- Home

- »

- Communications Infrastructure

- »

-

Anti-jamming Market Size, Share And Growth Report, 2030GVR Report cover

![Anti-jamming Market Size, Share & Trends Report]()

Anti-jamming Market (2024 - 2030) Size, Share & Trends Analysis Report By Receiver, By Technique, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-407-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-jamming Market Summary

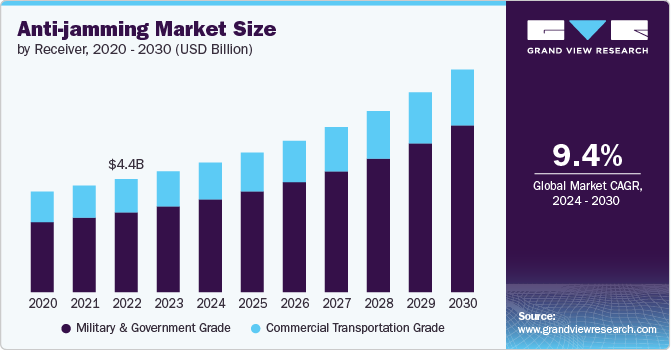

The global anti-jamming market size was estimated at USD 4.69 billion in 2023 and is projected to reach USD 8.64 billion by 2030, growing at a CAGR of 9.4% from 2024 to 2030. The rapid advancement in communication technology is significantly driving the anti-jamming market.

Key Market Trends & Insights

- The North America anti-jamming market dominated the global market and accounted for 35.85% in 2023.

- The U.S. anti-jamming market is anticipated to register significant growth from 2024 to 2030.

- Based on receiver, the military & government grade segment led the market and accounted for 71.1% of the global revenue in 2023.

- Based on technique, the nulling technique segment accounted for the largest market revenue share in 2023.

- By application, the position, navigation, and timing segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.69 Billion

- 2030 Projected Market Size: USD 8.64 Billion

- CAGR (2024-2030): 9.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Innovations in communication and navigation systems have led to an increased reliance on secure and reliable signal processing. As defense and commercial sectors adopt more sophisticated systems, the need for advanced anti-jamming solutions becomes paramount. Enhanced signal processing techniques and adaptive algorithms are continually being developed to combat evolving threats. This technological evolution is expanding the anti-jamming market's scope and application, thereby contributing to the growth of the market.The proliferation of electronic warfare is a critical factor fueling growth in the anti-jamming market. As geopolitical tensions escalate, there is a heightened focus on electronic warfare capabilities. This includes the development of advanced jamming and anti-jamming technologies to safeguard critical communication channels. The increased investment in military and defense sectors for electronic warfare readiness drives demand for effective anti-jamming solutions. Consequently, this trend is pushing the market towards more innovative and robust anti-jamming technologies.

The growing importance of secure communication and navigation in civilian sectors is another key driver for the anti-jamming market. As industries such as aviation, transportation, and logistics rely more heavily on GPS and communication systems, the need for protection against signal interference intensifies. This is particularly evident in autonomous vehicles and smart infrastructure, where reliable signal integrity is crucial. The expansion of these sectors underscores the increasing demand for anti-jamming solutions to ensure operational efficiency and safety. Thus, the civilian sector's growth contributes significantly to market expansion.

Increasing regulatory and policy measures aimed at enhancing signal security are shaping the anti-jamming market. Governments and regulatory bodies are implementing stricter standards and guidelines to protect critical infrastructure from signal interference and jamming. These regulations are prompting organizations to invest in advanced anti-jamming technologies to comply with new requirements. The enforcement of such policies is driving the development and adoption of state-of-the-art anti-jamming solutions across various sectors. This trend reflects a proactive approach towards ensuring robust signal protection.

The rise in technological convergence is fostering innovation in anti-jamming solutions. The integration of artificial intelligence, machine learning, and other advanced technologies is enhancing the capability of anti-jamming systems. By leveraging these technologies, anti-jamming solutions can better predict, detect, and counteract potential jamming threats in real time. This convergence is enabling more sophisticated and adaptive anti-jamming solutions, thereby expanding their application across diverse fields. As technological advancements continue, they are expected to further drive the growth and evolution of the anti-jamming market.

Receiver Insights

Based on receiver, the military & government grade segment led the market and accounted for 71.1% of the global revenue in 2023. The military & government grade segment of the anti-jamming market plays a pivotal role in ensuring the security and reliability of critical defense communications and navigation systems. This segment encompasses advanced anti-jamming technologies designed to protect sensitive military operations from electronic interference and disruption. With ongoing developments in electronic warfare and the increasing complexity of defense systems, the demand for high-performance, robust anti-jamming solutions is growing. As global defense spending continues to rise, the military & government grade segment is poised for sustained growth and innovation.

The commercial transportation trade segment is expected to register significant growth from 2024 to 2030. This segment focuses on anti-jamming solutions tailored for applications such as aviation, maritime, and ground transportation, where uninterrupted signal integrity is crucial. With the expansion of autonomous vehicles and smart infrastructure, the demand for effective anti-jamming technologies in commercial settings is increasing. These solutions are designed to provide protection against signal interference while maintaining high performance and cost efficiency. Since the commercial transportation industry evolves, the commercial transportation grade segment is expected to see significant advancements and adoption.

Technique Insights

The nulling technique segment accounted for the largest market revenue share in 2023. This technique focuses on advanced solutions designed to cancel out unwanted signals and interference. This method creates a "null" in the signal reception area, effectively reducing the impact of jamming sources. It is widely utilized in both military and civilian applications where high levels of signal security and integrity are required. The continuous enhancement of nulling technologies ensures improved performance in complex and dynamic environments. Threats and interference become more sophisticated, the nulling technique remains a key component in maintaining reliable communication and navigation systems.

The beam steering technique segment is expected to grow significantly from 2024 to 2030. The growth of the segment can be attributed to the real-time adaptation to changing interference patterns, enhancing signal clarity and reliability. It is particularly valuable in environments where jamming sources are mobile or constantly shifting, such as in modern military operations and advanced commercial applications. The ability to steer the antenna beam to focus on the desired signal while avoiding interference contributes to its growing adoption. As the technology advances, the beam steering technique is expected to become increasingly integral to maintaining effective communication systems across various sectors.

Application Insights

The position, navigation, and timing segment accounted for the largest market revenue share in 2023. Anti-jamming solutions are crucial for the position, navigation, and timing segment due to the increasing dependence on accurate and reliable positioning systems in both civilian and military applications. Position, navigation, and timing systems, such as GPS and other navigation aids, provide essential data for everything from autonomous vehicles to precision agriculture and military operations. Interference or disruption in these systems can lead to significant safety risks, operational inefficiencies, and strategic vulnerabilities. Effective anti-jamming technologies ensure that position, navigation, and timing systems maintain their accuracy and reliability, even in challenging environments or under electronic threats.

The flight control segment is expected to grow significantly from 2024 to 2030. Anti-jamming solutions are vital for flight control because they ensure the reliability and safety of aircraft operations. Flight control systems depend heavily on secure and accurate communication and navigation data to guide and manage aircraft movements. Any interference or disruption can jeopardize flight safety, potentially leading to severe consequences. Efficient anti-jamming technologies help maintain the integrity of these critical systems by preventing signal disruptions from impacting flight control functions. Furthermore, as aviation technology advances and the complexity of flight systems increases, the importance of robust anti jamming solutions becomes even more crucial for ensuring safe and efficient flight operations.

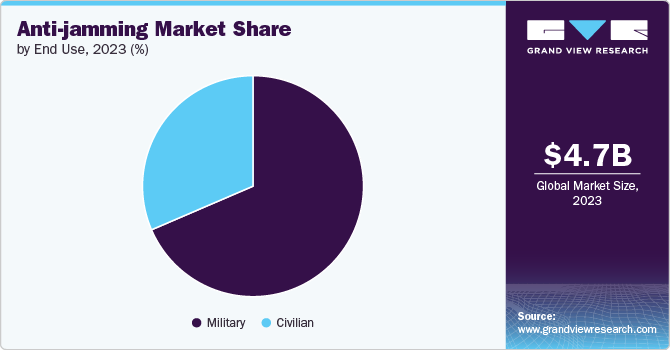

End-use Insights

The military segment accounted for the largest market revenue share in 2023. The growth of the segment can be attributed to the rising need for anti-jammers for safeguarding defense operations and maintaining the effectiveness of communication and navigation systems. In military applications, secure and reliable signal transmission is crucial for coordinating activities, executing missions, and ensuring national security. Advanced anti-jamming technologies are employed to protect military assets from interference and disruption, which could compromise operational success and safety. The increasing complexity of electronic warfare and the evolving threat landscape drive the demand for cutting-edge anti-jamming solutions in this sector.

The civilian segment is expected to grow significantly from 2024 to 2030. In the civilian sector, anti-jamming solutions play a critical role in protecting essential infrastructure and communication systems from signal interference. Applications such as aviation, transportation, and emergency services rely on accurate and reliable positioning and communication data to operate effectively. Anti-jamming technologies help ensure that these systems remain operational even in the presence of potential disruptions, thereby enhancing safety and operational efficiency. With the expansion of smart technologies and the increasing reliance on connected systems, the demand for anti-jamming solutions in the civilian market is on the rise.

Regional Insights

North America anti-jamming marketdominated the global market and accounted for 35.85% in 2023. The focus on enhancing military capabilities and ensuring national security drives the demand for advanced anti-jamming technology. The region’s substantial defense budget, ongoing modernization efforts, and adoption of innovative technologies to counter electronic warfare threats are major factors contributing to the growth of the market. Significant R&D investments and the presence of key market players also support industry growth. In addition, the growing reliance on GPS-dependent applications in various commercial sectors, including telecommunications and autonomous vehicles, further boosts the demand for dependable anti-jamming solutions.

U.S. Anti-jamming Market Trends

The U.S. anti-jamming marketis anticipated to register significant growth from 2024 to 2030. The U.S. is emerging as a lucrative and dynamic market, supported by government initiatives for technological innovation and collaboration between local and international defense companies, which are driving the development and deployment of advanced anti-jamming technologies.

Asia Pacific Anti-jamming Market Trends

The Asia Pacific anti-jamming marketis anticipated to register significant growth from 2024 to 2030. Amid rising geopolitical tensions, countries such as China, India, and Japan are heavily investing in advanced military technologies such as anti-jamming systems to enhance their defense capabilities. The market is also expanding due to the increasing use of GPS-dependent technologies in civilian sectors such as telecommunications, maritime navigation, and autonomous vehicles. In addition, the growing aviation industry in the region necessitates robust anti-jamming solutions to ensure the reliability and security of navigation and communication systems.

Europe Anti-jamming Market Trends

The European anti-jamming marketis poised for significant growth from 2024 to 2030. European countries are increasingly investing in advanced anti-jamming technologies to protect their military communication and navigation systems against evolving electronic warfare threats. In addition, the rise of autonomous vehicles, maritime navigation, and the need for secure telecommunications are fueling demand for reliable anti-jamming solutions. Collaborative efforts between European defense contractors and international technology firms are fostering innovation and the development of cutting-edge anti-jamming systems.

Key Anti-jamming Company Insights

Key players operating in the anti-jamming market include BAE Systems., Raytheon Systems Limited, Hexagon AB, ST Engineering, Thales, TUALCOM, Collins Aerospace, Lockheed Martin Corporation, Israel Aerospace Industries Ltd., and Meteksan Defence Industry Inc. These companies invest heavily in research and development to enhance their anti-jamming solutions, ensuring they meet the evolving demands of modern warfare and secure communications. In addition, collaborations and strategic partnerships between these leading firms and smaller, specialized technology companies are common, fostering the development of state-of-the-art anti-jamming systems.

Companies across the globe are securing investment to enhance their GPS signal capabilities. For instance, in November 2023, BAE Systems secured investment for the subsequent phase of the Eurofighter Typhoon aircraft's anti-jamming system. The Digital GPS Anti-jam Receiver (DIGAR) Phase 4 Enhancement was designed to enhance the aircraft’s survivability against radio frequency interference and GPS signal spoofing and jamming, The funding also included BAE’s new GEMVII-6 airborne digital GPS receiver, which enabled the aircraft to use digital beamforming for anti-jamming.

Key Anti-jamming Companies:

The following are the leading companies in the anti-jamming market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems.

- Raytheon Systems Limited

- Hexagon AB

- ST Engineering

- Thales

- TUALCOM

- Collins Aerospace

- Lockheed Martin Corporation

- Israel Aerospace Industries Ltd.

- Meteksan Defence Industry Inc.

Anti-jamming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.03 billion

Revenue forecast in 2030

USD 8.64 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Receiver, technique, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

BAE Systems.; Raytheon Systems Limited; Hexagon AB; ST Engineering; Thales; TUALCOM; Collins Aerospace; Lockheed Martin Corporation; Israel Aerospace Industries Ltd.; Meteksan Defence Industry Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-jamming Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global anti-jamming market report based on receiver, technique, application, end-use, and region.

-

Receiver Outlook (Revenue, USD Million, 2018 - 2030)

-

Military & Government Grade

-

Commercial Transportation Grade

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Nulling Technique

-

Beam Steering Technique

-

Civilian Technique

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Flight Control

-

Surveillance and Reconnaissance

-

Position, Navigation, and Timing

-

Targeting

-

Casualty Evacuation

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Military

-

Airborne

-

Ground

-

Naval

-

Unmanned Vehicles

-

- Civilian

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-jamming market size was estimated at USD 4.69 billion in 2023 and is expected to reach USD 5.03 billion in 2024.

b. The global anti-jamming market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 8.64 billion by 2030.

b. North America dominated the anti-jamming market with a share of 35.85% in 2023. The region’s substantial defense budget, ongoing modernization efforts, and adoption of innovative technologies to counter electronic warfare threats are major factors contributing to the growth of the market.

b. Some key players operating in the anti-jamming market include BAE Systems., Raytheon Systems Limited, Hexagon AB, ST Engineering, Thales, TUALCOM, Collins Aerospace, Lockheed Martin Corporation, Israel Aerospace Industries Ltd., and Meteksan Defence Industry Inc.

b. Key factors that are driving the market growth include the rapid advancement in communication technology increased innovations in communication and navigation systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.