- Home

- »

- Pharmaceuticals

- »

-

Anterior Uveitis Treatment Market Size & Share Report, 2030GVR Report cover

![Anterior Uveitis Treatment Market Size, Share & Trends Report]()

Anterior Uveitis Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Infectious Uveitis), By Therapy (Biologics), By Distribution Channel (Hospital, Retail, Online Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-450-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anterior Uveitis Treatment Market Trends

“2030 Anterior Uveitis Treatment market value to reach USD 967.5 million”

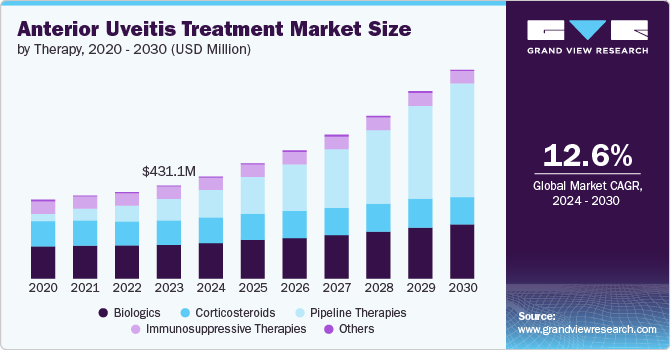

The global anterior uveitis treatment market size was valued at USD 431.1 million in 2023 and is projected to grow at a CAGR of 12.6% from 2024 to 2030. The continuous increase in the prevalence of anterior uveitis cases is driving the growth. According to the information published by World Health Organization in October 2022, the global population over 60 will rise to 22% in 2050 from 12% in 2015. This situation might increase the number of anterior uveitis treatment cases as predisposition to this disease increases with age.

New developments in applications of products and treatment modalities are ongoing, for instance, Humira’s approval for treatment of uveitis was a major breakthrough. After this, many biosimilars of this drug entered into the market providing alternative for corticosteroid treatments. Hence, factors such as growing geriatric population, rising incidence of the disease, and new product developments, exponential increase in pipeline therapies are expected to be some of the driving factors.

Anterior uveitis is one of the common ocular inflammation types that is reported to primary eye care professionals Increasing incidence of optical infections coupled with rising awareness about various treatments is likely to aid market growth over the forecast period. High expenditure on healthcare, increasing disposable income, and favorable government regulations are some other drivers of the market. For instance, the ministry of health and family welfare of India allocated USD 10,67 million in 2023-2024 by the government which is 13% more than the previous year to propel the industry growth

Type Insights

Non-Infectious Uveitis segment dominated the market and accounted for a share of 78.6% in 2023. This high percentage can be attributed to the massive prevalence of such uveitis cases; for instance, according to a study published in Springer Nature in July 2023, out of 6191 cases of uveitis registered at the University Hospital of Ioannina (Greece) from 1991 to 2020, 4125 were non-infectious which accounted for 66.62%. Additionally, continuous advancements in bringing about safer and more effective treatments boost the segment growth. According to the news provided by Tarsier Pharma Ltd. in August 2023, the results from the phase III clinical trial of the TRS01 eye drop demonstrated good anti-inflammatory activity in non-infectious anterior uveitis and expanded the product portfolio under this segment.

The infectious uveitis segment held a significant market share in 2023. An increase in the number of initiatives to find new ways for diagnosis and its treatment favors segmental growth. Moreover, the rising prevalence of uveitis due to various viral infections is expected to contribute in market growth. For instance, as per the article published in Elsevier B.V. on June 2024, the prevalence of infectious uveitis varies from 3.5% to 58% in different regions of the world. This number is higher in developing countries as compared to the developed regions, increasing the demand for the treatments, resulting in market growth.

Therapy Insights

The biologics segment dominated the market in terms of market share in 2023. Biologics have an advantage over conventional uveitis treatments, including corticosteroids, as they are more selective in targeting specific proteins to reduce inflammation and thus have fewer side effects. This advantage emerged as a breakthrough in the therapy segment. Biologic therapies such as TNF-alpha inhibitors proved to be better alternatives and treatments of choice by professionals for chronic ophthalmic conditions.

The domination of biologics in the market is because of the prudent advances in strategic launches by various pharmaceutical companies in different regions of the world. Diligent research approval for launches and acquisitions are driving innovations in the segment owing to vigorous growth in ophthalmology. For instance, in July 2023, Boehringer Ingelheim launched Cyltezo, an adalimumab biosimilar treating uveitis and other inflammatory diseases. Adalimumab is an FDA approved (TNF)-alpha inhibitor proven to manage anterior uveitis effectively.

Pipeline therapies are expected to rise exponentially in the anterior uveitis treatment market. Many companies are constantly trying to find new treatment options for the disease and provide better alternative therapy options to patients. For instance, in June 2024, Aldeyra Therapeutics, Inc., an innovative biotechnology company, completed its enrollment procedure for the phase III clinical trial of “Reproxalap”, an RASP (Reactive Aldehyde Species) inhibitor for the treatment of non-infectious anterior uveitis, dry eye disease, etc. The company also plans to submit the New Drug Application (NDA) in 2024. Such initiatives contribute in the growth of the segment.

Distribution Channel Insights

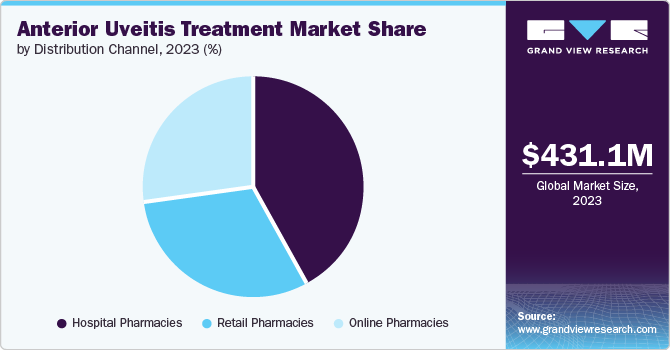

The hospital pharmacies segment dominated the market in 2023. This is due to the availability of a wide array of options for managing eye inflammation,such as, eye drops, topical ointments, implants, injections, laser treatments, etc. which can be guided by professionals in the pharmacy Moreover, hospitals provide treatment & care to many patients, making hospital pharmacies a leading segment.

The online pharmacies sector is projected to grow at the fastest CAGR over the forecast period. One of the primary factors of this growth is the generational shift of choice from retail stores to online stores. For instance, as per the report published in Oct 2022 by the National Library of Medicine, the preference for online pharmacies in India rose from 23% in 2013 to approximately 59% in 2018. There are more than 250 E-pharmacy stores in the country. Another factor is the discounted price that online pharmacies provide. Further, platforms such as Centre For Sight (CFS) Pharmacy purposefully focus on delivering eye care medicines to the doorstep, making the process more qualitative and trustworthy.

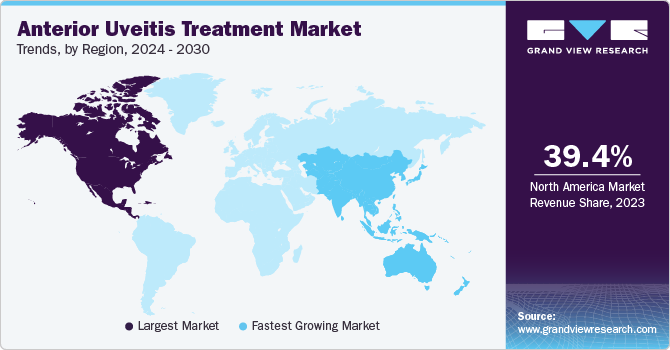

Regional Insights

North America dominated the anterior uveitis treatment market in 2023. This is attributable to the rising prevalence of the disease in the U.S., and the presence of key players in the region also leads to the high growth of this regional segment. Development of new methods, such as stem cell therapy, for the treatment of ocular diseases and approval of drugs such as Humira and its biosimilars for the treatment of this condition are some of the major driving factors. For instance, as per the article published in the National Library Of Medicine in November 2021, a study was performed on four uveitic patients and were treated with intravenous HUC-MSCs to conclude that human umbilical cord-derived mesenchymal stem cells (HUC-MSC) can be used to treat refractory uveitis.

U.S. Anterior Uveitis Treatment Market Trends

The anterior uveitis treatment market in the U.S. dominated the market with a share of 89.3% in 2023 due to frequent product approvals by the U.S. FDA and partnerships and acquisitions by the growing companies in ophthalmic healthcare. For instance, in November 2023, Harrow, Inc. completed the transfer of a new drug application for TRIESENCE and acquired the U.S. commercial rights to accelerate the market growth.

Europe Anterior Uveitis Treatment Market Trends

Europe’s anterior uveitis treatment market was identified as a lucrative region in this industry owing to new product launches, regulatory approvals by EMA, and the presence of key players in the region. Eye drops are regulated as medical devices in the region. Products with CE marking are regarded as highly safe.

The UK anterior uveitis treatment market is expected to grow rapidly in the coming years due to the presence of well-established healthcare infrastructure, and rising awareness of its benefits.

Anterior uveitis treatment market in Germany held a substantial market share in 2023. This high percentage can be attributed to the rising number of new players in the market and the increase in uveitis incidences in the region. For instance, according to the article published by ResearchGate GmbH in April 2023, out of 5088 random blindness cases registered in Northrhine, Germany, 1123 were due to uveitis., .

Asia Pacific Anterior Uveitis Treatment Market Trends

Asia Pacific anterior uveitis treatment market is anticipated to witness significant growth in the anterior uveitis treatment market. This growth is owing to the significantly increasing strategic partnerships and acquisitions among the leading market players worldwide resulting in expansion of distribution in the region. In addition, advanced research increasing the pipeline therapies, investments, and collaborations is expected to propel the market growth in coming years. For instance, in August 2023, the Department of Biotechnology & National Eye Institute (NEI)-National Institutes of Health (NIH) announced the funding opportunity for India-U.S. Collaborative Vision Research Program to promote research in ophthalmic treatments, including diseases such as uveitis.

China’s anterior uveitis treatment market held a substantial market share in 2023 owing to strong investments and collaborations with leading players in eye care. For instance, in May 2021, companies such as Nan Fung Group, headquartered in Hong Kong invested in Oculis to support the ongoing advancements in late-stage investigational ophthalmology drugs OCS-01 and OCS-02.

Latin America Anterior Uveitis Treatment Market Trends

Latin America’s anterior uveitis treatment market is expected to have significant growth in the anterior uveitis treatment market. This growth is attributable to several regional government initiatives undertaken to manage and control ophthalmic health. For instance, referring to the news published by the International Agency for the Prevention of Blindness (IAPB) in February 2022, Brazil’s Supreme Court recognized optometry to promote optometrists and work towards preventing blindness.

MEA Anterior Uveitis Treatment Market Trends

MEA contributed to a significant market share in the anterior uveitis treatment market. The increasing prevalence of ocular diseases is one of the major reasons driving the market growth. For instance, as per the article published in Bryn Mawr Communications, LLC. on August 2023, around 20%-25% of patients affected by EBOLA virus were diagnosed with uveitis. The article further states that uveitis is the second leading cause of blindness in the region. Such alarming situations in the region might increase the demand for the treatment of uveitis thus boosting the market growth

UAE anterior uveitis treatment market is expected to grow significantly in the coming years owing to the launch of various clinics, hospitals, and research conferences held especially dedicated to uveitis. For instance, according to the news published in WAM on May 2023, UAE’s largest healthcare platform “SEHA” inaugurated a clinic committed to treat pediatric patients suffering from uveitis

Key Anterior Uveitis Treatment Company Insights

Some of the key companies in the Anterior Uveitis Treatment market include Novartis AG, Santen Pharmaceutical Co., Ltd., AbbVie Inc., Kiora Pharmaceuticals, Inc., Clearside Biomedical, Aldeyra Therapeutics, Inc., UCB S.A., Agilent Technologies, Inc. (Lux Biosciences, Inc)., Tarsier Pharma Ltd. Key manufacturers are increasingly adopting strategic initiatives such as new product development, mergers & acquisitions, and regional expansion. For instance, in 2024, Kiora Pharmaceuticals, Inc. announced the results from phase I clinical trial of KIO-101 and plans for phase II clinical trial of KIO-104 for intravitreal delivery into the retina for treating posterior non-infectious uveitis.

AbbVie Inc. is actively functioning in the eye care segment. It has a wide range of products to treat various ophthalmic conditions. One of the prime products of the company for treating uveitis is “Humira” which is widely accepted as an effective treatment worldwide.

Kiora Pharmaceuticals, Inc. is exclusively involved in developing therapies for inherited and inflammatory retinal diseases. There are advanced products present in their pipeline to treat anterior uveitis.

Key Anterior Uveitis Treatment Companies:

The following are the leading companies in the anterior uveitis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Santen Pharmaceutical Co., Ltd.

- AbbVie Inc.

- Kiora Pharmaceuticals, Inc.

- Clearside Biomedical

- Aldeyra Therapeutics, Inc.

- Aciont Inc.

- Sirion Therapeutics, Inc.

- UCB S.A.

- Lux Biosciences, Inc.

- Tarsier Pharma Ltd.

Recent Developments

-

In January 2024, Tarsier Pharma Ltd. received the FDA agreement for the Tarsier-04 Phase 3 clinical trial of TRS01 eye drop under a Special Protocol Assessment (SPA).

-

In Oct 2023, Clearside Biomedical, Inc.’s partner, ARCTIC VISION HONG KONG BIOTECH LIMITED, announced the completion of the phase III trial of suprachoroidal delivery of ARCATUS (ARVN001) for the treatment of uveitic macular edema.

-

In July 2023, Harrow, Inc. acquired Santen Pharmaceutical Co., Ltd.'s branded ophthalmic portfolio to expand the company's product portfolio and strengthen its market presence.

-

In April 2023, Novartis AG’s division “Sandoz” received marketing authorization from the European Commission for Hyrimoz to expand its distribution. This includes all the indications by the reference medicine for various diseases, including uveitis.

-

In November 2021, EyeGate Pharmaceuticals, Inc. was named as “Kiora Pharmaceuticals, Inc.,” to focus on rebranding and developing novel ophthalmic therapeutics. EyeGate Pharmaceuticals, Inc. acquired Panoptes Pharma Ges.m.b.H. in December 2020 to propel the pipeline forward and broaden its portfolio across a diverse range of ocular, autoimmune, and neurological indications.

-

In May 2021, A German facility of AGC Biologics started working with Oculis to manufacture a drug for eye diseases. OCS-02 was under development and targeted both dry eye and anterior uveitis. This partnership was expected to help AGC Biologics expand its influence in Germany.

Anterior Uveitis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 474.0 million

Revenue forecast in 2030

USD 967.5 million

Growth Rate

CAGR of 12.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, therapy, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Novartis AG, Santen Pharmaceutical Co., Ltd., AbbVie Inc., Kiora Pharmaceuticals, Inc., Clearside Biomedical, Aldeyra Therapeutics, Inc., Aciont Inc., Sirion Therapeutics, Inc., UCB S.A., Lux Biosciences, Inc., Tarsier Pharma Ltd..

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anterior Uveitis Treatment Market Report Segmentation

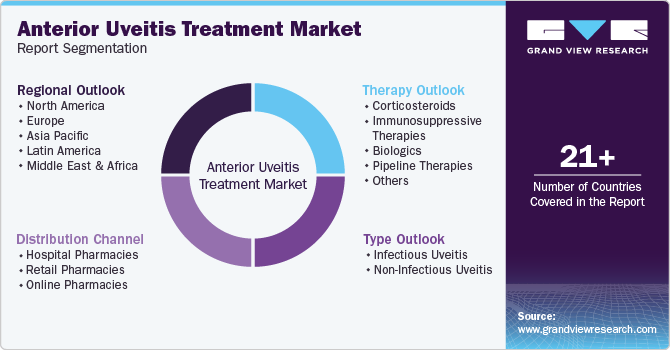

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anterior uveitis treatment market report based on type, therapy, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Uveitis

-

Non-Infectious Uveitis

-

Anterior Uveitis

-

Pan-Uveitis

-

Posterior Uveitis

-

Intermediate Uveitis

-

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Corticosteroids

-

Immunosuppressive therapies

-

Biologics

-

Others

-

Pipeline Therapies

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anterior uveitis treatment market size was estimated at USD 288.8 million in 2019 and is expected to reach USD 302.1 million in 2020.

b. The global anterior uveitis treatment market is expected to grow at a compound annual growth rate of 5.4% from 2019 to 2026 to reach USD 418.2 million by 2026.

b. North America dominated the anterior uveitis treatment market with a share of 40.2% in 2019. This is attributable to rising prevalence of anterior uveitis in the U.S., presence of key players in the region, and development of new methods, such as stem cell therapy, for treatment of ocular diseases and approval of drugs like Humira for treatment of this condition.

b. Some key players operating in the anterior uveitis treatment market include Novartis AG; Santen Pharmaceutical Co., Ltd; AbbVie Inc.; Eyegate Pharmaceuticals, Inc.; Clearside Biomedical, Inc.; Aldeyra Therapeutics, Inc.; Aciont Inc.; Sirion Therapeutics, Inc.; UCB Biopharma S.P.R.L.; and Lux Biosciences, Inc.

b. Key factors that are driving the market growth include rising incidence of anterior uveitis, growing geriatric population, and new product developments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.