- Home

- »

- Plastics, Polymers & Resins

- »

-

Anti-Corrosion Nanocoating Market Size, Share Report, 2030GVR Report cover

![Anti-Corrosion Nanocoating Market Size, Share & Trends Report]()

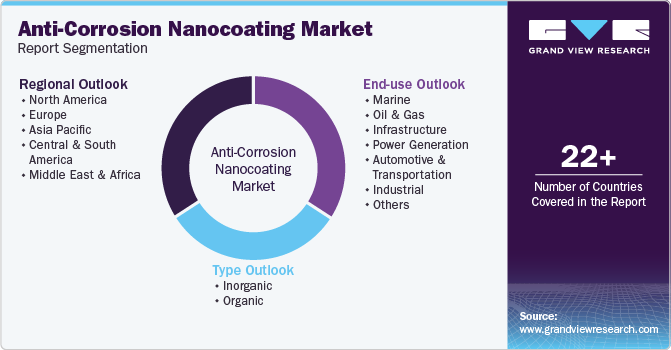

Anti-Corrosion Nanocoating Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Inorganic, Organic), By End Use (Marine, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-469-5

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-Corrosion Nanocoating Market Summary

The global anti-corrosion nanocoating market size was estimated at USD 1.06 billion in 2023 and is projected to reach USD 2.02 billion by 2030, growing at a CAGR of 9.6% from 2024 to 2030. Innovations in nanotechnology have led to the development of more effective anti-corrosion nanocoating, propelling their adoption and market expansion.

Key Market Trends & Insights

- The Asia Pacific held the largest global revenue share of 40.2% in 2023.

- Based on end use, the marine segment accounted for the largest revenue share of 32.6% of the market in 2023.

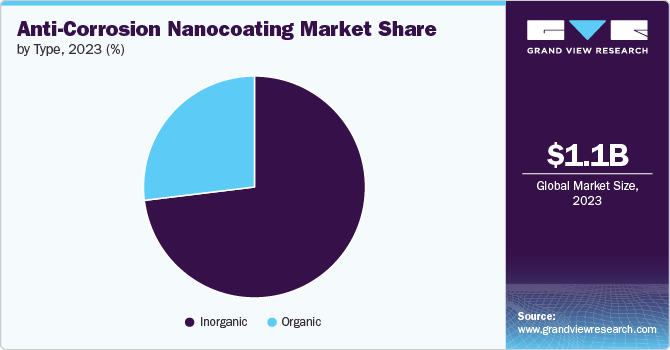

- Based on type, the inorganic segment of the market was valued at USD 778.86 million in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.06 Billion

- 2030 Projected Market Size: USD 2.02 Billion

- CAGR (2024-2030): 9.6%

- Asia Pacific: Largest market in 2023

The industry growth is driven by the rising demand for durable and efficient corrosion protection solutions across various sectors, including marine, automotive, industrial, and oil & gas.

Anti-corrosion nanocoatings are ultra-thin layers applied to surfaces to protect them from corrosion caused by environmental factors such as moisture, saltwater, and chemicals. These coatings are engineered at the nanoscale, offering superior protection by enhancing the surface's physical and chemical properties. The effectiveness of nanocoatings in preventing corrosion lies in their ability to provide a barrier that is highly resistant to penetration by corrosive agents while also being durable and long-lasting.

Drivers, Opportunities & Restraints

A significant driver for the adoption of anti-corrosion nanocoatings in the marine industry is the ongoing battle against marine corrosion, which poses a constant threat to ships, offshore structures, and maritime equipment. The marine environment is exceptionally harsh, with salt water, high humidity, and varying temperatures contributing to the rapid deterioration of metal surfaces. Traditional coatings often fail to provide long-term protection in such conditions, leading to frequent maintenance, costly repairs, and downtime.

Anti-corrosion nanocoatings, however, offer a superior level of protection due to their ability to form a more cohesive and impermeable barrier on metal surfaces. This enhanced durability and effectiveness in preventing corrosion can significantly extend the lifespan of maritime assets, reduce maintenance costs, and improve operational efficiency, making them a highly valuable solution for the marine industry.

However, despite the high initial costs associated with the development and application of anti-corrosion nanocoatings, the long-term benefits they offer can offset these expenses. The enhanced durability and effectiveness of nanocoatings in preventing corrosion can lead to significant reductions in maintenance, repair, and replacement costs over time. Furthermore, the ongoing advancements in nanotechnology and materials science are expected to gradually reduce production costs and improve the efficiency of application methods.

As these innovations continue, the cost-benefit ratio of anti-corrosion nanocoatings is likely to become increasingly favorable, potentially easing the current cost-related restraints and encouraging broader adoption across various industries.

Market Concentration & Characteristics

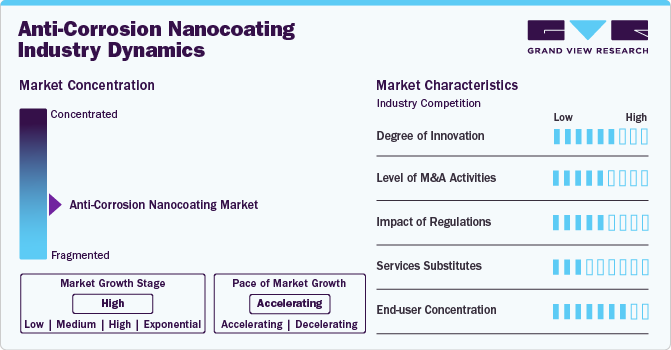

The market for anti-corrosion nanocoatings is moderately fragmented, characterized by the presence of numerous players and a diversity of specialized products across various industries.

The market is witnessing significant growth, driven by the demand for advanced materials that offer superior protection against corrosion. Innovations in nanotechnology have led to the development of nanocoatings that not only prevent metal degradation but also enhance the lifespan and durability of various structures and components across industries such as automotive, aerospace, marine, and construction.

Among the challenges facing the market are the high costs associated with the development and application of these advanced coatings and technical hurdles related to achieving uniform coverage and adhesion on diverse substrates. Despite these challenges, the market is buoyed by several drivers, including the global rise in infrastructure projects, innovations in the aerospace and automotive sectors seeking lighter and more durable materials, and the general need to reduce maintenance and replacement costs.

End Use Insights

“Oil & gas segment is expected to witness the highest growth at 10.0% CAGR.”

The marine segment accounted for the largest revenue share of 32.6% of the market in 2023. The segment growth is driven by the imperative need to protect vessels, structures, and equipment from the harsh marine environment. In the marine industry, anticorrosion coatings are applied to a wide range of assets, including ships, offshore platforms, and port infrastructure, to safeguard them against the relentless assault of salt water, humidity, and biological factors such as barnacle formation.

Anticorrosion coatings for the oil and gas industry are specifically formulated to withstand these harsh conditions, offering a protective barrier that extends the service life of assets, enhances safety, and minimizes maintenance costs. The coatings used in this sector typically include epoxy coatings, polyurethane coatings, and zinc-rich coatings, each selected based on the application's specific requirements for durability, chemical resistance, and environmental exposure.

Type Insights

“Organic segment is expected to witness growth at 10.0% CAGR.”

The inorganic segment of the market was valued at USD 778.86 million in 2023 and is projected to reach USD 1,459.48 million by 2030. These coatings are known for their exceptional hardness, chemical stability, and ability to withstand harsh environmental conditions. Inorganic nanocoatings often include materials such as zinc oxide, titanium dioxide, silica, and alumina. The effectiveness of inorganic-type anti-corrosion nanocoatings stems from their strong bond to metal surfaces, providing a durable shield against moisture, oxygen, and salts—common culprits of corrosion.

Organic-type anti-corrosion nanocoatings leverage organic polymers and compounds to offer effective protection against corrosion. These coatings are characterized by their flexibility, which allows them to provide a durable, adherent barrier on various surfaces. Organic nanocoatings are particularly noted for their ability to inhibit moisture penetration and chemical attack, significantly enhancing the corrosion resistance of the coated materials.

Regional Insights

“North America is expected to witness a market growth of CAGR 9.7%.”

The anti-corrosion nanocoating market in North America is anticipated to witness a CAGR of 9.7% over the forecast period. The extraction and processing of oil and gas in North America often involve harsh environments and corrosive substances, necessitating advanced coating solutions for pipelines, drilling equipment, and storage facilities. The shift towards more environmentally friendly extraction methods and the need for infrastructure maintenance and refurbishment drive the demand for durable and efficient anti-corrosion coatings.

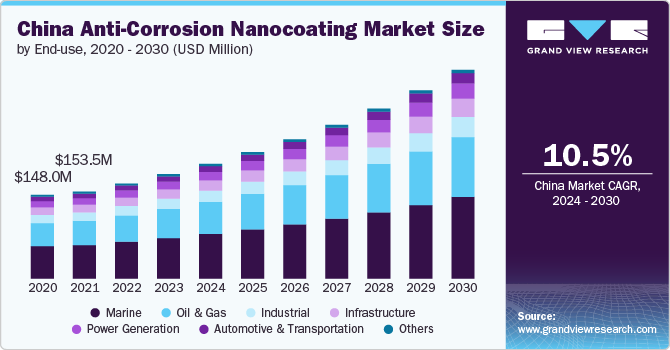

Asia Pacific Anti-Corrosion Nanocoating Market Trends

The anti-corrosion nanocoating market in Asia Pacific held the largest global revenue share of 40.2% in 2023. The regional growth is driven by the rapid industrial expansion and infrastructure development in this area. This demand is particularly pronounced in key sectors such as automotive, marine, oil & gas, and energy, which are central to the region's economic growth. Similarly, the marine sector, which is vital for the region's trade and commerce, relies heavily on anticorrosion nanocoatings to protect ships, offshore platforms, and port infrastructure from the corrosive effects of the marine environment.

The anti-corrosion nanocoating market is anticipated to grow at a lucrative CAGR over the forecast period. As the world's largest manufacturing powerhouse, China's marine, automotive, and oil & gas sectors are substantial consumers of anticorrosion nanocoatings. These advanced coatings are crucial for enhancing the durability and longevity of materials used across a wide range of applications, from vehicles and ships to buildings and bridges.

Europe Anti-Corrosion Nanocoating Market Trends

The anti-corrosion nanocoating market in Europe is anticipated to grow at a healthy CAGR over the forecast period. The European oil & gas sector, encompassing both North Sea operations and expanding activities in Eastern Europe, faces unique challenges due to harsh environmental conditions and aging infrastructure. The need for maintenance and refurbishment of existing facilities, coupled with the development of new installations, drives demand for advanced anti-corrosion solutions, thereby propelling product demand.

Key Anti-Corrosion Nanocoating Company Insights

Some of the key players operating in the market include AnCatt, Millidyne Oy, and NanoHorizons Inc.

-

AnCatt is a company that specializes in environmentally friendly, high-performance anti-corrosion paints and coatings. Their products are based on a unique conducting polymer nanodispersion (CPND) pigment that can outperform other anti-corrosion coatings. The company develops anti-corrosion coating technology utilizing a conductive polymer nano-dispersion (CPND) to replace current anti-corrosion pigments.

-

Millidyne Oy specializes in innovative coatings and surface treatments designed to enhance durability, efficiency, and performance across a wide range of applications. Their product lineup includes advanced solutions for wear resistance, corrosion protection, and surface functionalization, catering to various industries such as automotive, aerospace, and manufacturing. Utilizing cutting-edge research and technology, Millidyne Oy is committed to developing environmentally friendly and high-performance coatings that meet the evolving needs of its global clientele.

Key Anti-Corrosion Nanocoating Companies:

The following are the leading companies in the anti-corrosion nanocoating market. These companies collectively hold the largest market share and dictate industry trends.

- AnCatt

- Millidyne Oy

- NanoHorizons Inc.

- Nano Hygiene Coatings Ltd

- PChem Associates, Inc.

- Sarastro GmbH

- Surfactis

- Xtalic

- Aalberts

- Bavarian International

Recent Developments

-

In January 2024, WEG, a Brazilian technology company, developed a new coating for highly corrosive environments, increasing the durability of assets on oil platforms. The development involved two years of research and over $308,059 in investments, along with equipment, performance tests, and technical training.

-

In August 2023, Greenkote and Duroc N.V. formed a joint venture to bring Greenkote's anticorrosion coating capabilities to the European Union and surrounding regions.

Anti-Corrosion Nanocoating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.16 billion

Revenue forecast in 2030

USD 2.02 billion

Growth Rate

CAGR of 9.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilo Tons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Thailand, Brazil, Argentina, and South Africa

Key companies profiled

AnCatt, Millidyne Oy, NanoHorizons Inc., Nano Hygiene Coatings Ltd, PChem Associates, Inc., Sarastro GmbH, Surfactis, Xtalic, Aalberts, and Bavarian International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-Corrosion Nanocoating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-corrosion nanocoating market report based on type, end use, and region:

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Inorganic

-

Organic

-

-

End Use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Marine

-

Oil & Gas

-

Infrastructure

-

Power Generation

-

Automotive & Transportation

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global anti-corrosion nanocoating market size was estimated at USD 1,065.7 million in 2023 and is expected to reach USD 1,162.50 million in 2024.

b. The global anti-corrosion nanocoating market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 2,015.28 million by 2030.

b. Asia Pacific dominated the anti-corrosion nanocoating market with a share of 40.2% in 2023. The regional growth is driven by robust industrial expansion and infrastructure development in the region.

b. Some key players operating in the anti-corrosion nanocoating market include AnCatt, Millidyne Oy, NanoHorizons Inc., Nano Hygiene Coatings Ltd, PChem Associates, Inc., Sarastro GmbH, Surfactis, Xtalic, Aalberts, and Bavarian International.

b. Key factors that are driving the market growth include rising demand for durable and efficient corrosion protection solutions across various sectors, including marine, automotive, industrial, and oil & gas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.