- Home

- »

- Personal Care & Cosmetics

- »

-

Anisole Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Anisole Market Size, Share & Trends Report]()

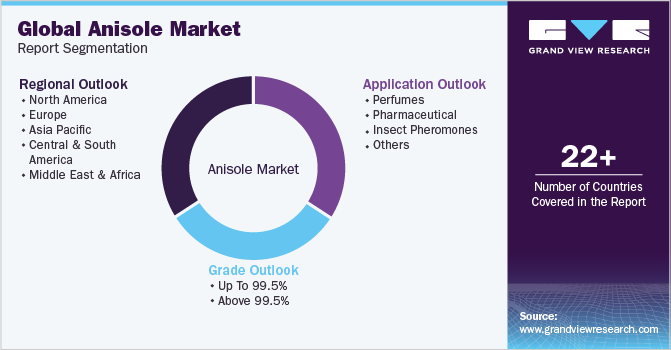

Anisole Market Size, Share & Trends Analysis Report By Grade (Up To 99.5%, Above 99.5%), By Application (Perfumes, Pharmaceutical, Insect Pheromones, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-598-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

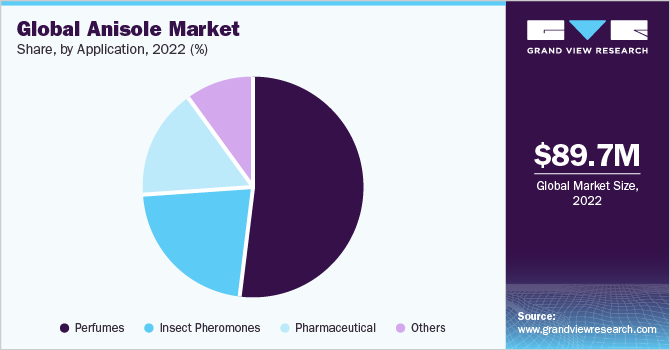

The global anisole market size was valued at USD 89.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Owing to the increasing applications in various industries including cosmetics, pharmaceuticals, and food & beverages. Increasing disposable income along with growing consumption of perfumes will augment industry growth, particularly in the Asia Pacific. Furthermore, the increasing use of cosmetic grades in Latin America and the Middle East is expected to increase consumption over the forecast period. Growing demand for scents, creams, and various types of perfumes will propel industry penetration over the forecast period. Also, the growing pharmaceutical sector in Asia Pacific countries including India and China, and Latin America is expected to have a positive impact on the market.

The market for anisole is anticipated to witness an upsurge in demand during the forecast period, primarily driven by supportive regulations pertaining to its utilization in the production of pharmaceutical grades intended for both internal and external usage. Additionally, technological advancements focused on enhancing manufacturing processes to achieve higher grade yields and increased purity levels will positively impact the industry. However, the growth of the market may be hindered by challenges such as volatility and the availability of raw materials, which are expected to restrain market expansion in the coming seven years. Novel applications, such as the synthesis of cotarnine as a pharmaceutical, are expected to open up future avenues for market participants willing to expand their typical customer base and venture into new geographies.

In March 2023, the increase in crude oil prices, coupled with the upward trend in benzene prices, resulted in higher prices for anisole. Benzene, being the key feedstock for anisole, directly impacts its supply in the global market as the prevailing market dynamics are determined by benzene prices. Anisole, which finds application in the production of perfumes, dyes, pesticides, and pharmaceutical products, is consequently affected by these price fluctuations.

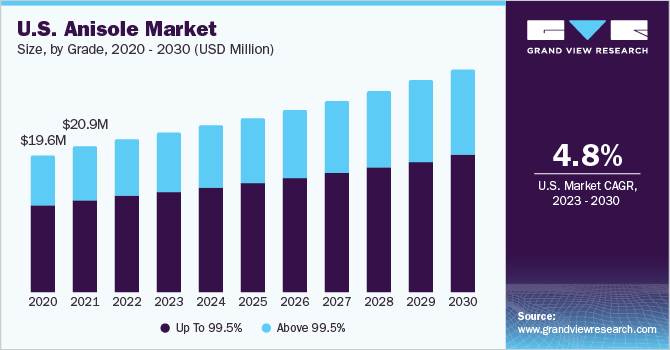

Grade Insights

The up to 99.5% segment accounted for the largest revenue share of 64.2% in 2022. Up to 99.5% of anisole finds extensive application in diverse industry sectors, encompassing the production of active pharmaceutical ingredients (APIs), cosmetics, colorants, flavor and fragrance chemicals, antioxidants, polymerization inhibitors, and agrochemicals. Additionally, it serves as a solvent in various chemical processes, further contributing to its wide-ranging industrial utility.

The above 99.5% segment is projected to grow at the fastest CAGR of 6.1% over the forecast period. Applications of anisole with a purity level exceeding 99.5% are found in various industries. This highly pure form of anisole is utilized in the manufacture of high-quality pharmaceutical grades, as well as in the production of premium-grade fragrances, flavors, and cosmetics. It is also employed as a key ingredient in the synthesis of specialty chemicals, such as polymerization inhibitors, antioxidants, and agrochemicals. Moreover, its exceptional purity makes it well-suited for use as a solvent in a variety of chemical processes that require precise control over the composition and characteristics of the substances involved.

Application Insights

The perfumes segment held the largest revenue share of 52.3% in 2022 as a result of high consumption owing to its unique properties. The robust manufacturing base of the cosmetic industry coupled with growing domestic demand in the U.S., China, Germany, Saudi Arabia, Italy, Mexico, Brazil, France, and the UK is expected to augment industry growth over the forecast period.

The pharmaceutical segment is expected to grow at a CAGR of 5.4% over the forecast period in light of high growth in China and India on account of favorable FDI policies. Moreover, growing domestic demand in developing countries due to increasing health awareness coupled with technological advancement is expected to further drive the pharmaceutical industry, contributing to market growth over the forecast period.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 28.8% in 2022. The established pharmaceutical and personal care industry in the U.S. and Canada contributes to the market in the region. According to the Congressional Budget Office of the U.S., the pharmaceutical industry spent USD 83.0 billion on R&D alone in 2019. Moreover, the growing emphasis on sustainable and eco-friendly grades is likely to create new opportunities for anisole in North America.

Asia Pacific market is anticipated to grow at a CAGR of 6.1% over the forecast period. on account of the growing pharmaceutical sector in China, India, Indonesia, Malaysia Philippines, Singapore, Thailand, and Vietnam. High investment by foreign players will promote industry penetration over the forecast period. Rising consciousness of personal grooming Chinese consumers, coupled with increasing spending power is expected to propel the demand for perfumes in the country thereby fueling market growth.

In June 2022, the market in Asia experienced a volatile trend, influenced by significant events in the region. Factors such as the pandemic impact and the unfortunate fire incident at Deepak Nitrite in India contributed to this fluctuation. During May 2022, the market demonstrated stability amid a complex scenario in the Chinese market. As lockdown restrictions eased, crude oil prices exhibited fluctuations, leading to an increase in raw material prices, particularly phenol prices. Consequently, downstream anisole pricing rose. Simultaneously, reduced demand from the domestic market exerted downward pressure on Anisole pricing.

Europe is expected to witness high growth on account rising need for cosmetic products in Germany, Italy, France, and the UK. Urbanization, higher spending power, and growing awareness regarding appearance and grooming are expected to propel the perfume industry in the region thereby driving demand over the forecast period.

Key Companies & Market Share Insights

The market is fragmented with the presence of numerous players. Current manufacturers have been employing various technologies for manufacturing anisole including electrophilic aromatic bromination, acetylation, and acylation. The following are some of the major participants in the global anisole market:

-

Evonik Industries AG

-

Atul Ltd

-

Solvay

-

Tokyo Chemical Industry Co., Ltd.

-

SURYA LIFE SCIENCES LTD.

-

Thermo Fisher Scientific

-

Westman Chemicals Pvt. Ltd.

-

Emmennar Pharma Pvt. Ltd.

-

Benzo Chem Industries Pvt. Ltd.

-

Merck KGaA

-

Camlin Fine Sciences Ltd.

Recent Developments

-

In July 2021, Clean Science and Technology secured funding of USD 57.9 million from 40 distinct investors. The company engages in the manufacturing of performance chemicals, pharmaceutical intermediates, anisole, and other chemicals. Customers rely on the company's products as essential starting-level inhibitors, components, or additives.

Anisole Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 94.2 million

Revenue forecast in 2030

USD 138.0 million

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million, Volume in Tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Qatar

Key companies profiled

Evonik Industries AG; Atul Ltd; Solvay; Tokyo Chemical Industry Co., Ltd.; SURYA LIFE SCIENCES LTD.; Thermo Fisher Scientific; Westman Chemicals Pvt. Ltd.; Emmennar Pharma Pvt. Ltd.; Benzo Chem Industries Pvt. Ltd.; Merck KGaA; Camlin Fine Sciences Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anisole Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anisole market report based on grade, application, and region:

-

Grade Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Up To 99.5%

-

Above 99.5%

-

-

Application Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Perfumes

-

Pharmaceutical

-

Insect Pheromones

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the anisole market Evonik, Atul Ltd., Surya Life Sciences Ltd., Westman Chemicals Pvt. Ltd., Emmennar Chem, Benzo Chem Industries, Sigma-Aldrich, Camlin Fine Chemicals, Eastman Chemical Company, and Parchem.

b. Key factors that are driving the market growth increasing demand in various industries including cosmetics, pharmaceuticals, and food & beverages.

b. The global anisole market size was estimated at USD 89.7 million in 2022 and is expected to reach USD 94.2 million in 2023.

b. The global anisole market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 138.0 million by 2030.

b. Asia Pacific dominated the anisole market with a share of 26.5% in 2022. This is attributable to the rising need for cosmetic products in China, India, Japan, South Korea.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."