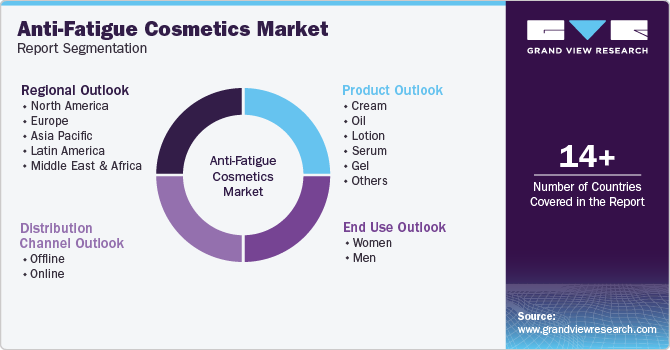

Anti-Fatigue Cosmetics Market Size, Share & Trends Analysis Report By Product (Cream, Oil, Lotion, Serum, Gel, Others), By End Use (Women, Men), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-867-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Anti-Fatigue Cosmetics Market Trends

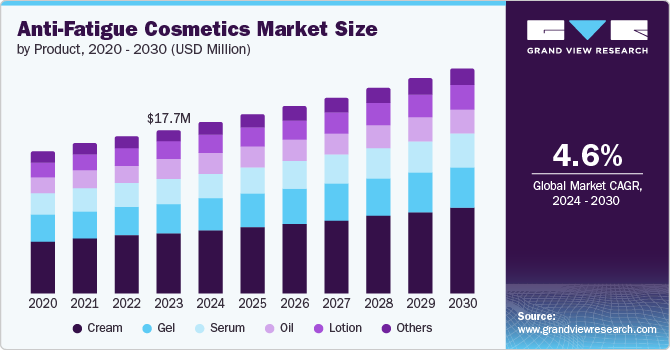

The global anti-fatigue cosmetics market size was valued at USD 17.7 million in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. The high stress level, changed lifestyles, poor nutrition, and urbanization coupled with excessive pollution are some factors generating greater demand for the product. Rising awareness about personal hygiene, easy availability of premium quality products, and growing disposable income levels, especially in millennials, are expected to fuel growth for this market.

Recently, consumers have preferred natural and organic cosmetic products, considered safer and beneficial for the skin. Rising environmental awareness among consumers also leads to a growing inclination towards using organic beauty products. Unceasing urbanization, constantly growing road traffic, increasing carbon emissions, and atmospheric changes have created numerous skin ailments, such as disruption of the skin microbiome, premature aging, acne, and more. This is developing a need for holistic skincare solutions such as anti-fatigue products.

A wide range of anti-fatigue products introduced by major companies in this market helps users deal with skin dullness, signs of sleep deprivation, puffy eye bags, dark circles, and fine lines while offering revitalized skin. Some common ingredients used in the formulation of these products include glycerin, caffeine, water, and anti-oxidants to assist in regaining the enhanced complexion.

Product Insights & Trends

The cream segment dominated the market and accounted for a revenue share of 37.3% in 2023. Growing awareness about the use of cosmetics and body care products contributes to the expansion of this segment. Continuous innovation and the addition of a new range of products in this segment offer a variety of choices to consumers. Moreover, consumers are willing to buy luxurious beauty products, particularly makeup collections and daily aesthetics, which is expected to generate larger growth in the anti-fatigue cosmetics market.

The serum segment is expected to grow significantly during the forecast period. The aging population among Gen X and millennials increasingly focuses on using anti-fatigue products to maintain youthful skin. This is a key driving factor for the market's growth of the serum segment. Cosmetic serums containing hyaluronic acid, peptides, and retinol are commonly used to address wrinkles and fine lines. Manufacturers are constantly developing new formulations to improve serums' effectiveness, permanency, and delivery methods. Microencapsulation and nanotechnology methods have attracted a greater number of consumers as they provide enhanced ingredient absorption.

End Use Insights & Trends

The women users segment dominated the market in 2023. The consumption of cosmetics among women is usually higher than that of men. Increasing consciousness regarding skin health, appearance, and personal hygiene drives growth for this segment. The growing awareness regarding self-care and the significance of maintaining healthy skin has resulted in increased mindfulness about adopting skin-care routines, using natural or organic products, and incorporating anti-fatigue cosmetics in personal care practices. Another major factor driving the growth of this market is social media influence, enhanced branding strategies of key market participants, and lucrative deals offered by e-commerce platforms during the purchase of these products.

The men users segment is projected to grow at the fastest CAGR over the forecast period. A rise in awareness about ill effects caused by pollution, irregular sleeping cycles, and unhealthy lifestyles has driven the demand for the men’s grooming products industry. In addition, factors such as endorsement by social media influencers, celebrities, and sports icons, effective branding strategies adopted by the major brands in the cosmetic industry, and increased availability attained through efficient distribution are expected to fuel growth for this segment in the approaching years.

Distribution Channel Insights & Trends

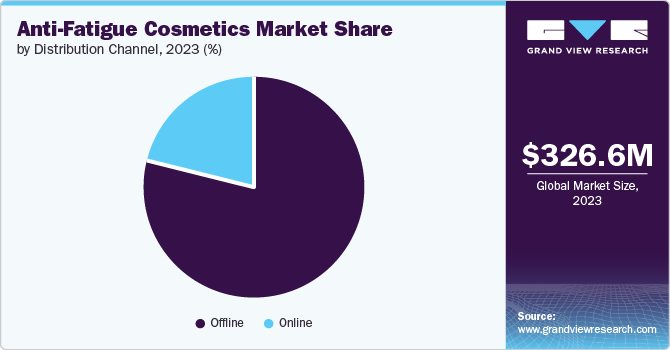

The offline distribution segment dominated the market in 2023. Brands, especially those in the consumer goods industry, have greatly focused on impacting offline distribution through supermarkets, hypermarkets, and pharmacies. Well-determined offline distribution networks have helped brands achieve greater brand visibility, enhanced market penetration, and improved market share. Unparalleled footfall coupled with well-worked rack techniques and operations layout have contributed to an overwhelming response to the sale of cosmetics.

The online segment is projected to grow at the fastest CAGR over the forecast period. The growth of the e-commerce sector is making it easy for consumers to buy products at their convenience, leading to the growth in the online segment of this market. Social media platforms are playing a vital role in influencing consumer-buying behavior. These platforms help to make consumers, mainly millennials, aware of the unique products being produced recently, such as anti-fatigue cosmetic products.

Regional Insights & Trends

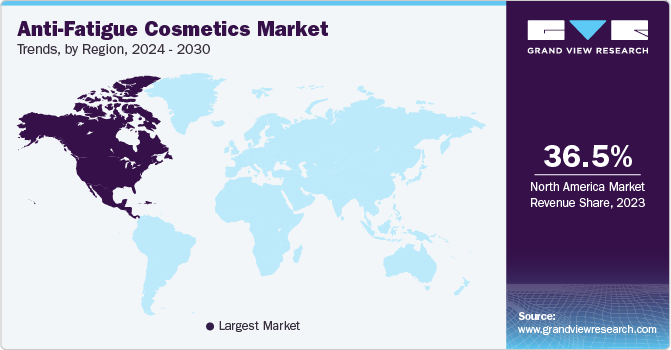

North America anti-fatigue cosmetics market dominated the global industry in 2023 with a revenue share of 36.5%. The presence of multiple applauded brands in the region, availability, accessibility through offline and online channels, and attractive discounts and deals offered by companies and retailers have generated a greater demand for anti-fatigue products in the region. In addition, growth in awareness about personal care and the significance of skin health has driven the development of this regional industry.

U.S. Anti-Fatigue Cosmetics Market Trends

The anti-fatigue cosmetics market in the U.S. dominated the regional industry in 2023. It is attributed to unhealthy lifestyles, growing awareness about benefits associated with skin-care products, effective marketing strategies executed by cosmetic brands, and enhanced accessibility & availability of anti-fatigue products through offline distribution networks. According to the National Health Interview Survey (NHIS) 2021-2022, 1.3% of adults in the U.S. had chronic fatigue syndrome.

Europe Anti-Fatigue Cosmetics Market Trends

Europe anti-fatigue cosmetics market was identified as a lucrative region in this industry. Unceasing skin exposure to polluting elements, the growing prevalence of sedentary lifestyles, and extended work timings followed by hours of travel have resulted in numerous skin-related problems in the region. The presence of large enterprises operating in the cosmetic industry, increasing response to the online sales of skin-care products, and rising awareness regarding the significance of adopting a skin-care routine are expected to generate demand for anti-fatigue cosmetics in the region.

The anti-fatigue cosmetics market in Germany is expected to experience a noteworthy CAGR during the forecast period. This market is mainly driven by factors such as the existence of multiple renowned cosmetic brands in the country, rising awareness about chronic fatigue, growing adoption of personal care products, and enhanced accessibility of anti-fatigue products.

Asia Pacific Anti-Fatigue Cosmetics Market Trends

The Asia Pacific anti-fatigue cosmetics market is anticipated to witness significant growth. The increase in purchasing power drives demand for anti-fatigue cosmetics, and the online distribution channel is growing rapidly in this region.

Key Anti-Fatigue Cosmetics Company Insights

Some of the key companies in the anti-fatigue cosmetics market include L’Oréal Paris, Unilever, Christian Dior SE, Nuxe and others. Owing to increasing competition, the prominent organizations in the industry have adopted strategies such as enhanced branding, collaborations with influencers, expansion of distribution network, increased presence in online markets, partnerships, and improved research & development to attain new product launches.

-

L’Oréal Paris, a prominent organization in the cosmetics industry, offers a variety of products related to skincare, haircare, personal care, makeup, sun protection, hair color, and more. The company distributes its products through numerous offline channels, such as retail markets, hair salons, beauty salons, pharmacies, drugstores, branded retail stores, hypermarkets, supermarkets, perfumeries, and more.

-

Christian Dior SE is a multinational luxury fashion brand that offers watches, leather goods, jewelry, footwear, eyewear products, and more. It is also famous for its premium-quality beauty products. Dior assesses the sustainability of natural ingredients, considering environmental and societal impacts. Their dedication to ethical beauty starts with utilizing sustainable ingredients.

Key Anti-fatigue Cosmetics Companies:

The following are the leading companies in the anti-fatigue cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oréal Paris

- Unilever

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- Bio Veda Action Research Co. (Biotique)

- Christian Dior SE

- Nuxe

- Groupe Clarins

- DECIEM Beauty Group Inc.

Recent Developments

-

In March 2024, L’ORÉAL Paris announced the launch of Melasyl, an innovative ingredient. The company stated that Melasyl can target specific skin pigmentation, leading to age spots and post-acne marks.

-

In February 2024, Shiseido, one of the renowned brands in the cosmetics industry, announced that it had developed a novel technology for a new skin lotion formulation that is anticipated to produce improved skin care results. This technology enables the efficient and even penetration of active ingredients into the skin.

Anti-Fatigue Cosmetics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 18.5 million |

|

Revenue forecast in 2030 |

USD 24.3 million |

|

Growth rate |

CAGR of 4.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, distribution channel, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, UAE |

|

Key companies profiled |

L'Oréal S.A.; Unilever; Shiseido Company, Limited; The Estée Lauder Companies Inc.; Bio Veda Action Research Co. (Biotique); Christian Dior SE; Nuxe; Groupe Clarins ; DECIEM Beauty Group Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Anti-Fatigue Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-fatigue cosmetics market report based on product, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cream

-

Oil

-

Lotion

-

Serum

-

Gel

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."