- Home

- »

- Pharmaceuticals

- »

-

Anti-venom Market Size, Share And Growth Report, 2030GVR Report cover

![Anti-venom Market Size, Share & Trends Report]()

Anti-venom Market (2024 - 2030) Size, Share & Trends Analysis Report By Species (Snake, Scorpion), By Type (Polyvalent, Monovalent), By Mode Of Action (Cytotoxic, Neurotoxic), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-357-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-venom Market Size & Trends

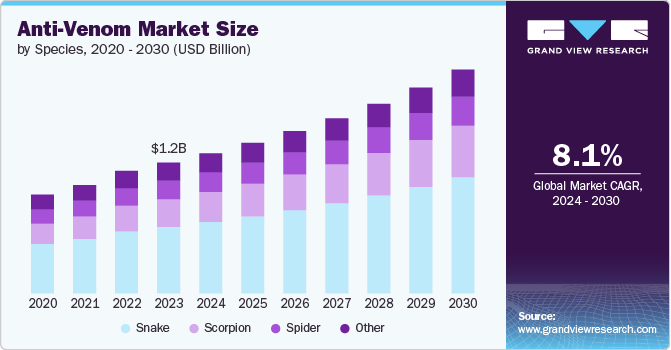

The global anti-venom market size was estimated at USD 1.18 billion in 2023 and is expected to grow at a CAGR of 8.11% from 2024 to 2030. This growth is attributed to the rising prevalence of venom bites/stings, increasing awareness of anti-venom treatments, growing research initiatives to develop effective treatments, and growing government initiatives to spread. According to the World Health Organization (WHO), approximately 5.4 million people get bitten by snakes each year. Moreover, around 81 410 to 137 880 mortalities occur globally each year as a result of snake bites.

Similarly, several venomous species, such as spiders, scorpions, and others, also significantly contribute to the increasing demand for anti-venom treatments. Bites from these venomous species often lead to various serious conditions and acute medical emergencies such as severe paralysis, which may prevent breathing, lead to bleeding disorders, and may even cause irreversible kidney failure. The increasing awareness about these effects of venom bites and the need for their treatment are expected to fuel the market growth over the forecast period. The countries and regions with weaker health systems and resources experience an increased burden of these conditions caused by venom bites, highlighting the importance of these treatments.

Various research institutes, universities, and healthcare companies are taking initiatives to enhance their R&D on anti-venom for the development of advanced solutions with better results and outcomes. For instance, in October 2022, Monash University Malaysia and Agilent Technologies Inc. signed a MoU for building an integrated biology center in Malaysia. This center is anticipated to help the institutions improve their scientific knowledge to develop better anti-venom & other applied biology research. Similarly, in March 2024, the Institute for Primate Research Kenya announced that it is ready to introduce the first-ever anti-venom produced in any African country. Such research initiatives taken by various institutions are expected to lead to the development of advanced treatments and drive market growth.

Similarly, several governments globally are trying to increase awareness about venomous species and the effects of their bites, which is further anticipated to contribute to market growth. For instance, in MAR 2024, the Union Health Ministry of the Government of India (GOI) launched the National Action Plan for Prevention and Control of Snakebite Envenoming (NAP-SE) in India. A snakebite helpline no was also launched at the event to ensure better access to medical care for the individuals or communities affected by snakebites in five different states of the country. Such increasing government initiatives to increase medical care access for venom bite victims are anticipated to fuel the anti-venom market growth over the forecast period.

Species Insights

The snake segment accounted for the largest revenue share of 50.83% in 2023. This can be attributed to the high prevalence of snake bites, the requirement for specialized treatment for different snake species, and the high awareness among the general public about necessary treatment for snake bites. Compared to other venomous species, snake bites are significantly more common, especially in regions of Africa, Latin America, and Asia. For instance, according to the WHO, around 435,000 to 580,000 snakebites are registered in Africa annually.

The scorpion segment is anticipated to witness the fastest growth over the forecast period. This can be attributed to the growing awareness about scorpion bite aftereffects such as pain, burning, difficulty in breathing, vomiting, extreme swelling, shock, and swelling. Similarly, the increasing efforts for the development of effective scorpion bite solutions globally, are further expected to propel the segment growth. For instance, in November 2023, the Indian Department of Science & Technology (DST) reported the development of a therapeutic drug formulation (TDF), which consists of low doses of α1- adrenoreceptor agonist (AAAs), commercial equine anti-scorpion antivenom (ASA), and vitamin C. This formulation is expected to inhibit the toxicity induced by the sting of the Indian red scorpion, thereby improving the clinical management for patients of scorpion stings.

Type Insights

The polyvalent segment accounted for the largest revenue share of 67.08% in 2023. Polyvalent anti-venom offers treatment opportunities to treat a diverse range of poisonous bites to some extent, increasing their applicability. It contains antibodies that can neutralize the venom of a group of related species. This is particularly helpful when the exact biting creature is unknown, which is often the case in snakebite emergencies. Moreover, the wide application attribute of polyvalent anti-venom makes them crucial in regions with a diverse range of venomous species. Moreover, the increasing R&D initiatives by scientists to develop anti-venom covering a wide range of venomous species are contributing to the segment's high share. For instance, in February 2024, Scripps Research scientists developed an antibody with the potential to inhibit the effect of lethal toxins in the venoms of a diverse range of snakes found in Asia, Africa, and Australia.

The monovalent segment is expected to witness the fastest growth over the forecast period. This can be attributed to the increasing need for the development of species-specific anti-venom, posing a significantly higher threat. Moreover, monovalent anti-venoms can provide better protection against the specific effects of a species’ poison, which is expected to significantly increase its demand. For instance, according to a study published on ResearchGate in June 2023, monovalent was found to be four times more effective that a commercialized antivenom against Moroccan Cobra Naja haje poison.

Mode Of Action Insights

The neurotoxic segment held the largest revenue share of 32.08% in 2023 and is anticipated to witness the fastest growth over the forecast period. This can be attributed to the high threat posed by neurotoxic venom and the increasing efforts to counter the high prevalence of these poisons. Moreover, neurotoxic venom has the potential to kill the victim within 30 minutes, depending on the injected amount. According to an article published on the Wildlife SOS organization's website in June 2022, the Black Mamba, producing the neurotoxic variant of poison, has a fatality rate of 100%, which makes it one of the deadliest snakes globally. Such a high threat to this segment is expected to increase the demand for treatments to this effect, thereby driving the market growth.

The cytotoxic anti-venom segment is expected to witness lucrative growth over the forecast period. Cytotoxic poison significantly impacts bodily tissues through various mechanisms, such as blood vessel damage. The increasing R&D efforts to further understand the impact of cytotoxic poison on the human body. The recent developments in various fields such as cell biology and proteomics are anticipated to further boost these R&D efforts and drive the segment growth.

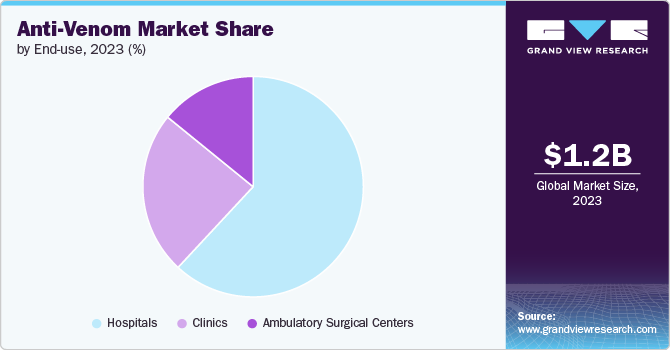

End-use Insights

Hospitals accounted for the largest revenue share of 62.58% in 2023. Snake bites, scorpion stings, and other conditions often require immediate medical attention. Hospitals are equipped to handle these emergencies, with qualified staff and facilities for rapid diagnosis, anti-venom administration, and supportive care. Moreover, hospitals offer expertise to determine the correct dosage based on the patient’s condition. The better accessibility of hospitals to patients seeking immediate treatment for these conditions further contributed to the high segment share of hospitals.

The clinics segment is expected to witness the fastest growth over the forecast period. This can be attributed to the shifting preference of patients to get specialized treatment for scorpion and snake bites. Moreover, the increasing efforts by dedicated clinics to counter venomous bites and stings to treat patients and study new approaches is further expected to fuel the segment growth. For instance, in June 2022, the UAB Comprehensive Snakebite Program was launched by UAB Comprehensive Wound Care Clinic to offer specialized treatment, keep follow ups, and study new approaches for snakebites.

Regional Insights

North America Anti-venom Market Trends

North America accounted for the largest revenue share of 37.67% share in 2023. This high share can be attributed to the increasing R&D efforts for the development of advanced treatments, supportive regulatory framework, and better accessibility to anti-venom treatments. For instance, according to the Centre for Disease Control and Prevention (CDC), around 7,000 to 8,000 people are bitten by venomous snakes each year, and approximately 5 of these people die. Maintaining such a low death rate compared to venomous snakes requires high accessibility to anti-venom treatments, which has contributed to the region’s market and is expected to drive growth in the future.

U.S. Anti-venom Market Trends

The market in the U.S. is expected to grow substantially over the forecast period. This can be attributed to the increasing focus on the development of advanced anti-venom treatments, rising efforts to enhance the accessibility of anti-venom treatments to a larger population base, the presence of key players in the country, and a supportive regulatory framework. The companies operating in the U.S. are significantly trying to develop anti-venom treatment for better results and improved outcomes in patients. For instance, in April 2021, Rare Disease Therapeutics, Inc. announced that it had received U.S. FDA approval for an expanded indication for ANAVIP, an equine-derived antivenin used for the management of pediatric and adult patients with North American Pit Viper envenomation.

Europe Anti-venom Market Trends

Europe market is expected to witness lucrative growth over the forecast period. This can be attributed to the increasing efforts by the government bodies to increase access to antivenom treatment, increasing funding for R&D on the development of venom bite treatments and growing incidents of snakebites in the region. The government bodies in the region are focusing on being preparedness to counter the patients with venom bites and ensure their access to the antivenom treatments. This has increased the demand for antivenoms in the region and is expected to drive the demand in the future.

Asia Pacific Anti-venom Market Trends

Asia Pacific market is anticipated to witness the fastest growth of 9.12% CAGR over the forecast period. This can be attributed to the high incidents of venom bites, increasing access to anti-venom treatment and rising initiatives to increase the access of anti-venom treatments. According to a study published by WHO in July 2020, approximately 1.2 million people in India died due to snakebites from 2000 to 2019. This accounts for an average of 58,000 snakebites per year. Such a high prevalence of snakebites and increasing venom bites in the region is expected to drive the market growth over the forecast period.

Key Anti-venom Company Insights

Some of the key players operating in the market include Pfizer Inc., Sigma Aldrich, Boehringer Ingelheim, CSL Limited, Bharat Serums and Vaccines Ltd., and others. These players undertake various strategies, such as new launches, partnerships, expansion, acquisitions, and collaborations, to increase their presence and gain a competitive edge over other market players.

Key Anti-venom Companies:

The following are the leading companies in the anti-venom market. These companies collectively hold the largest market share and dictate industry trends.

- Bharat Serums and Vaccines Limited (BSV)

- Boehringer Ingelheim International GmbH

- Boston Scientific Corporation

- CSL Limited

- Haffkine Bio-Pharmaceutical Corporation Limited

- Incepta Pharmaceuticals Limited

- Merck & Co., Inc.

- Pfizer, Inc.

- MicroPharm Limited

- Rare Disease Therapeutics Inc.

- South African Vaccine Producers (Pty) Ltd.

- Medtoxin Venom Laboratories

- Instittue of Immunology

- Alomone Labs, Ltd.

- Sigma Aldrich

Recent Developments

-

In March 2022, Ophirex, Inc. announced that the U.S. FDA granted Fast Track designation to varespladib-methyl (commonly known as "oral varespladib") for snakebite treatment. Ophirex is currently conducting clinical trials of oral varespladib, its leading investigational drug candidate, aimed at developing a broad-spectrum antidote for snakebites in both the United States and India.

-

In August 2022, Bharat Serums and Vaccines Ltd. announced partnership with Indian Institute of Science (IISc) for the development antivenom snakebite in India. This initiative intends to enhance the development of antivenom therapy, which can offer effective treatment and save lives of snakebite victims in the country.

Anti-venom Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.26 billion

Revenue forecast in 2030

USD 2.02 billion

Growth Rate

CAGR of 8.11% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Species, type, mode of action, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Bharat Serums and Vaccines Limited (BSV); Boehringer Ingelheim International GmbH; Boston Scientific Corporation; CSL Limited; Haffkine Bio-Pharmaceutical Corporation Limited; Incepta Pharmaceuticals Limited; Merck & Co., Inc.; Pfizer, Inc.; MicroPharm Limited; Rare Disease Therapeutics Inc.; South African Vaccine Producers (Pty) Ltd.; Medtoxin Venom Laboratories; Instittue of Immunology; Alomone Labs, Ltd.; Sigma Aldrich

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-venom Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-venom market report based on species, type, mode of action, end-use, and region:

-

Species Outlook (Revenue, USD Million, 2018 - 2030)

-

Snake

-

Common Cobra

-

Common Krait

-

Russell Viper

-

Others

-

Scorpion

-

Spider

-

Other Species

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyvalent

-

Monovalent

-

-

Mode Of Action Outlook (Revenue, USD Million, 2018 - 2030)

-

Cytotoxic

-

Neurotoxic

-

Haemotoxic

-

Cardiotoxic

-

Myotoxic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anti-venom market size was estimated at USD 1.18 billion in 2023 and is expected to reach USD 1.26 billion in 2024.

b. The global anti-venom market is expected to grow at a compound annual growth rate of 8.11% from 2024 to 2030, reaching USD 2.02 billion by 2030.

b. The snake segment accounted for the largest revenue share of 50.83% in 2023. This can be attributed to the high prevalence of snake bites, the requirement for specialized treatment for different snake species, and the high awareness among the general public about necessary treatment for snake bites.

b. Some key players operating in the anti-venom market include Bharat Serums and Vaccines Limited (BSV); Boehringer Ingelheim International GmbH; Boston Scientific Corporation; CSL Limited; Haffkine Bio-Pharmaceutical Corporation Limited; Incepta Pharmaceuticals Limited; Merck & Co., Inc.; Pfizer, Inc.; MicroPharm Limited; Rare Disease Therapeutics Inc.; South African Vaccine Producers (Pty) Ltd.; Medtoxin Venom Laboratories; Instittue of Immunology; Alomone Labs, Ltd.; Sigma Aldrich

b. The market growth is attributed to the rising prevalence of venom bites/stings, increasing awareness of anti-venom treatments, growing research initiatives to develop effective treatments, and growing government initiatives to spread.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.