- Home

- »

- Food Additives & Nutricosmetics

- »

-

Anti-Foaming Agents Market Size And Share Report, 2030GVR Report cover

![Anti-Foaming Agents Market Size, Share & Trends Report]()

Anti-Foaming Agents Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Water Based, Oil Based), By Application (Pulp & Paper, Oil & Gas, Paints & Coatings Water Treatment) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-365-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-Foaming Agents Market Summary

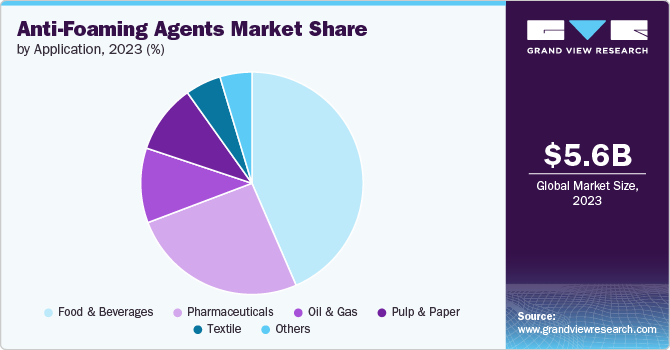

The global anti-foaming agents market size was estimated at USD 5.64 billion in 2023 and is projected to reach USD 7.67 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. This is due to rising consumption of the product in industries such as food and beverages, pharmaceuticals, and textiles, rely on anti-foaming agents to maintain smooth operations and ensure the quality of their products by reducing the foam formation during the manufacturing process.

Key Market Trends & Insights

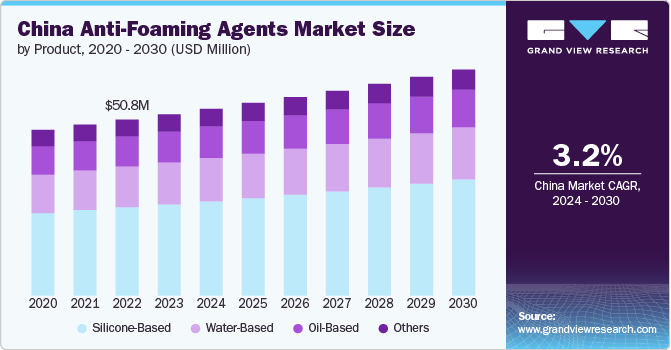

- The Asia Pacific dominated the market with a revenue share of 43.9% in 2023.

- By product, silicon based products dominated the market with a revenue share of 49.4% in 2023.

- By application, food & beverage dominated the market with a revenue share of 43.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.64 Billion

- 2030 Projected Market Size: USD 7.67 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

Anti-foaming agents are chemical additives designed to minimize and control foam formation in the processing of liquids and beverages. They are particularly important in breweries, where they are utilized during fermentation to enhance efficiency, and are also employed by companies involved in juice production. Consequently, the growth of the brewery and beverage sectors is significantly influencing both the market value and volume of anti-foaming agents during the forecast period.

Antifoaming agents are widely used in the paper and pulp industry to minimize foam production during the manufacturing process. The rising demand for paper and pulp, particularly for packaging applications, is expected to boost the growth of the antifoaming market in the coming years. The increasing use of paper-based materials in flexible packaging is a significant driver of this market.

Environmental concerns also play a significant role, some defoamers, particularly those based on silicones or petroleum-derived oils, can pose challenges in terms of biodegradability and ecological impact.

Product Insights

Silicon based products dominated the market with a revenue share of 49.4% in 2023. It is preferred over other types of the product owing to the silicone-based defoamers, being highly effective at low concentrations, offering broad application across various pH levels and temperatures with excellent thermal stability and chemical inertness.They are particularly useful in textiles, pharmaceuticals, and food processing, though they tend to be more expensive and may pose environmental concerns

Oil-based products, which use organic oils such as mineral or vegetable oils, are generally more cost-effective and suitable for specific applications like pulp and paper or wastewater treatment. However, they often require higher concentrations to manage foam effectively and may have limited performance under extreme conditions due to lower thermal stability and chemical sensitivity.

Application Insights

Food & beverage dominated the market with a revenue share of 43.5% in 2023. The product is used in food and beverages during various processing stages, which can affect product quality and production efficiency. In the production of beverages such as beer, soft drinks, and fruit juices, anti-foaming agents prevent excessive foam formation during mixing, fermentation, and bottling, ensuring smooth and consistent product flow and preventing spillage.

The product is vital in the pharmaceutical industry to enhance production efficiency and ensure product quality of pharmaceutical formulations.During the production of tablets and capsules, the product is used to prevent foam formation in mixing and granulation processes. Moreover, in liquid oral medications such as suspensions and syrups, antifoaming agents help control foam during mixing and filling, ensuring uniformity and stability of the final product.

Regional Insight

North America anti-foaming agents market is witnessing significant growth.The product is highly consumed by the textile industry in North America owing to its application for managing foam during various textile processing stages. Their application helps improve the efficiency of textile production and ensures high-quality finished products.

The textile and apparel industry in North America is growing rapidly as the exports to the Western Hemisphere rose 14.9 percent to reach USD 18 billion in 2022, compared with five years ago in 2017. Thus, the growing textile industry is further expected to increase the demand for the product in the region in the upcoming years.

Asia Pacific Anti-Foaming Agents Market Trends

The anti-foaming agents market of Asia Pacific dominated the market segment with a revenue share of 43.9% in 2023. Asia Pacific is a key region in terms of pharmaceutical production owing to the prominent pharmaceutical market including China and India.

As per India Brand Equity Foundation (IBEF) the Indian pharmaceutical industry is currently ranked third in pharmaceutical production by volume after evolving over time into a thriving industry growing at a CAGR of 9.43% since the past nine years. The rapidly growing pharmaceutical industry is further expected to increase product consumption in the region.

Europe Anti-Foaming Agents Market Trends

Europe anti-foaming agents market is a significant segment within the broader chemical industry, catering to various applications including industrial processes, textile manufacturing, water treatment, and more. Antifoaming is used in the food and beverage industry to control and eliminate unwanted foam that can occur during processing and production.

Germany is Europe's largest food producer, and the food & beverage industry represents the fourth largest industry sector in Germany. Moreover, the country is home to major national and international players including the Dr. Oetker Group, Südzucker, Arla, Mondelēz Deutschland, Nestlé, Cargill, and many more.

Key Anti-Foaming Agents Company Insights

Some of the key players operating in the market include Evonik Industries AG, Dow, BASF SE, Clariant, Huntsman Corporation, Wacker Chemie AG, Solvay, Arkema, Lubrizol Corporation and Ashland among others.

-

BASF SE, a Germany-based chemicals manufacturing company, hold a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments namely: chemicals, surface technologies, materials, nutrition & care, industrial solutions, agricultural solutions.BASF SE manufactures a variety of products, including those derived from mineral and natural oils, specialty emulsions, organosilicon-based solutions, as well as silicone-free and star-polymer defoamers.

-

Huntsman International LLC is a multinational chemical manufacturing company that produces a variety of chemical products such as polyurethanes, performance products, and advanced materials. The company operates in more than 100 countries with production facilities in 69 countries.

Key Anti-Foaming Agents Companies:

The following are the leading companies in the anti-foaming agents market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Dow

- BASF SE

- Clariant

- Huntsman Corporation

- Wacker Chemie AG

- Solvay

- Arkema

- Lubrizol Corporation

- Ashland

Recent Developments

-

In Feb 2024, DIC unveils PFAS-Free antifoaming agent for lubricating oils in electric vehicles, offering exceptional performance

-

In February 2021, BYK introduced two new defoamer additives, BYK-329 and BYK-092, designed to enhance both solvent-borne and solvent-free formulations.

Anti-Foaming Agents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.88 billion

Revenue forecast in 2030

USD 7.67 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Evonik Industries AG; Dow; BASF SE; Clariant; Huntsman Corporation; Wacker Chemie AG; Solvay; Arkema; Lubrizol Corporation; Ashland

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-Foaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-foaming agents market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Water-Based

-

Oil-Based

-

Silicone-Based

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Oil & Gas

-

Textile

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-foaming agents market size was estimated at USD 5.64 billion in 2023 and is expected to reach USD 5.88 billion in 2024.

b. The global anti-foaming agents market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 7.67 billion by 2030.

b. Asia Pacific dominated the anti-foaming agents market, with a share of 43.9% in 2023 owing to its prominent pharmaceutical markets, including China and India.

b. Some key players operating in the anti-foaming agents market include Evonik Industries AG, Dow, BASF SE, Clariant, Huntsman Corporation, Wacker Chemie AG, Solvay, Arkema, Lubrizol Corporation, Ashland

b. Key factors that are driving the market growth include rising consumption of the product in industries such as food and beverages, pharmaceuticals, and textiles, relying on anti-foaming agents to maintain smooth operations and ensure the quality of their products by reducing the foam formation during the manufacturing process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.