- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Anti-Graffiti Coatings Market Size And Share Report, 2030GVR Report cover

![Anti-Graffiti Coatings Market Size, Share & Trends Report]()

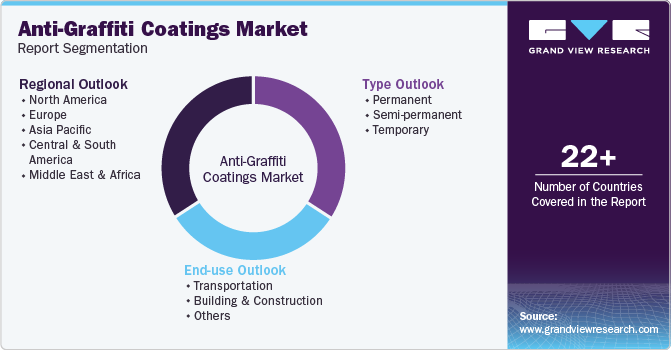

Anti-Graffiti Coatings Market Size, Share & Trends Analysis Report By Type (Permanent, Semi-permanent, Temporary), By End Use (Transportation, Building & Construction), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-341-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Anti-Graffiti Coatings Market Size & Trends

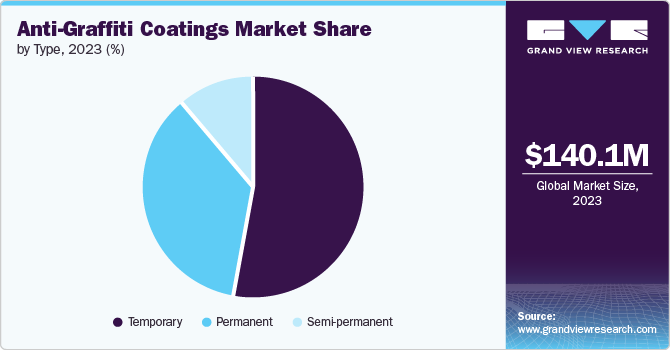

The global anti-graffiti coatings market size was estimated at USD 140.1 million in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. Technological advancements, government regulations, and increasing demand for sustainable and cost-effective solutions drive market growth. Technological innovations in nanotechnology and advanced coating technologies have propelled the market's expansion. Manufacturers are investing in nanomaterials, such as nano-silver, photo-catalytically active nano-titanium dioxide, and nano-silica dioxide, to enhance the quality and performance of protective films. These advancements have led to the development of ultra-thin, non-toxic, and environmentally friendly films, driving the market's growth.

Market growth is also driven by the steps taken to curb the economic impact of vandalism and government regulations. Initiatives, such as the Anti-Graffiti Task Force in New York City, and the implementation of laws regulating the sale of aerosol spray-paint cans to minors have demonstrated a proactive approach to combating vandalism. The market's growth is further supported by the construction industry's increasing concern for protection, driving the demand for protective coatings and films.

The global anti-graffiti coatings market is driven by several key factors, including the growing demand for sustainable and environmentally friendly films. With increasing awareness of environmental impact, there is a rising preference for non-toxic and eco-friendly coatings. This demand has led to significant investments in developing films that meet stringent environmental regulations and offer sustainable solutions. Companies focus on creating films with hazardless chemicals, aligning with the global shift towards environmentally responsible products. These sustainable films provide effective protection against graffiti and contribute to environmental conservation, driving their adoption across various industries.

The annual expenditure on graffiti cleanup, which amounts to billions of dollars, has prompted property owners and municipalities to seek preventive measures. Protection films offer a cost-effective and dependable solution to mitigate the impact of infrastructure defacing. By preventing paint adherence to surfaces, these films reduce the need for frequent and labor-intensive graffiti removal, resulting in substantial cost savings. This economic incentive has significantly contributed to the market's growth as property owners and public entities increasingly recognize the value of investing in proactive measures.

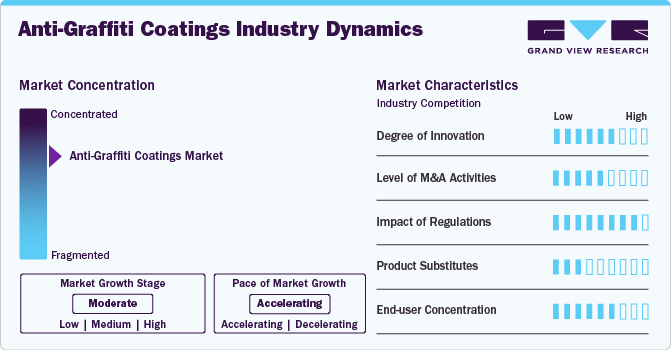

Market Concentration & Characteristics

The global anti-graffiti coatings market exhibits characteristics of being fairly consolidated, with a few large and medium-sized companies accounting for most of the market revenue. Major players in the market are deploying various strategies, such as mergers & acquisitions, strategic agreements & contracts, and developing more effective protection film products. For instance, companies like The Sherwin-Williams Company, 3M, and Akzo Nobel N.V. are prominent players, commanding a substantial share of the overall market revenue.

Government regulations play a crucial role in shaping the global anti-graffiti coatings market. The application of low-VOC protective surfaces reduces allergy-causing toxins and has a low impact on air quality. Government regulations in favor of protective films, in general, are also a factor driving market revenue growth.

Product substitutes also impact the global market. Sacrificial layers create a clear film barrier upon the surface and are a popular choice. These films can be easily removed, absorbing the paint and leaving the below area graffiti-free. The materials used for these types of films are usually inexpensive and composed of waxes or polymers that form weak links with the surface, allowing them to be easily removed.

End-Use Insights

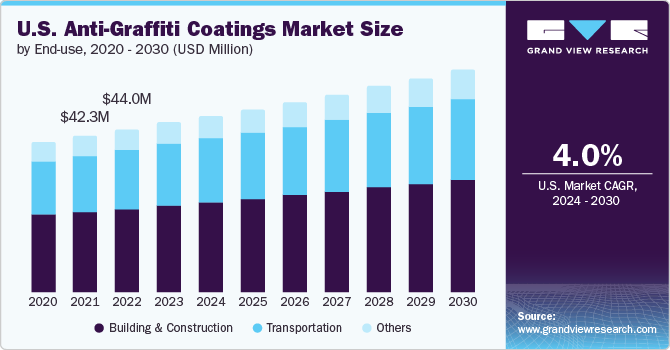

The building & construction segment dominated the market with a revenue share of 51.3% in 2023. Anti-graffiti coatings are widely used in commercial and residential construction to safeguard substrates, such as building facades, windows, and infrastructure from damage. These films are essential for maintaining the aesthetic appeal and structural integrity of buildings, reducing the need for frequent repainting and refurbishment. The construction industry's reliance on protective films underscores their importance in preserving the visual appeal and value of architectural structures, making them a crucial component in the construction sector.

The transportation industry is another significant end-user segment for anti-graffiti coatings, particularly in the context of public transport systems. Graffiti vandalism poses a significant challenge for painted metal surfaces in the transportation sector, leading to high cleaning costs and downtime of trains. As a result, the transportation industry has a substantial demand for protective films to minimize cleaning costs. These films are crucial for protecting transportation vehicle bodyworks and public areas from damage, presenting considerable cost savings for urban administration and transportation companies.

Type Insights

The temporary type segment dominated the market with a revenue share of 53.1% in 2023. They create a clear film barrier upon the surface, allowing the coating to be easily removed along with the graffiti, leaving the underlying area clean. These coatings are preferred for murals, artistic surfaces, and surfaces that require frequent cleaning. While temporary coatings are effective in preventing graffiti from bonding to the substrate, they require reapplication after each removal. The use of temporary films is a cost-effective approach for surfaces with low to moderate exposure to contacts, providing an easily renewable protective layer.

Semi-permanent coatings are high-build films that can shed layers of themselves upon each cleaning. These films must be removed after a certain period and can be reapplied once the coating has been completely worn away. Semi-permanent films are ideal for surfaces like natural stone walls and historic buildings as they can be easily cleaned using hot water or high pressure without damaging the material underneath. Semi-permanent coatings balance durability and ease of maintenance, making them suitable for a wide range of applications, including historic structures and surfaces with moderate exposure to damage.

Permanent coatings create a protective surface that prevents spray paint from bonding to the substrate. After the surface is vandalized, simple solvents or manufacturer-supplied cleaners are used to remove the graffiti, leaving the underlying surface and the protective coating undamaged. Permanent films are often more expensive than temporary films but last for an extended period with minimal maintenance, making them suitable for high-traffic areas and surfaces prone to frequent damage.

Regional Insights

The North America anti-graffiti coatings market dominated the global industry with a revenue share of 42.5% share in 2023. The regional market demand is driven by the increasing emphasis on urban infrastructure maintenance and the need to combat graffiti vandalism. The rising adoption of permanent anti-graffiti coatings in North America, particularly in the United States and Canada, reflects the region's commitment to long-term solutions for protecting surfaces.

The anti-graffiti coatings market in Canada is driven by the high product demand due to the need to protect public infrastructure and architectural surfaces from vandalism. The country's emphasis on maintaining urban infrastructure and preserving cultural heritage has led to the adoption of advanced measures around the country, especially in major urban centers, such as Vancouver and Toronto.

Germany Anti-Graffiti Coatings Market Trends

The Germany anti-graffiti coatings market is influenced by the country's focus on heritage preservation and infrastructure maintenance. The country's advancements in nanotechnology and bio-based technology have contributed to the development of innovative solutions, driving the technological advancements and market's growth.

China Anti-Graffiti Coatings Market Trends

The anti-graffiti coatings market in China will have a significant growth in the future. The rapid urbanization and infrastructure development have fueled the demand for anti-graffiti coatings. The country's flourishing automotive industry and the increasing need to protect public transport systems from damage have led to the widespread adoption of temporary films.

Brazil Anti-Graffiti Coatings Market Trends

The Brazil anti-graffiti coatings market is estimated to witness rapid growth over the forecast period. The use of temporary coatings on public murals and artistic surfaces highlights Brazil government’s efforts for preserving cultural assets while addressing the challenges posed by graffiti vandalism. In addition, the country's focus on using sustainable and environmentally friendly coatings has contributed to the development of advanced solutions, driving the market's growth and technological innovations.

Saudi Arabia Anti-Graffiti Coatings Market Trends

The anti-graffiti coatings market in Saudi Arabia is propelled by the demand for protection films due to the country's focus on urban infrastructure maintenance. The country's investments in advanced coatings technologies have contributed to the development of advanced solutions & innovations, driving the market's growth and technological advancements.

Key Anti-Graffiti Coatings Company Insights

The competitive landscape of the anti-graffiti coatings market is characterized by the strategic initiatives undertaken by leading players to gain a competitive edge and influence supply chains. Major companies, such as The Sherwin-Williams Company, 3M, and Akzonobel N.V., are actively engaged in deploying these strategies to drive advancements in the anti-graffiti coatings market, contributing to the overall growth and development of the industry.

Some of the key players operating in the market include:

-

The Sherwin-Williams Company offers anti-graffiti coatings in the form of its 2K water-based product, which is a hydrophobic, two-component polyurethane providing damage resistance, gloss & color retention

-

3M offers films that provide protection against UV rays as well as all forms of graffiti, gouges, and scratches. The coating is easy to remove and replace and offers reduced glare from sunlight.

A&A Thermal Spray Coatings, FSC Coatings Inc., and Edge Film Technologies are some of the emerging market participants in the anti-graffiti coatings market.

-

A&A Thermal Spray Coatings offers metal, cermet, ceramic and hardfaced films. The Cerami-Pak films are used for packaging purposes, Microcoat coatings are used for the semi-conductor sector, and A706 for the printing industry

-

FSC Coatings Inc. offers various products in the anti-graffiti coatings segment, including SP 50 SIL Poly, TWP W-100 “UV,” and TWP 300 Series

Key Anti-Graffiti Coatings Companies:

The following are the leading companies in the anti-graffiti coatings market. These companies collectively hold the largest market share and dictate industry trends.

- The Sherwin-Williams Company

- 3M

- BASF SE

- AkzoNobel N.V.

- Axalta Coating Systems, LLC

- Edge Film Technologies

- ChemMasters, Inc.

- SIKA CORPORATION

- A&A Thermal Spray Coatings

- FSC Coatings Inc.

Recent Developments

-

In February 2024, AkzoNobel N.V. completed the expansion of its powder coatings manufacturing facility based in Como, Italy for a cost of USD 22.7 million. The four new manufacturing lines would be used to produce architectural coatings and automotive primers, increasing the company’s capacity to serve customers across Eastern Europe.

-

In June 2022, Sika Corporation announced the launch of a new anti-graffiti product named Sikagard-850 Clear Solution. The product offers a sustainable solution for removing graffiti without affecting surface protection

-

In April 2022, PPG Industries, Inc. announced the launch of its new anti-graffiti coating PPG ENVIROCRON P8 series at the Paint Expo 2022 in Germany. The product is a hybrid powder coating designed to erase surface damage and graffiti. It is intended for use in medical environments, buildings, and automotive surfaces

Anti-Graffiti Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 144.6 million

Revenue forecast in 2030

USD 180.9 million

Growth rate

CAGR of 3.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

The Sherwin-Williams Company; 3M; BASF SE; AkzoNobel N.V.; Axalta Coating Systems, LLC; Edge Film Technologies; ChemMasters, Inc.; SIKA CORP.; A&A Thermal Spray Coatings; FSC Coatings Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-Graffiti Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-graffiti coatings market report based on type, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Permanent

-

Semi-permanent

-

Temporary

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Building & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-graffiti coatings market was valued at USD 140.1 million in 2023 and is expected to reach USD 144.6 million in 2024.

b. The global anti-graffiti coatings market is expected to witness moderate CAGR of 3.8% from 2024 to reach USD 180.9 million by 2030.

b. North America dominated the market with a revenue share of 42.5% share in 2023. The region's demand is driven by the increasing emphasis on urban infrastructure maintenance and the need to combat graffiti vandalism. The rising adoption of permanent anti-graffiti coatings in North America, particularly in the United States and Canada, reflects the region's commitment to long-term solutions for protecting surfaces.

b. The competitive landscape of the anti-graffiti coatings market is characterized by the strategic initiatives undertaken by leading players to gain a competitive edge and influence supply chains. Major companies such as The Sherwin-Williams Company, 3M and Akzonobel N.V. are actively engaged in deploying these strategies to drive advancements in the anti-graffiti coatings market, contributing to the overall growth and development of the industry.

b. The anti-graffiti coatings market is being primarily driven by technological advancements, government regulations, and the increasing demand for sustainable and cost-effective solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."