditions, including improved access to medications. Regulatory bodies like ANVISA play a crucial role in ensuring the safety and efficacy of new antiarrhythmic drugs, fostering a conducive environment for innovation. Furthermore, the growing middle class in Brazil is increasing demand for advanced healthcare solutions, contributing to the expansion of the antiarrhythmic drugs market.

Middle East & Africa Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in the Middle East and Africa is witnessing significant growth driven by an increasing prevalence of cardiovascular diseases and improving healthcare infrastructure. The World Health Organization reports that cardiovascular diseases account for a substantial percentage of mortality in the region. Government initiatives aimed at enhancing healthcare access, such as the African Union’s Agenda 2063, are fostering investments in health systems. Additionally, rising awareness of cardiovascular health among populations is contributing to the demand for antiarrhythmic drugs.

Saudi Arabia Antiarrhythmic Drugs Market Trends

The antiarrhythmic drugs market in Saudi Arabia is characterized by a growing prevalence of cardiovascular diseases, with studies indicating that heart disease accounts for a significant portion of mortality. The Saudi government’s Vision 2030 initiative emphasizes improving healthcare services and increasing access to essential medications, including antiarrhythmic drugs. Recent investments in healthcare infrastructure, along with partnerships with global pharmaceutical companies, are enhancing the availability of advanced treatments and drugs.

Key Antiarrhythmic Drugs Company Insights

The global antiarrhythmic drugs market is dominated by several major pharmaceutical companies that collectively account for a significant market share. These leading players established themselves through extensive research and development efforts, resulting in the introduction of innovative drug class options. They also expanded their product portfolios through strategic collaborations, mergers, and acquisitions.

Key Antiarrhythmic Drugs Companies:

The following are the leading companies in the antiarrhythmic drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer

- Novartis

- Mylan (now part of Viatris)

- Baxter International

- Sanofi

- GlaxoSmithKline

- Mayne Pharma

- Upsher-Smith Laboratories

- Amomed Pharma

- Merck

Recent Developments

-

In November 2024, Huyabio International announced new patient data for an antiarrhythmic drug, HBI-300. The drug candidate has a unique profile for the treatment of one of the most serious heart conditions, atrial fibrillation.

-

In May 2024, Milestone Pharmaceuticals Inc. announced a partnership with Arrhythmia Alliance to raise awareness about supraventricular tachycardia (SVT). Milestone, a biopharmaceutical company specializing in innovative cardiovascular medicines, aims to enhance education and understanding of this condition through this collaboration.

-

In December 2023, Acesion Pharma a biotech company pioneering first-in-class novel therapies for atrial fibrillation (the most common cardiac arrhythmia), announced the publication of data in Nature Medicine with the full results from its Phase 2 proof-of-concept trial of AP30663, a first-in-class SK ion channel inhibitor for conversion of AF to normal sinus rhythm.

Antiarrhythmic Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.2 billion

Revenue forecast in 2030

USD 1.6 billion

Growth rate

CAGR of 6.35% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug Class, Route of Administration, Distribution Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Pfizer; Novartis; Mylan (now part of Viatris); Baxter International; Sanofi; GlaxoSmithKline; Mayne Pharma; Upsher-Smith Laboratories; Amomed Pharma; Merck

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antiarrhythmic Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antiarrhythmic drugs market report based on drug class, route of administration, distribution channel, and region.

-

Drug Class Outlook (Revenue, USD Million; 2018 - 2030)

-

Sodium Channel Blockers

-

Beta Blockers

-

Potassium Channel Blockers

-

Calcium Channel Blockers

-

Other

-

-

Route of Administration Outlook (Revenue, USD Million; 2018 - 2030)

-

Oral

-

Parenteral

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antiarrhythmic drugs market size was estimated at USD 1.1 billion in 2024 and is expected to reach USD 1.2 billion in 2025.

b. The global antiarrhythmic drugs market is expected to grow at a compound annual growth rate of 6.35% from 2025 to 2030 to reach USD 1.6 billion by 2030.

b. In 2024, the beta blockers segment accounted for the largest revenue share of 34.80% in global antiarrhythmic drugs market. Their efficacy in reducing heart rate and controlling blood pressure has made them a cornerstone in the treatment of these disorders.

b. Some key players operating in the antiarrhythmic drugs market include Pfizer; Novartis; Viatris; Baxter International; Sanofi; GlaxoSmithKline; Mayne Pharma; Upsher-Smith Laboratories; Amomed Pharma; and Merck.

b. Key factors that are driving the market growth include the rising prevalence of cardiovascular diseases (CVDs), an aging global population, advancements in drug development, regulatory support, and government initiatives aimed at improving cardiovascular health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.