- Home

- »

- Beauty & Personal Care

- »

-

Anti-pollution Hair Care Products Market Size Report, 2030GVR Report cover

![Anti-pollution Hair Care Products Market Size, Share & Trends Report]()

Anti-pollution Hair Care Products Market Size, Share & Trends Analysis Report By Product (Shampoo, Conditioners, Oils, Serums & Masks), By End-user (Men, Women), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-254-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The global anti-pollution hair care products market size was estimated at USD 4.24 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030. The growth is primarily driven by increasing awareness regarding the adverse effects of environmental pollution on hair health. Rising pollution levels, exposure to pollutants, and urban lifestyles contribute to various hair-related issues, such as damage, dullness, and loss of vitality. Consumers are seeking specialized hair care solutions formulated with anti-pollution ingredients that can help protect and rejuvenate hair from the harmful effects of pollutants, likely favoring the growth of the market.

The demand is further fueled by a growing emphasis on personal grooming, wellness, and the desire for effective preventive measures against environmental stressors, propelling the market forward. With growing awareness of the importance of hair health, consumers are more willing to invest in premium and luxury products that claim to offer advanced solutions for issues like anti-pollution properties, hair damage, aging, and scalp health. The Harris Williams Annual Health & Beauty Survey conducted in Fall 2022 highlighted that despite economic uncertainties, 93% of beauty consumers expect to increase or maintain their spending over the next year.

Advancements in beauty and skincare technology have enabled the development of innovative formulations in the anti-pollution hair care segment. Consumers are seeking innovative and effective solutions for their unique hair care needs. The evolution of consumer hair care routines from basic shampoos and conditioners to a more comprehensive approach is reflected in the growing trend of the "skinfication" of hair. Consumers are now prioritizing the health of their hair, similar to their skincare routines. This shift is driven by an increased understanding of the impact of environmental factors on the scalp, leading to a demand for innovative and effective solutions.

Changing lifestyle patterns, particularly in urban settings, contribute to the need for targeted hair care solutions including anti-pollution. Urbanization exposes individuals to higher pollution levels, making them more susceptible to the adverse effects on hair. The demand for anti-pollution hair care products is, therefore, a response to the changing environmental dynamics and the desire to counteract the impact of pollutants on hair quality.

Market Concentration & Characteristics

The anti-pollution hair care products market is characterized by a high degree of innovation as manufacturers respond to the growing consumer demand for advanced solutions to combat the environmental impact on hair. Continuous research and development (RD&) efforts have led to the formulation of innovative products that blend scientific advancements with natural ingredients, offering enhanced protective and rejuvenating properties. From novel formulations that create a barrier against pollutants to the incorporation of cutting-edge technologies, such as antioxidants and detoxifying agents, the market is witnessing a continuous influx of inventive products.

Regulations play a significant role in shaping the market, influencing both formulation and marketing practices. Stringent regulatory standards regarding ingredient safety, environmental sustainability, and product efficacy contribute to the development of high-quality and eco-friendly formulations. Additionally, labeling requirements and transparency regulations impact how manufacturers communicate the anti-pollution benefits of their products to consumers.

The end-user concentration in the market is diverse. This market caters to individuals residing in urban areas facing higher pollution levels, professionals seeking preventative hair care solutions, and consumers with a growing emphasis on personal grooming and overall well-being. The wide-ranging appeal of anti-pollution hair care products indicates a market with a dispersed and expanding customer base, driven by a shared concern for protecting hair from environmental damage.

Product Insights

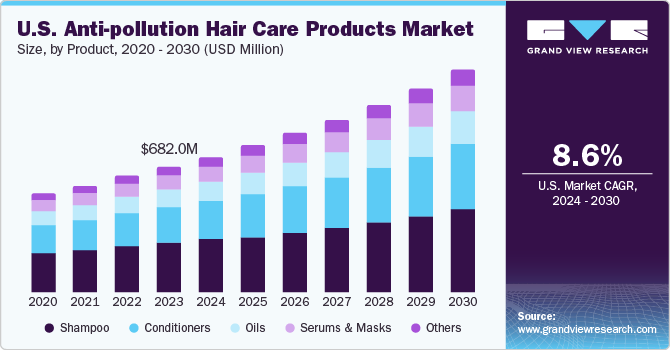

The anti-pollution shampoo segment accounted for a revenue share of 38.61% in 2023. Shampoos are an essential part of the personal care routine. The rising demand for shampoos is attributed to the increasing prevalence of hair-related problems. Environmental challenges such as rising pollution, which is harmful to hair and scalp health, are also bolstering segment growth. As a result, key manufacturers are innovating their product offerings to meet the consumer demand. For instance, BASF has Chom Chom Shampoo that contains Rambuvital, a seed extract from the Rambutan fruits. This ingredient offers anti-pollution efficiency to hair and scalp.

The demand for anti-pollution conditioners is expected to grow at a CAGR of 8.4% from 2024 to 2030. Conditioner enhances the shine and texture of hair. It is a moisturizing agent used after shampoo to replenish lost moisture and soften hair fiber. Consumers associate shiny and silky hair with a healthy scalp, which drives the demand for conditioners including anti-pollution hair conditioners. Moreover, busy lifestyles have increased demand for products that offer quick and easy hair and hygiene management. Natural or organic hair conditioners are also gaining attraction among consumers.

End-user Insights

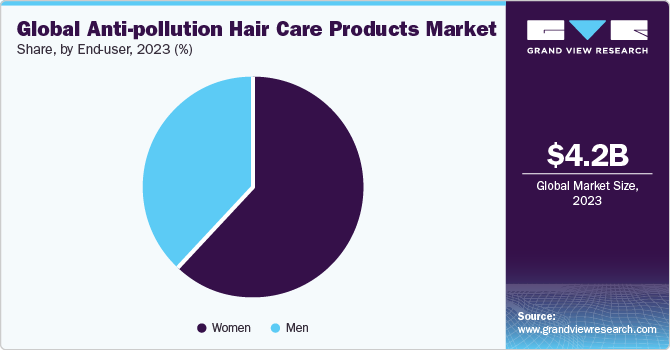

The demand among women accounted for a market share of over 62% in 2023. The increasing consciousness among women about appearance, especially hair health, is driving the demand for hair care products, particularly anti-pollution formulations. Women show significant emphasis on maintaining aesthetic appeal but overall well-being and recognize the harmful effects of environmental pollution on hair quality. This awareness fuels the demand for specialized products designed to respond to the impact of pollutants, reflecting a proactive approach to preserving and enhancing hair health, likely favoring the demand among the women population.

Anti-pollution hair care products demand among men is projected to grow at a CAGR of 7.9% from 2024 to 2030. This demand can be attributed to a growing awareness of the impact of environmental pollutants on hair quality. As men become more conscious of grooming and overall well-being, they seek specialized solutions to address specific challenges such as hair damage and dullness caused by pollution. The desire for a healthy and well-maintained appearance, coupled with changing societal norms that encourage men to prioritize self-care, has led to rising demand for anti-pollution hair care products.

Distribution Channel Insights

The supermarkets and hypermarkets segment accounted for a market share of around 48% in 2023. The sale of anti-pollution hair care products through supermarkets and hypermarkets is driven by the convenience and accessibility these retail channels offer to a broad consumer base. Supermarkets and hypermarkets serve as one-stop destinations for personal care needs, providing a diverse array of products under one roof. The wide availability of anti-pollution hair care products in these stores capitalizes on the impulse purchasing behavior of consumers, who can easily incorporate these specialized items into their regular shopping routines.

The product sale through online channels is expected to grow at a CAGR of 8.8% from 2024 to 2030. The sale of anti-pollution hair care products through online channels is driven by the convenience, accessibility, and extensive product information offered by e-commerce platforms. Online channels provide consumers with the flexibility to browse and purchase a diverse range of anti-pollution hair care products from the comfort of their homes, catering to a tech-savvy and time-conscious customer base.

Regional Insights

The anti-pollution hair care market in North America is expected to grow at a CAGR of 9.0% from 2024 to 2030. Rising consumer interest in high-end haircare products and expenditure on hair styling products are some of the key factors fueling product demand in the region.

U.S. Anti-pollution Hair Care Products Market Trends

In 2023, the anti-pollution hair care market in the U.S. accounted for 70% of the revenue share in North America. The U.S. is one of the vital markets for hair care in North America which has shown strong economic growth over the years and as a result, consumers in these countries have a higher spending power, which enables them to opt for high-end hair care and other beauty products. According to a 2021 report by the American Academy of Dermatology; 30 million women and 50 million men in the U.S. suffered from hereditary hair problems. Therefore, youngsters and millennials in the region are increasingly concerned about maintaining a proper hair care regime and investing in different hair care products including anti-pollution hair care products.

Asia Pacific Anti-pollution Hair Care Products Market Trends

The anti-pollution hair care products market in Asia Pacific accounted for a revenue share of around 38% in 2023. As the Asian economies thrive, a corresponding surge in disposable income has empowered consumers to allocate more resources to personal care, notably hair care products. This economic upswing has opened the doors for the entry of luxury international brands into the region. Brands like L'Occitane, a leading hair care brand in its home market, have successfully penetrated the Asian markets, particularly India, securing the top spot for its shampoo on Amazon. As the brand establishes its presence in these markets, it sets its sights on untapped opportunities in emerging economies like Indonesia, Vietnam, and Taiwan, likely favoring the demand in the region.

Key Anti-pollution Hair Care Products Company Insights

Key industry players face intense competition and have large customer bases for their services in both regional and international markets. Product launches, partnerships & collaborations, mergers & acquisitions, and geographical expansions are expected to remain the key strategies among the industry participants.

Key Anti-pollution Hair Care Products Companies:

The following are the leading companies in the anti-pollution hair care products market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oreal S.A.

- Beiersdorf AG

- Shiseido Company

- Unilever

- CLR Berlin

- Kao Corporation

- Procter & Gamble

- Coty, Inc.

- De Lorenzo

- Avon Products Inc.

Recent Developments

-

In September 2023, Beiersdorf AG launched a new production center in Leipzig with an investment of around USD 324 million. The new plant meets environmental and sustainability standards along with the incorporation of automation and extensive digitalization across all levels of production.

-

In October 2023, Procter & Gamble launched haircare microsite #HairDNA, to solve consumer queries via expert advice from the leading brands, on Southeast Asia’s e-commerce platform Lazada. #HairDNA on Lazada will act as a one-stop shop for consumers seeking to switch hair care routines and find new products on a single platform.

Anti-pollution Hair Care Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.52 billion

Revenue forecast in 2030

USD 6.75 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

L'Oreal S.A.; Beiersdorf AG; Shiseido Company; Unilever; Kao Corporation; CLR Berlin; Procter & Gamble; Coty, Inc.; De Lorenzo; Avon Products Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Anti-pollution Hair Care Products Market Report Segmentation

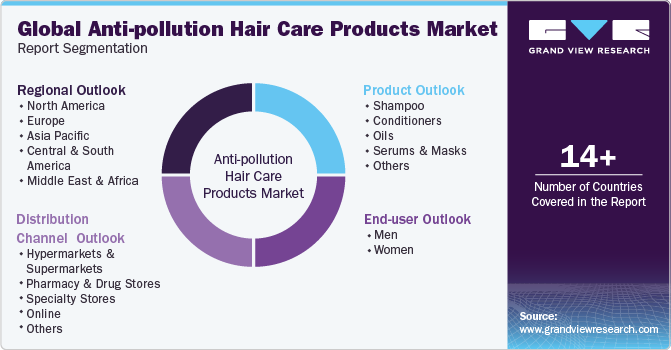

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-pollution hair care products market report based on product, end-user, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Shampoo

-

Conditioners

-

Oils

-

Serums & Masks

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-pollution hair care products market was estimated at USD 4.24 billion in 2023 and is expected to reach USD 4.52 billion in 2024.

b. The global anti-pollution hair care products market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 6.75 billion by 2030.

b. Asia Pacific dominated the anti-pollution hair care products market with a share of around 38% in 2023. Increasing instances of scalp-related problems such as hair fall and itchiness have led consumers in the European region to opt for anti-pollution hair care products.

b. Some of the key players operating in the anti-pollution hair care products market include L'Oreal S.A.; Beiersdorf AG; Shiseido Company; Unilever; Kao Corporation; CLR Berlin; Procter & Gamble; Coty, Inc.; De Lorenzo; and Avon Products Inc.

b. Key factors that are driving the anti-pollution hair care products market include growing awareness of the damaging effects of pollution on hair.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."