- Home

- »

- Beauty & Personal Care

- »

-

Anti-wrinkle Products Market Size, Industry Report, 2033GVR Report cover

![Anti-wrinkle Products Market Size, Share & Trends Report]()

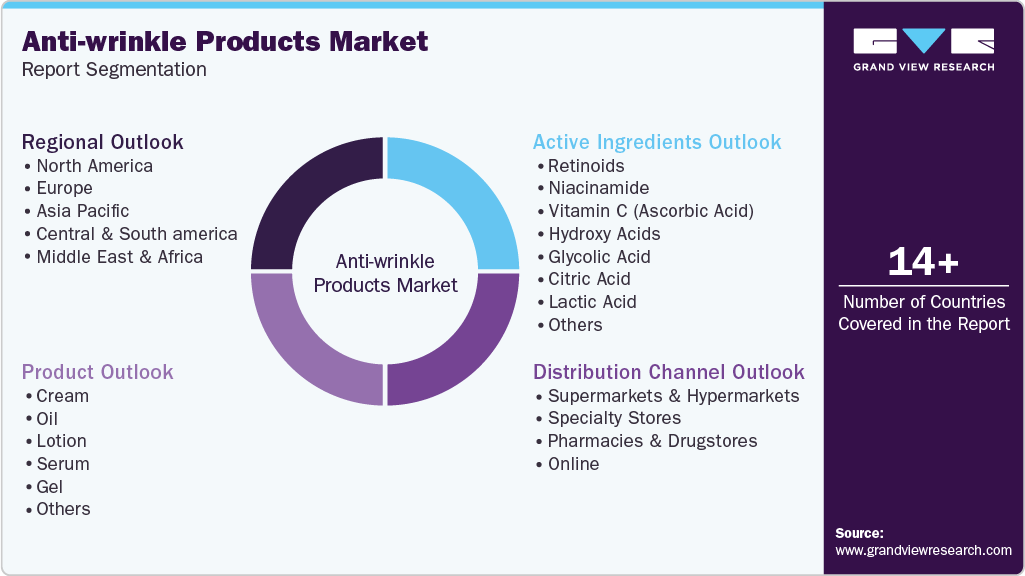

Anti-wrinkle Products Market (2026 - 2033) Size, Share & Trends Analysis Report By Active Ingredients (Retinoids, Glycolic Acid, Citric Acid, Lactic Acid), By Product (Cream, Oil), By Distribution Channel (Specialty Stores, Pharmacies & Drugstores), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-835-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-wrinkle Products Market Summary

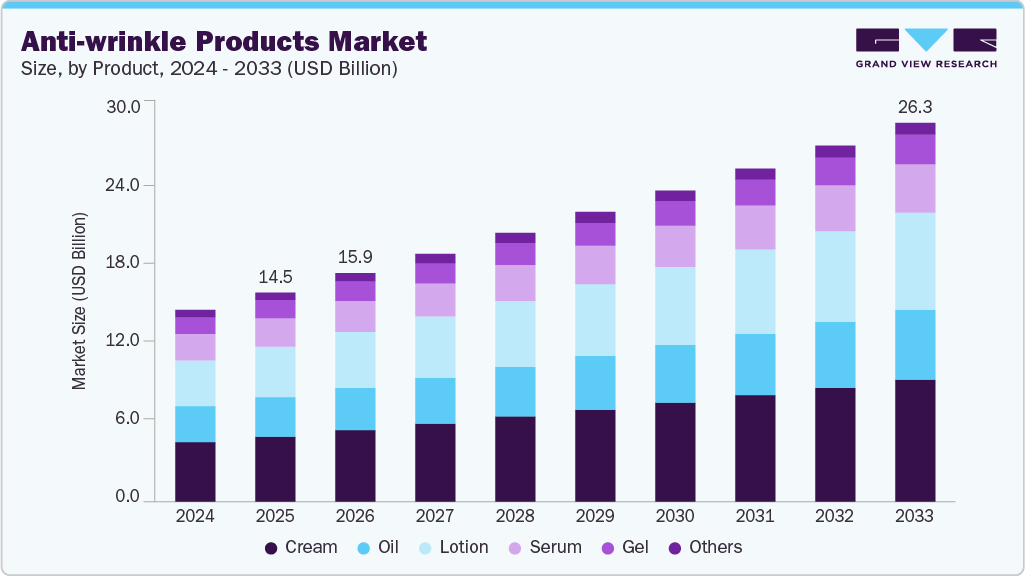

The global anti-wrinkle products market size was estimated at USD 14.55 billion in 2025 and is projected to reach USD 26.32 billion by 2033, growing at a CAGR of 7.5% from 2026 to 2033. Rising awareness among consumers related to age-related skin problems such as fine lines, wrinkles, and dullness of skin, coupled with an increasing propensity to spend on products that help retain a youthful appearance, is expected to drive the product demand throughout the forecast period.

Key Market Trends & Insights

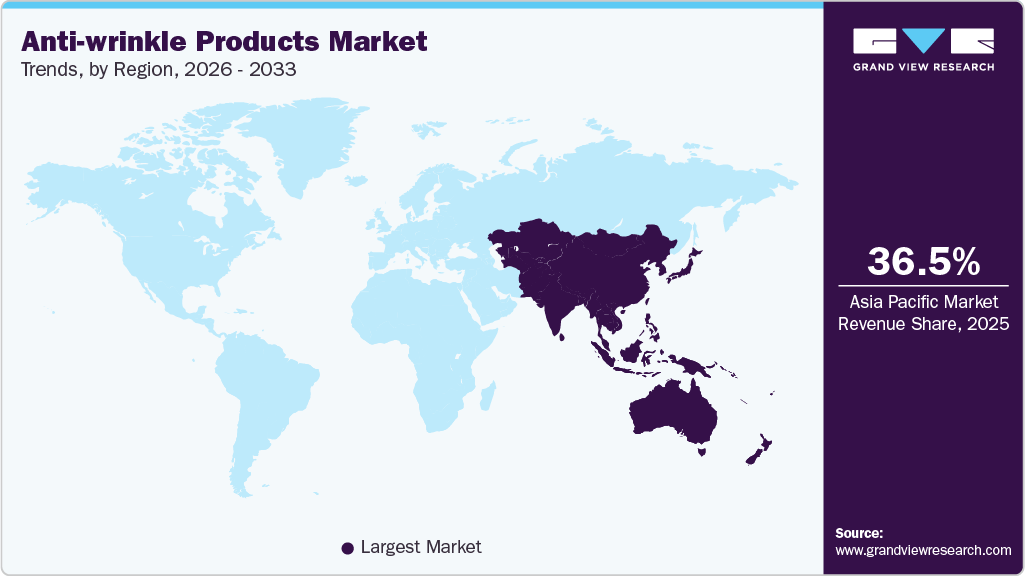

- Asia Pacific led the market accounted for a share of 36.5% in 2025.

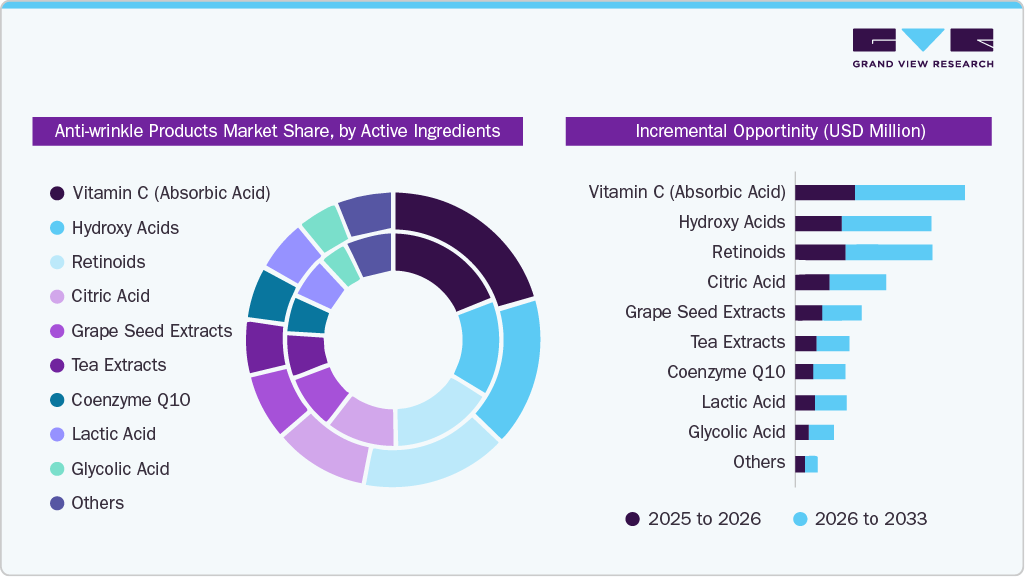

- By active ingredients, the Vitamin C accounted for a dominant share of 18.9% of the global revenue in 2025.

- By product, the creams led the market and accounted for a share of 31.4% in 2025.

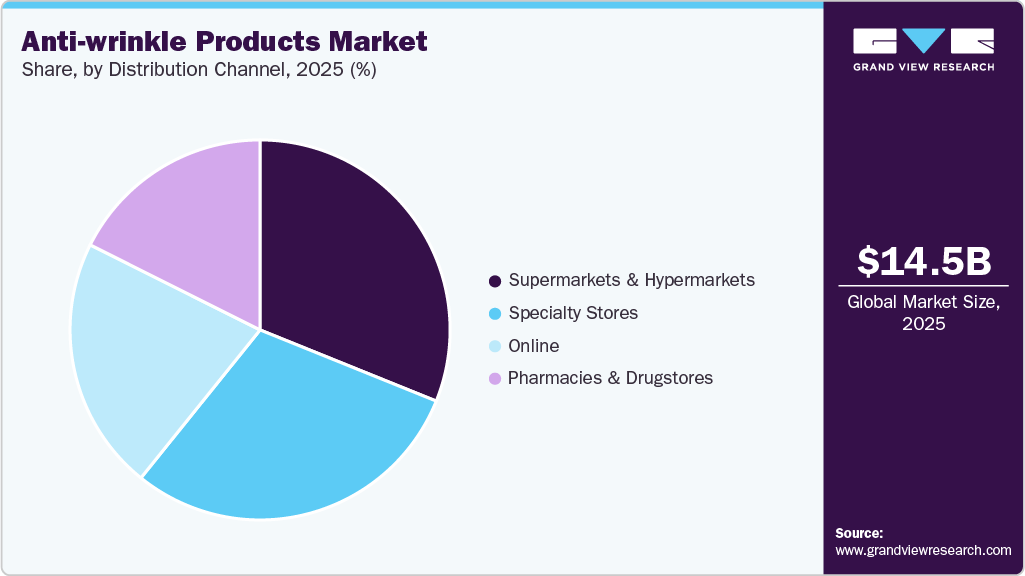

- By distribution channel, the supermarkets & hypermarkets led the market and accounted for a share of 31.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 14.55 Billion

- 2033 Projected Market Size: USD 26.32 Billion

- CAGR (2026-2033): 7.5%

- Asia Pacific: Largest market in 2025

In addition, the rising elderly population across the globe and technological advancements in the cosmetic industry are expected to be key factors driving the market growth. Anti-wrinkle products are gaining traction as they contain formulations that help slow down the aging process. Major causes of wrinkles include lack of essential nutrients in the body, exposure to UV light and pollution over a long period, smoking, dehydration, and drugs, as well as genetic predisposition.

The growing inclination toward plant-based alternatives has resulted in a recent shift in consumer preference for organic and natural products. In this regard, many brands are providing anti-wrinkle products containing natural ingredients. For instance, Alpyn Beauty, a manufacturer of skin care products, offers a moisturizer with Bakuchiol and Squalane that brightens the skin and minimizes the appearance of wrinkles. Furthermore, numerous crossover products have emerged under the natural beauty trend. These offer the dual functionality of makeup as well as wrinkle care. For instance, Lancôme, a part of the L'Oréal brand, offers a range of makeup and cosmetics that contains Génifique, an anti-aging serum.

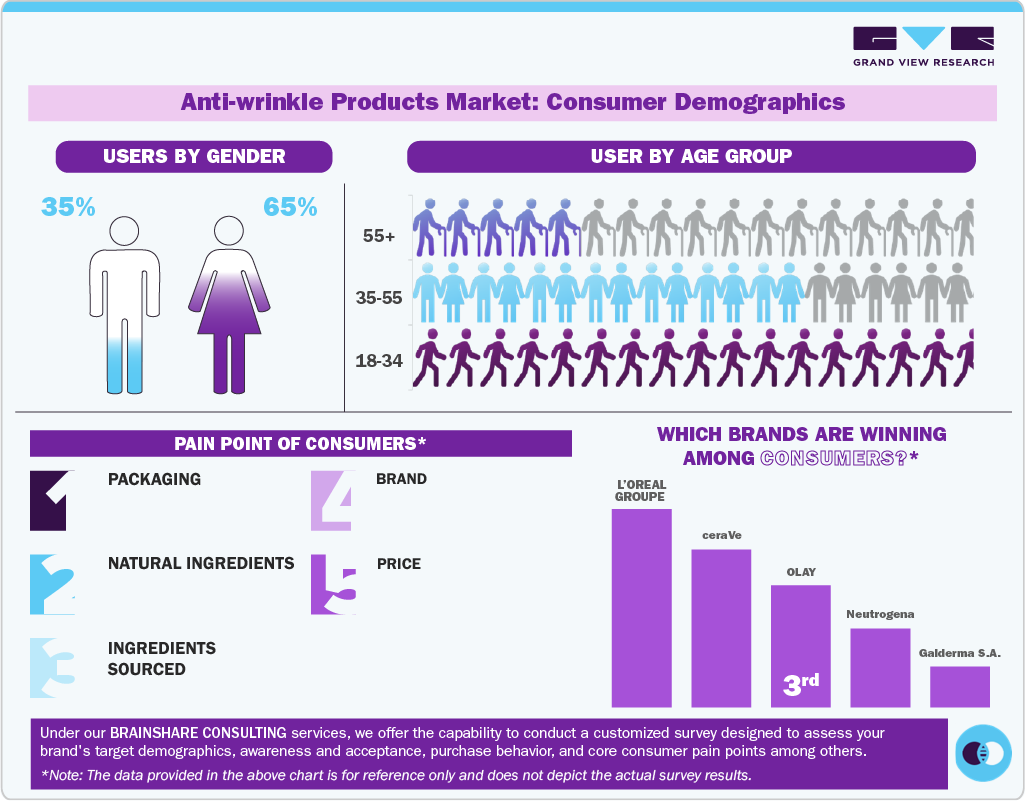

Cosnumer Insights

Consumer interest in anti-wrinkle products has strengthened as individuals increasingly seek evidence-based, results-oriented skincare solutions. Modern buyers prefer formulations featuring clinically validated actives such as retinoids, peptides, vitamin C, hyaluronic acid, niacinamide, and growth-factor complexes, driven by their proven ability to improve fine lines, texture, elasticity, and overall skin firmness. There is also a widening preference for dermatologist-endorsed brands, "medical-grade" skincare, and products supported by visible clinical results. This reflects a broader shift toward scientific credibility and ingredient transparency in beauty purchasing decisions.

Younger demographics, particularly Millennials and Gen Z, are adopting early interventions such as retinol serums, peptide creams, SPF-anchored routines, and preventive treatments. This adoption is influenced by extensive digital education, online reviews, and social media content that explain how early skincare habits can delay visible aging. As a result, "pre-juvenation" has emerged as one of the strongest consumer segments.

Consumers are simultaneously prioritizing skin barrier health, recognizing that a healthy barrier enhances the efficacy of anti-wrinkle actives while reducing irritation. This has led to increased preference for products with ceramides, squalane, probiotics, and soothing botanicals that support tolerance and long-term skin resilience. Additionally, texture, ease of use, and multi-functional benefits are key preferences: consumers increasingly favor products that combine hydration, brightening, and anti-wrinkle effects into a single formula to streamline routines without compromising efficacy.

Sustainability and safety have also become important purchase drivers. Many consumers choose anti-aging products that are clean-label, fragrance-free, cruelty-free, vegan, and packaged responsibly, especially as ingredient literacy improves. The preference for minimalist, non-irritating formulas lies alongside the desire for highly potent serums that deliver visible differences within defined timeframes, reflecting a balanced approach between performance and skin tolerance.

Active Ingredients Insights

Vitamin C accounted for a dominant share of 18.9% of the global revenue in 2025. Demand for Vitamin C in anti-wrinkle products is rising as consumers increasingly seek clinically supported, multi-benefit ingredients that deliver visible improvements in skin texture, firmness, and brightness. Vitamin C is widely recognized in dermatology for its proven ability to stimulate collagen synthesis, reduce oxidative stress, and protect against photoaging three core mechanisms linked to wrinkle formation. Its strong reputation as a science-backed, antioxidant-rich ingredient has boosted consumer confidence, particularly as skincare users gravitate toward active formulations that offer both preventive and corrective benefits.

The hydroxy acid segment is expected to grow at a CAGR of 9.2% from 2026 to 2033. Demand for hydroxy acids in anti-wrinkle products is increasing as consumers prioritize ingredients that deliver visible, clinically supported results for skin renewal and aging concerns. Alpha- and beta-hydroxy acids (such as glycolic, lactic, and salicylic acid) are valued for their ability to exfoliate the skin, stimulate cell turnover, smooth fine lines, and improve overall texture, benefits that align closely with rising interest in scientifically effective, dermatologist-recommended solutions.

Product Insights

Creams accounted for a dominant share of 31.4% of the global revenue in 2025. Growing awareness of early aging signs, driven by lifestyle stress, pollution, and greater screen exposure, has accelerated interest in products that enhance collagen production, improve skin elasticity, and reduce fine lines. Advancements in dermatological research and the availability of clinically backed ingredients such as retinoids, peptides, hyaluronic acid, and antioxidants have strengthened consumer confidence in topical anti-aging solutions.

The lotion segment is expected to grow at a CAGR of 8.4% from 2026 to 2033. Growing awareness of early signs of aging, combined with higher exposure to pollution, UV radiation, and digital screens, has heightened concerns around fine lines, dryness, and loss of firmness. Consumers are seeking lightweight, hydrating formulations enriched with clinically backed ingredients such as retinol, peptides, ceramides, and antioxidants that offer daily, non-invasive solutions for maintaining youthful skin. Additionally, the normalization of multi-step skincare routines and the strong influence of dermatologists and social media have accelerated adoption, making anti-wrinkle lotions a preferred choice for both convenience and visible results.

Distribution Channel

Sales of anti-wrinkle products through supermarkets & hypermarkets accounted for a revenue share of 31.1% in 2025. The rising focus on preventive aging, combined with greater awareness of active ingredients such as retinol, peptides, and hyaluronic acid, has driven consumers to purchase anti-aging products from familiar retail environments. These retail formats offer convenience, competitive pricing, and a broad assortment of dermatologist-recommended brands, enabling shoppers to compare products easily and make quick, informed decisions. Additionally, the growing presence of premium and mass-premium anti-wrinkle ranges in large-format stores has made advanced skincare more approachable, further contributing to the steady growth of this segment.

Sales of through online channels are expected to grow at a CAGR of 11.2% from 2026 to 2033. The online segment is driven by the rising number of consumers opting for online platforms to buy products. Online platforms offer various benefits, such as easy product availability and numerous brands to choose from. In addition, online discounts offered by skincare manufacturers are anticipated to drive the growth of the segment. In addition, the ease of ordering products through websites encourages manufacturers to sell their products online.

In addition, the rising penetration of the internet and social media platforms such as Instagram and YouTube is also supporting the growth of the online segment. Several customers follow influencers on these platforms for recommendations and additional information on anti-aging skin care products. In addition, the growing prevalence of live shopping is also driving the growth of the segment.

Regional Insights

The anti-wrinkle products market in Asia Pacific accounted for a share of 36.5% in 2025. Demand for anti-wrinkle products is rising rapidly across Asia-Pacific as consumers increasingly prioritize early-age skincare, preventive anti-aging routines, and overall skin health. Younger demographics in markets such as China, South Korea, Japan, and Southeast Asia are adopting anti-wrinkle solutions earlier due to high awareness of UV-related aging, pollution exposure, and digital skin damage from prolonged screen use. Cultural emphasis on youthful, smooth skin-reinforced by K-beauty trends and social media has further accelerated demand, making anti-wrinkle products a core part of daily skincare routines in the region.

North America Anti-wrinkle Products Market Trends

North America anti-wrinkle products market accounted for a share of 26% in 2025. The demand for anti-wrinkle products in North America is growing rapidly as consumers increasingly prioritize preventive skincare and long-term skin health. An aging population, coupled with early adoption of anti-aging routines among Millennials and Gen Z, has strengthened interest in ingredients such as retinoids, peptides, hyaluronic acid, and antioxidants. Higher awareness of sun damage, lifestyle stress, and environmental exposure has also accelerated the need for effective solutions that improve fine lines, firmness, and overall skin texture.

Europe Anti-wrinkle Products Market Trends

The anti-wrinkle products market in Europe is projected to grow at a CAGR of 6.8% from 2026 to 2033. An aging population, combined with higher awareness of skin health, has led individuals in their 30s and 40s to adopt early anti-aging routines focused on fine-line reduction, collagen support, and long-term skin maintenance. At the same time, widespread exposure to dermatological education on digital platforms has strengthened interest in clinically proven ingredients such as retinoids, peptides, hyaluronic acid, and antioxidants. European consumers also prefer high-efficacy, science-backed formulations with clean, sustainable profiles driving growth for both premium dermocosmetic brands and natural anti-aging solutions.

Central & South America Anti-wrinkle Products Market Trends

The anti-wrinkle market in Central & South America is projected to grow at a CAGR of 7.5% from 2026 to 2033. Urbanization and higher disposable incomes have expanded access to premium beauty products, while social media and beauty influencers have accelerated interest in clinically effective ingredients such as retinol, peptides, hyaluronic acid, and vitamin C. Additionally, greater exposure to environmental stressors-such as high UV radiation across the region has amplified concerns around premature aging, prompting consumers to adopt anti-wrinkle creams, serums, and targeted treatments at earlier ages.

Middle East & Africa Anti-wrinkle Products Market Trends

The anti-wrinkle market in the Middle East & Africa is projected to grow at a CAGR of 4.4% from 2026 to 2033. Higher disposable incomes, greater exposure to global beauty trends, and widespread adoption of dermatology-led routines have accelerated interest in clinically effective formulations such as retinoids, peptides, vitamin C, and hyaluronic acid. The region's harsh climate characterized by intense sun exposure, dehydration, and pollution-has heightened awareness of premature aging and driven demand for targeted solutions that address fine lines, uneven texture, and loss of firmness.

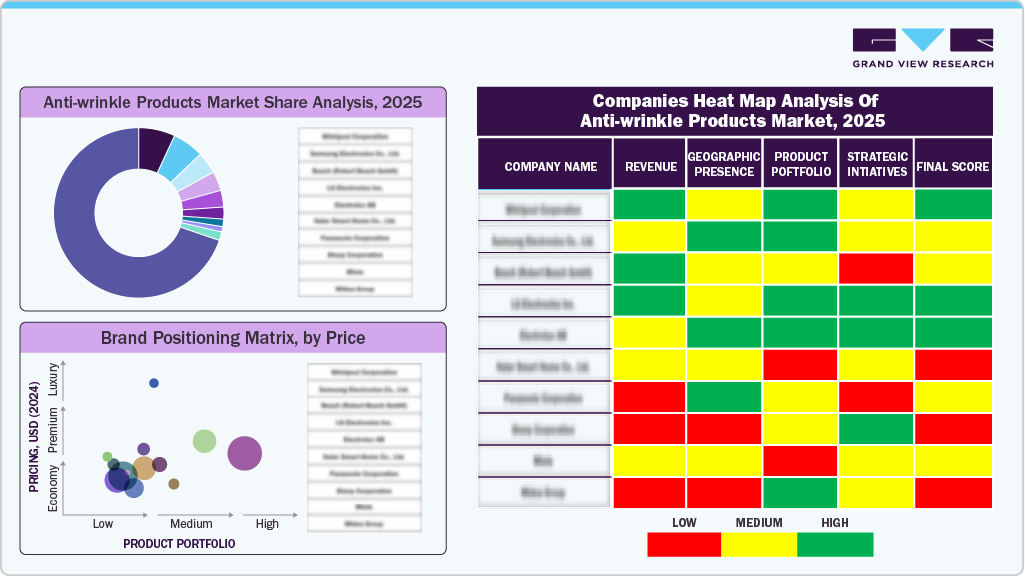

Key Anti-wrinkle Products Company Insights

Key players operating in the anti-wrinkle products market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Anti-wrinkle Products Companies:

The following are the leading companies in the anti-wrinkle products market. These companies collectively hold the largest market share and dictate industry trends.

- L’ORÉAL GROUPE

- OLAY

- CeraVe

- Neutrogena

- RoC Skincare

- POND'S

- No7 Beauty Company (Walgreens Boots)

- La Roche-Posay Laboratoire Dermatologique

- REN Clean Skincare

- Galderma S.A.

- Clinique Laboratories

- Shiseido Co., Ltd

- The Estée Lauder Companies Inc.

- Life Extension

- Vichy Laboratoires

- Kiehl's Since 1851

- Groupe Clarins

- Origins Natural Resources, Inc.

Recent Developments

-

In March 2025, Chemyunion launched Peptid4 B-Like, a new sustainable tetrapeptide targeting expression wrinkles as a non-invasive alternative to botulinum toxins. It works by reducing muscle contraction and smoothing wrinkles, showing significant clinical results such as a 20% reduction in eye wrinkles within 14 days and improved skin elasticity. Peptid4 B-Like is eco-friendly, cost-effective, and made via a green chemistry process, appealing to both high-performance and environmentally conscious skincare brands.

-

In May 2025, Koru Pharma launched the Mesoheal Glow Series, a new skincare line featuring three products: Pink Glow, Amber Glow, and Orchid Glow. Each product targets different skin concerns: Pink Glow addresses pigmentation issues and uneven skin tone, Amber Glow combats visible signs of aging like fine lines and loss of elasticity, and Orchid Glow focuses on anti-wrinkle therapy and enhancing skin firmness. The series utilizes advanced scientific research and high-quality ingredients to help achieve radiant, youthful skin.

Anti-wrinkle Products Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.87 billion

Revenue forecast in 2033

USD 26.32 billion

Growth rate (revenue)

CAGR of 7.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Active ingredients, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain: China; Japan; India; Australia; Brazil; UAE

Key companies profiled

L'ORÉAL GROUPE; OLAY; CeraVe; Neutrogena; RoC Skincare; POND'S; No7 Beauty Company (Walgreens Boots); La Roche-Posay Laboratoire Dermatologique; REN Clean Skincare; Galderma S.A.; Clinique Laboratories, LLC; Shiseido Co., Ltd; The Estée Lauder Companies Inc.; Life Extension; Vichy Laboratoires; Kiehl's Since 1851; Groupe Clarins; Origins Natural Resources, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-wrinkle Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global anti-wrinkle products market report on the basis of active ingredients, product, distribution channel, and region:

-

Active Ingredients Outlook (Revenue, USD Million, 2021 - 2033)

-

Retinoids

-

Retinol

-

Retinoic Acid

-

-

Niacinamide

-

Vitamin C (Ascorbic Acid)

-

Hydroxy Acids

-

Glycolic Acid

-

Citric Acid

-

Lactic Acid

-

Coenzyme Q10

-

Peptides

-

Tea Extracts

-

Grape Seed Extracts

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cream

-

Oil

-

Lotion

-

Serum

-

Gel

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South america

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global anti-wrinkle products market size was estimated at USD 14.55 billion in 2025 and is expected to reach USD 15.87 billion in 2026.

b. The global anti-wrinkle products market is expected to grow at a compound annual growth rate of 7.5% from 2026 to 2033 to reach USD 26.32 billion by 2033.

b. Vitamin C accounted for a dominant share of 18.9% of the global revenue in 2025. Demand for Vitamin C in anti-wrinkle products is rising as consumers increasingly seek clinically supported, multi-benefit ingredients that deliver visible improvements in skin texture, firmness, and brightness.

b. Some key players operating in the anti-wrinkle product market include L’ORÉAL GROUPE, OLAY, CeraVe, Neutrogena, RoC Skincare, POND’S, No7 Beauty Company (Walgreens Boots), La Roche-Posay Laboratoire Dermatologique, REN Clean Skincare, Galderma S.A., Clinique Laboratories, LLC, Shiseido Co., Ltd, The Estée Lauder Companies Inc., Life Extension, Vichy Laboratoires, Kiehl’s Since 1851, Groupe Clarins, Origins Natural Resources, Inc.

b. Key factors that are driving the market growth include rising awareness among consumers related to age-related skin problems such as fine lines, wrinkles, and dullness of skin, coupled with an increasing propensity to spend on products that help retain a youthful appearance, is expected to drive the product demand throughout the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.